An update from Senior VP and head of Sustainable Investing, Sarah Bratton Hughes

Impact investing refers to investment strategies that have the potential to deliver competitive long-term returns while seeking to have a positive impact on society. For the sixth time, American Century Investments surveyed individual investors to understand their views on, and involvement in impact investing. This latest survey, conducted in December 2022, covered representative samples of adults in the U.S., U.K., Germany, Singapore and Australia. The results reveal interesting differences across generations and countries, and challenge some assumptions people make about impact investors and their investing priorities.

Here are five noteworthy findings from this year’s survey:

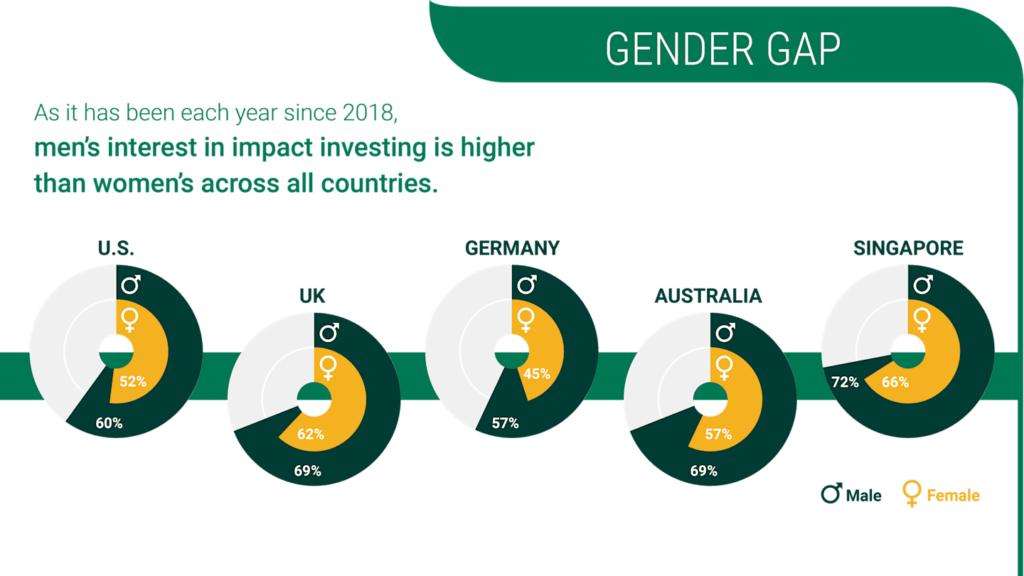

1. A Gender Gap Persists

Impact investing’s appeal is still stronger among men than women in all of the countries surveyed (see Figure 1). The gender gap is largest in Germany and Australia. Separately, the 2022 results show that impact investing appeals to a growing share of women in all of the countries surveyed. In the U.S., interest among women has increased by five percentage points since 2018, seven points among U.K. women since 2019, sixteen points among German women since 2020, and two points among Australian women since 2021. Singaporean women have a greater interest in impact investing than women in the other countries surveyed. Nonetheless, interest among men remains higher in each country.

Figure 1 | Interest in Impact Investing Is Higher Among Men

2. Interest and Awareness Differ Across Generations

With the exception of Singapore, interest in impact investing in all of the surveyed countries is highest among millennials, followed by Gen Xers, then baby boomers. Although Singapore breaks the pattern, adults there are more likely than their counterparts in the other countries to either be currently involved in impact investing, or planning to get involved within the next five years.

3. Awareness Lags Among Older Investors

A majority of baby boomers in every country other than Singapore said they were not familiar with impact investing, but many also said the concept appeals to them. Discussing impact investing with older investors, particularly women, may have important implications for financial advisors who want to preserve and grow their clientele. A recent study by McKinsey notes that in the US, an unprecedented amount of wealth will shift to women over the next three to five years. Note that our survey found that baby boomers are more likely to rely on television, magazines and newspapers than their financial advisors to learn about impact investing.

4. The ESG Pushback Is a U.S. Issue, but Greenwashing Is a Concern Everywhere

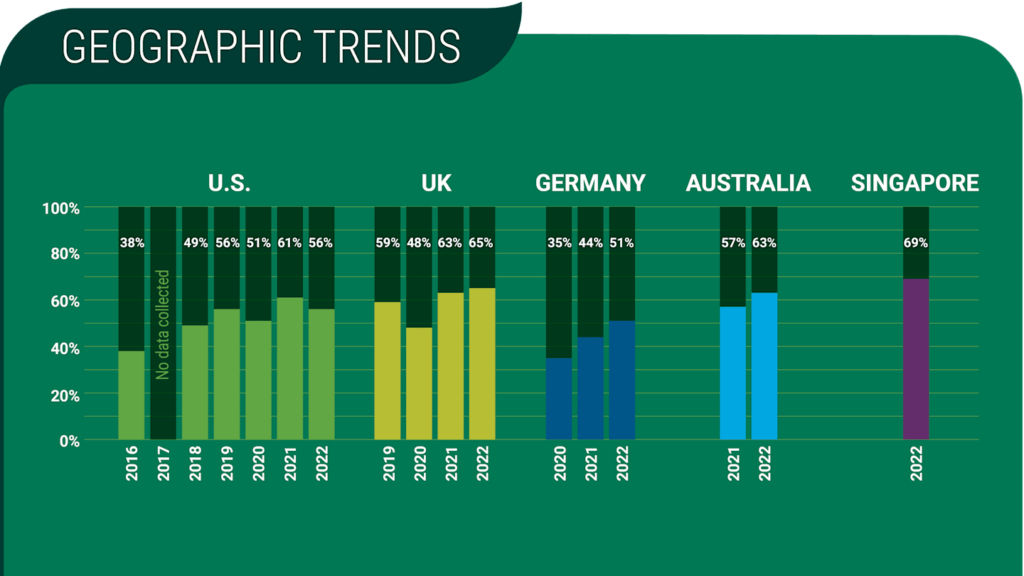

Impact investing’s appeal is increasing everywhere after dipping early in the pandemic, except for in the U.S. (see Figure 2), where the term Environmental, Social and Governance (ESG) has been politicized. Across every region, men feel the “ESG backlash” more than women. In addition, roughly half (in some cases more) of survey participants across all countries are concerned about “greenwashing” (i.e., giving a false impression of a company’s or fund’s focus on sustainable practices).

Figure 2 | Interest in Impact Investing Is Rising, Except in the U.S.

Although investors face a challenging global economy, evolving regulatory environment, and political pushback in the U.S., we see that interest in sustainable investing not only endures, it has grown in most places. And even though the appeal in the U.S. fell versus last year, it has increased 18 percentage points since 2016. It’s notable that survey participants in the U.S. and Germany were least likely to say that the recent ESG backlash affected their interest in impact investing.

Despite political pressure in the U.S., we believe Americans are neither “anti-ESG” nor anti-environment. The “E” that concerns them is exclusion. In our view, the issue in the U.S. is related to what is known as the “Just Transition” – we need to take care of workers and regions that are being affected by the transition to a clean energy future. Unfortunately, ESG is often framed and implemented in a way that is exclusionary, rather than inclusionary. We get it.

We believe that integrating sustainability and ESG concepts into the investment process is valuable and important, and should not be politically motivated. While we are active investment managers, we are not activists. Incorporating sustainability into our processes is our responsibility because it can lead to better informed decisions and better long-term risk-adjusted returns for our clients.

5. Health Care Is Top of Mind

It continues to be the cause that matters most to impact investors in the U.S. and Australia. Health care is second only to climate change elsewhere, except Germany, where reducing poverty was second most important. American Century has a unique perspective on impact investing in the area of health care and medicine. Over 40% of our dividends support the Stowers Institute for Medical Research, a world-class biomedical research organization that holds an equity stake in American Century. We have generated nearly $2 billion in dividends for the Stowers Institute since 2000.

Our relationship with the Stowers Institute allows us to have an impact on global health while helping our clients to achieve their financial goals. Our purpose-driven business model sets us apart in the industry, and our connection with the Stowers Institute has helped to shape our culture and made it easy for us to incorporate sustainability into our investment practices.

Overall, our impact investing surveys show that the appeal of impact investing has increased over the years, across nations and generations, for both men and women. Even subgroups where interest has lagged are making gains. This isn’t surprising, because the long-term drivers that make sustainable investing compelling remain strong, and that reaches everyone, everywhere.