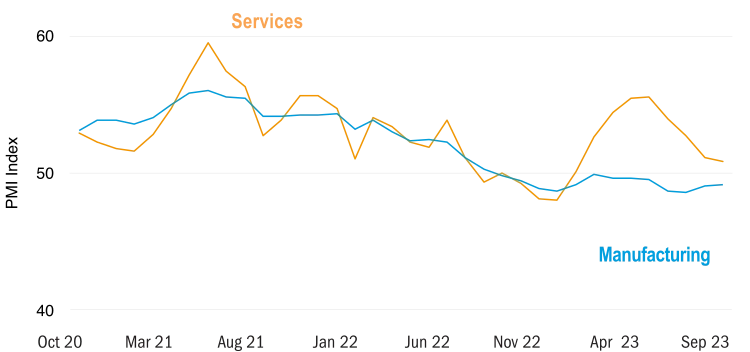

As the services boom decelerates, manufacturing picks up.

The strength of the services sector of the economy, led by the US, was key to averting recession over the past year, while manufacturing is only now emerging from its a post-Covid cycle.

The weakness of the services sector will help cool the jobs market, as it is a much larger part of the overall economy and more labour-intensive.

A recovery in the more capital-intensive manufacturing sector will help support slowing economic growth but will have much less impact on the jobs market. It will also be positive for equities, where its significance is greater than in the wider economy.

Once central bankers see unemployment rising their priorities will change. We expect the switch in drivers of economic growth will prompt central banks to cut rates more quickly than expected.

Services slowdown

Is the US heading for a soft landing?

The US economy growth rate surged to 4.9% in the third quarter 2023, when many at the start of the year had been anticipating recession by now.

However, the trend is clearly down from here. As it takes up to 18 months for the full impact of interest rates increases to be felt on the economy, there is a lot more monetary policy tightening to come, since we are only just 18 months from when the Fed first started to hike rates.

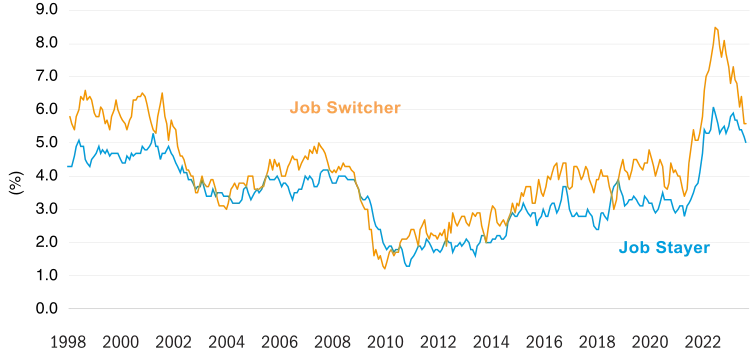

A virtuous wage spiral will be supportive as the economy slows. Falling inflation gives a boost to real wages, even as it encourages lower wage inflation. The manufacturing recovery will support economic growth. Clearly there are risks, including a government shut-down due to legislative gridlock, but if we do slip into a recession it will be mild.

Firms no longer losing staff to higher paying rivals

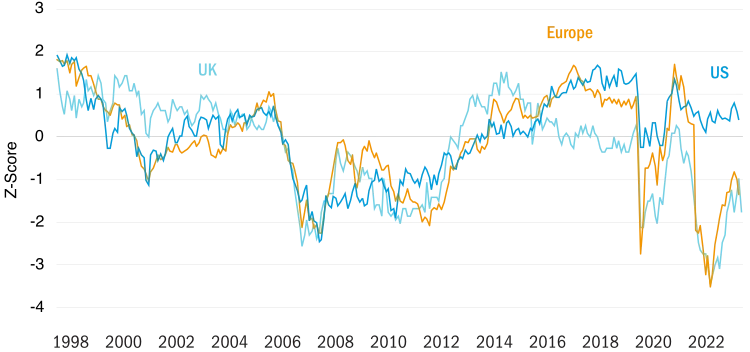

Are we heading for recession in the UK and Europe?

The manufacturing downturn, China’s faltering recovery and the energy crisis have all hit Germany’s economy hard. Germany’s consumers have reflected these uncertainties, rather than strong employment, rising wages and falling inflation as the energy crisis has been addressed, so that savings accumulated during lockdown have gone unspent.

We expect that the UK, currently the laggard on inflation, to outperform expectations. The delayed impact of exchange rates will bring down inflation by the end of the year. Although the housing market is set to fall further, the impact is restricted by the slow roll-off of fixed-rate mortgages and the relatively low number of mortgage-holders affected.

Consumer confidence gap v. US has narrowed

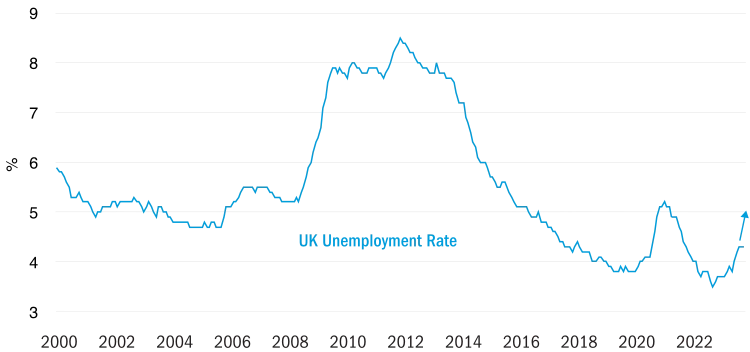

Rising unemployment will prompt a rapid reversal of central banks’ priorities.

Tough central bank rhetoric on ‘higher for longer’ interest rates has pushed up bond yields and so further tightened monetary policy. As long as it doesn’t threaten the financial system, central banks are unconcerned about the impact on stock markets; in their view this impact is positive, indirectly tightening monetary policy without further hike interest rates.

However, we do not believe that this hawkish rhetoric will continue once unemployment starts rising. The Fed has an explicit mandate for full employment, but other central banks will come under increasing political pressure to be seen to be helping the economy if people are losing their jobs. While the market is anticipating a half-point cut in US interest rates in 2024, we think that it will be more than double that.

With UK unemployment already ticking up as the labour force expands, we see scope for a positive wage spiral leading to interest rate cuts in 2024.

There is also a potential path for a virtuous spiral of falling inflation, rising real income and falling wage inflation to take hold in Europe, leading the ECB to cut interest rates. But that path is longer, requires forecasting further ahead and for more things to fall into place. We therefore expect the Eurozone to lag and are least confident on our forecast for rate cuts in 2024.

UK unemployment is edging higher and is set to rise further

Falling inflation makes high bond yields attractive, while a manufacturing recovery supports equities.

There has been a big rise in yields – the best measure of risk-free returns, the real yield on US Treasury Inflation-Protected Securities, is now 2.5%. This is a very attractive yield compared to recent history. With inflation break-evens fairly stable, it also means that conventional government bonds are attractive as well.

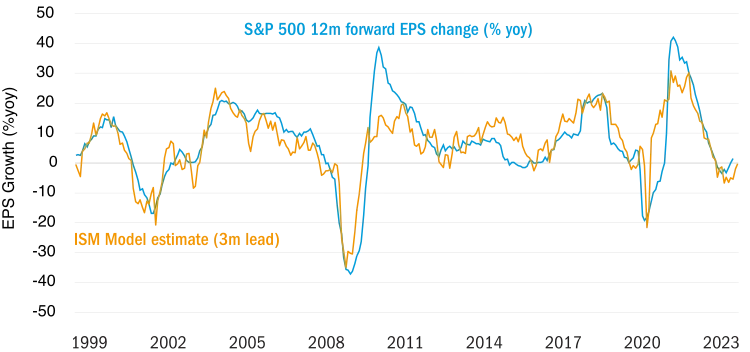

We have shifted more positive on equities. Rising earnings are needed to justify current valuations, but we see the earning outlook improving. While that might seem paradoxical with the economy slowing, this reflects the much greater significance of the recovering manufacturing sector for the stock market.

We don’t like European equities, given the weaker economic outlook. We prefer Japanese equities, which stand to benefit from the quiet revolution in corporate governance. We also like UK equities given their valuation, defensive composition and scope for the UK to catch up as it outperforms overly-pessimistic expectations on inflation.

Earnings outlook set to improve

Past performance is not an indication of future performance