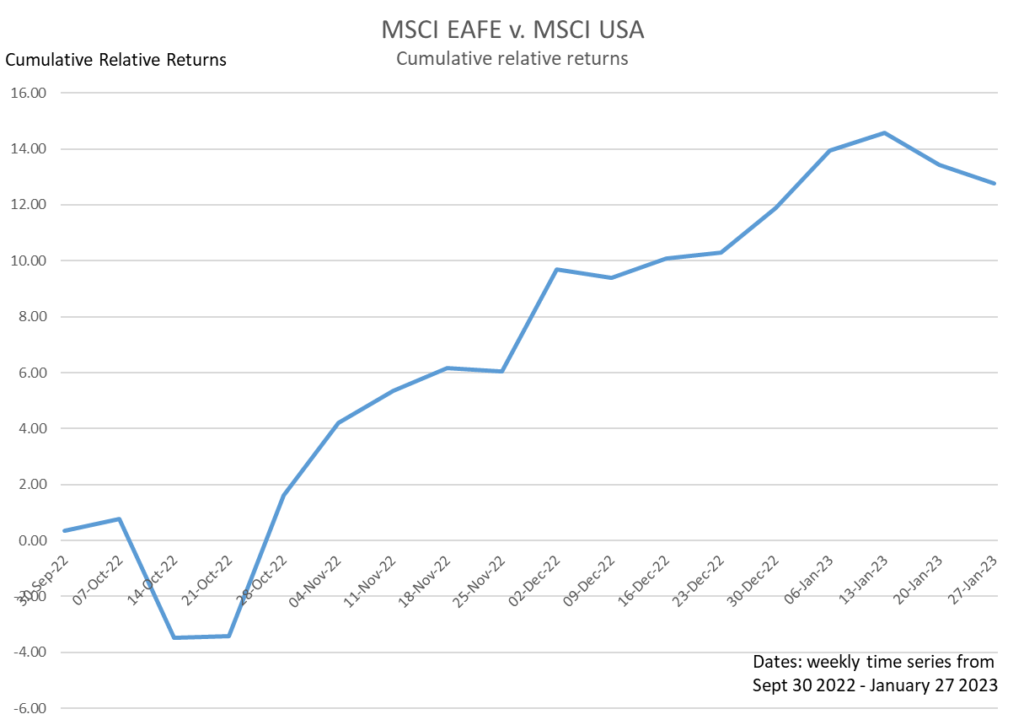

London – The strong outperformance of European equity markets from mid-October last year continued into January, as fears of an energy crisis in Europe have abated. The surprisingly quick re-opening of China from zero-COVID measures, along with a more pro-growth policy shift, will combine with lower energy prices to deliver much-needed growth stimulation for Asia-Pacific.

We expect corporate earnings to be the key driver of equity markets throughout 2023, a major pivot from last year’s macro driven environment dominated by multiple compression from rising inflation and aggressive rate hikes from central banks.

International Equity Markets Outperforming U.S. from Mid-October 2022

Entering 2023, investors have been considering the impact of the earnings contraction and where the impact on share prices will be felt greatest. With recession widely expected in many large economies by investors, there is widespread fear over corporate profitability.

A key focus for equity investors will be identifying pockets of resilience, which include companies that can continue to deliver on earnings expectations against a backdrop of slowing economies and continued rising interest rates. It is important to remember that periods of investor angst are often seen as buying opportunities and we believe that share prices will look beyond 2023 earnings.

Impact of high interest rates

The impact of central bank tightening is expected to significantly squeeze the economy this year. Even as we expect unemployment and corporate earnings to deteriorate, we are optimistic that this could be a year of bad economy/good market. Our team’s focus is on mid- to long-term investing, and understanding the enduring power of a company’s business model.

We maintain a positive outlook for international equities in 2023, particularly compared to the U.S. For some time, the U.S. equity market has appeared imbalanced, due to the dominance of a handful of large technology companies. A bubble mentality, fuelled by ultra-loose monetary policies globally, was finally burst by central banks’ interest rate policy moves last year.

We believe we are at a point in the economic cycle where the impact of high interest rates, after so many years of zero to negligible rates, will undoubtedly increase the probability of left-field risks arising in the economy. Such distortions are simply not as meaningful in international equities. We have moved beyond the era of free money, and risk within equity markets will start to be priced more efficiently.

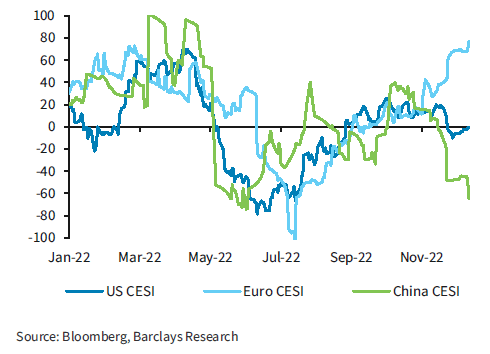

EU Economic Surprises Rising More Than Other Regions

Economic surprise indexes by number of observations1

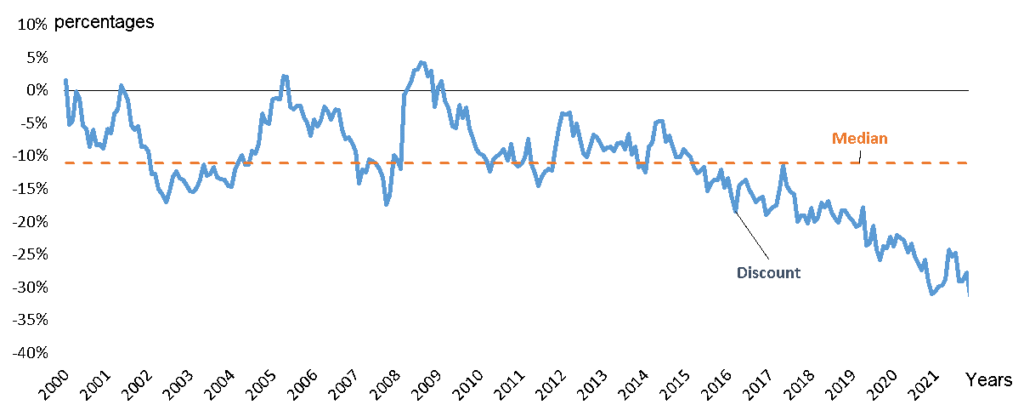

Relative valuations favor international equities

The valuation case for international equities is also attractive compared to the U.S. The discount of the MSCI EAFE Index to the MSCI US Index has persisted for some time, and has now stretched to an extreme multi-decade low.

MSCI EAFE vs MSCI US

Two Year Forward Price/Earnings Ratios

Investor sentiment focused on Europe has been weak due to ongoing concerns over the possibility of an energy crisis in the wake of Putin’s invasion of Ukraine. From Germany’s reliance on Russian supplied natural gas, to the farcical events in British politics last September that crippled the UK’s currency, investors have worried about the European economic outlook. We believe much of this is priced into European equities and obscures the opportunities for experienced investors to uncover and invest in many world-leading businesses that are priced at attractive multiples.

From a sector perspective, we believe that the biggest pressures in 2023 will wallop the consumer, as the powerful cocktail of higher interest rates and inflation bites hard. Secular trends in the industrial economy — such as automation and digitization, supply chain re-calibration and energy efficiency — are powerful forces that will remain important for the stocks we invest in, long after we know the outcome of 2023.

Dynamics of China's re-opening

China’s rapid abandonment of restrictive COVID policies has surprised the market, raising an interesting dynamic in equity markets in 2023. Chinese authorities have switched focus more onto growth by loosening monetary and fiscal policy, in stark contrast to the rest of the world. Chinese consumers have been locked down for some time, and consumer savings are robust.

We believe the Chinese consumer and industrial sectors will accelerate in 2023, providing a meaningful tailwind for commodities, specifically for countries like Japan and Germany, where China is an important trade partner.

Bottom line: It feels as if 2022 marked the end of an era for equity markets. Rather than predicting the next trillion-dollar U.S. tech stock to bet on, now investors must again grapple with old-fashioned issues like inflation. We welcome some sanity in markets, and we believe our rigorous approach to understanding fundamental earnings power positions us well for whatever lies ahead in 2023.

For our equity strategies, we believe that our philosophy, framework and approach to bottom-up stock picking, with a focus on sustainable business models, positions us to perform well in 2023 and beyond.

1 Citigroup Economic Surprise Index (CESI), data as of 12/31/2022.

Risk Considerations: The value of investments may increase or decrease in response to economic, and financial events (whether real, expected or perceived) in the U.S. and global markets. The value of equity securities is sensitive to stock market volatility. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed markets. Diversification does not eliminate risk of loss.

Active management attempts to outperform a passive benchmark through proactive security selection and assumes considerable risk should managers incorrectly anticipate changing conditions. There is no guarantee that any investment strategy will work under all market conditions, and each investor should evaluate their ability to invest for the long-term, especially during periods of downturn in the market.