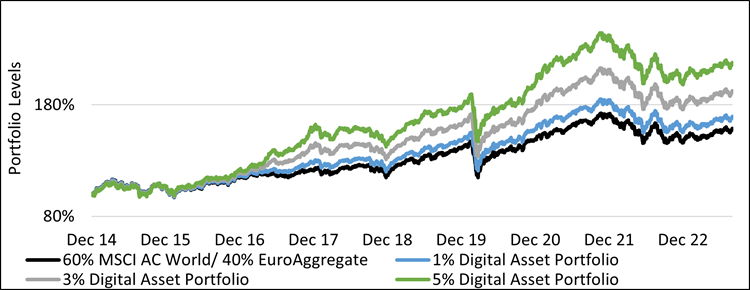

Crypto could enhance multi-asset portfolio returns

In a recent WisdomTree survey1, 36% of institutional investors indicated they are looking to increase their allocation to digital assets and cryptocurrencies. Investing in digital assets could increase the return potential of a multi-asset portfolio. At WisdomTree, we did several portfolio simulations allocating 1–5% of a multi-asset portfolio’s funds to digital assets, and in all cases over the long term2, the annual return for the digital asset portfolio was higher than for a traditional 60/40 equities/bonds portfolio and only with a small increase in volatility. Note that in our simulation, the requirement is that the illustrative portfolio is rebalanced at least quarterly to limit the downside.

Figure 1: Portfolio with digital assets outperformed the traditional 60/40 portfolio

Source: Wisdomtree. Time frame simulated: December 2014 — August 2023.

Historical performance is not an indication of future performance and any investment may go down in value.

Macro environment improving

At the moment the crypto industry seems to be gaining in positive momentum and the macro environment seems to be improving. It appears that the interest rate hiking cycle could be behind us and that markets are anticipating lower interest rates for next year. This could be positive for crypto assets. We have also observed that the central bank liquidity that went down from December 2021 to December 2022 has slowly been improving and this could be positive for digital assets as well.

Figure 2: Market liquidity and bitcoin price

Source: WisdomTree, Bloomberg, 20 November 2023.

Historical performance is not an indication of future performance and any investment may go down in value

Bitcoin price driven by potential approval of spot bitcoin ETFs and bitcoin halving in 2024

Bitcoin, the largest crypto asset by far, making up over 50% of market cap in the space, is likely to be driven by the very likely approval of spot bitcoin exchange-traded funds (ETFs) in the US. The potential approval of this ETF wrapper will make it much easier for wealth advisors and institutional investors to invest in the largest digital asset efficiently at a very low cost. We have written about our expectations for the changes in the competitive landscape in the US if spot bitcoin ETFs are approved here. It is possible that tens of billions, and over the years, over a hundred billion US dollars could flow into spot crypto products in the US.

Next year, the potential approval of a spot bitcoin ETF could coincide with bitcoin halving, an event where the number of new bitcoin awarded to bitcoin miners per block will get cut in half from 6.25 to 3.125 bitcoin. This means that bitcoin miners will have less bitcoin to sell in the market. This could lead to a meaningful supply/demand imbalance and an increase in price as less bitcoin is available in the market.

Bitcoin halving

Source: WisdomTree.

Historical performance is not an indication of future performance and any investment may go down in value.

Major blockchains in race toward scalability

In the past month or so3 we have also seen an increase in the price of ethereum, the second largest crypto asset, with 17% of the crypto market cap, and solana, another popular smart contract network with less than 2% of the total crypto market cap. It is quite likely, in our view, that spot ether ETF will also be launched after the bitcoin product in the US. Both ethereum and solana are in a race to upgrade their blockchains to more scalable forms. Ethereum has postponed its Proto-Danksharding scalability upgrade to early 2024, and solana has introduced its Firedancer scalability upgrade in the solana testnet. It’s also expected to be launched in the solana mainnet in early 2024.

Several layer 1 networks were introduced in 2021 during the last crypto bull market when the ethereum blockchain could not cope with a large number of transactions which led to some very high transaction fees in the network. Solana was designed to be a faster and cheaper version but has suffered from stability problems. The network has, however, had a very loyal developer base and so we believe institutional investors are particularly attracted to solana. Encompassing just less than 2% of the crypto market cap, many institutional investors believe solana could have more upside potential than ethereum.

Scalability upgrades are absolutely necessary for a true mass market to emerge. The blockchains need to be able to handle a large number of transactions at a very cheap price and in seconds. This is not the case today.

Making blockchain transactions easier to pay potentially another driver

One of the key features of blockchain payments is their decentralised nature which eliminates the need for banks and other intermediaries. Transactions are recorded on distributed ledgers and become immutable and secure in the process. Blockchains are based on code, which are executed automatically after rule-based conditions are met. At the moment, it is necessary to hold ether or solana, for example, on one’s crypto wallet to make a small transaction directly on the blockchain. We think this is too cumbersome. We view the experiments conducted by Visa, for example, very positively, as users could potentially pay their monthly blockchain transactions with a credit card instead of having to pay a transaction fee every time a small transaction is made on the blockchain.

Sustainable bull market needs killer use cases

The two most prevalent use cases for blockchains today are tokenised currencies or stablecoins, often the US dollar, and tokenisation of real-world and financial assets. We have listed a number of potential blockchain use cases in our recent Crypto Monthly, but as is often the case with new technologies, it is very likely that something totally new will come along. An application that’s far superior to anything we are using today will take the market by storm and push the crypto industry mainstream. It will only be obvious in hindsight.

Sources

1 Source: WisdomTree, Censuswide. Pan-Europe Professional Investor Survey Research, Survey of 803 professional investors across Europe, conducted during August 2023.

2 Porfolio simulations included years between December 2014 – August 2023. More information can be found in our white paper, A New Asset Class: Investing in the Digital Asset Ecosystem.

3 From mid October to mid November 2023.