To invest or not to invest in Digital assets, that is the question!

Or at least, you might think that it is the question if you have read anything written about the recent drawdown in digital assets. Such a question paints the choice in stark, black-and-white terms: as if the only two choices available were blind trust or complete distrust with nothing in between. There is a far more pertinent question to ask – but it requires a more nuanced perspective.

Contrast this stance with the recent discussions around the current equity drawdowns and the potential risk of recession are never framed in black and white terms. There is no mention of divesting fully out of equities. In their outlooks or investment commentaries, asset managers discuss: underweighting equities, rotating out of cyclical into defensive stocks, focusing on high quality companies. All nuanced and thought-out strategies that allow one to apprehend the situation and its many uncertainties.

Investing, in digital assets or other assets, is no Shakespearean play. Investors never deal in absolutes. It is all about scenarios and probabilities.

Why should an investment in digital assets be any different? Why would investors not apply the same nuanced approach to their investment in digital assets? Whether one takes a market portfolio approach, mirroring digital assets’ 1% weighting amongst all asset classes, or whether one takes a longer-term approach to benefit from digital assets’ effects on the Sharpe ratio, there are many ways to make an allocation that balances the risks and opportunities of this emerging asset class.

1% in Digital Assets, the rational choice?

Not investing in digital assets is, in fact, an active decision. It may reflect a belief that the digital asset space will disappear completely over time. This view could be an ambitious position to take. Digital assets’ market capitalisation reached up to USD$3 trillion in November 20211. Despite the current drawdown, in recent months, the ecosystem and number of use cases have been growing steadily for over a decade. Digital assets’ size is still on par with emerging market small-caps, listed real estate investment trusts (REITS), or global high yield bonds: assets that are part of most asset allocation and portfolios.

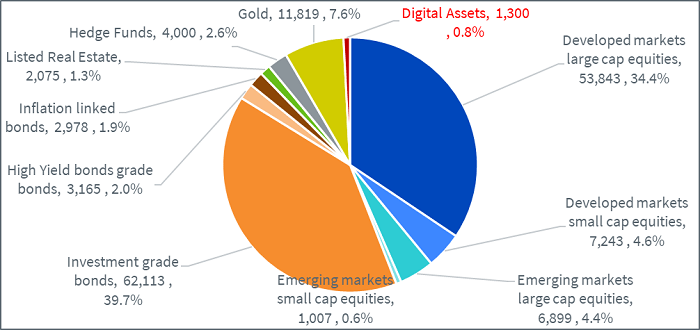

Figure 1 showcases the current market portfolio, that is, the different listed assets available to investors weighted by their total market capitalisation. The total market represents around USD$160 trillion after the recent drop in risky assets, and digital assets represent around 1% of that. To minimize this deviation from the hypothetical Market Portfolio, a passive investor or an uninformed investor should in theory have around a 1% investment in digital assets. This is the rational choice in absence of any view or added information. This is a safe position that allows one to benefit from the continued growth of the space in positive scenarios and that allows one to cap losses (at 1%) in more negative scenarios.

Figure 1: Today’s Market Portfolio

Source: Bloomberg, WisdomTree. As of 31st May 2022. Market caps are shown in US Dollars billion.

You cannot invest directly in an index.

Why is 6% per annum enough to justify an investment in digital assets?

The main investor’s pushback when it comes to investing in digital assets is usually the volatility and the drawdown risk. However, such worries tend to overlook two important facts:

- Whatever the volatility of digital assets, if an investor invests only 1% in digital assets, the maximum loss is 1%. In the context of a multi-asset portfolio, losing 1% happens multiple times per month because of equities or any other risky asset.

- The return required to justify digital asset-like volatility is not as high as investors expect. Digital assets growing north of 6% a year would be enough to justify investment in the hypothetical portfolio.

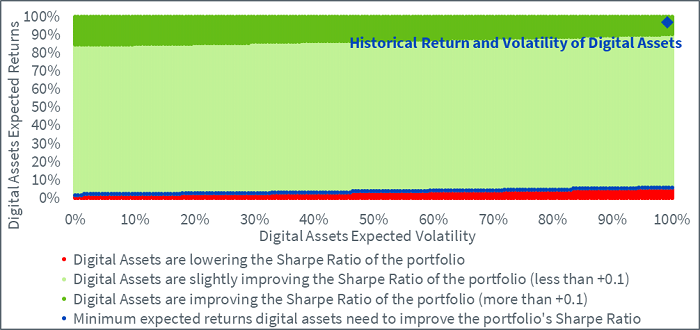

In the recently released ‘WisdomTree Insights – A New Asset Class: Investing in the Digital Asset Ecosystem’ the taxonomy, we use multiple allocation techniques to figure out the risk/benefit balance offered to a long term investor in digital assets. Figure 2, for example, shows the difference in the Sharpe ratio of a portfolio investing 1% in digital assets, compared to a portfolio without digital assets. The illustrative portfolio invests consistently in:

- 59% in the MSCI All Country World

- 40% in the Bloomberg EUR Agg

- 1% in digital assets

The performance and risk of equities and fixed income are estimated using J.P. Morgan Asset Management’s Long-Term Capital Market Assumptions (LTCMAs) 2022. These assumptions aim to estimate returns, volatility, and correlation for the next ten years. The historical correlation of digital assets with equity and fixed income is used. We vary the annualised performance and volatility of digital assets from 0 to 100% to study the impact on the illustrative portfolio.

Figure 2: Digital assets’ future volatility and return would need to change dramatically not to benefit a multi-asset portfolio

Source: Bloomberg, WisdomTree. From 31 December 2014 to 31 May 2022 2022. Calculated in EUR on monthly returns.

You cannot invest directly in an index. Historical performance is not an indication of future performance and any investment may go down in value. For illustrative purpose only.

You cannot invest directly in an index. Historical performance is not an indication of future performance and any investment may go down in value. For illustrative purpose only.

It is clear that for most levels of digital assets’ volatility and returns, the Sharpe ratio of the portfolio benefits from their inclusion (‘green’ in Figure 2). Digital assets returned 99.2% per annum with 97% volatility in the last seven years or so. Whether digital assets can perform like that for the next ten years is doubtful but, assuming that the volatility remains the same (99%), the Sharpe Ratio of a 60/40 portfolio is improved by the inclusion of digital assets as long as they return at least 6% per annum.

Faced with this analysis, investors might finally argue that it is too late to invest in digital assets and that exponential growth is behind us. However, from an asset allocation point of view, this is not that relevant. Looking at Figure 2, rather than asking the Shakespearean ‘to invest or not invest in digital assets?’, the only relevant question actually is: Will digital assets grow by more than 6 or 7% going forward?

If the answer is “yes”, then they deserve to be considered for some allocation.