Washington – Female representation on the boards of companies in Japan, as well as in some other Asian markets, has improved dramatically in recent years. More Japanese large-cap companies are recruiting women to executive and board positions and improving their gender diversity practices. This is due, in part, to a voluntary directive from the Japanese government for corporations to fill at least 30% of their management positions with women.

At GDP of $5.06 trillion, Japan ranks as the world’s third-largest economy — and is influential in world markets. It is also home to the second-largest stock market globally. South Korea is 10th in the world economy, with a GDP of $1.64 trillion, according to the latest World Bank 2020 data.1 Improving board diversity in these countries, as well as globally, can make a material economic difference.

A 2019 analysis from McKinsey found that “companies in the top quartile for gender diversity on executive teams were 25% more likely to have above-average profitability than companies in the fourth quartile — up from 21% in 2017 and 15% in 2014.” 2

Measuring Japan's standing

Although Japan is often viewed as a laggard in gender equity, its female labor force participation rate and board representation have advanced significantly over the last several years. Likewise, South Korea has made notable progress. Globally, the ratio of female-to-male labor force participation ranged from 66% to 68% between 1990 and 2020.3 In contrast, Japan’s female labor force participation rate rose from 65% in 1990 to 75% in 2020, and from 63% to 73% for South Korea.

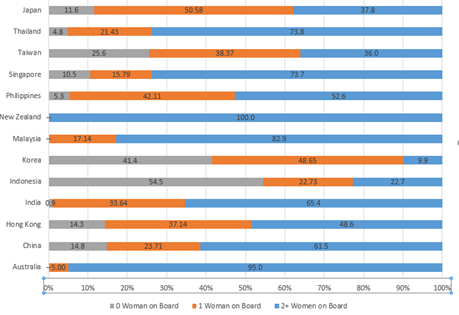

In 2019, 33% of Japanese companies in the MSCI ACWI had no women on their boards. South Korea had weaker representation, at 77%.4 Today, both countries have improved remarkably: Only 11.6% of Japanese companies lack a female board member, while the percentage for South Korea has come down to 41.4% (Display 1). Though there is still a ways to go on gender diversity, both countries are making progress towards catching up to other developed markets. We find it is no longer common for a Japanese company to have no female board representation when we evaluate its social and governance performance.

Display 1: Female Board Representation in the Asia-Pacific Region

Comparing the 13 countries in the Asia-Pacific region, New Zealand leads, with 100% of companies in the MSCI ACWI having at least two women board members; Australia places second, at 95%; and Malaysia places third, at 83%. In contrast, Indonesian companies have the fewest women board members (54.5% have none) and 41.4% of South Korea’s corporate boards lack female representation.

Women on boards: Global status

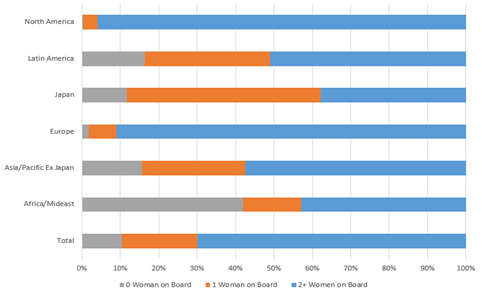

In 2022, nearly 70% of global boards represented by companies in the MSCI ACWI have at least two women on them (Display 2). Compared with other Asia-Pacific regions, Japan has fewer corporate boards with two or more women (38% versus 57%). In our view, one woman on a corporate board is not sufficient for promoting gender diversity and may be a sign of tokenism. Generally, we think a company needs to have two or more women on its board to have more diverse representation of viewpoints and experience.

Display 2: Women on Board — by Region

Overboarding women?

In considering corporate governance issues, one board metric we examine is overboarding — the percentage of a company’s board members who also sit on other corporate boards. We think this could be problematic. When one person sits on multiple boards, we question whether they have the time, focus or capacity to fully address the issues at each company. There is also the potential for tokenism, with companies appointing women simply to fulfill a diversity quota. We consider executive board members sitting on three or more boards to be overboarding.

Our review of the MSCI ACWI companies indicates this is not a major concern for Japanese boards overall. According to MSCI ACWI data, companies whose executive board members sit on at least three corporate boards averages 7.30% globally. For North America, the average percentage is 6.83%, and Europe averages 6.71%. The Asia-Pacific region, ex-Japan, has an overboard rate of 7.58%. Overboarding in the U.S. is 6.68% and Hong Kong’s companies have the most overboarded executive directors, at 34.29%. At 6.18%, Japan’s rate is not higher than other regions.

When we looked at male versus female board representation in Japan, based on the total board seats in the MSCI Japan IMI Index, we found women sit on 1.25 boards on average, which is more than men who sit on 1.06 boards on average, but the difference was not significant.

In our view, overboarding by gender does not appear to be a significant issue for Japan’s large-cap companies. Where we see a Japanese company improving on board diversity — specifically, adding a woman to its board within the past three years — we believe that likely indicates the needle-moving improvements needed in other areas of the company’s diversity, equity and inclusion practices.

Bottom line: Japan and, to some extent, South Korea are often misrepresented in terms of their progress toward gender diversity. Japan has increased its female labor force participation in recent years, particularly in management and boardroom positions. Globally, women have left the workforce in droves as a result of the pandemic. We believe corporations need to redouble their efforts toward gender equity and inclusion to reverse this trend. In our research, reducing gender disparities in the workplace has been shown to bring material, financial benefits to corporations as well as help drive global economic growth.

1. Global PEO Services, “Top 15 Countries by GDP in 2022.”

2. McKinsey & Company, “Diversity wins: How inclusion matters,” May 19, 2020 report.

3. The World Bank, “Ratio of female to male labor force participation rate (%) (modeled ILO estimate)”, February 8, 2022. Data delivered using International Labour Organization, ILOSTAT database.

4. MSCI, “Women on boards: 2019 Progress Report,” by Olga Emelianova and Christina Milhomem, December 2019.

MSCI ACWI is an unmanaged free-float-adjusted market-capitalization-weighted index designed to measure the equity market performance of developed and emerging markets. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. Historical performance of the index illustrates market trends and does not represent the past or future performance of the fund. MSCI indexes are net of foreign withholding taxes. Source: MSCI. MSCI data may not be reproduced or used for any other purpose. MSCI provides no warranties, has not prepared or approved this report, and has no liability hereunder.

MSCI Japan Investable Market Index (IMI) is designed to measure the performance of the large, mid- and small-cap segments of the Japan market. With 1,127 constituents, the index covers approximately 99% of the free-float-adjusted market capitalization in Japan.