In times of great uncertainty, investors focus more on managing risk than positioning for the future. In reality, it is becoming increasingly possible to forecast inflation with some precision both in the United States and to a lesser extent in Europe.

• In the case of Europe, the duration of a quasi-natural gas embargo from Russia is hard to predict; as is the weather and the strength of consumer demand faced with an inflation shock. On a more positive note, government outlays, particularly in Germany, are helping many lower income households.

• In the US, consumer demand from wealthier households should stay robust before belatedly cooling down. This fact should be amplified as the Democrats will likely lose control of Congress. Republicans are likely to choose fiscal prudence, which should cool growth further.

While time is indeed the great redeemer for the markets and the economy, key problems remain ahead

The challenges ahead

• The cost of dealing with our global supply and demand shock is rising government debt levels in many countries striving to insulate households from a large spike in energy prices. Some countries, like Italy and Greece, cannot afford these elevated debt levels for long.

• Investments in new ship containers, oil & gas production or microchips is probably going to be prudent as the global economy slows and the eventual rebound in China’s economy likely somewhat shallow given a real estate crisis. When demand recovers more strongly end of 2024, this should prove to be inflationary as supply fails to keep up.

• The climate transition should slow down in countries with poor balance sheets and those searching for energy solutions to mitigate the impact of the Russia-Ukraine war.

A slow changing of the guard

After inflation peaks, partly driven by base effects, new trends should emerge

• Eventually as the economy cools, the Fed and ECB will likely pivot to ease monetary policy. Asset allocation studies typically show that, in scenarios like this, equities and fixed income rally when leading indicators start to show a rebound. The spiral of risk taking begins in sovereign fixed income, followed by credit and sometimes with a delay in equities (credit pricing out the odds of a deep recession).

• As we saw in June, US equities can rally early driven by bargain hunters and the hope of an eventual rapid set of Fed rate cuts and quantitative easing. It should be noted that the June rally did not end well as the Fed was surprised by supply side constraints and continued strong demand from richer households.

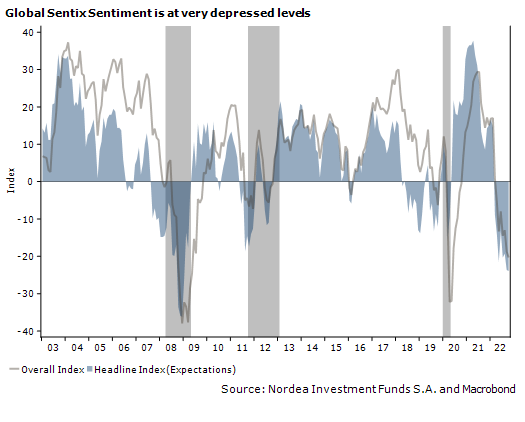

• The challenge therefore is to find in the coming weeks the market’s point of maximum pain and monitor when sentiment shifts. Such pain can be assessed based on extreme bearish positioning and sentiment, outflows from equities and credit, forced risk reduction, cheap valuations, changes in the reaction of financial assets to news (e.g. bad news now has a positive impact), and dislocations and incoherencies across asset classes.

As we saw in the June rally, identifying the market’s pain points will not be not enough. The market needs time for the mix of growth and inflation to improve enough. Time indeed is the great healer, and the odds are improving week after week.

What does it mean?

The opportunity set is currently narrowly focused on Covered Bonds and Value/Quality Equities. However, in Q1 or Q2 of 2023, we should see it expand by leaps and bounds into Fixed Income, Credit (Developed Markets, selective ESG/Emerging Markets) and Equities (e.g. ESG). Broadly speaking, Equities are actually attractively valued, particularly so in Europe and Emerging Markets.