Key takeaways

We believe emerging market (EM) investment grade hard currency debt could be an attractive option for insurers as it offers compelling long-term value potential.

The value proposition is underpinned by better growth prospects for EM economies compared to advanced economies and consists of a large and diverse investment universe.

EM fundamentals have strengthened in recent years and the overall credit quality of the asset class has improved with the growth in the proportion of A rated assets.

EM investment grade hard currency debt is an attractive option for insurers, in our view, as it is an increasingly broad and mature asset class that offers attractive return potential and potential diversification benefits.

While the last three years have been a tumultuous period for EM due to a series of rare and highly disruptive events, recent history indicates that the asset class can deliver attractive risk-adjusted returns over the long term.

From 2010-2019, EM investment grade debt produced higher returns than US investment grade debt, with only modestly more risk. We believe the asset class is set up to perform similarly well in comparison to US credit coming out of this recent period of crisis.

EM’s evolution

EM economies solidly outperformed developed market (DM) economies during the 2008-2009 global financial crisis (GFC). Like all risk assets at the time, EM valuations, especially in credit, were depressed. Attractive valuations and relatively better fundamentals set the stage for attractive returns, which garnered the attention of investors and drove strong investment flows into the asset class. Sentiment remained tempered, however, among higher quality, longer-term institutional investors, who maintained concerns about the relative newness of the asset class, its level of risk and limited breadth.

In our view, those concerns have been addressed over the decade or so. The asset class has grown several fold over that period to over US$4 trillion of bond stock, representing more than 130 countries and over 1,000 distinct issuers, with more than half the market now rated investment grade. The EM market is currently larger than the US high yield or commercial mortgage-backed securities market and much more diverse.

Greatly improved credit quality across EM investment grade universe

Credit quality has greatly improved across both the sovereign and corporate segments of the EM investment grade universe, making it much more suitable and attractive for insurers.

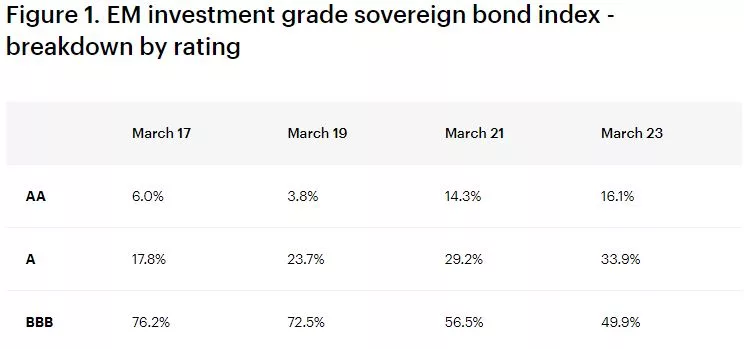

The improved quality is due to the expansion of the A and AA rating buckets of the asset class and the heavy downgrade cycle we have experienced over the last three years, which has pushed marginal investment grade issuers into high yield.

An example is Colombia, which was downgraded to high yield after a prolonged period of deficits and rising debt levels.

Similarly, the Mexican oil and gas company, Pemex, was downgraded to high yield after years of posting credit metrics consistent with a single-B or lower rated credit.

Most large, private Chinese real estate companies have also been downgraded to high yield, removing some of the most opaque and levered constituents of the corporate investment grade universe. On the positive side, we have seen an expansion of the A and AA rating categories, driven by governments and companies in the Middle East, Asia and Latin America.

The improvement in the asset class’s average credit quality is most dramatic in the sovereign and quasi-sovereign space where the percentage of the market rated A or higher has more than doubled since 2017, to just over 50%.

This ratings dynamic has corresponded with meaningful improvement in political stability rankings among investment grade governments, as measured by the World Bank Worldwide Governance Indicators (WGI).2 This measure is a good proxy for the generally improved credit quality of constituent countries, in our view, as it suggests more stable, financially sound entities. Sovereign credit metrics, such as debt-to-GDP ratios and fiscal deficits, are not as meaningful on their own, in our view.

Diversification benefits and broad investment opportunity

Beyond the primary consideration of attractive risk-adjusted returns, EM debt also offers diversification benefits. In the past, a justifiable view held that EM hard currency debt was a narrow, highly correlated asset class. That is no longer the case. The market is quite broad in terms of credit quality and maturity profile, which reflects the strong growth in market size over the past decade of more than six times for corporates and three times for sovereigns.

Currency considerations – Cross currency swaps

The EM credit asset class comprises a sizeable debt stock denominated in euros, though most of the market is denominated in US dollars. This can create some uncertainty

for European institutions, whose base currency is euros or pounds. Foreign exchange hedging in such situations has typically been done using currency forwards on a one-to-six month basis. While relatively simple to implement, such a strategy leaves longer-term investors subject to fluctuations in hedging costs.

Over the past three years, for example, costs have fluctuated from 1.8% to 3.2% and back to 1.9%[i]. Such movements can significantly impact returns and may be problematic for investors seeking certainty over the life of their portfolios. By using a slightly more complex hedging strategy that makes use of cross currency swaps, insurers may be better able to match hedges to the duration of their portfolios. We find this is a more efficient approach to managing foreign exchange risk than simple hedges using currency forwards.

Regulatory capital treatment

European insurance regulation is straightforward in its treatment of all fixed income assets, regardless of their origin. Under the Standard Formula of Solvency II, the capital charge is captured under the spread risk, as with other bonds. There is no specific treatment for EM debt.

If hedged into local currency, an EM bond consumes no more capital than a domestic bond with an equivalent rating.

For the bonds and loans of central banks and governments denominated in their own currencies, specific favourable shocks apply. Compared to corporate bonds, these shocks are more favorable.

EM debt that is completely swapped back into sterling (using cross currency swaps) is eligible for a matching adjustment.

An attractive alternative for insurers

EM investment grade debt is a large, diverse asset class that offers attractive value and will likely make up an increasingly large share of the global fixed income universe. As such, we believe an allocation to the asset class warrants serious consideration by insurers. At Invesco, we have extensive experience investing in EM debt and working with institutional clients to provide access to the asset class via tailored solutions that meet their exact requirements.

Sources:

1Bloomberg L.P. Data as of March 30, 2023.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Important information

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.