Tech can help to enable ESG but the often-disruptive nature of new technologies makes it imperative that tech companies build trust with different stakeholders. As the Chinese tech sector improves on its ESG commitments and disclosures, this is in line with the broader trend we see in the China A-share market.

Despite its later start, ESG practice is gaining momentum in China. After the China Securities Regulatory Commissions (CSRC) and the Shanghai Stock Exchange promoted new ESG guidelines in 2019, the CSRC and the Ministry of Environmental Protection asked listed companies and bond issuers to disclose ESG risks associated with their operations in 2020. More recently in May 2021, the CSRC released new guidelines requiring listed companies to make ESG disclosures in their annual and semi-annual reports. This entails providing transparency on environmental breaches as well as efforts to reduce carbon emissions and other ESG initiatives. Meanwhile, the Chinese central bank has indicated recently that it will support the development of a standardized international climate reporting framework after it started stress testing its financial institutions to identify those most at risk from climate change effects.

Prior to the latest requirement by the CSRC, it is estimated that about 25% of China A companies provided ESG-related disclosures. Given rising investor and regulator scrutiny, as well as the Chinese government’s ambition to achieve carbon neutrality by 2060, the quantity and quality of ESG-related disclosures among China A companies is likely to improve.

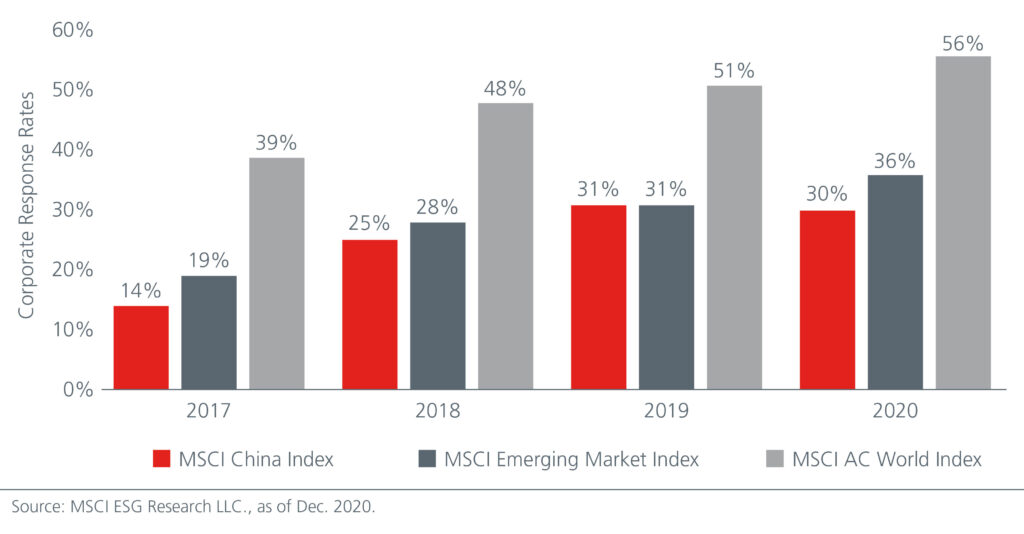

It is encouraging to note that ESG disclosures by Chinese companies in general have risen over the years. The corporate response rate among constituents of the MSCI China Index almost doubled from 2017 to 2018 and is on par with that of the Emerging Markets in 2019. Fig. 1.

Fig. 1. Corporate response rates

While China’s carbon neutrality target, as stated in the government’s 14th Five Year Plan, may lead investors to immediately consider the implications for the utilities, transportation, energy and commodity sectors, there are also important implications for the tech sector.

Assessing Tech-Related ESG Risks

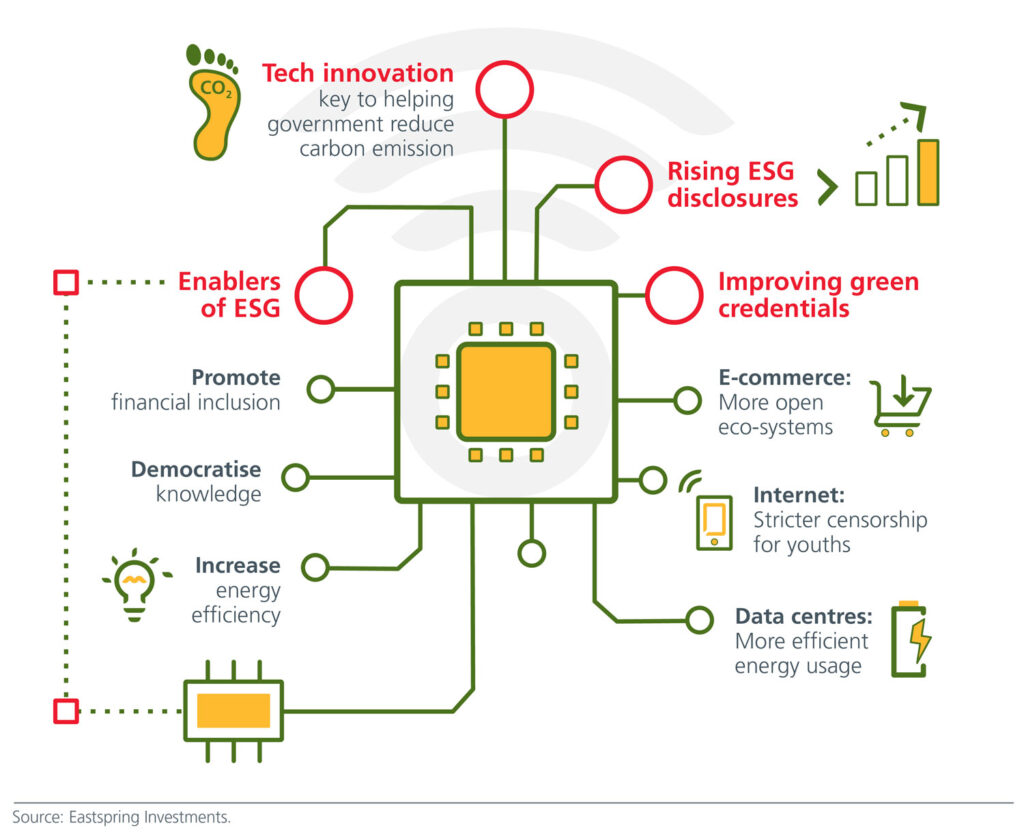

Tech is an important enabler of ESG, as seen from the innovative solutions used to promote financial inclusion, increase energy efficiency and democratise knowledge.

At the height of the COVID-19 outbreak in 2020, Chinese ecommerce players and food delivery platforms played important roles in helping the economy and society stay connected and productive. Online learning platforms ensured that students could continue learning despite the pandemic while many Chinese cloud companies offered free video and audio chat tools, helping companies maintain their daily operations. They also provided free access for research institutions to accelerate drug screening for potential vaccines. Over the years, Chinese fintech companies have also transformed how millions of Chinese consumers make payments, borrow, save, invest, and insure themselves against risk.

With technological innovation being one of the key pillars in the Chinese government’s growth agenda, we believe that technology should be a core exposure in investors’ portfolios. At the same time, given the Chinese government’s green ambitions, tech companies will need to continue to improve their green credentials.

As such, investors need to review the sustainability of business models to assess how companies are adapting to the new demands from policy shifts, changing consumer preferences and increasing investor appreciation of ESG risks.

Tech companies, more so than other sectors, tend to have charismatic founders/CEOs. Accountability and governance issues may arise although these concerns can potentially be resolved by having an independent board and separating the roles of the CEO and chairman. At the same time, these risks may have to be balanced against the value add and vision which many of these founders/CEO bring to the company.

It is also important to stay up to date of the companies’ evolving ESG practices in order not to miss out on potential opportunities.

For example, data centers are often criticised for their high energy consumption because of the low temperatures needed for these centers to function efficiently. China’s data center operators have been incorporating new features in their data centers to make them more energy efficient. For one operator, this includes having one of the world’s largest server clusters that are submerged in liquid coolant. The coolant keeps IT hardware chilled and reduces energy consumption by more than 70%. Some data center operators are also investing in high performance computing infrastructure to meaningfully increase the computer performance to power consumption ratio. Other centers aim to leverage free-air cooling systems where possible. This is especially viable for centers that are located where temperatures can drop substantially during winter. This means there is no need for additional machine-powered cooling for some months of the year. There are also efforts to tap natural water bodies for cooling or renewable sources of energy such as solar and wind.

At the same time, some of China’s internet platforms are introducing stricter censorship programmes to restrict adolescents’ access to gaming and other sensitive content, while e-commerce players are working to ensure more open ecosystems for online merchants.

Fig 2: Why invest in Chinese tech

New Technologies to Achieve Carbon Emission Target

We continue to find opportunities within the Chinese tech sector. The fast ramp up of Electric Vehicles (EV) and Advanced Driver-Assistance Systems drive strong demand in semiconductor and other electronic components. With China being the largest EV market in the world, we are also seeing significant innovation from local companies within the EV supply chain. Meanwhile, despite recent headwinds from rising regulatory oversight, we believe that the long-term trend underpinning the e-commerce sector is likely to continue. Technological innovation will be key to helping the government achieve its emission reduction target. As such, we expect to find more exciting tech-related opportunities going forward.

The often-disruptive nature of new technologies makes it even more important for tech companies to build trust with their different stakeholders. Given the rising influence of technology in society and businesses, it will be ideal if the tech sector can set the pace on ESG commitments and disclosures.

In KPMG’s Global CEO 2019 Outlook, more than half of technology CEOs indicated that they must look beyond purely financial growth to achieve long term sustainable success while 74% believed that it was their personal responsibility to ensure that their organisation’s ESG goals reflect the values of their customers.

Delivering ESG Alpha to Investors

As China’s ESG disclosures improve, it is critical that active managers complement companies’ voluntary disclosures and third party ESG ratings with their own on the ground research and understanding of the local policy backdrop and cultural nuances. Compared to the developed markets, there are distinct differences in policy priorities, social needs and customer preferences that need to be considered. We believe that companies’ disclosures will often need to be interpreted using local knowledge and market experience in order to add value to the investment process and deliver alpha to investors.