Real estate debt can act as a “triple hedge” against inflation. Firstly, real estate income streams capture inflation because tenants’ lease terms incorporate inflationary uplifts. Secondly, debt strategies can often comprise largely of floating rate loans and therefore will react to changes in interest rates.

Finally, the typical weighted average life of the loans is around four years. This ensures that the income and rent from the underlying collateral is re-based to market on a regular basis.

Why could a pan-European approach to real estate debt strategies be the key to resilient income?

By adopting a pan-European approach, it is possible to limit single-market exposure to interest rate hikes and ensure a more predictable and steady income stream.

It is important in a market where interest rates are increasing to ensure the underlying asset will be defensive against this backdrop. This means features such as asset location, demand, rental affordability and interest cover are essential building blocks to providing a resilient income stream.

Importantly, in most scenarios where interest rates and inflation start to rise, the security on these loan positions can improve over time. This is because rents (and therefore valuations) grow and borrowers are able to cover their liabilities.

The value of any property investment is derived from the capitalisation of its future income streams. The pricing of this income is set by the market rental appetite and are locked into place through a lease structure with reviews during or at the end of the contract.

These lease reviews help protect a lender against refinancing risk on exit, while at the same time building in sensitivity to underlying rent inflation.

How can an investor diversify regional exposure through a pan regional approach?

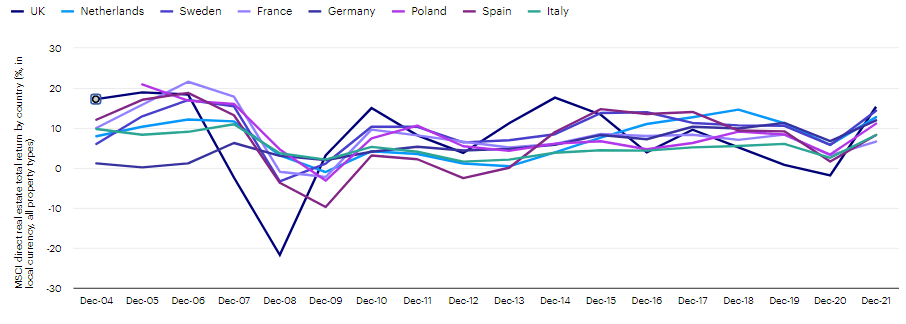

As demonstrated in figure 1 below, any one regional real estate market can experience volatility at any point in time.

This was evident during the Global Financial Crisis which was the most significant period of real estate market volatility. During the crisis, some regional markets behaved contrarily to others, experienced drawdowns at different times (and for different periods of time), or sometimes not at all.

We therefore believe that a pan-regional approach offers diversification benefits as the asset class is fundamentally influenced by local drivers.

This is even more evident when delving deeper from region to sector. To draw on some examples for illustration, the drivers behind a last-mile logistics unit in France will be very different from those of student housing demand in the UK.

Meanwhile, office market supply and demand dynamics can vary across Central Business Districts across Europe. And in retail, online penetration rates differ dramatically, highlighting the potential opportunity for attractively priced logistics assets.

Additionally, by looking beyond the limits of an investor’s domestic market, entirely new asset classes may exist which may not necessarily be found at home. Such examples may exist in, for example, logistics, self-storage, life sciences, or healthcare.

Beyond borders

Whilst some markets such as the UK are relatively transparent, there may also be opportunities to explore by leveraging from local knowledge and experience in more opaque markets.

We have found that our on-the-ground teams allow for the identification of potentially attractive opportunities that wouldn’t necessarily present themselves from the perspective of an outsider looking in.

With a focus on real estate debt, conservative loan-to-value ratios (LTVs) can reduce volatility associated with equity ownership through the exclusion of capital value movements and emphasis on stable income streams.

This improves the diversification benefits. That’s because we see a reduction of correlation to both the performance driven by direct real estate ownership as well as other asset classes.

Investment risks:

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested.

Property and land can be difficult to sell, so investors may not be able to sell such investments when they want to. The value of property is generally a matter of an independent valuer’s opinion and may not be realised.

Important information:

This document is marketing material and is not intended as a recommendation to invest in any particular asset class, security or strategy. Regulatory requirements that require impartiality of investment/investment strategy recommendations are therefore not applicable nor are any prohibitions to trade before publication. The information provided is for illustrative purposes only, it should not be relied upon as recommendations to buy or sell securities.

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals, they are subject to change without notice and are not to be construed as investment advice.