Our research shows following a certain cohort of sell-side analysts can yield a better investment outcome than the broader group as their recommendations tend to have a greater and longer-lasting impact on prices.

Information from sell-side analysts – such as buy and sell recommendations, price targets and earnings forecasts – has long been an important input into quantitative investors’ models.

However, in recent years, the advice given by those who some call “prophets” has become less effective in helping systematic investors maximise their profit.

This is because the speed at which stock prices incorporate analyst predictions has increased so much that the information becomes almost obsolete only days after it has been made public. In other words, for quantitative-focused investment strategies that have longer-term holding periods and lower portfolio turnover, the value of such information is barely positive, after costs, in major, efficient equity markets like the US.

That said, sell-side forecasts do contain information that is effective and potentially rewarding; the problem lies in distinguishing the signal from the noise. Our research has identified a subset of sell-side information that has a greater and long-lasting effect on prices.1 By incorporating this data into our model, we have been able to deliver additional returns during portfolio rebalancing.

Test of time

Analysts employed by the sell-side, such as investment banks, brokers and market makers, play an important role in the process of finding the clearing price of a stock.

They scrutinise information such as company earnings calls or discussions with management to produce forecasts for company fundamentals.

Quantitative investment managers have for decades used analyst forecasts, buying stocks that are upgraded and selling stocks that are downgraded. But the benefit of this approach has weakened significantly.

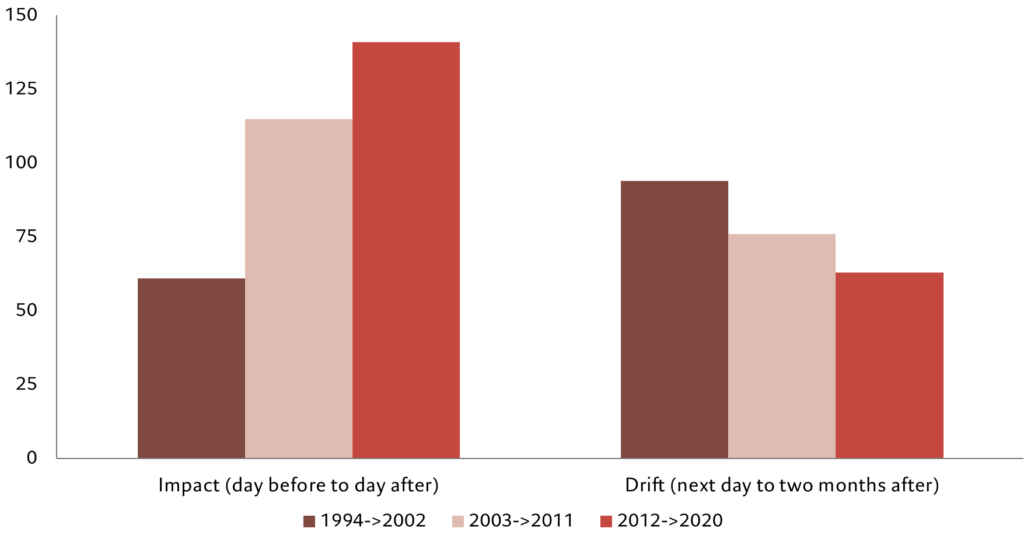

Our analysis of the past 24 years shows the price impact of a recommendation change is being felt closer to the point when the change is made public. The immediate effect of a recommendation change – or relative changes in the average return generated by a stock from the day before the change is announced to the day after – has become greater in the most recent eight-year period than the previous two eight-year periods.

After the impact, although the stock continues to out (under) perform after the up (down) grade, relative price moves observed in the subsequent two months have become smaller, while still correlated to the recommendation.

Fig. 1 – Price evolution through time of the impact and drift

Average return difference* in %

This means that while changes to sell-side recommendations are still of interest to investors, they must be acted upon ever more rapidly, ideally within days and no longer than a week after the upgrade or downgrade is made public.

However, using sell-side recommendations in this way provides little or no benefit to investors with a long-term horizon and a lower turnover – such as ourselves – as they typically avoid trading on short-term signals, in part to limit trading costs.

Finding analysts worth following

Yet that doesn’t mean broker recommendations are of no value at all.

Our research shows there ways in which long-term investors can capitalise on sell-side information.

Specifically, we have identified a group of analysts – which we describe as either “good” or “underestimated” – that have an enduring impact on asset prices.

“Good” analysts are those whose recommendations have impact – as indicated by the stock’s return between the close of the day before and the day after recommendation. “Underestimated” analysts are those whose recommendations impact the stocks’ return in the subsequent two-month period, a movement we describe as “drift”.

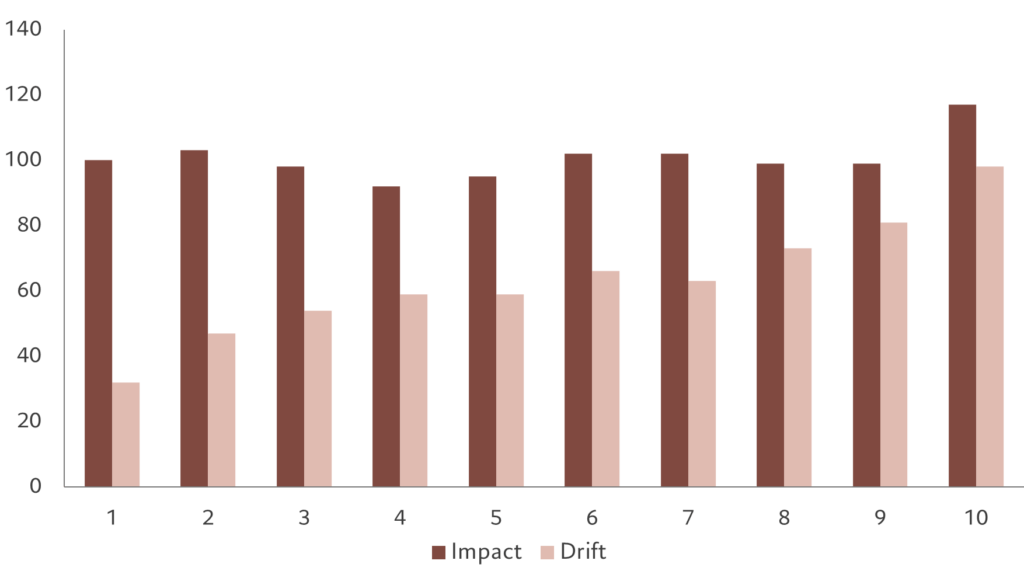

To distinguish the “good” and “underestimated” from the rest, we split the analyst community into 10 groups, estimating the strength of each analyst according to how good they were and how underestimated they were.

Our findings show that analysts who have historically had the greatest price impact after the recommendation continue to see the largest price impact at the moment the announcement is made.

That said, the returns in the subsequent two-month “drift” period are similar across all analysts, offering no tradeable benefit.

More importantly, however, we find that recommendations of “underestimated” analysts – those whose recommendations generate the most powerful two-month price moves – keep on being underestimated. In fact, the average two-month price moves of strong underestimated analysts is about twice as high as those of weak analysts, making them worth following.

Fig. 2 – Longer-lasting impact

Average return difference (%) at and after the announcement by analyst strength decile

Using analyst prediction in practice

Our quantitative strategy uses this specific type of information to effectively implement portfolio rebalancing and maximise the return potential from each position.

Our strategy invests in companies with attractive valuation and lower risk – characteristics that add long-term value.

This is evaluated within our proprietary 4P framework: profitability, prudence, price and protection (see Appendix). We regularly reassess each company against this framework but rebalancing takes place on a monthly basis because 4Ps are relatively slow-moving indicators.

This means our holding periods of 12 to 18 months are typically longer than many other quantitative managers.

To implement each rebalancing, we give ourselves one month to target the most attractive entry and exit points for our trades.

Our fast-moving quantitative signals, which allow us to identify the optimal trading point within the next month, incorporates effective sell-side analysts forecasts that we’ve identified, along with other technical indicators such as co-movements of stocks and short-term price moves.

Appendix: 4P framework - towards building a resilient portfolio

We invest in businesses with persistent high profitability, prudent growth history and an ability to generate shareholder returns over a full market cycle. We gauge a firm’s investability along four dimensions: profitability, prudence, protection and price – what we call our “4P” factor framework.

The Profitability factor is our gauge of a business’s strengths and competitive advantage. Companies that rank highly on this measure have, among other things, steady earnings growth, low operational leverage and high cash generation. Our research shows that firms with a strong track record of profitability tend to have more reliable and predictable earnings than firms whose stock valuations are in part based on lofty expectations for profit growth.

Prudence is the factor that captures a company’s operational and financial risks. In our framework, prudent firms are those that exhibit a lower risk of default and expand organically rather than through acquisitions. We invest in businesses that can create and preserve shareholder value by pursuing manageable growth and maintaining a sound financial profile. We measure this by looking at the nature and stability of a company’s cash flows relative to its financial commitments, including interest, dividends or capital spending.

Our Protection metrics monitor how a firm behaves over the course of the economic cycle – the aim is to quantify systematic or company-specific risks. We are looking for companies that have sustainable business models and whose prospects are insensitive to shifts in economic cycles. At the same time, we also analyse a stock’s volatility and its correlation with other equities to understand how it might affect the risk-return profile of the overall portfolio.

Finally, we don’t want to overpay for our investments. Therefore, our Price screen incorporates several reliable valuation models that help us identify the most attractively-priced stocks. Without this screen, portfolio managers could overlook promising investments or choose stocks that risk a capital loss. As a result of this comprehensive approach, our portfolio has a defensive profile that encompasses large cap, quality, value and low volatility stocks.