We continue to believe that the environment for emerging market credit should remain favorable. A strong global economic recovery is ultimately positive for overall credit fundamentals.

We also think that the current valuations of emerging market credits relative to their developed market counterparts still look attractive and should lead to further inflows over the year. This strong backdrop should provide enough support for credit spreads even in a somewhat higher-volatility environment. Recent comments by key officials point toward a rather cautious approach in terms of when they will start reducing their expansionary monetary policy. As such, we do not expect any changes from the Fed in the near term.

Reasons for optimism

The overall emerging market scenario is, in our view, still supportive. Our base case remains for a rebound in global economic growth, supported by high PMIs and low real yields in the US and ongoing fiscal support as well as central banks continuing their expansionary monetary policy. The US political transition is not the only driver of emerging market credit at the moment: markets are also bolstered by current trading results holding up well, coupled with global expectations of improvement from the second quarter as vaccines are rolled out and COVID-19 case numbers begin to fall. Markets continue to be buoyed by growing positioning in the asset class, as evidenced by strong inflows of funds over the last few months.

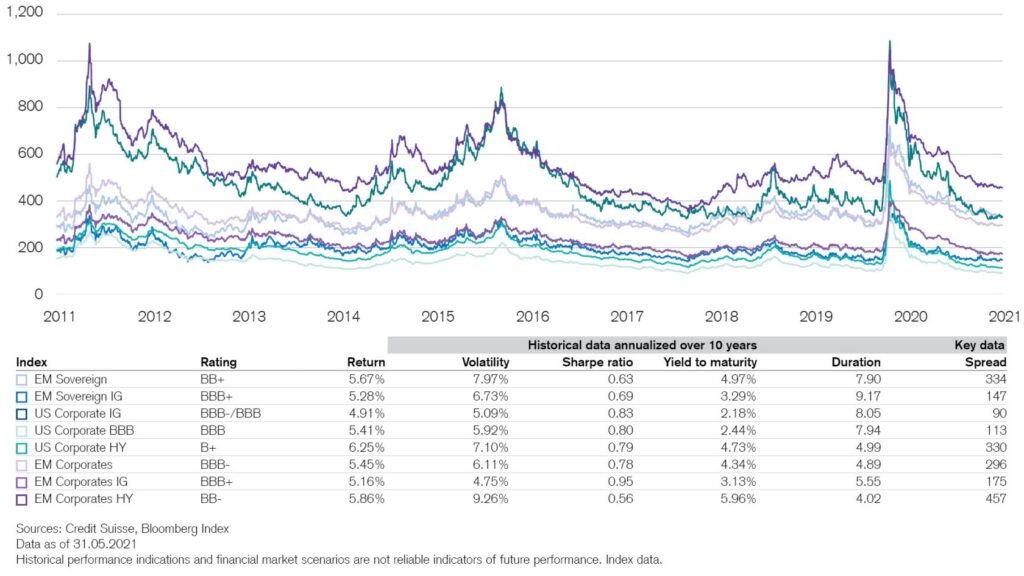

We believe that emerging market corporate bonds are a very attractive opportunity that investors should consider, especially at the present time. The following table shows the spread history of the main fixed-bond asset classes and their key characteristics as well as the historical performance and volatility of each of them. In a world of zero or negative interest rates, emerging market corporate debt is one of the few asset classes that offers a respectable yield pickup without the necessity of pursuing overly speculative credit ratings or extending duration risk. With currency hedging costs currently at five-year lows, we see potential for EUR investors to earn an attractive expected return of almost 3.5% by investing in emerging market hard-currency debt hedged against currency exchange risk.

The case for emerging market corporates: valuations remain attractive on a relative basis

With an eye on the valuation of emerging market corporate bonds, current spread levels continue to offer better value than developed market products. Even though credit spreads have narrowed in recent months, we continue to see a good carry supported by shorter duration than in developed markets. Looking at fundamental analysis parameters, we expect a rebound in Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) levels as vaccination programs help us return to some kind of normality. We therefore believe that the overall net leverage figures for emerging market companies should improve going forward, approaching late-2019 levels by the end of this year. As usual, primary market activity should continue to grow strongly. January was a record month, with net new issuance at USD 78 billion as positive fund flows continue to boost liquidity, supporting the market.

One key area to keep an eye on in 2021 will be fluctuations in sovereign credit ratings for certain countries, such as Colombia, India, and – to a lesser extent – Mexico, which are possible candidates for downgrading to fallen angel status. A sovereign credit rating downgrade would mean the downgrading of many companies in the affected countries.

A positive view and commitment to the asset class

We maintain our constructive view of emerging market credit as technicals remain positive with ongoing inflows into the asset class. From a valuation perspective, while credit spreads have tightened substantially over recent months, current spread levels continue to offer value, particularly versus developed markets. We continue to see new issues well absorbed by the market given recent and expected inflows into the asset class.

Credit Suisse Asset Management has over CHF 15 billion in assets under management across several actively managed solutions for investors seeking exposure to emerging market corporate debt.

Source: Credit Suisse, unless otherwise specified.

Unless noted otherwise, all illustrations in this document were produced by Credit Suisse Group AG and/or its affiliates with the greatest of care and to the best of its knowledge and belief.