Our focus on industry leaders creates a market storm shelter

After selling off and largely underperforming major equity markets for the past 16 months, China has recently bounced back in a big way after the Shanghai lockdown was lifted. Investor sentiment has stabilized alongside economic and regulatory conditions, as evidenced by the positive inflows into Chinese equities year to date. Compared to the US and Europe, which are struggling under mounting inflationary pressure and fears of possible recession, China suddenly appears to be on better footing. Could this be a good time for investors to start tiptoeing back into Chinese equities?

Economic lift powered by the people

To be clear, we are not surprised by the turn of events, even before the latest data on manufacturing and services sectors pointed to a recovery gaining momentum. Amid the worst of the lockdowns and logistics disruption, China’s exports have mostly stayed the course, partly owing to the resilient spirit of the Chinese people and companies. Chinese entrepreneurs are determined and work hard to put out the most compelling products at the most attractive price points, even in these challenging times.

Our job as a fundamental stock picker is to identify those companies that we believe will become stronger, more competitive and better recognized around the world. We think there are still a lot of great Chinese companies that have that chance, especially since the recent market correction has cast aside some of the more unprofitable, less competitive companies (see chart below). There is often ample liquidity in a bull market to support a large number of companies, but once that excess is dried up and market returns to fundamentals, the companies that remained tend to be healthier and could move forward on more solid ground.

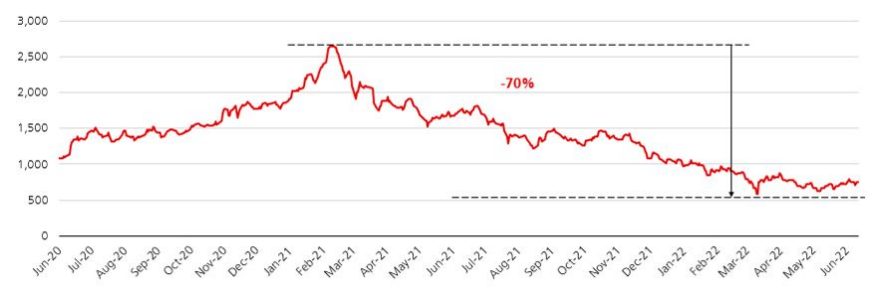

Market returns to fundamentals and is less generous to unprofitable companies

Focus is shifting to companies with profitability

Morgan Stanley Asia Unprofitable Tech index (%)

Sources: Morgan Stanley Research, Bloomberg. Data as of end 16 Jun 2022

Morgan Stanley line chart showing the Asia Unprofitable Tech index (%)

Lead with industry leaders

And that’s one of the main reasons that our strategies are centered around industry leaders. Although it’s true that policy shifts so far have had a larger impact on industry leading companies, turning to their less competitive peers is not a sound solution. Why? To begin with, a company’s standing in its industry is one of many factors we look at when making a decision to invest. Given the impact of policy shifts and regulatory grip in the last two years, we are aware and alert to the likelihood of an industry being targeted by regulators, but it has not altered our fundamental investing principles in the search for great companies.

We are disciplined and have long focused on industry leaders—for the most part the top two players in an industry in terms of market share—because of their long-term potential. Only the most competitive companies will survive changing market conditions, while the less competitive will not. It doesn’t matter where the company is, but when the interests of the founders, management and shareholders align and when management is working for shareholders, you have the ingredients to make a great company. And chances are, a great company makes a great stock.

That said, our long held investing framework is more multidimensional than before, and we look at companies from many different angles. While we cannot predict what the future holds for certain companies, what we can do is to diversify the different risks including policy risk by investing across several companies and industries. Given our focus and the market’s return to the fundamentals story, we continue to believe that high quality companies with strong competitive advantage will deliver results in the long run.

A stock rebound in the making

Before May, Chinese equities were beaten down to what we believe to be an unsustainably cheap level—about one deviation below their historical trading mean. Historically speaking, a period of market weakness tends to be followed by a strong rally, which appears to be what we are seeing today.

It’s interesting that because of the economic slowdown, many Chinese companies are better positioned for a rebound. The slowdown forced companies to cut costs and operate on a healthier and leaner model, which contributed to a better-than-expected bottom-line earnings growth. If we take the slowdown as a blessing in disguise, some companies are now better set up to report strong earnings and perform in the long run once the economy recovers. And because a lot of high quality Chinese companies have been trading at extremely attractive prices, we believe Chinese equities could outperform their global peers in the medium term—despite more ups and downs that COVID flareups and rolling lockdowns could bring down the line.