Global Investment Solutions Conference

London | 16th October 2025

Global markets are entering a period of profound transformation—driven by persistent inflation, rapid advances in technology, and shifting capital flows across regions and asset classes. This half-day conference brings together brings together leading fund managers and investment strategists to deliver forward-looking perspectives, equipping fund buyers with the insights needed to identify opportunities, manage risks, and position portfolios with confidence in today’s evolving landscape.

Designed for professionals in fund selection, manager research, due diligence, portfolio construction, and investment advisory, this premier event offers plenary macro sessions, practical investment strategy roundtable sessions and invaluable networking. Engage directly with industry leaders, explore actionable solutions, and gain the edge needed to thrive in today’s evolving investment landscape.

Global markets are entering a period of profound transformation—driven by persistent inflation, rapid advances in technology, and shifting capital flows across regions and asset classes. This half-day conference brings together brings together leading fund managers and investment strategists to deliver forward-looking perspectives, equipping fund buyers with the insights needed to identify opportunities, manage risks, and position portfolios with confidence in today’s evolving landscape.

Designed for professionals in fund selection, manager research, due diligence, portfolio construction, and investment advisory, this premier event offers plenary macro sessions, practical investment strategy roundtable sessions and invaluable networking. Engage directly with industry leaders, explore actionable solutions, and gain the edge needed to thrive in today’s evolving investment landscape.

Plenary Speakers

LILIAN CHOVIN

Head of Asset Allocation

Coutts

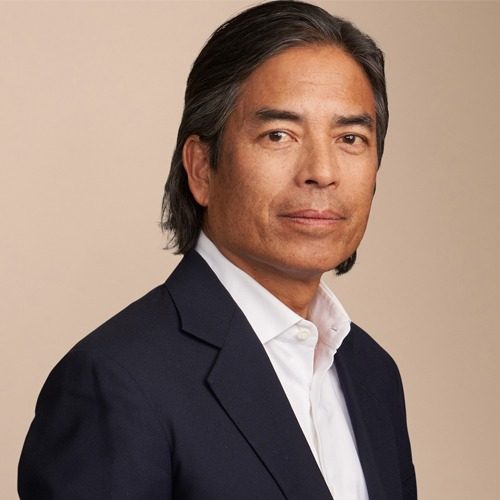

PATRICK THOMAS

Senior Investment Advisor

BEN HAMILTON

Head of Investment Manager Oversight

M&G

JULIUS BENDIKAS

European Head of Macro & Dynamic Asset Allocation

Mercer

PETER SANFEY

Deputy Director, Head of Country Economics

EBRD

GEORGE BROWN

Senior Economist

Schroders

Prof. DEEPH CHANA

Co-Director - Institute for Security Science & Technology

Imperial College London

ANUSHA KRISHNAN

Senior Fund Analyst

Union Bancaire Privée

DANIEL VERNAZZA

Chief International Economist

Unicredit

ANDREAS ROTHACHER

Senior Investment Consultant

Complementa

SUBHRA TRIPATHY

Chief Executive Officer

QuantumStreet AI

DAVID DEVLIN

Asset Management

Strategic Partnerships

Phoenix Group

NICK ROSENBLATT

Wealth Management Proposition Leader

Mercer

ROHIT VASWANI

Investment Director

Omnis Investments

Roundtable Presenters

Event Sponsors

Past Speakers

Sir John Redwood

Chief Strategist

Charles Stanley

Shanti Keleman

CIO

M&G Wealth

Daniele Antonucci

CIO

Quintet Private Bank

Alan Higgins

CIO

Coutts

Shiwen Gao

Portfolio Manager

Fulcrum

Michael Eakins

CIO

The Phoenix Group

Ash Arora

Partner

Local Globe

Kenneth Lamont

Sr Manager Research Analyst

Morningstar

Nalin Patel

Lead Analyst

EMEA Private Capital

Pitchbook

Anusha Krishnan

Senior Fund Analyst

SG Kleinwort Hambros Bank

John Romeo

Managing Partner

Oliver Wyman

Sophie Winwood

Principal

Anthemis

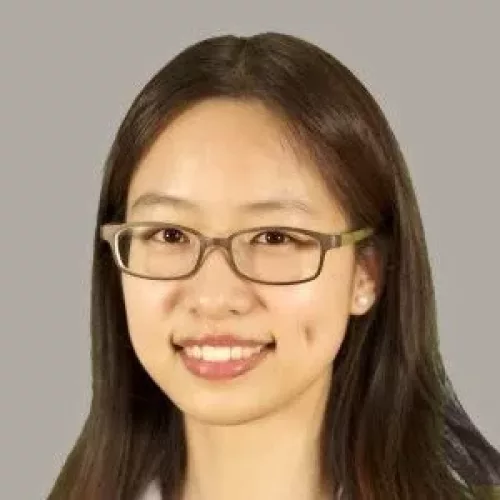

Huiting Pan

Fund Research Analyst

DWS

Ben Hamilton

Investment Manager Analyst

PPMG

Nick Rosenblatt

Wealth Management Leader

Mercer

Aman Ghei

Partner

Finch Capital

Christopher Carlton

Head of Manager Research

abrdn

Cornelia Meyer

Chairman & Chief Economist

LBV Asset Management

George Lagarias

Chief Economist

Mazars Wealth Management

Per Wimmer

CEO

Wimmer Family Office

Sonali Punhani

Chief Economist UK

Credit Suisse

Dr. Walter Boettcher

Chief Economist

Colliers International

Caroline Simmons

Chief Investment Officer UK

UBS Wealth Management

Chris Iggo

Chief Investment Officer

AXA IM

Haydn Jones

Head of Blockchain Technology & Investments

PwC

Charles MCgarraugh

Chief Strategy Officer

Blockchain.com