You don’t need to look far to see inflation – commodity prices are rising rapidly (Gas prices are up 125% YtD, Oil +62%, Aluminium +48%, Coffee +55%, Cotton 48%, Tin 73% etc); as are other input costs such as shipping (freight costs are up 1,000% versus last year). And with the rising cost of living it’s only a matter of time before employers realise that they will need to increase wages.

Where does this leave us in markets? From a fundamental perspective, it has us thinking about the ramifications for corporate margins. How much of these input costs can be passed through and how much will need to be borne by the corporates? These are the questions we are asking ourselves, and when in doubt, we are opting to move out of supply chain exposed industries – which is not easy!

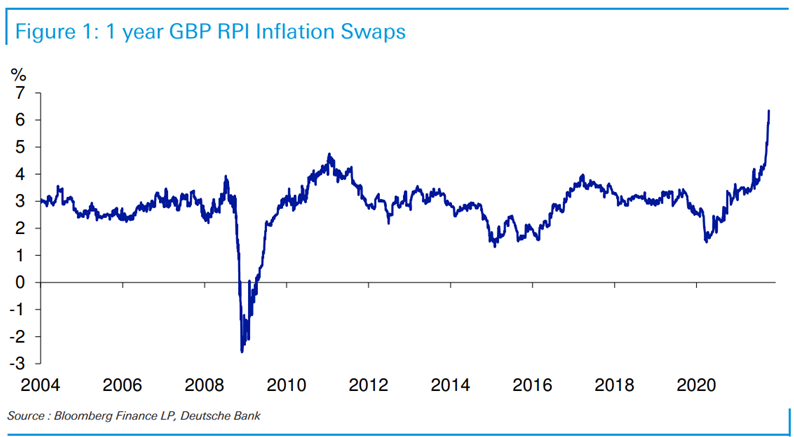

From a valuation perspective, we need to start asking ourselves what the real yield should be on different sectors of the fixed income asset class. High Yield for example has historically offered a real yield of 5%…a long way from where we stand today. As figure 1 below shows that index linked bonds are now implying UK RPI inflation to be 7% in 2022. If this comes to fruition, it is sure to disrupt markets, households and also students who are painfully charged student loan interest on an RPI +3% basis.

As a Deutsche Bank strategist bluntly stated – “it would take a brave person to receive a low fixed income for any length of time with all the transitory, cyclical and structural inflation in the pipeline”. That’s why in our High Yield portfolios we prefer to stay short on curves whilst targeting lower rated corporates for our yield pickup.