Key Takeaways

- Strong first half for EM: EM credit thrived in the first half of 2024, driven by favourable macro conditions and limited supply, a trend likely to continue.

- Positive outlook: supportive macroeconomic policy and consumer demand expected to continue to drive EM in 2H and default rates are expected to remain low.

- Increased allocation to EM: given the strong performance of 1H we expect inflows to gain momentum for the remainder of the year.

If you have any feedback on this article or are interested in subscribing to our content, please contact us at opinions@muzinich.com or fill out the form on the right hand side of this page.

——-

An improving macro picture and less election noise could provide a tailwind for EM credit for the rest of 2024.

The big story: EM delivers

Our optimistic outlook for emerging market credit in 2024 has, so far, been vindicated with a heavy election calendar and geopolitical concerns failing to have much of an impact on performance.

A widening growth differential has favoured EM as central banks switched from inflation fighting to growth preservation. Positive momentum in frontier markets has offered a further boost, with reform agendas passed and the adoption of orthodoxy monetary policy.

Meanwhile, EM credit markets have been cleansed by two years of defaults and downgrades. Only the strongest survived and now exhibit robust credit metrics and limited supply pressure.

But does the first half’s performance give a good indication of what credit investors can expect for the remainder of 2024? And will investors reverse their underweight position to EM?

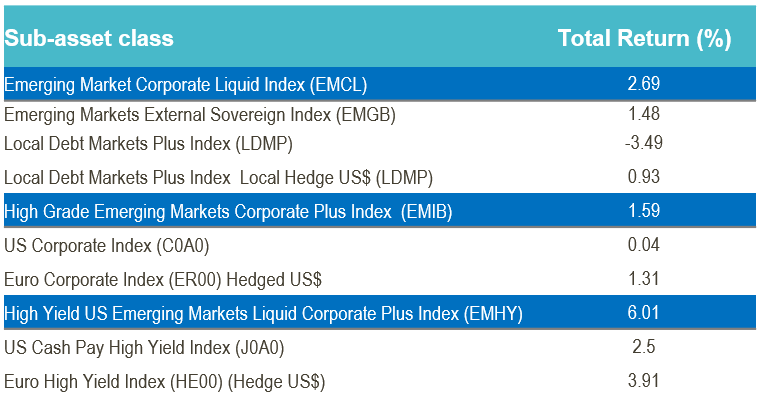

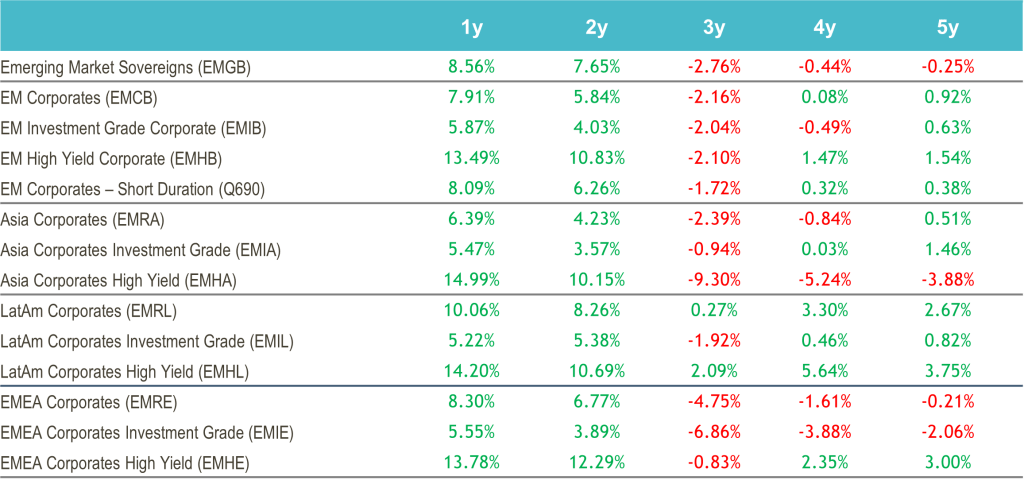

For the first 6 months of 2024, the EM corporate universe has outperformed all other credit markets (Figure 1). In our view, the dynamics that drove this outperformance are likely to continue.

Figure 1: EM outperforms DM in H1

Source: ICE Index Platform, as of 30th June 2024. See Index Descriptions on page 9 for full list of index names. Indices selected represent best proxy to highlight markets being discussed.

Supportive policy and consumer demand driving investment grade

Tagged as the place to go at the start of 2024 given the higher interest rate environment, asset allocators may be disappointed by the first half returns of investment grade (IG), even though the asset class outperformed government bonds. EMIG generated a total return of 1.59%, an excess return to its underlying US government curve of 2.05% (spreads tightened while government bond yields finished higher).

Asia was EMIG’s main performance driver. Notable returns were generated by the Hong Kong property sector, which benefited from the government’s new strategy to resolve the supply/demand imbalance through state-backed house purchase schemes.

In China, the highest returns came from the consumer segment, driven by strong earnings as domestic consumption stabilised. South Korea also did well: its auto sector is benefiting from the global roll out of next-generation electric vehicles, a long-term theme likely to continue to underpin the sector for the foreseeable future.

It could be argued Asia IG spreads were slightly cheaper-to-fair-value at the start of the year, especially in the property sector. However, we believe the main outperformance driver is a lack of supply. Year-to-date, net supply (gross issuance minus maturing securities, coupons received and tendered bonds) is -US$39bn.2 In other words, the universe has shrunk.

Given the rising popularity of IG and above-average yields that have attracted the region’s yield-hungry insurers, the imbalance (lack of supply) pushed spreads and prices higher.

We expect this supply imbalance to continue in the second half, not due to a lack of demand from investors, but because regional companies can issue cheaper debt in their own currencies. The average funding cost in Asia is 3.35%.3 Interest rates across most of Asia are lower than the US, making domestic borrowing the cheapest option.

High yield now higher quality

High yield’s (HY) positive return – an impressive 6.01%4 – was well ahead of IG, which may come as a surprise to asset allocators. The asset class has benefited from the global economic ‘soft-landing’ consensus view along with loosening financial conditions.

Excess returns were broadly distributed across the emerging world; the top-ten single-name contributors were domiciled in eight countries across seven industries. Latin America was the largest total return contributor to the index, but Asia took the top spot for efficiency, per unit invested.4

Figure 3: Top 10 by sovereign

In our experience, this broad-based pattern is commonly observed once the default cycle has peaked. The universe has been cleansed as weak companies defaulted and were removed from the index, leaving only the strongest survivors. The remaining distressed-priced credits recover as investors realise the likelihood of default is significantly overpriced. This often occurs as domestic conditions improve, due to loosening monetary policy and a pick-up in growth and earnings. This is a trend we are seeing now and is reflected in a year-to-date default rate of just 0.7%5

One major difference for the second half is that the election calendar will switch from emerging to developed markets, bringing more certainty for EM. As a result, we expect the trend of early tendering of HY debt securities to gain further momentum.

As refinancing conditions become more favourable, HY companies will likely take advantage to extend maturities well in advance of maturity or call dates. This will give investors a greater return profile than what is currently priced.

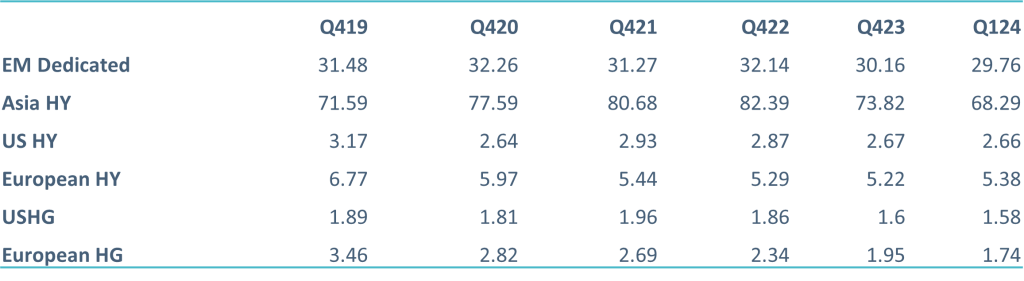

Finally, will the EM underweight positioning of credit allocators be covered (Figure 4)? Performance can typically be one of the reasons which attracts investors. Given EM was the outperforming credit asset class in the first half, we see no reason for allocators to continue to remain underweight EM credit for the rest of the year.

Figure 4: EM corporate holdings by dedicated and crossover investors at lowest in 5 years

Source: JP Morgan, “Smooth sailing into the summer lull”, as of 31st May 2024. For illustrative purposes only.

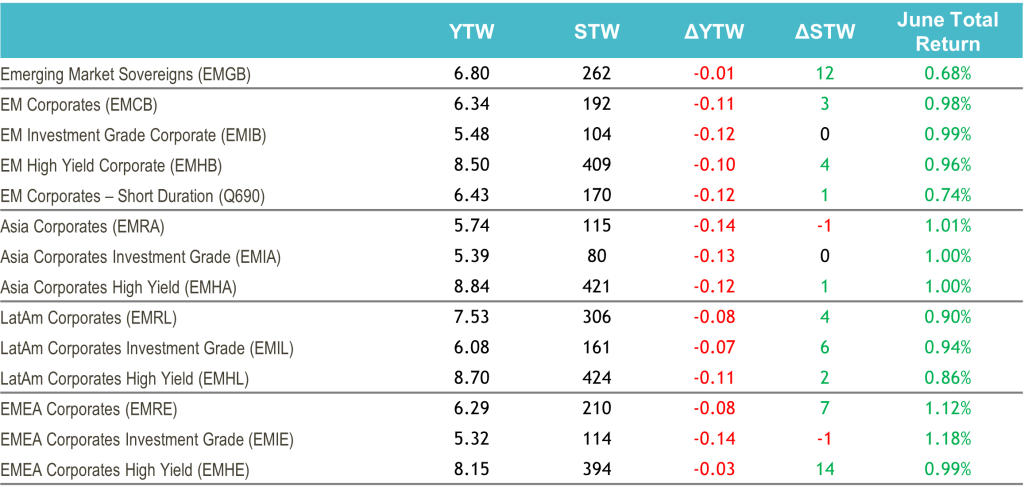

The Month In Credit: Joyful June

EM credit outperformed its sovereign and developed market peers in June. With US government bonds range bound, total return was generated through coupon and spread tightening.

By sub-asset class, HY outperformed IG, although this was largely due to HY’s higher coupon. Single Bs had a strong month, driven by Asian homebuilders and Latin American telecoms, which also made Asia the best HY performer by region.

Within IG, the Europe, Middle East and Africa region outperformed, driven by its heavy energy exposure – June was a strong month for energy (oil was up 10% in June). At the sector level, homebuilders and transportation were the outperformers while capital goods weakened.1

It was a heavy month for issuance, which reached US$31.99 billion, well above last June’s US$22 billion, but still below the month’s 5-year average of US$43 billion. Given scheduled cashflows of US$34 billion, June’s net financing is expected to be in negative territory. New issuance was spilt with Asia the dominant region, printing US$18.7 billion, while by sub-asset class, US$14 billion came from investment grade and US$7 billion from high yield.6

Past performance is not a reliable indicator of current or future results.

Turkish (inflation) delight?

It was another busy month of macro news as EM countries continued to forge ahead with accommodative monetary policies.

This was evident in Czechia, where the central bank cut rates 50bps down to 4.75%, in line with expectations as inflation trended toward the central bank’s target and concerns over a sluggish economy won over lingering price risks.7

Mexico’s central bank kept its policy rate unchanged at 11%, in-line with expectations and in what is seen as a dovish-split decision (4-1 votes in favour of remaining on hold). The central bank cited market volatility from the recent election and rising consumer prices for maintaining a conservative approach.8

Chile, meanwhile, signalled it may have already reached the end of its rate-cutting cycle with the central bank lowering its benchmark rate by 25bps to 5.75%, after cuts of 50bps, 75bps and 100bps respectively at the previous three meetings.9 With electricity prices set to increase inflationary pressures, this could put the breaks on further easing.

Inflation remained a theme in Turkey, with inflation hitting 75.45% year-on-year in May.10 Nevertheless, this could mark a peak in price rises as the government’s efforts to reduce inflation take effect over the summer. The Bloomberg consensus forecast is for inflation to fall to 38% by year end.11

Brazil’s central bank announced changes to its inflation targeting system, due to take effect in 2025. The central bank will continue to focus on a 3% inflation target within a +/- 1.5% range. However, the target will be continuous, meaning the bank will aim to always keep inflation within the target range, rather than only at year end.11

However, budgetary data suggest fiscal discipline is being ignored by the Brazilian government, with the primary budget deficit printing BRL63.9 billion versus projections of BRL59.5 billion in May.12

In Eastern Europe, seven nations faced censure for running budget shortfalls above the bloc’s 3% limit, leaving them subject to the so-called Excessive Deficit Procedure that requires remedial action and potential fines for non-compliance. This will affect Poland, Bulgaria and Hungary.13

More positively, in Colombia, the announcement of the Medium-Term Financial Framework provided confidence the government is committed to staying within fiscal compliance, including adjustments on the expenditure side.14 The Ministry of Finance’s announcements included COP20 trillion (1.2% of GDP) in budget cuts.14 However, the fiscal deficit widened to 5.6%, mainly due to higher interest payments as the primary balance remained at -0.9% of GDP while debt/GDP is stable at around 55%.14

While the round of elections slackened pace, the results continued to be felt. In South Africa, a coalition of parliamentarians from the African National Congress (ANC), pro-business Democratic Alliance (DA), and other parties reappointed Cyril Ramaphosa as president at their first sitting since the May 29 elections.15 Ramaphosa garnered 283 votes, or 87%, with several rival parties throwing their support behind the ANC leader. Parliament also elected the ANC’s Thoko Didiza as speaker and the DA’s Annelie Lotriet as her deputy.16 A detailed framework for the ‘unity’ government is set to be hammered out in the coming weeks with a priority to accelerate infrastructure reforms.

India finally announced the results of its general election. Markets were volatile after initially being buoyed by exit polls showing an increase in Modi’s Bharatiya Janata majority and the possibility of the National Democratic Alliance securing a super-majority. The result showed a reduction in support for the ruling coalition.17 Despite the noise, at its meeting held shortly after the election, the Reserve Bank of India confirmed the fundamental strength of the Indian economy with an upward revision to India’s FY25 GDP growth.18

In Ukraine, the government and ad-hoc bondholder committee unsuccessfully concluded the first round of negotiations over restructuring of US$20 billion of its debt, increasing fears the country may default.19

Ukraine expected to face more bad news as Hungarian Prime Minister Viktor Orban assumes presidency of the European council in July for a six-month tenor.20 Relations between Orban and Zelenksy have not been warm with Orban blocking EU aid for Ukraine in the past.21

In Argentina, government reform appeared to be on track as the senate approved the Omnibus bill, the cornerstone to the government’s reform. The approval has taken six months and has been significantly diluted in the process. 36 votes in favour and 36 votes against, with Vice President Victoria Villaruel offering an affirmative tie-breaking vote.22 The bill will now return to the Chamber of Deputies since multiple modifications to the bill were made in the Senate.

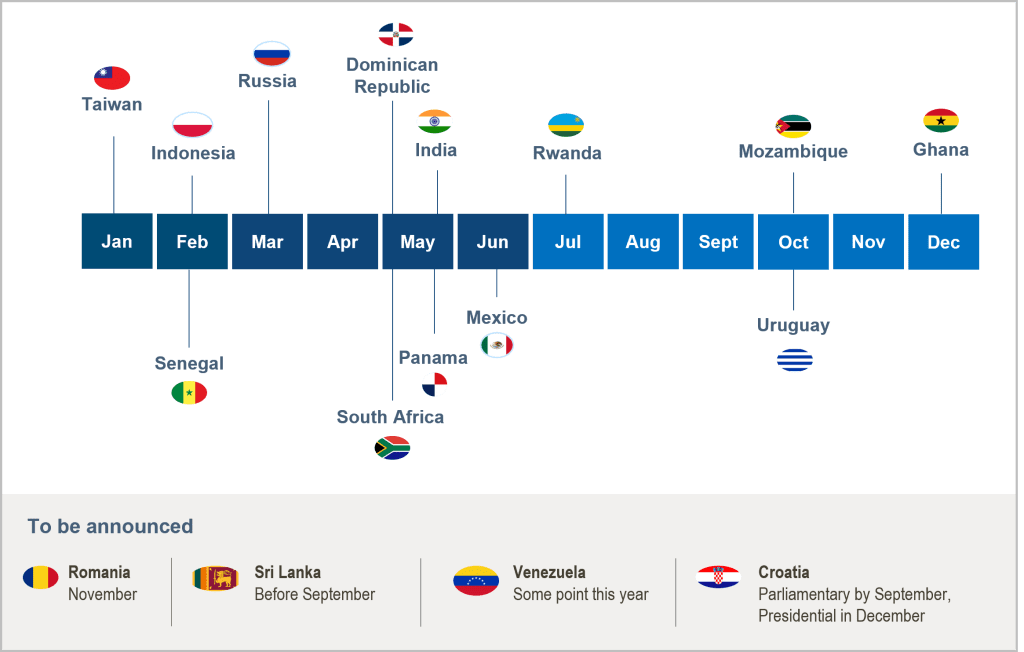

EM Election Calendar

A bumper year for elections in emerging markets with more than half of the world’s population due to go to the polls.

Source: Muzinich & co as of July 2024. For illustrative purposes only.

Credit

Past performance is not a reliable indicator of current or future results.

Source: ICE data platform. as of 30th June 2024. EMGB – ICE BofA Emerging Markets External Sovereign Index EMCB – ICE BofA Emerging Markets Corporate Plus Index, EMIB – ICE BofA High Grade Emerging Markets Corporate Plus Index, EMHB – ICE BofA High Yield Emerging Markets Corporate Plus Index, Q690 – ICE BofA Custom Emerging Markets Short Duration Index, EMRA – ICE BofA Asia Emerging Markets Corporate Plus Index, EMIA – ICE BofA High Grade Asia Emerging Markets Corporate Plus Index, EMHA – ICE BofA High Yield Asia Emerging Markets Corporate Plus Index , EMRL – ICE BofA Latin America Emerging Markets Corporate Plus Index, EMIL – The ICE BofA High Grade Latin America Emerging Markets Corporate Index, EMHL – ICE BofA High Yield Latin America Emerging Markets Corporate Plus, EMRE – ICE BofA EMEA Emerging Markets Corporate Plus Index, EMIE – ICE BofA High Grade EMEA Emerging Markets Corporate Plus Index, EMHE – ICE BofA High Yield EMEA Emerging Markets Corporate Plus Index,. Index performance is for illustrative purposes only. You cannot invest directly in the index. Indices selected provide best proxy for highlighting performance of emerging market corporate bonds. For illustrative purposes only.

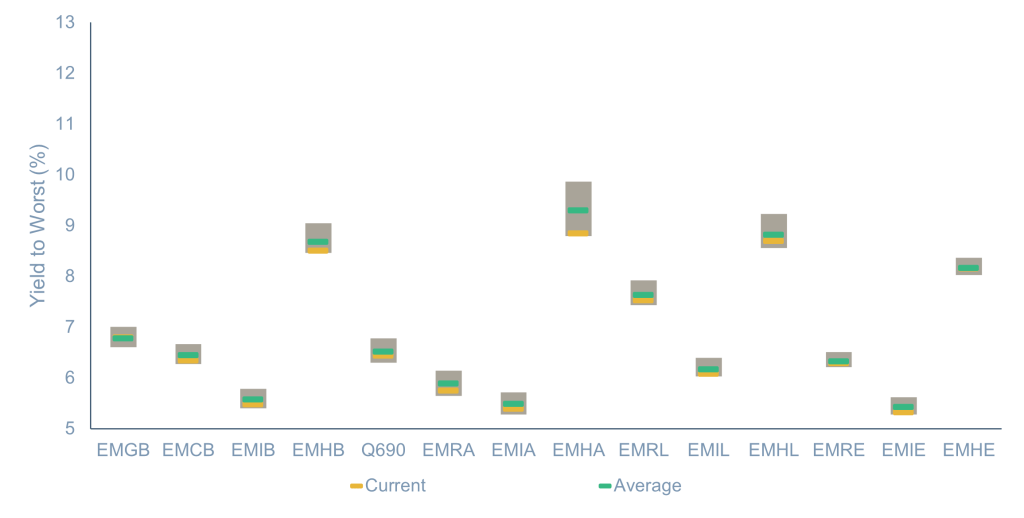

Yield to Worst

Source: ICE data platform. as of 30th June 2024. EMGB – ICE BofA Emerging Markets External Sovereign Index EMCB – ICE BofA Emerging Markets Corporate Plus Index, EMIB – ICE BofA High Grade Emerging Markets Corporate Plus Index, EMHB – ICE BofA High Yield Emerging Markets Corporate Plus Index, Q690 – ICE BofA Custom Emerging Markets Short Duration Index, EMRA – ICE BofA Asia Emerging Markets Corporate Plus Index, EMIA – ICE BofA High Grade Asia Emerging Markets Corporate Plus Index, EMHA – ICE BofA High Yield Asia Emerging Markets Corporate Plus Index , EMRL – ICE BofA Latin America Emerging Markets Corporate Plus Index, EMIL – The ICE BofA High Grade Latin America Emerging Markets Corporate Index, EMHL – ICE BofA High Yield Latin America Emerging Markets Corporate Plus, EMRE – ICE BofA EMEA Emerging Markets Corporate Plus Index, EMIE – ICE BofA High Grade EMEA Emerging Markets Corporate Plus Index, EMHE – ICE BofA High Yield EMEA Emerging Markets Corporate Plus Index,. Index performance is for illustrative purposes only. You cannot invest directly in the index. Indices selected provide best proxy for highlighting performance of emerging market corporate bonds. For illustrative purposes only.

References

1.ICE Index Platform, as of 30th June 2024. ICE BofA Emerging Market High Grade Index (EMIB).

2.JP Morgan, EM Corporate Supply Technicals as of 2nd July 2024.

3.JP Morgan, as of 28th June 2024. Global Central Bank Watch.

4.ICE Index Platform, as of 30th June 2024. ICE BofA Emerging Market High Yield Index.

5.JP Morgan “Smooth sailing into the summer lull”, as of 31st May 2024.

6.JP Morgan Global Corporate Weekly Monitor, “Steady going into DM elections in France and UK,” as of 28th June 2024.

7.Focus Economics, Czech Republic Monetary Policy, Trading Economics, Mexico Interest Rate, as of 27th June 2024.

8.Trading Economics, Mexico Interest Rate, as of 27th June 2024.

9.Focus Economics, Chile: Central Bank of Chile decreases rates, as of 18th June 2024.

10.Trading Economics, as of 3rd June 2024.

11.Bloomberg “Turkey poised to reach worst of inflation with peak close to 75%”, as of 2nd June 2024.

12.Banco Central do Brasil, as of 29th June 2024.

13.Reuters “France and six other countries face EU budget discipline measures”, as of June 19th 2024.

14.Fitch ratings, “Colombia’s fiscal consolidation plans still face significant challenges”, as of 3rd July 2024.

15.BBC News, Cyril Ramaphosa re-elected South African president, as of 14th June 2024.

16.Parliament of the Republic of South Africa press release “National Assembly Elects Ms Thoko Didiza as NA speaker and Dr Annelie Lotriet as deputy speaker”, as of 14th June 2024.

17.The Economist “A shock election result in India humbles Narendra Modi”, as of June 4th 2024.

18.Reuters “India’s economy poised for robust growth ahead of annual budget”, as of 17th July 2024.

19.Reuters “Ukraine’s international bond rework derailed as deadline nears”, as of 18th June 2024.

20.Le Monde “Hungary’s Orban takes over Council of the European Union presidency for six months”, as of 30th June 2024.

21.France 24, “Hungary blocks 50 billion euros in EU aid for Ukraine following approval of membership talks”, as of 15th December 2024.”

22.Reuters, “Argentine Senate passes Milei reform bill as protests rage outside”, as of 13th June 2024.

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed by Muzinich & Co are as of July 2024 and may change without notice.