We look at how over-stretched balance sheets are creating opportunities in the European mid-market.

The past decade saw corporates dining out on cheap financing and growing ever more comfortable with increased debt levels. Buoyed by the cut price menu on offer, many borrowers gorged themselves, levering up their balance sheets.

Then came the Covid-19 pandemic. For some businesses, profitability was heavily impacted and further spikes in leverage followed. Despite stretched capital structures, these issuers could still often re-finance on the prospect of improved future earnings, growing cashflow generation, and forecasted debt reduction.

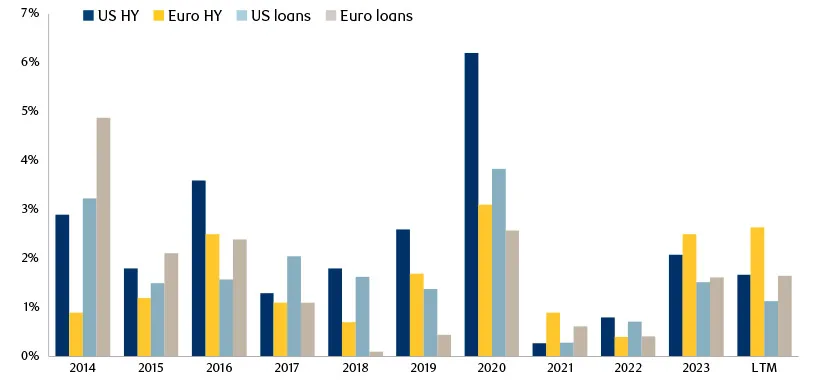

Now, however, in the wake of the most aggressive hiking cycle in a generation, many of those corporate balance sheets are showing clear signs of stress, as it becomes clear that the existing balance sheets of many borrowers are simply not engineered to endure a higher interest rate environment. Accordingly, after a period of relatively low default rates by historical standards, recent quarters have seen a steady rise in default rates across leveraged finance markets (Figure 1).

The counter-cyclical nature of distressed investing means that dislocation in public credit markets creates opportunities for distressed investors. As a result, today, we see a far broader opportunity set in the distressed portion of the European mid-market.

Figure 1: Default rates across US and European HY bonds and loans

Stress amongst levered names

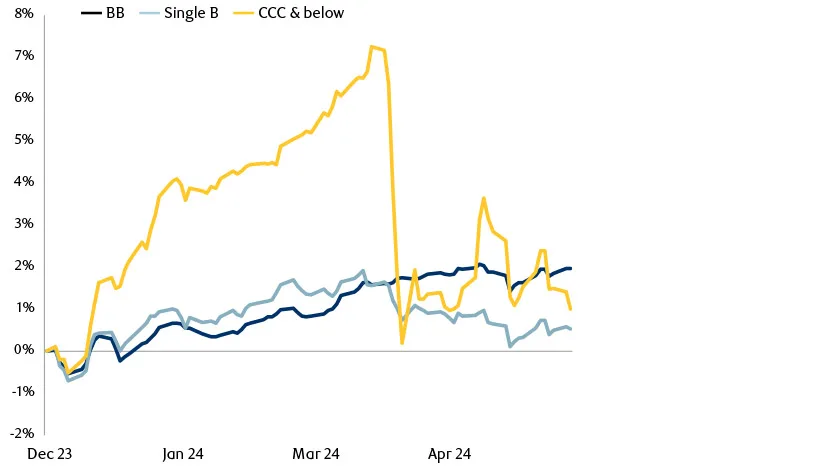

In 2024, price volatility has returned amongst the most levered public credit market issuers. Year-to-date, European markets have registered a notable underperformance, due to volatility generated by a handful of CCC-rated credits (Figure 2).

Figure 2: European HY returns by rating

Note: BB – ICE BofA BB Euro High Yield Index;

Single-B – ICE BofA Single-B Euro High Yield Index;

CCC & below – ICE BofA CCC & Lower Euro High Yield Index.

The principal sources of volatility have been global packaging company Ardagh Group, French telecom giant Altice, and Swedish debt collector Intrum. The stress in these credits has not been driven by any major operational challenges at the businesses, rather it has been precipitated by the leveraged nature of their balance sheets.

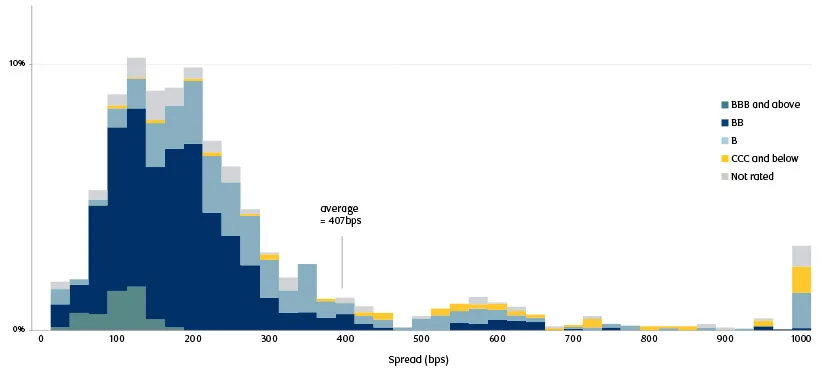

Consequently, European leveraged finance markets are increasingly bifurcated. The valuation gap between the distressed and non-distressed portions of the market has grown significantly. Today, whilst more than a third of European high yield issues still trade below 200bps option-adjusted spread, there is also a cohort of lower-rated credits that trade at cycle wides, in excess of 1,000bps spread (Figure 4).

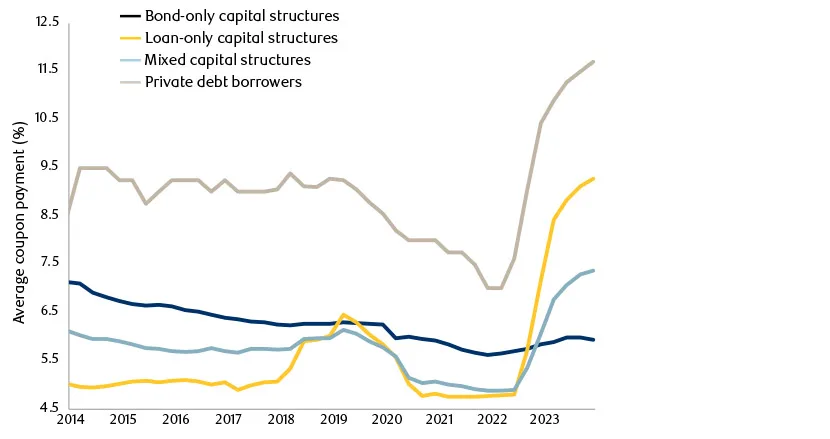

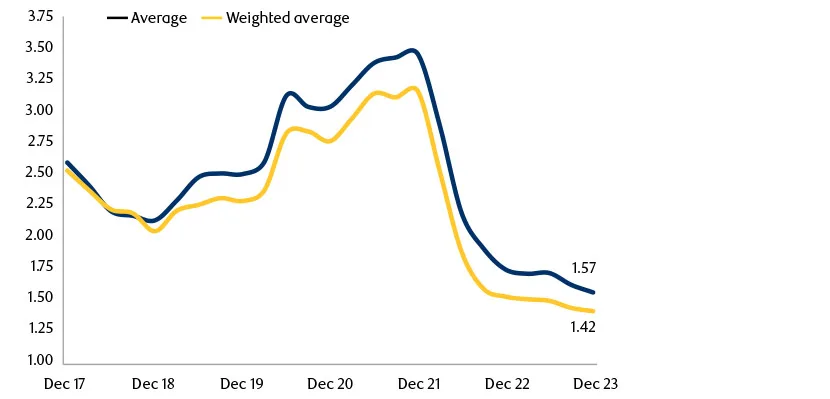

Similarly, in private credit markets, lower-rated companies have seen their ability to cover interest payments erode as rates climb (Figures 3 and 5).

Figure 3: Average coupon payments in US leveraged finance markets

Figure 4: European HY spreads (by rating)

Figure 5: Private credit interest coverage has fallen precipitously in recent quarters

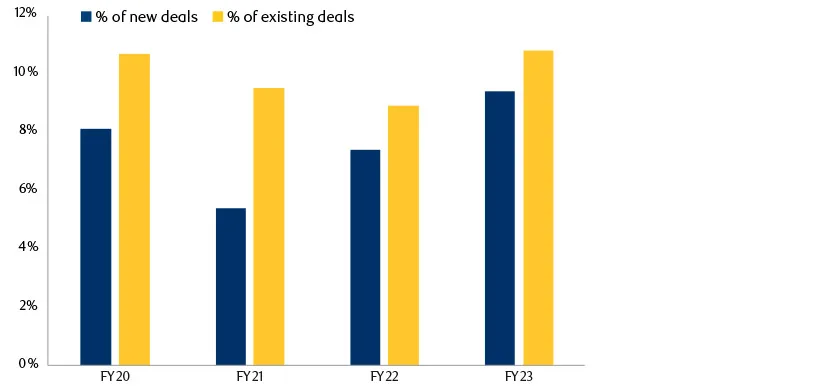

Although declining interest coverage metrics are a strong indicator of this increasing stress, default rates in private markets have remained relatively low to date. This may, in part, be because direct lenders can easily offer borrowers the option to switch to ‘payment-in-kind’ (PIK), paying interest in additional debt instead of cash. However, as private credit PIK arrangements become increasingly unsustainable, we could see an increase in stress events amongst private borrowers (Figure 6).

Figure 6: PIK optionality is being featured more frequently in new private credit deals

European mid-market opportunities

It does not require a full-blown crisis to generate bountiful opportunities for special and distressed situations investors. Indeed, we are finding that the current levels of stress across markets are already delivering a strong pipeline of opportunities.

As special situations investors, our role is to bring capital to areas of the market where credit is no longer flowing freely.

In the current market environment, thematically speaking, we frequently see opportunities to participate actively in restructurings. These are situations in which borrowers need to restructure balance sheet liabilities to address debt obligations and avoid selling assets at distressed prices.

Having a seat at the table and actively participating in restructurings is essential to our approach as a distressed manager. Being an active player in these situations gives us more control when setting the parameters for downside protection within our investments.

The following are two recent examples that are illustrative of this type of distressed opportunity:

- A European heat exchanger business was no longer able to meet its existing debt obligations. The issuer unsuccessfully attempted to amend and extend its debt obligations and was unsuccessful its in attempt to amend and extend those agreements. We took the view that the investment would be more than covered by the current value of the re-instated debt and partial cash paydown. As a result, we invested in the opportunity. Now, in early 2024, the business has undergone a full restructuring, which involved new money from the sponsor and a partial debt-for-equity swap.

- A leading European manufacturer of pre-cast concrete operating in Europe and emerging markets has seen declining profitability, as a result of weakening demand in the construction end market, particularly in Europe. The issuer has recently announced a restructuring where bondholders will inject new money into the business and take control of the company. As a result, the senior secured bonds traded off significantly, which presented a buying opportunity. In the longer term, we see construction markets recovering, which should enable the business to return to previous levels of opportunity.

Our strategies

It is not yet clear whether the most recent blow-up of European CCC-rated credits is a one-off event that the market can shrug off or whether it is indicative of a more systemic issue. Likewise, it is not yet clear how many private market borrowers will default on their existing debt obligations in the coming months.

For our strategies, however, the current extent of market dislocation and stress is already offering a broad set of appealing investment opportunities in the European mid-market. The longer that rates remain higher and inflation persists, that opportunity set is only likely to broaden.

At RBC BlueBay, we offer strategies that can find and take advantage of the opportunities that arise in these environments. Please contact your sales representative if you would like more information about these strategies.