Very good, but not fully smooth sailing

The world held up better than we expected in the 4Q

Our mid-September overall macro theme proved, in the end, to be too negative for the 4Q, as markets and economies held up better than we expected. However, we expected a major rally for bonds and equities in 2023, so our intermediate-range targets were much more accurate. There certainly were some important financial “accidents,” as we forecasted, especially in the Gilt market and the crypto industry, but none proved of lasting impact on overall conditions. Also, China’s major pivots in virus control, property market support and economic stimulus was a major positive surprise for markets. The re-election of Xi Jinping also led to a new détente in foreign affairs despite all the difficult situations. We had expected China to open up sooner than consensus, but even we are shocked at what transpired, in what will continue to be an uncertain, but defining moment ahead. Globally, our central bank expectations, with the exception of the BOJ (please see our note “BOJ’s YCC shift parallels a Fed pattern” for analysis of its policy shift), were correct for the 4Q, but not for the 1Q, in which we expected rate cuts after a sharp but brief market and economic downdraft. The eurozone looks like it is now in recession, as we expected, but not a deep one, while the US is not in the mild recession that we expected. For the most part, 2022 GDP forecasts are higher than we expected, but consensus for 2023 is at or below what we expected for the US, eurozone, Japan and China. Our negative stance on global equities (excluding Japan, where we correctly expected gains) and bonds was initially correct, but both bonds and equities rallied after mid-October. As for geopolitics, our “less worried” stance was reasonably correct.

Looking forward in obviously murky conditions, on 21 December, our committee decided, with a significant majority, on a macro-economic scenario that matches consensus, with a view that China delivers an economic rebound after reasonably moderate 1Q problems related to virus effects. Given this scenario, we expect corporate results and guidance in the upcoming 4Q earnings season to remain cautious, with global demand decelerating while margins are being squeezed by higher labour and other input costs. Supply chain disruptions should be less of a burden to profitability, although the mobile phone industry will need another quarter to recover from the major problems in China this autumn. Investor sentiment, meanwhile, will likely be reasonably positive in the 1Q, but likely encountering occasional potholes. Indeed, some macro data could be very disappointing, but these sorts of surprises should not distract one from the intermediate-term view that inflation will decelerate, as per consensus, which will eventually hearten central banks and allow the Fed to declare victory in the 4Q and start cutting rates.

Our new scenario predicts that globally, GDP will match consensus in the quarters ahead, with the US up 0.8% on a Half on Half Seasonally Adjusted Annualised Rate (HoH SAAR, as used in all references below) in the 1H23 and 0.3% in the 2H23. Eurozone GDP will continue to be hurt the most by the Ukraine crisis, showing -1.0% and 0.6%, respectively, while Japan’s economy should benefit from re-opening and many other factors, growing 1.5% and 0.7%, respectively. Regarding China, we continue to expect that it will be able to wade through its current troubles, although it should be quite rocky through the 1Q, with GDP growing 3.3% and 4.3%, respectively. For full year 2022 GDP growth, the US, the eurozone, Japan and China, at 2.0%, 3.3%, 1.3% and 3.1% should, with the exception of China, decline, as per consensus, to 0.9%, -0.1%, 1.2% and 4.1% in 2023. Clearly, this is not a major rebound as the restructuring of the global economy, with its increasing de-globalisation and the shift to sustainability, particularly in the energy sector, is causing major problems with inefficiencies and productivity. Moreover, one major risk factor is if labour strikes accelerate further globally, especially in Europe, from their present levels. Countries in which socialism or major union power are prevalent, especially in Europe, but also Korea, will face a populace that will force corporations to share the burden with higher salaries, coupled with various negative government mandates, that will lower corporate profits. Economic growth is obviously hurt by strikes, as well. However, in our view, commodity prices should stabilise, causing consumer prices to fall more broadly, and thus, labour will likely become less adversarial than expected, which is what central banks desire above all.

Geopolitics will no longer be ignored

Whereas in the past the problems were fleeting, geopolitical risk should now remain something that markets will not ignore. Not only will the Ukraine conflict continue to be a major problem, North Korea, China/Taiwan and the Middle East need watching. On Ukraine, although fighting might lessen ahead, a peace treaty is very unlikely. We expect that grey-zone warfare with Ukrainian forces and with the rest of the world, including hacking, will continue to disrupt markets, economies (especially as Ukraine and Russia are such large commodity producers that affect supply chains and inflation) and investor confidence. Meanwhile, relations between the West and China remain very tense, despite increasing détente, although neither side seems willing to cross any red lines, while China’s support of Russia and North Korea has the potential to cause major economic disruptions with the West. Increased fears about Taiwan certainly should not be ignored either. Meanwhile, the Middle East remains on tenterhooks, especially as an Iran deal now looks impossible, while the new government in Israel is arguably its most aggressive ever.

As for US political risk, the country remains mired in conflict. Social issues will also likely provoke unrest and the outlook points to complete political stalemate. House Republicans will launch investigations into Democrats, including President Biden, that will likely prove unsettling. The net result of all of this should make risk markets and business leaders somewhat wary, although assuming the omnibus and debt-limit bills pass, urgent government action does not seem needed at this time.

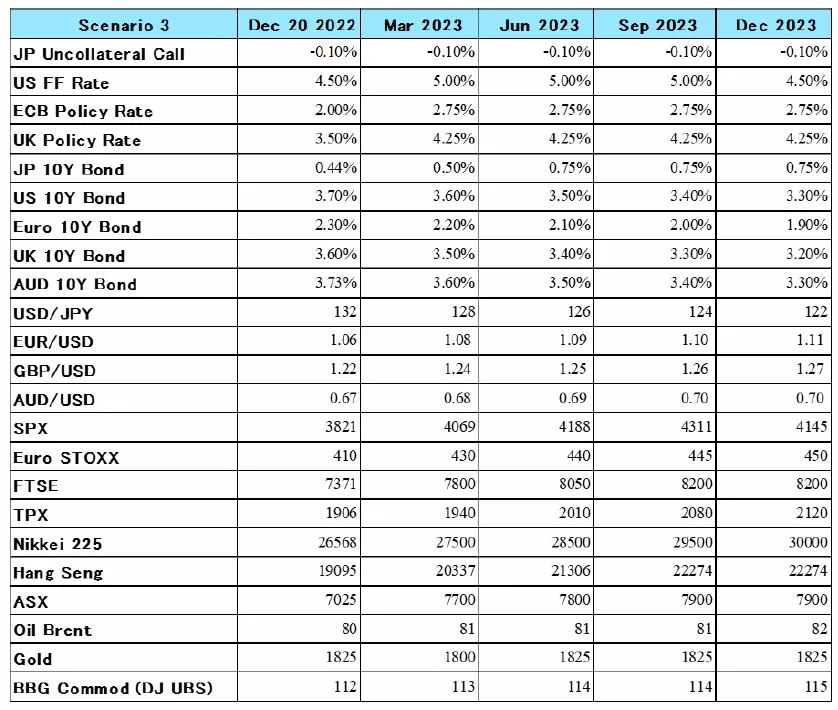

Our detailed forecasts:

Central banks: Fed peaks in 1Q and cuts in 4Q

Our new view on central banks is basically in line with consensus. We expect the Fed to hike 50 bps in the 1Q, and then pause until cutting 50 in the 4Q. As for the ECB, we expect it to hike 75 bps in the 1Q, and then pause through 2023. The BOJ will likely increase the YCC band to 75 bps in 2Q after a new governor is installed in April, and maintain it there, with increasing signs of policy normalisation but not actually hiking policy rates. Furthermore, the Fed and ECB will proceed with QT and also, along with the BOJ, reduce their balance sheets by winding down special pandemic-related lending programs.

US and European bond yields decline; USD weakens further

For bonds globally, weak economic growth and a continuing decline in inflation should greatly help, although Fed and ECB QT certainly will prove challenging. Many investors, given their disposition, will likely worry about virus scares, disappointing economic data points, geopolitical flare-ups and problems during China’s economic transition; thus, they should be enthusiastic about bonds, especially as the Fed “pivot” truly arrives. For US 10Y Treasuries, our target for end-March is 3.60%, while those for 10Y Bunds and 10Y JGBs are 2.20% and 0.50%. We then see 10Y Treasuries and 10Y Bunds falling to 3.50% and 2.10% in June, respectively, and further in the following quarters. Regarding forex, we expect the USD to sink to 128 vs. the yen in March and to 126 in June (and further thereafter), with the euro at 1.08 and 1.09 for those periods. Notably, both the Gilt market and the fear of reigniting inflation should keep the pressure on governments to avoid further fiscal stimulus, which should assuage bond investors.

Regarding the world’s largest asset class, real estate in its various forms, one should remember that fixed mortgage rates, though down from their highs, have soared globally, presenting a major headwind to the crucially important residential and commercial property markets. Such can cause negative wealth effects and also credit problems. Also, in many countries, especially the UK, anyone with a variable mortgage rate will suffer major cost increases that will likely lead to a decent amount of defaults and continually declining home prices, not to mention declining personal consumption (although partially offset by savers earning much more). Also, overdue residential rent cases in the US are surging and many tenants will likely leave their current apartments, leaving landlords and any securities based on housing (with a similar situation for commercial properties) vulnerable to shocks.

We forecast that the FTSE WGBI (index of global bonds) should produce in USD terms a 3.3% unannualised return from our base date of 20 December through March, 5.3% at June-end and 10.2% by December. Thus, we are quite positive. For yen-based investors, however, this index in yen terms should return only 0.2%, 0.5% and 1.8% through those respective periods, with JGBs returning -0.5%, -2.7% and -2.5%, respectively, so offshore bonds should be preferred to JGBs despite yen strength.

The Brent oil price will likely stabilise, in our view, in the quarters ahead due to slower growth in the West, partially offset after the 1Q by China’s re-opening, especially regarding travel. Of course, the Russian and Iran questions loom large, both geopolitically and as regards global oil supply, but we think there is a good chance that supply will adjust to conditions.

Greatly due to the high base effect caused by the peak of commodity prices in 2022, coupled with deceleration in other prices, particularly the oddly calculated medical cost component, we expect the headline and core CPI readings to match consensus estimates ahead, with the former at 3.2% and 2.6% in June and December 2023, respectively, and the latter at 3.8% and 2.8%. On a 6-month annualised rate, which the Fed is supposedly carefully watching, Headline and Core CPI both should be 3.8% in June and 1.8% and 2.6% in December respectively. Indeed, the core rate should come close to hitting the Fed’s target, assuming that the PCE deflators are a bit lower than the CPI. As for further details, housing rent will likely, due to the lagged effect of repricing of new contracts, continue to march upward, though to a lesser degree; but food, gasoline, airfares, new and used cars, apparel, home furnishings and many services prices should soften soon due to lower demand. Eurozone and Japanese CPIs should decelerate greatly ahead too, although the eurozone will take longer to approach the ECB’s target, especially if second round effects and labour strikes are more pervasive than expected.

Despite potholes, global equities should improve through 2023

We do not expect full smooth sailing ahead, but whatever potholes occur should be mostly overshadowed by the intermediate-term improving global prospects. Indeed, there will likely be some fairly worrisome economic statistics ahead, and the overall economic recovery should be quite muted, especially in Europe, while credit market conniptions should occur after all the excesses of the past few years. Excluding the crypto carnage, only a few “accidents” have occurred so far, whether in the derivatives markets, leveraged loan syndications, securitised real estate investments, junk-rated firm collapses, personal loan defaults or other aspects, but we expect quite a few to appear globally. Furthermore, even among stable firms, we expect corporations globally to report earnings (and guide) negatively during the 4Q season for rather obvious reasons, although many companies in the US will be helped by a weaker USD, even if just for forex translation gains. Geopolitical events could also get scary at times, hurting market sentiment and proper economic functioning.

But due to improving global monetary policy prospects, lower bond yields, the avoidance of deep recession and China’s pivots, we shift to a positive view on global equities for 2023. Aggregating our national forecasts from our base date, we forecast that the MSCI World Total Return Index in USD terms will be +7.2% through March, +11.1% through June and +12.7% by December (+3.9%, +6.1% and +4.2% in yen terms).

In the US, the SPX’s PER on its CY22 consensus EPS estimate is 17.5 (and 16.4 for 2023), which is high, especially given present bond yields, and earnings reports and guidance ahead will likely be disappointing, especially to short-term investors and algorithm models; however, buybacks remain fairly strong, but the improving intermediate-term macro outlook, and a less hawkish Fed turning full dovish by the 4Q, should encourage investors. We do, believe, however, that concerns about valuation and the economy in 2024 will subdue sentiment by year-end. In sum, we expect the SPX to rise to 4,069 (7.0% total unannualised total return from our base date) at end-March, 4,188 in June (10.5% return) and 4,145 at end-December (10.3% return), with yen-based returns of 3.7%, 5.5% and 2.0%, respectively. Thus, the US is not expected to outperform in 2023.

European equities surged in the 4Q, especially in USD terms, after underperforming greatly in the 3Q. So far, the situation there has been less negative than anticipated despite the ECB turning very hawkish, which strengthened the euro. The Euro Stoxx PER, at 12.0 times CY22 EPS consensus estimates (and 11.8 for 2023) is somewhat below its historical average, and despite earnings and economic disappointments, investors will likely anticipate better times ahead. A key factor (along with, of course, the Russia-Ukraine situation) will be how pervasive labour strikes (and the resulting wage increases) are. Thus, we expect the Euro Stoxx index to rise to 430 at end-March and the FTSE to 7,800, which translates to a total return of 8.1% (unannualised from our base date) for MSCI Europe through then in USD terms. Thereafter, we expect 12.8%, through June and 19.0% through December, greatly aided by a rebound in the euro, which argues for an overweight of the region.

Japanese equities were high performers in the 4Q in USD terms, rising 12% so far from June in USD terms (vs 6% for the SPX) and 3% in yen terms. Indeed, through 21 December, MSCI Japan in USD terms fell 16.1% year to date, outperforming the SPX’s -17.3%. As noted in our latest update to Show Me the Money series, corporate profit margins hit new highs in the 3Q, and given the full re-opening of the economy (including inbound tourism), consumer optimism is rebounding. High inflation, which worried consumers, looks set to decline ahead, especially with the yen’s surge in recent days. The auto sector, which is a major portion of the stock market and economy, will likely be hurt by the stronger yen and increasing doubts about the rebound in auto demand globally, while the global tech sector also is in a deep downturn, primarily as excess demand during the pandemic is reversed. But investor interest in financials and other domestic-oriented companies should be very strong. So, overall corporate earnings face the yen headwind, but the economic re-opening, including in China after the 1Q, should offset most if not all of such. Notably, many Japanese exporters have hedged a good portion of their forex exposure for the next 3-6 months, so the yen effect will be gradual. Meanwhile, Japan has low political risk and structural reform is continuing, especially in digitalisation and alternative energy. Japan’s low exposure to Russia is fortunate, and fortunately it secured its natural gas supplies from Sakhalin, and the country will thus continue to benefit the most from reasonable global commodity prices. TOPIX’s PER is now 12.3 times its CY22 EPS consensus estimate, which is very low (and 11.9 for 2023). Also supporting the market are share buybacks, which are very strong, and the market’s dividend yield, which at 2.6% remains extremely attractive vs. bonds. Thus, we forecast the TOPIX at 1,940 at end-March, 2,010 in June and 2,120 next December for total unannualised returns of 5.7% in USD terms (2.5% in yen terms), 11.2% (6.9% in yen terms) and 23.3% (14.0% in yen terms), respectively, from our base date through those periods. As for the Nikkei, it should hit 27,500, 28,500 and 30,000, respectively. These returns are obviously very attractive for both domestic and global investors.

Developed Pacific-ex Japan MSCI: Australia should benefit from many commodity prices remaining at high levels, especially those geared to the rebound in China after the 1Q. Relations between the countries have entered a détente, which should greatly assist Australia, as well. However, the domestic downturn in property prices is a headwind for many consumers due to the wealth effect, and for banks and construction firms too, so domestic economic growth should not surge in 2023. Hong Kong’s stock market, which is dominated by PRC firms, rebounded sharply after China’s pivots and prospect of a revival in tourism. A weakened local property market certainly does not help, but less hawkish central banks after the 1Q (and the Fed potentially easing in the 4Q) should allow for some stabilisation in property and equity sentiment in 2023. We expect the region’s MSCI index returns in USD terms (total unannualised) at 10.8% through March, 15.7% through June and +22.2% through next December.

Investment strategy concluding view

We don’t expect smooth sailing for the global economy and markets, but there should be great relief for both stocks and bonds in 2023, with pockets of strong outperformance due to idiosyncratic advantages. Notably, Europe and Developed Pacific-ex Japan should be overweighed for equites for the next six months, but Japan should perform the best by next December. Of course, there are a plethora of risks that must be navigated, some the most challenging since the end of World War II, but investors should not be distracted by occasional potholes unless the scenario ahead is likely to be durably altered by such. If such occurs, especially if events in China unfold badly, we are ready to meet again and share our new views.

Important disclaimer information

Please note that much of the content which appears on this page is intended for the use of professional investors only.