The digital asset ecosystem as a whole has retreated from all-time highs of over US$3 trillion in November 2021. Now sitting just below US$1 trillion in mid-July 20221, the drawdown of -73% has been vertiginous for the recently initiated. However, this is not the first time that such drawdowns have occurred in the digital asset ecosystem. In fact, it is fairly common to see boom and bust cycles in the adoption of new technologies.

In many instances, new technologies or new industries emerge in a series of booms and busts. Let’s not forget the railway mania, canal manias or the dot-com bubble. Notice that the infrastructure is still left after the boom-bust cycle is complete.

This is a part of the entrepreneurial process, Schumpeter’s “creative destruction”, particularly when new technologies are involved. Initially, it is not always obvious what will work or where new markets lie. This only becomes clearer as the technology becomes more available and affordable to different population segments.

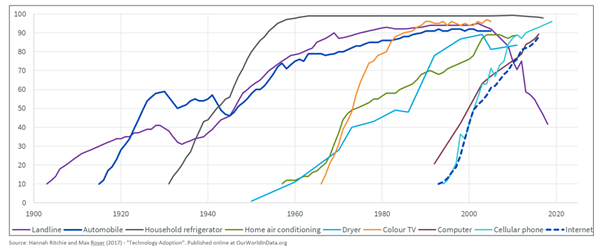

Below is a depiction of technology adoption S-curves, which show how new technologies spread across societies. Note that the process is rarely linear, with regression occurring at various points of the adoption process. Note also that the time taken for these technologies to reach close to full saturation is speeding up. Historically, they all related to some physical good – even the Internet involves fibre optic and submarine cables – and it took time for them to diffuse across societies.

Figure 1. Technology adoption S-curves

The arrival of Bitcoin in 2009 marked the start of what has now been over a decade of entrepreneurial and technical experimentation with digital assets and distributed ledgers (‘blockchains’).

A key point here is that Bitcoin, and other digital asset networks like Ethereum, are at their core open source software. This means that they can spread very quickly over the pre-existing internet infrastructure and, being open-source, can be iterated on quickly by developer communities.

This would help to explain how digital assets have grown so quickly globally over the past decade. With cellular phones now ubiquitous, and the internet infrastructure now well established, digital asset and distributed ledger technology have found their way into many sets of hands at a rapid rate.

People have found and brought to market new use cases as they use these technologies to solve their problems. As this process has played out, there have been phases of booms and busts.

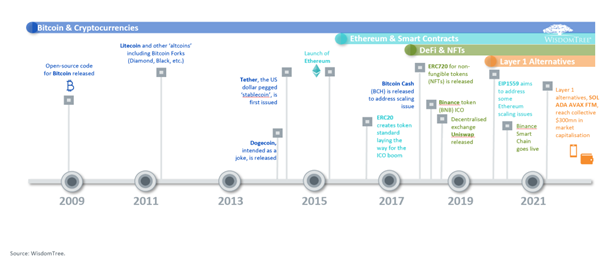

Figure 2 . Historical drawdowns in the digital asset space

WisdomTree has summarised this history in approximately four phases so far, which are explained in-depth in the new report ‘WisdomTree Insights – A New Asset Class: Investing in the Digital Asset Ecosystem’:

- Bitcoin and ‘alt-coin’ cryptocurrencies, ending in the Mt Gox exchange hack

- Ethereum and smart contracts, ending with the bust of the Initial Coin Offering (ICO) bubble

- Defi and NFTs, built on smart contract networks and having receded from highs in late 2020 and late 2021 respectively

- Layer 1 smart contract alternatives, such as Solana and Cardano, which have experienced steep falls in the first half of 2022 broadly speaking.

Figure 3. A timeline of the history of the development of the digital asset ecosystem

So there have been many such boom-and-busts for the space over the years, a process whereby ‘what works’ is found, which then forms the basis for future development/adoption, and ‘what does not work’ ends in failure. This is characteristic of the space, which:

- has enjoyed a backdrop of relatively loose global monetary policy

- is ruthless in terms of competition due to the way that open-source software can be copied and altered (‘forked’)

- Benefits (or suffers) from network effects which can quickly appear and disappear for these networks and decentralised applications.

It would be unwise to suggest that the entire space will disappear once this latest bust is over and a new phase begins. More venture capital went into the space in 2021 than in the six previous years combined (US$25 billion)2. The ecosystem is more diverse than ever. The more pertinent questions will aim to uncover what new use cases might emerge and form the new opportunities of the next phase in digital asset adoption.