Hedge funds present investors with potential diversification benefits, attractive market capture and low exposure to the broader markets.

Highlights

- For decades investors have used a traditional approach to asset allocation, diversification across fixed income and equities.

- This traditional approach relies on fixed income to preserve capital and generate income, and equities for growth and capital appreciation.

- Today, investors are faced with a potential imbalance in this longstanding relationship as markets grapple with historically low interest rates and credit spreads, heightened equity valuations and bouts of market volatility.

- In today’s environment, many sophisticated investors are employing alternative strategies, particularly hedge funds, in an attempt to mitigate risk and produce more consistent returns.

Why allocate to hedge funds?

Hedge funds seek to produce performance with low correlation to fixed income and equities and that provides a degree of capital protection in volatile markets. In most cases, the primary source of hedge fund returns is from manager skill and security selection, rather than from directional asset class exposure (Beta).

Hedge funds can potentially provide additional sources of return by employing leverage, selling securities short and employing hedging strategies to both protect capital and to produce lowly correlated, low beta returns. While most hedge funds focus on equities, there are diverse strategies across fixed income, credit, commodities and other sectors that have the goal of providing higher risk-ad¬justed returns compared to long-only investments in their sector.

Hedge funds offer an alternative to fixed income

Historically, bond portfolios have often been considered a diversifier in equity portfolios. For the last 30 years, bonds have benefited from a secular bull market, delivering consistent portfolio returns with relatively low volatility as interest rates declined. However, continued uncertainty surrounding market outcomes has had a negative effect on investors who have been allocating to longer duration credit.

For the period 1981 to 2015, nearly 75% of investors’ total return on intermediate duration bonds was derived from income, which was then reinvested in higher coupons that were available leading up to the historically low post-2008 interest-rate environment.

While price fluctuations have always been a risk to investors, financial regulations enacted after the Global Financial Crisis of 2008-2009 have significantly limited the liquidity that traditional intermediaries, typically banks, can devote to keeping bond markets orderly. Generally, even a modest rise in interest rates has the potential to expose bond portfolios to losses, and with fewer intermediaries able to provide market liquidity, bond holders are more exposed to price gap risk and volatility as rates rise.

Hedge funds present investors with various potential benefits that may alleviate the risks associated with traditional bond exposure in a rising interest rate regime. Historically, hedge funds have exhibited superior market down and up-capture, preserving capital during market drawdowns and capturing larger percentages of market appreciation, compared to traditional long-only strategies. Hedge funds also employ tactical strategies, with long, short and relative value exposure, providing further opportunities to potentially capture directional market movements.

Additionally, hedge funds provide investors with exposure to sophisticated fixed income products, such as asset backed securities, structured products, insurance-linked securities and credit derivatives that are difficult to access as a traditional retail investor.

A powerful diversifier to equities

Traditional long-only equity investing typically requires successful timing and patience as well as separating emotions from investing throughout market downturns. The dramatic reflation in the equity markets after the Global Financial Crisis caused many investors to invest in passive, long-only equity strategies, but these vehicles generally add a high degree of market beta and potentially greater exposure to market volatility.

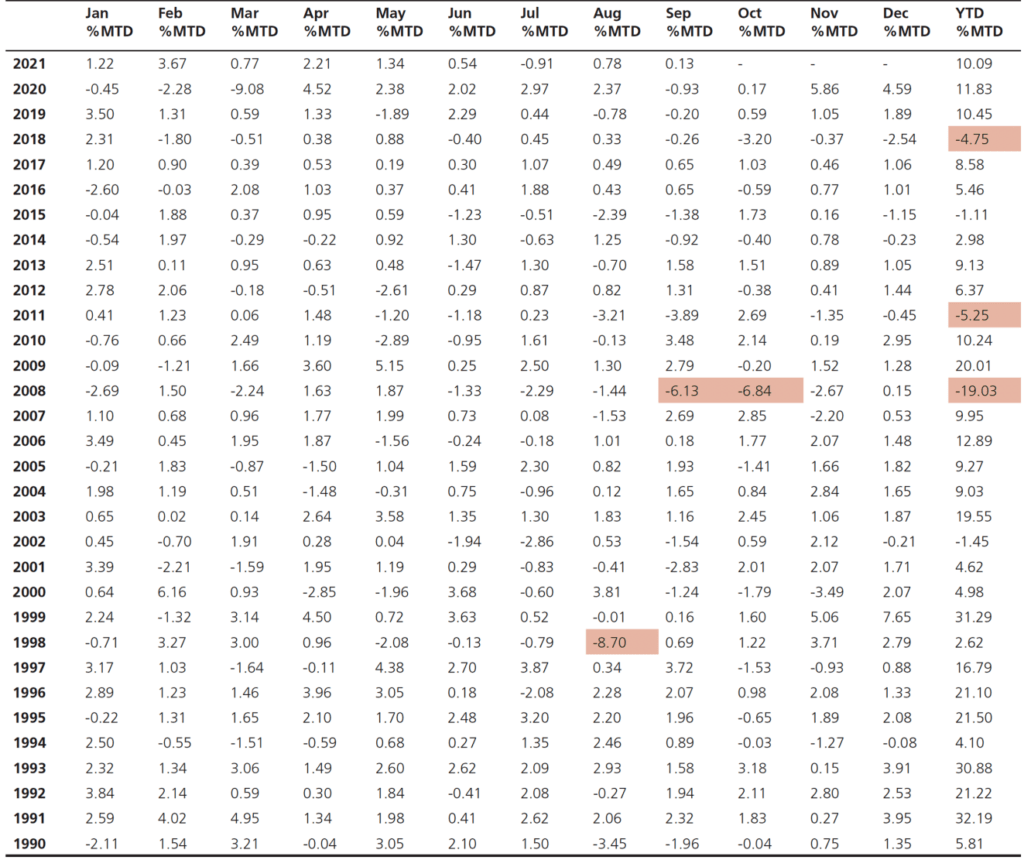

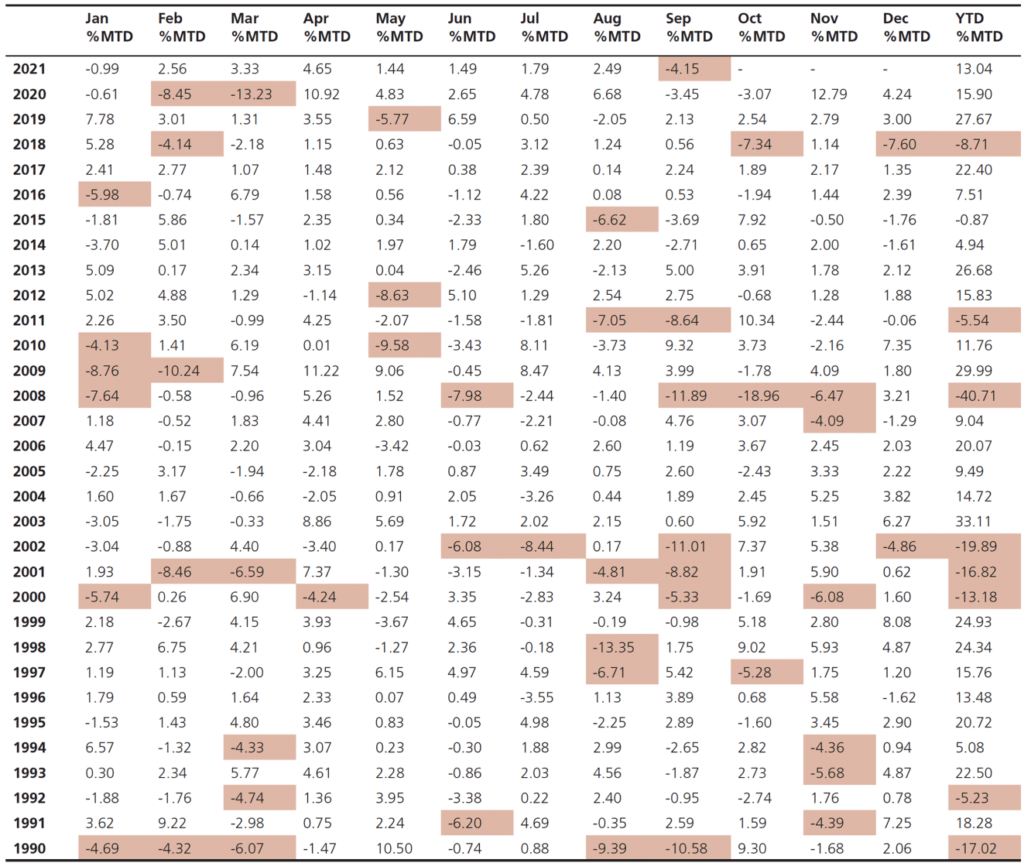

The active approaches employed by hedge funds potentially offer more consistent returns with reduced volatility and low correlation to equity markets, and can add a compelling degree of diversification and loss limitation in challenging market environments. Historical monthly return comparisons indicate that hedge funds typically exhibit lower and less frequent drawdowns relative to global equity markets (see Figures 1, 2 and 3 for various perspectives). Supplementing traditional equity exposure with hedge fund allocations may help investors stay the course for the long term.

Click on image to view enlarged version.

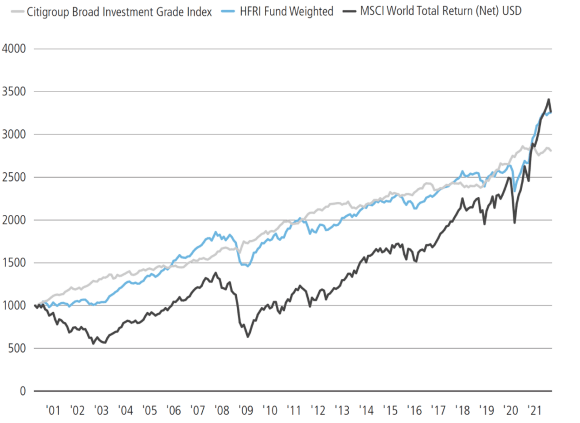

Over the long term hedge funds have produced high risk-adjusted returns compared to stocks and bonds

Hedge funds have historically outperformed the markets over the long term, driven by their focus on protecting capital in falling markets. Losing less makes the path to recovery shorter and positive returns nearer at hand, which is central to the goal of producing positive returns in most, if not all, market environments. Hedge fund allocations have historically helped reduce volatility in a portfolio and enhanced long-term returns, compared to traditional portfolios without hedge fund allocations.

Figure 3: Hedge fund performance compared to equities and fixed income

Investing in hedge funds

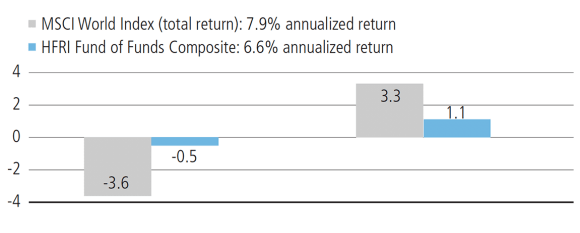

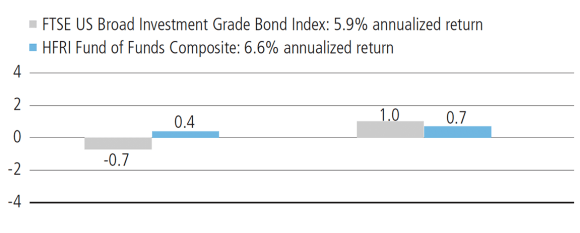

Hedge funds present investors with potential diversification benefits, attractive market capture and low exposure to the broader markets. This value proposition has historically enabled hedge funds to preserve capital during months with negative market returns, while attempting to capture a greater percentage of gains during positive months (Figures 4a and 4b).

Downside protection and upside capture

Figure 4a: Compared to equities

Figure 4b: Compared to fixed income

Fund of hedge funds investing

Why fund of hedge funds?

Fund of hedge funds typically offer a range of solutions, customized to meet particular investment objectives, sourced from a broad universe across strategies. Employing a fund of hedge funds model provides investors with a holistic approach to portfolio construction and professional risk management oversight. Generally, investors are able to access approaches across the risk/return spectrum that seek to provide alternatives to high-yield levered loans, to generate alpha with less beta and less volatility, or approaches that seek to increase returns with allowances for higher volatility.

Funds of hedge funds provide active management of active managers. This provides two tiers of asset allocation, risk management and portfolio construction. When a multi-manager provider makes a top-down asset allocation decision they can aim to identify a hedge fund manager to implement this strategy based on their investment acumen and style. Additionally, the multi-manager approach provides bottom-up manager selection and due diligence to potentially rotate managers within a strategy if a preferable option is identified. A strong fund of hedge funds program will strive to add value from both asset allocation and manager selection.

A hypothetical investor example could be a pension fund that needs to meet liabilities and generate a target return of 7% and is struggling in a world of zero interest rates and narrow credit spreads. Additionally, fixed income portfolios have not been an effective hedge to equities, and investors want to know how to get diversification back in their portfolios. This is where a fund of hedge funds may provide a dynamic solution to meet an investor’s specific needs.

Our edge and approach at UBS Hedge Fund Solutions (HFS)

As one of the top hedge fund multi-managers globally, HFS is able to leverage its scale, resources and access to customize and specialize portfolios on behalf of clients. Through a dynamic approach, HFS tactically allocates across strategies and opportunities to take advantage of market conditions. In addition, strong manager relationships and longevity provide access to portfolio information, capacity and talent pipelines. As an active manager of active managers, the team provides an additional tier of oversight for asset allocation and tactical positioning. Portfolios are turned over actively—about 20% per annum on average depending on the market conditions and manager views.

HFS’s expertise is backed by the bulk of our investment team, including all strategy heads, having directly traded the strategies they now cover. Having previously traded these strategies, either on the sell side or at a hedge fund, allows the investment team to go more in depth on manager ideas, talk their language, analyze if they’re expressing positions thoughtfully and dive into details.

HFS aims to create low beta and diversifying solutions to help clients solve their complex investment challenges. Some of our enhanced investment capabilities include: Private Credit, Emerging Managers, Diversity, Equity and Inclusion, Asia opportunities, Co-investments and Sustainable Investing.

Multi-strategy hedge fund investing

The benefits of a multi-strategy approach

Hedge fund managers attempt to produce absolute performance across all market cycles, and seek comparatively lower volatility and more consistent returns, often placing a higher priority on attempting to limit losses.

Multi-strategy hedge funds employ active risk management and are often defensive, skilled at managing downside, and may capture available returns by virtue of their capital allocation and ability to be dynamic. This approach offers differentiated returns by targeting alpha capture over beta production, actively balancing exposures and incorporating leverage. Multi-strategies look to offer diversification in any market environment by capitalizing on structural imbalances, cyclical trends and idiosyncratic dislocations.

Multi-strategy hedge fund managers strive to have the scale and the ability to bring in the best talent and pursue the most attractive market opportunities. This requires infrastructure, expertise and a bigger budget than many institutions possess.

Our edge and approach at UBS O’Connor

For over 21 years, O’Connor’s flagship Global Multi-Strategy Alpha Fund has focused on liquid relative value investing, diversified at the security level across geographies, market sectors and asset classes. The Fund seeks to extract alpha from the market by employing a broad array of complementary sub-strategies with minimal or negative correlation to one another and broad market indices.

Our core values of maintaining liquidity and preserving investor capital along with our investment approach of fundamental analysis, quantitative risk management and financial markets expertise remain as strong today as ever, producing consistently high risk-adjusted returns and only 2 losing calendar years across the Fund’s 21 year history. We continue to leverage the core strengths of O’Connor while orienting the portfolio to a return goal of 8-12% with volatility of 5-7%. Over the past few years we have shifted away from broad diversified strategies with declining alpha profiles, and removed factor and risk constraints to allow our PMs both greater flexibility in managing their books and in adding concentration in high conviction positions. We concentrate capital in strategies where we believe that our strong PM talent can take advantage of a supportive macro backdrop, less crowding and greater dispersion. Some of these changes have been particularly meaningful:

- Increased focus on Equity L/S strategies in Europe and Asia has been a source of compelling idiosyncratic returns, particularly in the China A-share market where our PMs in Hong Kong and Shanghai have a meaningful competitive advantage by leveraging UBS’s global footprint, local markets expertise and access to borrow.

- Launched our Environmental-focused long/short equity strategy through a PM team with 12 years’ expertise trading the energy economy, targeting the dramatic changes in corporate behavior in addressing climate change.

- Significantly increased allocation to our long-tenured Merger Arbitrage team, while developing adjacent strategies in Event Driven and Special Purpose Acquisition Companies (SPACs).

- Increased allocation to Credit strategies, particularly in Convertible Arbitrage and High Yield, with an aggressive approach to trading to capitalize on short-term catalysts and dislocations, and introduced both Private Credit and Working Capital strategies.

O’Connor’s evolution has allowed us to successfully navigate the COVID crisis and ensuing pandemic, protecting our investors’ capital through the market downturn. Our focus on liquidity allowed us to be nimble and aggressive in repositioning our exposures in the dramatic market moves, and we have gone back to our roots as derivative traders in actively using equity and credit derivatives to both hedge and tilt our overall exposures.

Looking forward, we remain in an environment of unprecedented uncertainty in both geopolitics and corporate fundamentals, which we anticipate will be a huge driver of alpha in the market. We’ve always been mindful of volatility as a leading indicator in the market, and we are keeping a watchful eye for signs of interest rate volatility as a potential predictor of heightened risk. We will continue to leverage our fundamental research and data science tools as we look to continue our history of high risk-adjusted returns and meaningful capital protection in dynamic markets.