With rising incomes and an ever-increasing population, Asia’s rising importance in the world economy is becoming even clearer. But what are the key drivers to stronger Asian economies.

If we look at Asian companies, what we see is pretty good health, there’s no buildup of excess capacity, and cash as a percentage of assets is at a historical high. Similarly, debt is near a historical low.

A Steepening Yield Curve May be Good for Asia

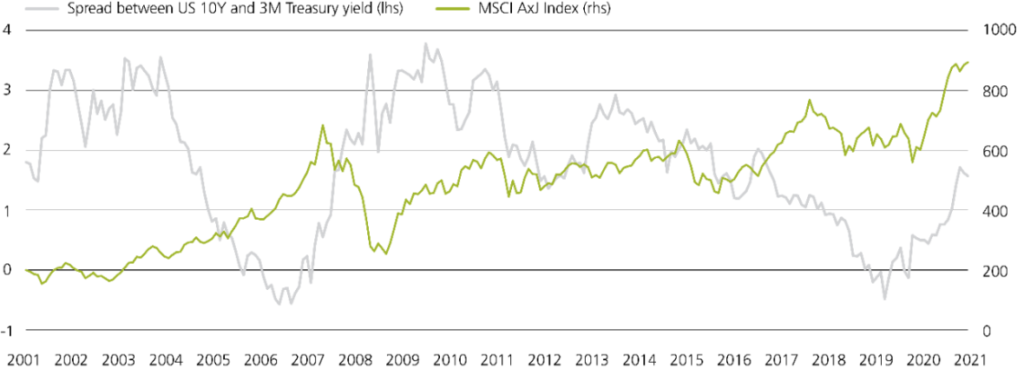

Recently there’s been some fear about rising bond yields. Historically, there’s been a rather loose correlation between the equity index and the yield curve. We believe the steepening yield curve is signaling stronger US economic growth which has generally been positive for Asian equities. So we’re not too concerned about rising rates at the long end.

US Yield Spread vs MSCI Asia ex Japan Index

Secular Growth Drivers are Key for Long-Term Investors

When looking at fundamentals, we believe specific themes will provide secular growth drivers for some companies in Asia, including:

- Changing consumer patterns: As consumers become more affluent, consumption patterns are moving from basic functional brands to premium brands.

- E-commerce: Digital transformation is taking place and e-commerce penetration is increasing. Some Asian countries, like India and Indonesia, have low penetration, but we expect they will catch up.

- Innovation: Asian companies are innovating – filing more patents than in the US and Europe combined in 20201 – and they are spending more on R&D than companies in the US and Europe2.

- Growth of financial services: When Asian economies develop, credit markets will likely grow faster than GDP, opening opportunities for banks to take market share.

1 World Intellectual Property Organization, October 2020

2 R&D World, March 2020

Asia Small Caps Offer Opportunities

Looking deeper into Asia, we believe the small cap space may offer investors profitable opportunities, and here are four specific reasons why:

#1 Higher alpha opportunity. As small and mid cap companies are under researched, this creates more opportunities for investors to outperform by exploiting knowledge inefficiencies

#2 Higher growth. Through smaller companies, we believe investors can invest in structural themes at an earlier stage and benefit from a longer runway of growth.

#3 Diversification The Asia small cap universe is larger and more diversified than the large-cap space, thus offering valuable diversification benefits.

#4 Better focus. Large cap companies tend to be spread across different business lines while small cap companies can be more focused on specific areas.

Asia: The Place to be for Global Bond Investors?

Asia is displaying a strong recovery and we believe this will continue in 2021 and into 2022. So what does that mean for credit? It means there is a higher growth trajectory across Asia relative to the rest of the world due to higher earnings power and the ability to pay back on debt.

When we look at Asia from a credit or yield perspective, Asia offers a substantial pick up in yield relative to US and Europe.

Investment Grade Credit Market: Yields

Why China Bonds?

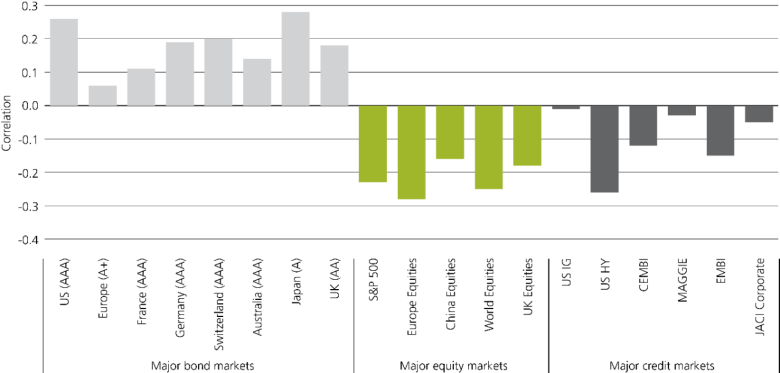

China government bonds offer one of the highest nominal yields in the world today compared to other developed markets and our offering one of the highest real yields in the world today in bond markets. Chinese bonds historically have very low correlation to other developed market bond markets, as well as to equity and credit markets.

China bonds: Five year correlation with global asset classes

So to sum up, we believe Asian credit looks like it offers a lot of value today relative to other markets. When we consider the risk, the assessment looks even better, particularly on the investment grade credit side. Hence from a nominal and real yield and correlation perspective, we think that Chinese bonds have a place in everybody’s portfolio.

China A-Share's Part in the Asian Opportunity

The China A-share market is one of the largest in the world but remains underinvested by global investors. Here are four reasons why it’s a market that investors can’t ignore.

#1. This market is dominated by retail investors that have short holding periods. This can contribute to market volatility and create attractive entry points for active investors.

#2. There are more companies in the China A-share market than offshore and particularly in fast-growing sectors like healthcare, consumer, and information technology, thus creating a rich opportunity set.

#3. Still relatively under-researched, almost 70% of A-share companies are covered by three or less analysts, according to Reuters.

#4. China A-shares have historically had low correlation to overseas markets and have, over time, shown low correlation to overseas markets because of low foreign ownership, controls on investor access, and the composition of the investor base.