Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The Liontrust UK Growth Fund returned 2.3%* in March. The FTSE All-Share Index comparator benchmark returned 1.3% and the average return in the IA UK All Companies sector, also a comparator benchmark, was 1.6%.

Although geopolitical volatility and macroeconomic uncertainties continued to loom large in the form of Russia’s ongoing invasion of Ukraine and the monetary policy response to rampant inflation, the UK market was able to notch up its first monthly gain of the year.

The potentially far-reaching economic impact of the war in Ukraine has combined with pre-existing inflationary concerns to trigger a sharp increase in discussion of the alarming prospect of stagflation. The FTSE All-Share’s ability to post a positive return in this environment was helped by 0.55% and 0.59% contributions from the energy and basic materials sectors respectively, both of which are benefiting from price rises as a result of supply disruption.

While the macro backdrop provided plenty of topics to keep market commentators occupied, it was also a busy month for those – like us – who prefer to take a bottom-up approach to their analysis. March is usually very heavy on newsflow, with many companies with December year-ends reporting their full-year results.

Of the Fund’s holdings that released 2021 results during the month, investors were most enthused by Coats Group (+25%). Shares in the industrial threads manufacturer moved higher as it commented that 2022 performance was now anticipated to be modestly ahead of its previous exceptions. The company reported a 29% rebound in revenues in 2021 to $1.50bn, which is also 9% higher than its 2019 level. Sales accelerated through the year, as demand recovered in its Apparel & Footwear division and its Threads business made market share gains. Operating profit still remains below 2019 levels but Coats is focusing on cost base efficiency as it targets margin improvement over the next two years.

Interdealer broker TP ICAP (+24%) performed poorly last year as it commented on subdued secondary markets and Covid-19 disruption at the interim stage before downgrading revenue guidance in November following disappointing volumes for its new Liquidnet. During March, it released 2021 results showing a 1% drop in revenues once the effect of the Liquidnet acquisition is adjusted for, prompting further share price weakness. However, the shares recovered dramatically at the end of the month. The catalyst was pressure from US activist investor Phase 2 Partners, which is calling for TP ICAP to explore strategic options, including a sale process.

While 2021 results from TI Fluid Systems (-13%) were in-line with guidance from its January trading update and, – at 5.6% constant currency revenue growth – reflected an outperformance of global light vehicle production, outlook concerns still weigh on the shares. The manufacturer of automotive fluid systems expects industry volumes to return to pre-Covid levels by the end of 2023 but thinks that short-term activity will be volatile due to geopolitical conflicts and an uncertain macro-economic backdrop.

Shares in Savills (-13%) performed very strongly in the second half of 2021 as interim results flagged a recovery in transactions in most of its markets, before a November trading update stated that UK prime residential markets had been significantly stronger than expected. Some of this ground was given back in March as Savills released 2021 results: revenue rose 23% to £2.2bn, while a doubling of underlying profit before tax to £200m displayed the real estate group’s operational gearing. However, Savills expects to see a normalisation of transaction volumes and discretionary spend from these elevated levels in 2022.

It has been a similar story for recruiter PageGroup (-14%), which reported a record gross profit of £888m in 2021, up 49% on 2020 and 7% higher than 2019. The company returned to growth versus 2019 levels in Q2 (+2%), a comparison which improved in Q3 (+13%) and Q4 (+24%). This performance was reflected in the shares’ 30% outperformance of the FTSE All-Share in 2021. With Pagegroup including a cautious outlook statement which cited macroeconomic uncertainties for 2022, there was little in the results to drive further share gains.

Brooks Macdonald Group (+14%) made some headway on the back of interim results, although many of the headline numbers were already public following the release of a detailed trading update in January. The asset manager grew assets by 5.3% to £17.3bn over the six months through a combination of net inflows and positive investment performance. This fed through to a 10% year-on-year improvement in revenues and a 25% rise in underlying profit before tax.

The Fund’s heaviest faller was translation and intellectual property services provider RWS Holdings (-20%). It has very successfully executed an acquisitive growth strategy over the years, notably doubling its size with the 2020 acquisition of SDL. In March, it announced the acquisition of Liones Holding for up to €22.5m. Liones is a Dutch provider of a cloud-native, data-driven authoring solution for mission critical documents. Alongside the acquisition announcement, RWS held investor presentations in which it gave updated short and medium-term growth targets.

The company stated that results for the year to 30 September 2022 are on track to be at the lower end of analysts’ range of forecasts, while a new investment programme is also expected to constrain earnings growth in the following two years. However, it expects this investment to yield market-beating sales growth from FY2024 to FY2026, with pre-tax profit margins benefitting by between 200 and 300 basis points.

In other notable portfolio news, shares in Pearson (+18%) shot higher on the disclosure that it had received and rejected two takeover proposals from US private equity investor Apollo Global at 800p and 854p a share. Apollo then made a third approach at 870p which was inclusive of rights to a recently announced 14p dividend, but this proposal was also rejected by Pearson’s Board, leading Apollo to withdraw its interest in making a takeover offer. Shares in Pearson finished the month 18% higher but 16% below the level of Apollo’s final proposal.

Positive contributors included:

Coats Group (+25%), TP ICAP (+24%), Pearson (+18%), Brooks Macdonald Group (+14%) and AstraZeneca (+12%).

Negative contributors included:

RWS Holdings (-20%), Renishaw (-17%), PageGroup (-14%), TI Fluid Systems (-13%) and Savills (-13%).

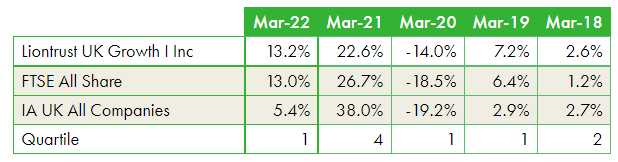

Discrete years’ performance** (%), to previous quarter-end:

Past performance does not predict future returns.

**Source: Financial Express, as at 31.03.22, total return (net of fees and income reinvested), bid-to-bid, primary class.

Understand common financial words and terms SEE OUR GLOSSARY

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust. Always research your own investments and if you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.