Key takeaways

- The fight against global hunger is becoming increasingly difficult as food prices are driven higher by war, supply chain difficulties, and climate change.

- Improving food supply is complex, partly because of issues in relation to biodiversity damage and agricultural emissions risks.

- Active “impact” investors can play their part by allocating capital to companies providing solutions in this area.

- We currently see attractive investment opportunities along the whole food value chain.

- Such investments also support many UN Sustainable Development Goals, as well as supporting social change.

A pandemic and a war were enough to do away with decades of progress in the fight against global hunger. Do investment strategies matter in this critical situation? We believe they do. Stock-pickers in the area of impact investing have the ambition to contribute to environmental as well as social improvement via insightful capital allocation and engagement. If done right, the solutions provided by the companies asset managers choose will have a significant effect, we believe.

In 2020, over 2.3 billion people, or roughly a third of the global population, lacked access to adequate food.1 Over the coming decades, there will be about 2 billion more mouths to feed, mainly in food-insecure regions. The past pandemic and Russia’s invasion of Ukraine, one of the major global grain producers, have not only exposed the vulnerability of our energy system, but also of our agricultural supply chains. When grain shipments are blocked and silos attacked, people in the Middle East or the Horn of Africa could die of hunger. This is a dimension we in the West, often preoccupied with food prices, sometimes fail to recognize. This summer’s heatwaves and wildfires have made matters worse.

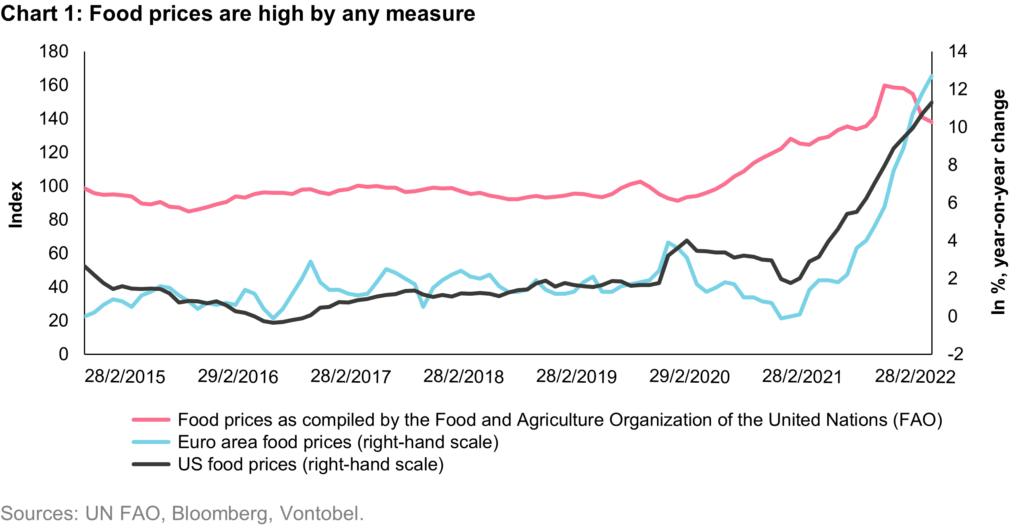

After Russia’s aggression, food prices reached historical highs. The acceleration of the Food and Agriculture Organization of the United Nations (FAO) food price index2 (see chart 1) started to moderate following the creation of a corridor for grain and fertiliser exports through the Black Sea in July. However, food inflation remains in the double digits in many countries, with worrying implications for the worsening cost-of-living crisis.

Capital is needed to address the challenges

There is no quick fix. Even so, asset managers, though not the typical problem solvers, can assist in taking on the challenge. Their help comes in the form of capital allocation to companies that sell products to improve the long-term resilience of the food chain. For example, impact investors typically focus on ways to increase land yields, manage food waste, improve food safety as well as security, support smallholders, cut emissions, and/or protect and restore biodiversity.

Food quantity, rather than quality, edging into view

Producing more food without using poisonous chemicals and damaging the planet is tough. The food emergency has triggered a temporary setback3 in the European Union’s fight in favor of organically farmed land – a cornerstone of the EU’s 2030 Farm to Fork (F2F) strategy announced in May 2020 – as cutting the amount of chemical fertilizers and pesticides could lower productivity at a time when higher quantity is a must.

By the same token, crop-based (“first generation”) biofuels are now under scrutiny despite an initial endorsement by the EU as part of its Fit for 55 initiative.4 There are concerns that corn, sugar cane, or palm oil could be increasingly used for first-generation biofuels rather than food production. So-called second-generation biofuels, made with food waste, algae, or non-food biomass, could be an answer to the ethical question this raises. Indeed, the US is looking to advance biotechnologies and use science to produce biofuels (alongside drugs, biofertilizers and bioplastics, to name a few).5 Given that the global food and agriculture system accounts for over a quarter of the world’s greenhouse gas (GHG) emissions,6 progress in this field is important despite the complexity of the subject matter.

From tractors and recyclers to algae-based feed

A few examples of what we consider interesting companies or areas of activity illustrate our way of thinking. When it comes to increasing agricultural efficiency, we see farmers investing in better machines, equipped with modern technology including cameras to distinguish a crop from a weed and only provide nutrients to the former. Equally, tractors equipped with satellite navigation guide farmers to the right plot areas, without compressing the same soil multiple times as this would damage biodiversity and impoverish the soil. For example, one of the world’s largest agricultural machinery companies sells sophisticated tractors and sprayers that improve farming efficiency.

Food waste usage is an investable area too. This could include investments in specialized companies such as a large global collector of used cooking oil as well as waste from animal processing. The raw material is then converted into food ingredients (e.g. gelatines, collagen), animal feedstock, and second-generation biofuel, so called renewable diesel.

To be present in the area of plant-based diets, investors may also look at a company that sells key ingredients for vegan burgers offered by a leading restaurant chain, or a concern that owns brands such as Linda McCartney, which is very popular among, for instance, British fans of vegetarian sausages.

On the point of protecting biodiversity, we believe that the algae-based feedstock produced by a Netherlands-based company is a good example for innovation. It allows aquafarm companies to feed salmon (rich in omega3 fatty acids believed to have health benefits) without sacrificing small wild fish in the ocean. Furthermore, it helps to reduce animal food waste: its feedstock preservative cuts the risk of fungi and yeasts in animal food, and hence the risk of digestive disorder, salmonella and E. coli bacteria for animals.

Another interesting franchise is one of the leading providers of environmental clean-up services in the US. The group operates incinerators,7 provides management services for hazardous waste, and recycles used motor oil to produce lubricants. One of its divisions helps to restore biodiversity: for example, after the disastrous BP oil spill in the Gulf of Mexico in 2010,8 this group was one of the companies hired to clean up the ocean and the shores. It was involved in many aspects of the spill response including containment, removal, and the ultimate treatment and disposal/recycling of the recovered product. It provided equipment, mobilised thousands of workers and assisted in the capture of a portion of the oil spilled, allowing the flora and fauna to recover faster.9

We currently see attractive investment opportunities along the whole food value chain encompassing greener agriculture, food safety and security, plant-based diet, recycling and food waste management, clean water, and biodiversity. Generally, any holding should contribute to one or several Sustainable Development Goals (SDGs) by the United Nations, such as SDG 2 “Zero hunger”, SDG 6 “Clean water and sanitation”, SDG 14 “Life below water”, and SDG 15 “Life on land”. And the possibilities for investors remain vast amid continued innovation and changes in consumers preferences. By the same token, access to seeds and equipment to small farmers is an important “enabler” for positive social transformation. All in all, trying to aim for environmental and social improvements is something that should make impact investors want to come to work every day.

1. Prevalence of moderate or severe food insecurity, The World Health Organisation, July 2021.

2. The FAO Food Price Index (FFPI) is a measure of the monthly change in international prices of a basket of food commodities. It consists of the average of five commodity group price indices weighted by the average export shares of each of the groups over 2014-2016.

3. Brussels braces for ‘acrimonious’ fight over reducing pesticides, Politico, 8 Aug 2022 ( https://www.politico.eu/article/brussels-brace-acrimonious-fight-reducing-pesticide/ ); Financial Times, EU reviews sustainable food plans as Ukraine war disrupts imports, 20 March 2022 ( https://www.ft.com/content/f99d784c-0448-4552-ab8b-e77ed68ea173 ).

4. Safeguarding food security and reinforcing the resilience of food systems, European Commission, 23 March 2022 https://ec.europa.eu/info/sites/default/files/food-farming-fisheries/key_policies/documents/safeguarding-food-security-reinforcing-resilience-food-systems.pdf

5. The United States Announces New Investments and Resources to Advance President Biden’s National Biotechnology and Biomanufacturing Initiative, The White House FACT SHEET, 12 Sept 2022 ( https://www.whitehouse.gov/briefing-room/statements-releases/2022/09/14/fact-sheet-the-united-states-announces-new-investments-and-resources-to-advance-president-bidens-national-biotechnology-and-biomanufacturing-initiative/ ).

6. Our World in Data, 2019 ( https://ourworldindata.org/food-ghg-emissions#:~:text=Food%20is%20responsible%20for%20approximately,for%2031%25%20of%20food%20emissions )

7. In the US, where most of the waste piles up in landfills, the company has by far the largest incineration capacity in the industry, and it is active in recycling. Its services represent a comprehensive solution and help cut the amount of waste going to landfills.

8. 1,300 miles of shorelines were affected, 82,000 birds and almost 26,000 marine animals died, according to the Center for biological diversity https://www.biologicaldiversity.org/programs/public_lands/energy/dirty_energy_development/oil_and_gas/gulf_oil_spill/a_deadly_toll

9. Scientists report that many species are still struggling as their population is still lower than before the spill. By contrast, other species have shown a robust recovery, e.g. the brown pelican, Louisiana’s state bird. Source: The National Geographic, 17 April 2020. https://www.nationalgeographic.com/animals/article/how-is-wildlife-doing-now–ten-years-after-the-deepwater-horizon