The cycle and the spreads: 17 May 2022

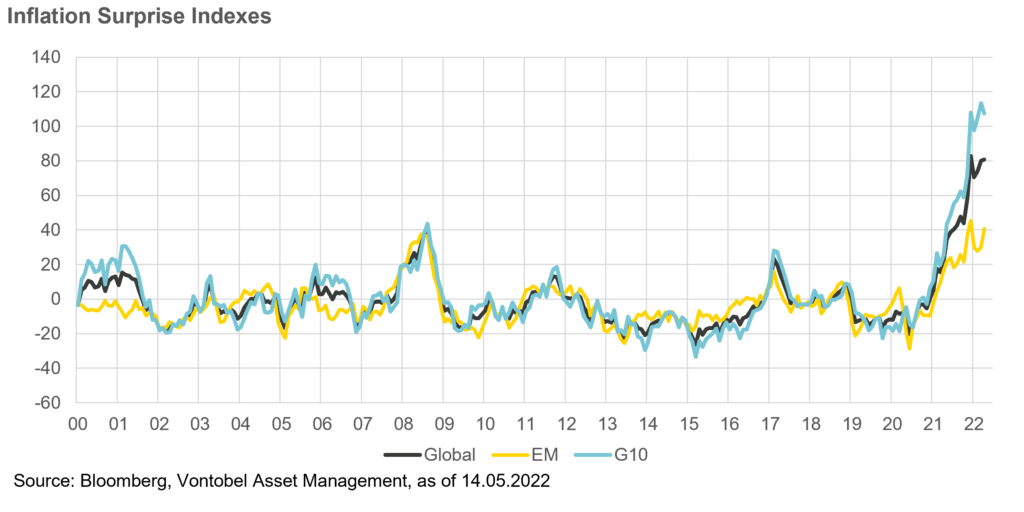

- A week of inflation data: still higher than expected, everywhere.

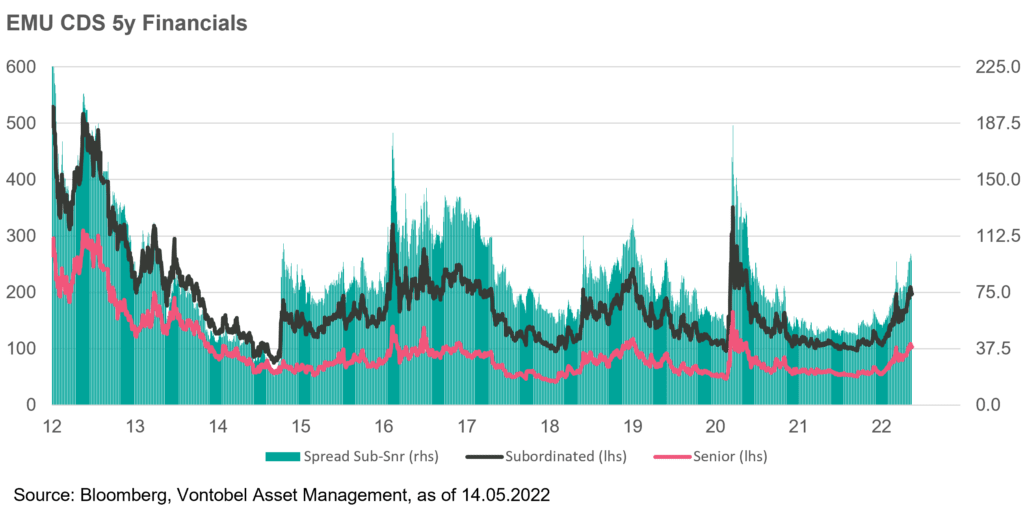

- Financial subordinates in the euro zone: historically wide spreads. An opportunity?

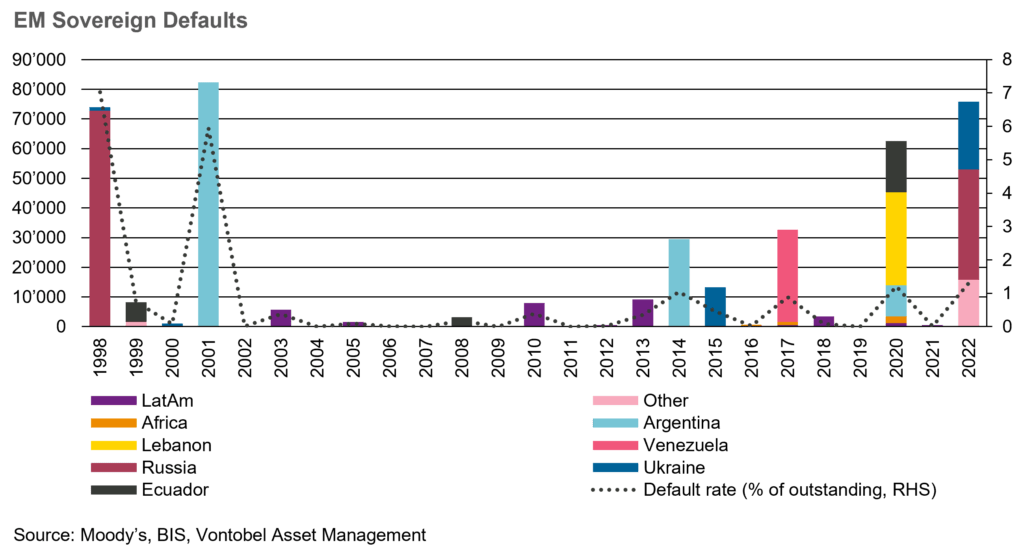

- Emerging market sovereign defaults: not scary if one looks into the details

Upside pushing surprises are not over – but hope is growing

Last week, a large number of prices data were published, in both emerging and developed markets. As the above graphic shows, the consensus has never been caught in such a continuous and violent failure to anticipate inflation figures. As we underlined in a previous note, history shows that the turn in data should be led by – or at least coincide with –a turn in surprises.

Important EM economies published their April figures: Indonesia, Mexico, Brazil, China, India, Romania, Russia, the Czech Republic, and Hungary. Inflation is clearly spreading to Asia, where we saw higher figures with strong upside surprises in all of them. Food becomes a concern as the Indian ban of wheat exports illustrates. Also, upside pressure resumed in Latin America, with Mexico at 7.7% now, and Brazil at 12.1%. Finally, prices do not abate either in Central Europe, with data above consensus and significantly up – in the Czech Republic CPI reached 14.2% in April, triggering a sharp FX move and the central bank’s intervention.

The good news may have come from the US, with a headline figure that dropped for the first time in eight months (+8.3% in April). The contribution of energy declined, at 2.1% (vs. 2.2% in March); food added 1.3%, 10 basis points less than last month, goods contributed by 2% (vs. 2.4%) and services by 3%.

Other encouraging data were US producer prices, still high (11% year on year) but declining and even surprising on the downside for the core measure. A stronger deceleration in prices would extend the growth cycle and open a wide number of investment opportunities given the sometimes undiscriminated sell offs.

The spread between subordinated and senior financial debt at a crossroads

The spread between senior and subordinated European financial debt reflects global stress. The current five-years credit default swap, at 102 and 196, respectively, imply a probability of default of 8.2% and 15.1% within the next five years, a high level but also still significantly off the 2011 highs for example. In terms of expected return, many highly rated European banks offer subordinated papers yielding above 6% (in euros).

Globally, spreads of the asset class are at a crossroads. Various investment strategies look possible. First, given the attractive spreads, a directional buy-and-hold-to-maturity strategy may make sense, given the effective very low probability that a big bank or insurance company does not pay its bonds. Second, a long subordinated-debt position can be hedged with senior CDS. Such a strategy has less downside risk (marked to market) than a pure directional one in case the economies and the cycle turns sour quicker and sooner than expected. Finally, one can adopt a wait-and-see mode, hoping for even lower prices to invest, when a recession steps in. But here the risk is to miss both the carry and capital gains of what may have been a good entry point.

Emerging Market sovereign defaults: Not scary if one looks into the details

Emerging and developing economies’ government debt increased from an average of 54% of GDP in 2019 to 65% in 2021, reducing the fiscal space available to face additional external shocks such as higher food and fuel prices, which has increased fears of potential defaults in a context of rising global interest rates.

The EM debt market is 5.5 times larger today than in 1998 when Russia defaulted, as many more countries have accessed global capital markets. This increased diversification implies that the effect of a sovereign default on the EM market tends to be much smaller than was the case 20 years ago.

Six countries defaulted in 2020 (Lebanon, Argentina, Ecuador, Suriname, Zambia, Belize) and yet the EMBIG Diversified delivered a 5.3% return in that year. In most cases, their bonds were already trading at deep discounts pre-pandemic minimizing the blow.

This year, Sri Lanka faces an inevitable default, Russia may be forced to default in June unless the US changes current sanctions, and Ukraine is likely to eventually need to restructure. But in all cases, these bonds are trading below 40 cents on the dollar – below the 53 cents historical average recovery value for sovereign bonds implying that it’s already been priced in.

There are currently another seven countries trading at distressed levels (spreads above 1,000 bps). In a worse-case scenario where all of them default in the next three years, default rates would still decline to less than half of 2020 because most of these countries are quite small. And losses would be very limited because they already trade at deep discounts.