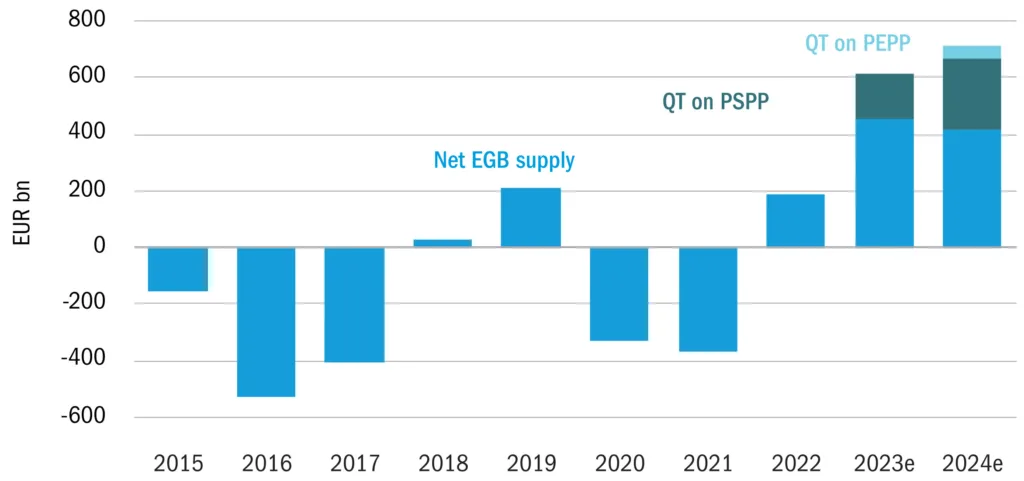

US is on course for ‘immaculate disinflation’; UK and Europe to follow suit.

High employment and the absence of significant economic contraction has removed pressure on central banks to cut interest rates as headline inflation falls. Instead, they can wait for wage inflation to fall to the 3-4% level consistent with their long-term 2% inflation targets.

We think that US wage inflation is already at these levels so, when the figures come through, the Federal Reserve (Fed) will be first to cut. The European Central Bank (ECB) should also see better news on wages ahead of their June meeting. The Bank of England is set to lag, as wage inflation remains high even as headline consumer inflation falls sharply.

However, delays of a few months to the start of interest rate cuts may not matter much to markets and consumers if long-term interest rates come down in anticipation of an extended cycle of interest rate cuts. We therefore continue to forecast a pickup in economic growth. While bond valuations are attractive, the combination of rate cuts and economic growth will also support gains in the equity market.

Figure 1: Core inflation falling fast

US is on course for ‘immaculate disinflation’

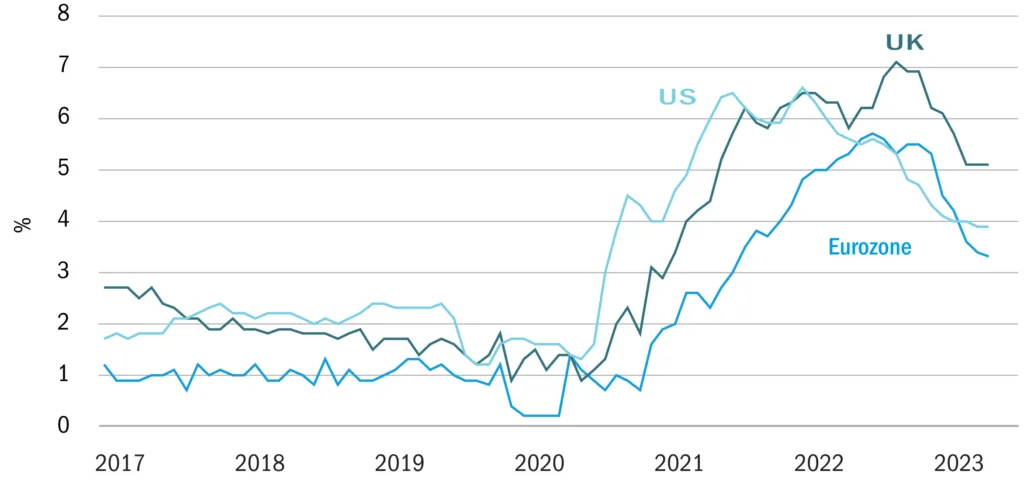

The US economy is seeing some headwinds, such as a rebound of bond yields eroding previous mortgage rate cuts. That has dampened consumer confidence and, while the Purchasing Manager Indices (PMIs) remain positive, there is little sign of reacceleration.

However, the weaker patches of the US economy may help keep wage inflation down. As a consequence, the Fed is set to lead developed economies in cutting interest rates. The economy will also be supported by the virtuous cycle of falling inflation driving real income gains, while moderating wage demands help sustain lower inflation and provide headroom for interest rate cuts.

Figure 2: Composite Purchasing Manager’s Indices

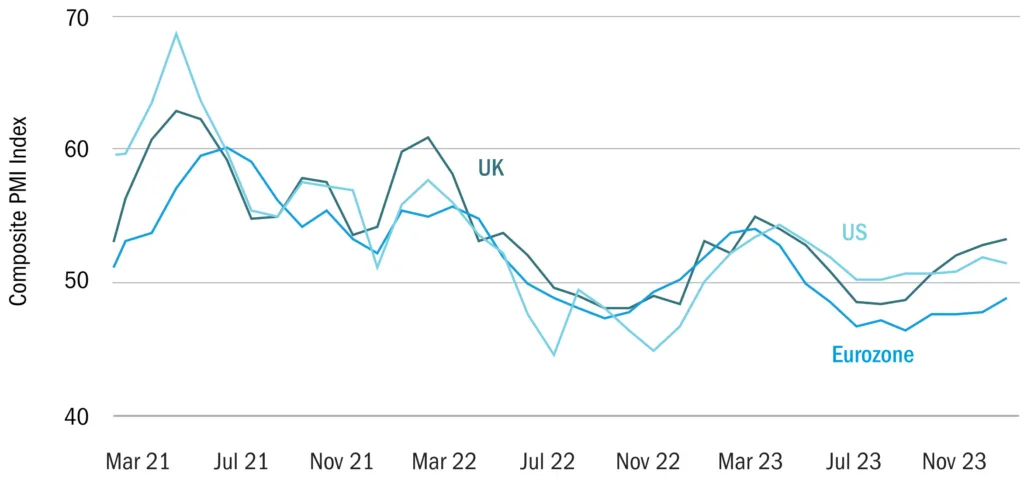

We forecast a dramatic recovery for the UK economy.

While we disagree with the ‘technical recession’ description, the UK economy has been through a dismal period. However, the PMIs indicate that growth has already resumed. We believe this recovery will be boosted by improving consumer confidence.

A sharp fall of annual inflation in the coming few months is baked into the figures, from lower energy prices, higher sterling reducing import prices, and the unwinding of a distortion from supermarket loyalty card discounts. Falling headline inflation will reinforce the positive impact of rising real wages and encourage consumers to reverse their current build-up of precautionary savings.

However, this positive economic outlook removes pressure on the Bank of England to cut interest rates. Instead, it can wait for the current high pay rises to fall, likely in the second half of the year.

Mortgage rates, linked to five-year interest rates, have already fallen back and with high employment and rising real wages supporting demand, the housing market has seen a pickup in activity. We expect that house prices will rise from here.

This forecast turnround in the UK economy does not translate directly for UK equity markets, or indeed the Conservatives in the upcoming election. The international focus of the FTSE 100 dilutes the benefits of recovery in the UK, while its sectoral composition means that it is likely to lag gains from global equities. For the Conservatives, falling inflation and better growth will cut the opinion poll deficit, but is unlikely to be enough to change the outcome. It will provide a favourable economic wind for the next government.

Figure 3: GDP growth % quarter on quarter

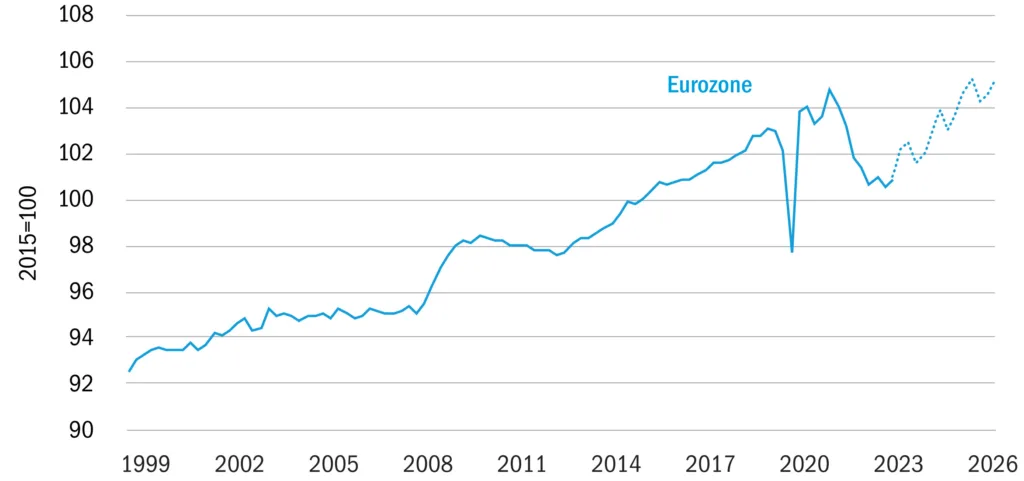

European growth to recover slowly in 2024

It is easy to look at German manufacturing data and be too pessimistic about the outlook for the European economy. Manufacturing is a global soft spot, while weak German exports to China are another factor.

Instead, the wider figures show that European inflation is falling fast, real wages have started to recover from the energy crisis hit and that consumer confidence is following. That alone is sufficient to support modest growth. Interest rate cuts will also support recovery, though the ECB is keen to wait until it is clear that pay rises are trending down.

We think that sustained higher employment levels in Europe points to a shift of the economic equilibrium. With growth, inflation and interest rates set to trend above previous very low levels, that will limit the scope for interest rate cuts in Europe.

Figure 4: Eurozone real compensation per employee

We are positive on asset markets, but the scale of returns is likely to be moderate.

For equities, we do not believe that expensive valuations, especially in the US market, preclude gains as the economy recovers, while inflation and interest rates fall. But it does cap forecast equity returns.

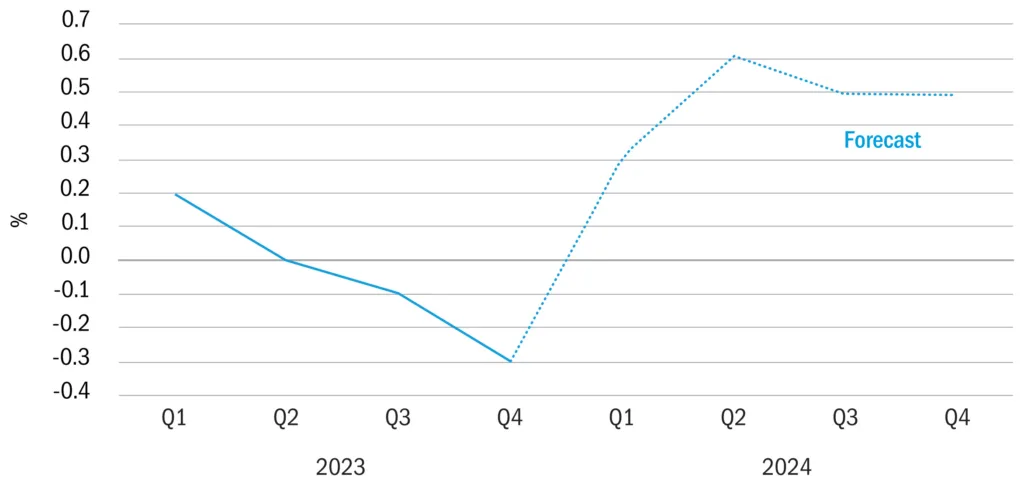

By contrast bond yields offer an attractive, real ‘risk-free’ return. However, the rising supply of government bonds from higher budget deficits, but also the unwinding of purchases by central banks, is likely to keep bonds looking cheap to attract buyers.

High interest rates and falling inflation means attractive cash returns will keep some investors on the sidelines. That will help underpin markets, especially when interest rates fall.

Figure 5: Total net supply of Euro government bonds (EGB)