Key takeaways

- Stable and sustainable economic growth appears to drive the new political tone of China’s leadership.

- The attractiveness of China is expected to become more apparent, as corporate earnings and macro data increasingly reflect the end of zero-Covid on Chinese consumer confidence.

- Investors have the space to focus once again on company fundamentals, which we believe ultimately drive stock price returns over the long term.

Fear of missing out, popularly referred to as FOMO, is not automatically associated with Chinese equities. However, the return to ‘normal’ life post the country’s zero-Covid policy had been eagerly anticipated by the market for what feels like a very long time. In this article we assess the buzz that occurred around China once the world’s second largest economy reopened and explain why investors are now likely to shift their focus to fundamentals such as earnings growth and profitability.

A remarkable comeback

After one of the worst months on record in October 2022, Chinese equities staged a remarkable comeback following the country’s decision to abandon its zero-Covid policy. In the space of only a few weeks, investor sentiment towards China swung wildly from incredibly negative (“is China still investible?”) to extremely positive, evidenced by investors establishing meaningful positions in Chinese equities.

The story of this comeback is clear when you look at the data. Between the end of October 2022 and the end of January 2023, Chinese equities roared back with a return of over 50 percent for the MSCI China index, while the MSCI China A Onshore index rose by almost 25 percent. And northbound equity flows to the Shanghai and Shenzhen stock exchanges surged by RMB 245 billion (approximately USD 36 billion) between the end of October 2022 and end of February 2023, according to data compiled by JP Morgan.

It seems like FOMO was the driving force behind this significant rally in the asset class. While FOMO is a relatively new term in our collective vernacular, what’s not new is to see investors keen to follow the crowd to avoid the fear of missing out.

However, this rally was short-lived, with the MSCI China index and MSCI China A Onshore index dropping approximately 16 and seven percent respectively from January 27 to March 20, 2023. Such a reversal in performance is a normal market reaction in our view as investors are still concerned with inflation, the pace of global economic slowdown and geopolitical tensions. Furthermore, we believe that the initial uplift in Chinese equities was led by valuation expansion (from very depressed levels), with the next leg likely to be driven by corporate earnings and profitability.

China’s economy: Are we seeing early shoots of recovery?

If Chinese equities are to continue their upward trajectory, investors will be looking for evidence of economic recovery in the data. What is the data currently telling us?

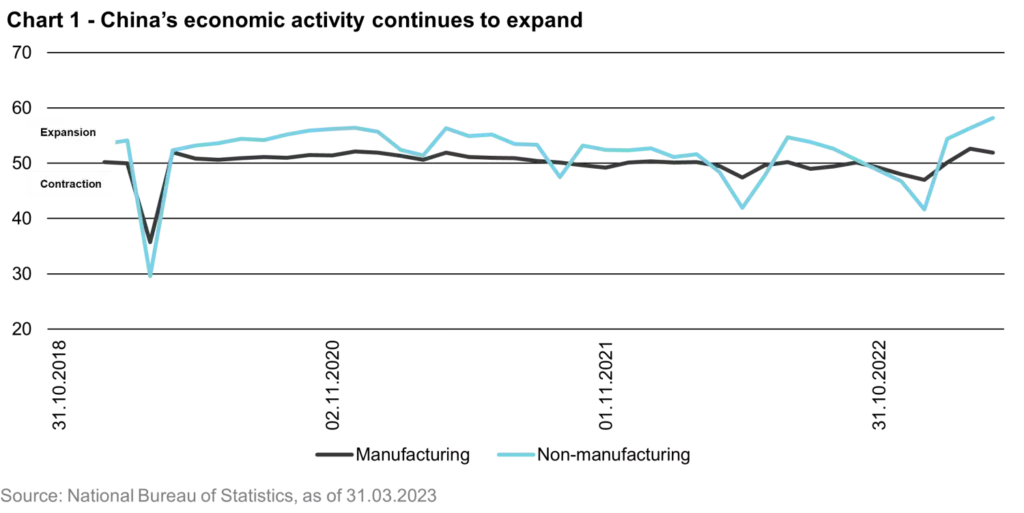

Manufacturing and services data has provided glimpses of recovery. Chart 1 shows the Purchasing Managers Index (PMI), released by the National Bureau of Statistics of China, which is a major economic indicator. At the start of March, the highest monthly improvement in manufacturing activity in over a decade was reported. Roll forward a month and the services and construction activity data for March surged to its highest level since May 2011.

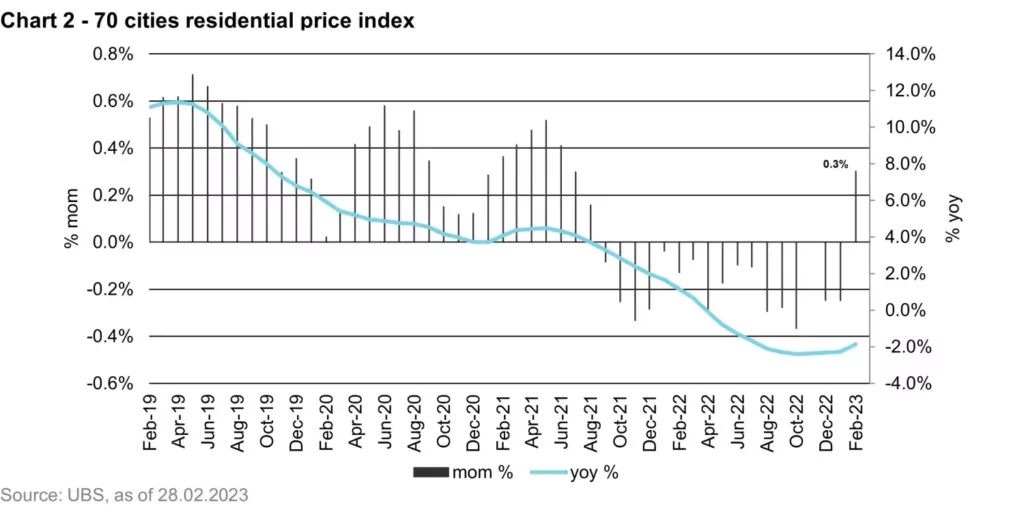

Real estate has also provided positive news. Chart 2 shows that home sales showed early signs of stabilization in February, with the value of new home sales by the country’s 100 biggest real estate developers climbing 14.9 percent compared to one year earlier. Importantly, new home prices also saw the first monthly increase in 18 months.

However, domestic investors are still somewhat lacking in confidence due to the fragility of the real estate sector’s recovery. Given that the real estate sector accounts for around 20 percent of China’s GDP, its recovery is considered essential by many. As more data of continued recovery in the real estate sector emerges, this should also reinstate the confidence of domestic investors.

Further overall signs of economic recovery are present. Foot fall at malls pointed to a strong rebound in January and February. Policies to restore the confidence of consumers and home buyers are being prioritized. And it seems a new credit cycle is beginning with structural monetary policy tools channelling low-cost funds to strategically important sectors, at least for more vulnerable borrowers.

In the same way that the first signs of spring shift the mood of many, these early shoots of recovery are important for investors who have been biding their time until a pattern of recovery in economic activity is clearly established in the data. The recent release of China’s Q1 2023 GDP figures were notably above expectations, with the economy growing 4.5 percent year on year (vs. 2.9 percent year on year in Q4 2022), confirming that the data is starting to show a pattern of recovery. While Chinese equities have experienced strong inflows over the past number of months (approximately USD 22 billion into onshore equities during January and February), China and Hong Kong remain a neutral weight for most global emerging market equity strategies. A reacceleration in corporate earnings and hard evidence of domestic consumption recovery is likely to lead more emerging market portfolio managers to start overweighting China.

What can history tell us?

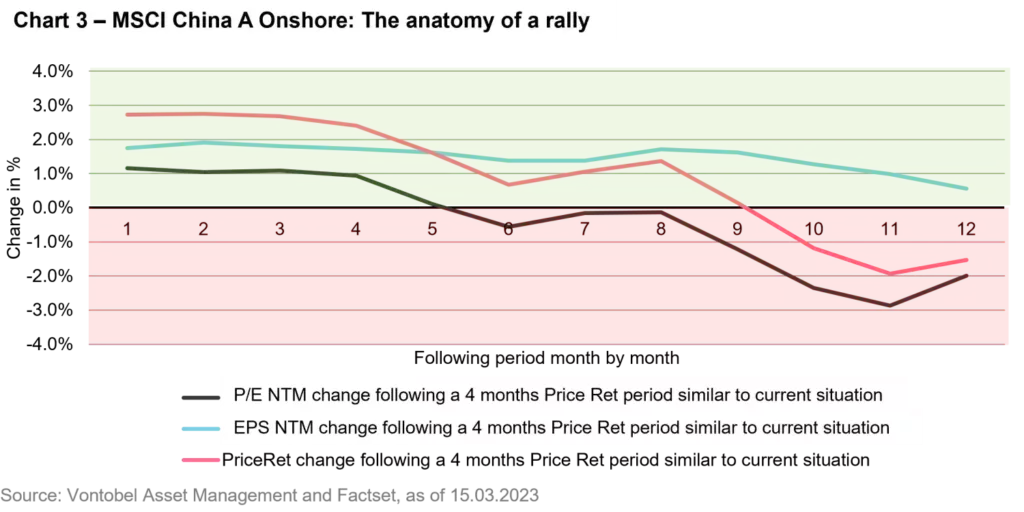

While the reopening of the world’s second largest economy following a pandemic-prompted lock-down is thankfully not a common occurrence, history can provide us with valuable lessons on market behavior. To identify patterns among investors following a strong four-month period of performance of Chinese equities, we analyzed the returns of the Chinese onshore market over the past 19 years. Looking at chart 3, we found that these strong periods of performance were usually followed by a further period of P/E expansion and earnings growth. The effect of P/E expansion lasted on average four months longer. Afterwards the effect reverses (P/Es fall back / black line crosses the zero line in month five and is below zero afterwards). However, we observed that earnings continued to rise for longer following these strong periods of performance, typically expanding for a further 12-month period.

While history is no guarantee of future performance, the pattern of performance seen over the last 19 years of China’s onshore market indicates that positive earnings from Chinese companies now need to come through to justify a continuation in the rally. It also shows how important momentum is for Chinese equities. Of course, caution is called for here, as China is in a very different situation today, both economically and politically. Growth rates are lower and there is greater political uncertainty today than ten years ago.

What’s next for Chinese equities?

At mtx, we remain positive on the outlook for Chinese equities for the following reasons:

- China’s leaders appear to have set a new political tone. The focus is on stable and sustainable economic growth. It also seems that large-scale regulatory intervention in the economy is no longer a top priority, and this will likely prompt global investors to start refocusing on the fundamentals of Chinese companies.

- We expect Chinese consumers to experience incremental improvements in confidence as the shift from zero-Covid to ‘normal’ life progresses. Chinese equities could be set to experience an upward trajectory in its return cycle given how developments have progressed. This will become more evident in corporate earnings and macro data (both lagging indicators) as time passes. Should economic activity in the US cool down – given the Fed’s significant rate hikes and concerns around the health of the US banking sector – the relative attractiveness of China may come to the fore.

- As bottom-up stock pickers, we believe that company fundamentals ultimately drive stock price returns over the long term. It’s been difficult for investors to focus on the fundamental health of Chinese companies over the past few years, yet we believe the recent developments discussed in this article significantly increase the odds of investors focusing more on fundamentals.

Important Information: Past performance is not a reliable indicator of current or future performance. Indices are unmanaged; no fees or expenses are reflected; and one cannot invest directly in an index.

Any projections, forecasts or estimates contained herein are based on a variety of estimates and assumptions. There can be no assurance that estimates or assumptions regarding future financial performance of countries, markets and/or investments will prove accurate, and actual results may differ materially. The inclusion of projections or forecasts should not be regarded as an indication that Vontobel considers the projections or forecasts to be reliable predictors of future events, and they should not be relied upon as such.

Vontobel reserves the right to make changes and corrections to the information and opinions expressed herein at any time, without notice. This document is for information purposes only and does not constitute an offer, solicitation or recommendation to buy or sell any investment instruments, to effect any transactions or to conclude any legal act of any kind whatsoever.