Paul O’Connor, Head of the UK-based Multi-Asset Team, considers recent uncertainty in the US and European banking sectors in the context of a broader late-cycle environment.

Key takeaways:

- Financial stocks in Europe, Japan and the US have endured dramatic losses in March, with sharp drawdowns also seen in oil, mining and some other more cyclical sectors.

- Expectations now are that central banks in the western world are close to reaching peak interest rates, with the US Federal Reserve likely to start cutting rates in the second half of 2023 as financial stability becomes a new priority.

- Late-cycle volatility create opportunities for active asset allocation, while rising idiosyncratic risk creates opportunities for active security selection.

Although Q1 is not yet over, investors have already seen financial markets switch through three very distinct phases so far this year. January began with the “everything rally” with all the major asset classes rising, as investor sentiment shifted towards soft-landing scenarios. Then, February saw a broad-based reversal of these moves, amid a hawkish consensus rethink on interest rates in developed economies. And the mood has changed once again in March as concerns about the banking system in Europe and the US have come to the fore.

While defensive assets and risk assets rose and fell together in January and February, performance dispersion has been a notable feature of global markets in recent weeks. Within equities, financial stocks in Europe, Japan and the US have endured dramatic losses in March thus far, with sharp falls also seen in oil, mining and some other more cyclical sectors. However, defensive stocks and other less economically sensitive assets have been notably resilient. With government bonds, investment grade bonds, emerging market debt and gold all showing gains in March so far, more cautiously positioned multi asset portfolios have had an opportunity to prove their worth to investors, through a period when bank stocks were giving them headaches.

Rates rethink

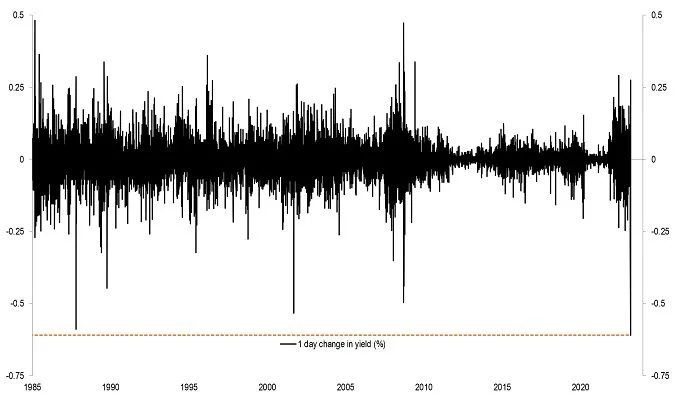

The flare-ups in some banks have had a dramatic impact on interest rate expectations, with investors quite rightly deciding that signs of fragility emerging in the financial sector could make central banks more cautious about raising interest rates going forward. On Monday 13th March, the yield on 2-year US Treasury bonds dropped more than on Black Monday 1987, on 9/11 and on any day during the Global Financial Crisis (GFC) (Exhibit 1). By Wednesday 15th March, market expectations for where US interest rates will be in Q4 2023 had dropped by 185 basis points (1.85%) in just a week. These moves were echoed, albeit less dramatically, in other major developed economies. Expectations now are that central banks in the eurozone, the UK and the US are within 25bps to 50bps (0.25%-0.5%) of their rate-hiking peaks, with the US Federal Reserve (Fed) expected to be cutting interest rates in the second half of the year.

Exhibit 1: The biggest one day move in decades for US 2-year government bond yields

Given the scale of the moves seen in financial stocks, interest rates and related areas, we would be wary of extrapolating the recent price action much further, for now. Where banks are concerned, we take comfort from the decisive actions of policymakers to provide liquidity where needed. Also, we believe that the high-profile bank crises of recent days are more reflective of weak business models and more isolated questionable decision-making than the systemic issues associated with the US sub-prime crises and the eurozone financial crisis that followed.

High idiosyncratic risk

Still, while it seems wrong to interpret recent events in US and European banks as the first signs of a serious global banking crisis, it would probably also be wrong to regard them as one-offs within the wider financial system. The global interest rate shocks of the past year or so are still working through the global economy and will inevitably cause more damage in banking and credit markets. So, while we do not see the current environment as being one of unusually high stress in the financial system, it is however an environment of high cyclical risk and high idiosyncratic risk. Given that financial stress usually emerges in unpredictable ways, investors should steel themselves for more shocks and surprises in the months ahead.

We agree with the broad direction in which interest rates have been repriced in recent days. The emergence of signs of stress in the banking system is a game-changer for monetary policy. In broad terms, from here it seems fair to expect tighter lending conditions in the financial sector and a dampening impact on confidence and activity among corporates and consumers. In an environment of such financial fragility, we expect central banks to increasingly prioritise financial stability alongside their pursuit of price stability. That argues for imminent pauses and maybe even peaks in interest rate cycles in Europe and the US, as central banks respect the uncertainties arising from deteriorating credit and liquidity conditions in the financial sector.

Opportunities in volatility

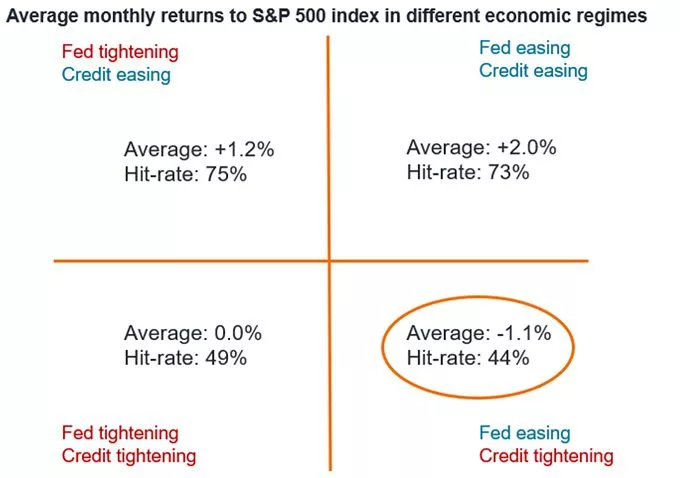

While this week’s market volatility has created some tactical market opportunities for nimble market participants, the strategic significance of recent developments is nevertheless fairly sombre. We would interpret recent stresses in the financial system as confirmation that we are now in a typically turbulent late-cycle market regime. This is the stage of the economic cycle when interest rate hikes begin to gain traction, slowing growth and inevitably causing financial accidents (Exhibit 2). This is rarely the best time in the economic cycle for financial risk-taking. In this environment investors should consider the challenges and opportunities of managing late-cycle market volatility.

Exhibit 2: Stocks typically struggle when the Fed is easing and credit is tightening

Still, while we see reasons to prioritise defensive over risk-seeking investment strategies, we would be wary of getting too gloomy. Across the multi-asset space, asset valuations are now at levels from which investors have normally enjoyed respectable medium-term investment returns, (although past performance does not predict future returns). And, while market volatility is likely to remain a source of frequent discomfort for investors in the months ahead, it can also be a source of great opportunity. The dramatic price shifts seen in some assets so far in 2023 provided many opportunities for tactical manoeuvring on the asset allocation front. Also, this is the stage of the economic cycle when fundamental analysis can really pay off. When idiosyncratic risk is high, investors can be well rewarded for their ability to distinguish between the winners and losers in equities, credit and alternative assets.

Important information:

Financials industries can be significantly affected by extensive government regulation, subject to relatively rapid change due to increasingly blurred distinctions between service segments, and significantly affected by availability and cost of capital funds, changes in interest rates, the rate of corporate and consumer debt defaults, and price competition.

Fixed income securities are subject to interest rate, inflation, credit and default risk. The bond market is volatile. As interest rates rise, bond prices usually fall, and vice versa. The return of principal is not guaranteed, and prices may decline if an issuer fails to make timely payments or its credit strength weakens.

Diversification neither assures a profit nor eliminates the risk of experiencing investment losses

S&P 500® Index reflects U.S. large-cap equity performance and represents broad U.S. equity market performance.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.