The strategies in our latest generation of investment solutions again proved their worth in the past year.

Global Portfolio Solution, our investment solution that combines several of the latest investment tools, again delivered strong results in 2021. Most portfolios in Global Portfolio Solution outperformed their reference indexes in the past year – including Global Portfolio Solution Balanced, which most clients are invested in.

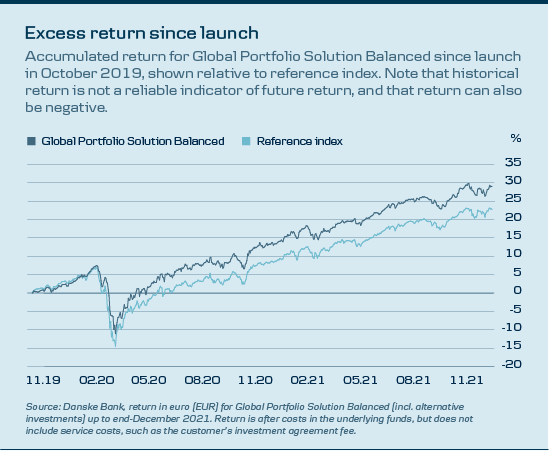

Global Portfolio Solution Balanced delivered another 0.9% outperformance in 2021 (net of costs in the underlying funds), bringing total excess performance to 6.3% since inception in 2019 with a Sharpe ratio of 1.25 (vs 0.92 for the reference index). However, historical return is not a reliable indicator of future return, which can also be negative.

“Global Portfolio Solution has generally delivered strong results and an excess return since its launch in autumn 2019, and the past year was a continuation of that pattern.”

– Thomas Otbo, CIO at Danske Bank Asset Management.

Exposure to inflation proved profitable

Søren Mose Nielsen is chief portfolio manager for Global Portfolio Solution, and he notes that the solid results in 2021 were mainly driven by high returns from equities. In contrast, rising yields reduced the return from government bonds. However, other strategies compensated for the negative impact of these securities.

“Yields have risen because inflation expectations have climbed, and in Global Portfolio Solution we have also had exposure to inflation. The profit from these investments largely neutralised the capital losses on government bonds,” says Søren Mose Nielsen.

READ ALSO: How to hedge inflation risks optimally

Bumper strategies contributed positively to return

A particular feature of Global Portfolio Solution is the special strategies designed to reduce the vulnerability of investments to pronounced price falls in the financial markets. These are termed bumper strategies and comprise investments that are expected to produce a positive return during periods of major market declines, so the portfolios lose less in value.

“Our bumper strategies proved their worth when the corona virus triggered dramatic price falls across the financial markets in spring 2020. During periods without significant prices falls, we have to expect the ongoing costs of bumper strategies to take a share of the return, though these strategies also contributed positively to return when yields surged in spring 2021,” says Søren Mose Nielsen.

Global Portfolio Solution in brief

• Global Portfolio Solution is our new generation of investment solutions.

• Global Portfolio Solution employs a number of the latest investment tools, and the aim is to create more robust portfolios that produce a higher risk-adjusted return compared to Danske Bank’s other investment solutions.

• Global Portfolio Solution combines direct investments in equities and bonds with investments in financial derivatives. This facilitates greater risk diversification across investments and the chance to react quickly in the financial markets when attractive investment opportunities arise.

• A new feature of Global Portfolio Solution is the use of special strategies to reduce the vulnerability of investments to pronounced price falls in the financial markets. We term these bumper strategies

This material has been prepared for information purposes only and does not constitute investment advice. Note that historical return and forecasts on future developments are not a reliable indicator of future return, which may be negative. Always consult with professional advisors on legal, tax, financial and other matters that may be relevant to assessing the suitability and appropriateness of an investment.