Key takeaways

- EM local rates are currently at their widest level compared to US rates

- Higher US rates do not hurt EM local bonds across the board

- Rising US rates do not necessarily result in weaker EM currencies

Let’s bust a myth straight out of the blocks: the widely held belief that emerging market local bonds are sensitive to US long rates. It’s groundless and unfounded.

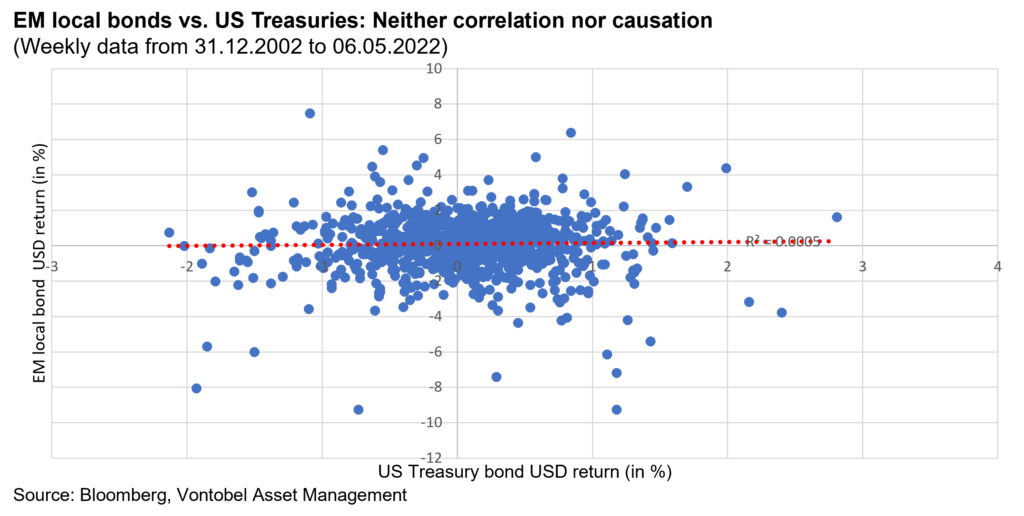

Sure, there are times (like now) when the performance of EM local bonds is negative US rates are rising, and vice versa, but the correlation is by no means a sign of solid, stable causation – a pity that, as it would make my job a lot easier. But as Algernon says in Oscar Wilde’s play The Importance of Being Earnest: “the truth is rarely pure and never simple.”

The adherents of the higher-US-rates-are-bad-for-EM-bonds theory claim that, on average, rational investors would allocate their money where interest rates are higher and, in addition, will tend to divest from the borrowers that are supposed to suffer from higher US rates. Putting that in the context of EM debt, investors would sell EM debt because higher rates would make EM issuers less creditworthy, and they would then use the proceeds to buy US Treasuries that are safer and more lucrative.

Let’s dispel that fallacy point by point:

- Higher rates weaken sovereign creditworthiness only in countries that are unable (or unwilling) to run primary budget surplusesi. But a lot of emerging countries do run primary budget surpluses that are similar or even better than the US. Of course, the US has the enormous advantage of being able print the world’s reserve currency, but it remains that emerging countries do not necessarily face a debt sustainability deterioration when US rates rise.

- Higher US rates do not impact EM local bonds across the board. Not only because EMs display a lot of idiosyncrasies that make US rate moves only one part of the equation, but also because EM local bonds are denominated in local currencies which, on average, generate the greater part of EM local bond returns expressed in US dollar. And EM currencies have their own dynamics where US rates are an even more diluted part of the equation (cf. next point).

- Higher rates do not necessarily entail weaker EM currencies because currencies tend to move on the back of different factors e.g., prospective real short ratesii, real growthiii and the net international investment positioniv to name a few.

But what if the above rationale is just EM propaganda, a sort of biased post-truth written by people who are judges of their own cause? Well, in that case, we can turn to the facts:

Over the past 20 years or so, the correlation between EM local bonds and US rates is close to zerov.

In other words, anyone who was lucky and/or smart enough to predict US rate moves correctly over the past 20 years, was unable to generate any profit from taking the opposite stance on EM local bonds. The latter statement might sound provoking and unsettling, but it is the reality.

As my colleagues and I have often advocated (see here and here ), what matters for EM investors is not if US rates are high but where the US dollar is heading to. Of course, higher US rates can put upward pressure on the US dollar, but let’s remember that EM local rates are currently at their widest level compared to US rates. Algernon was right, the truth is rarely pure and never simple.