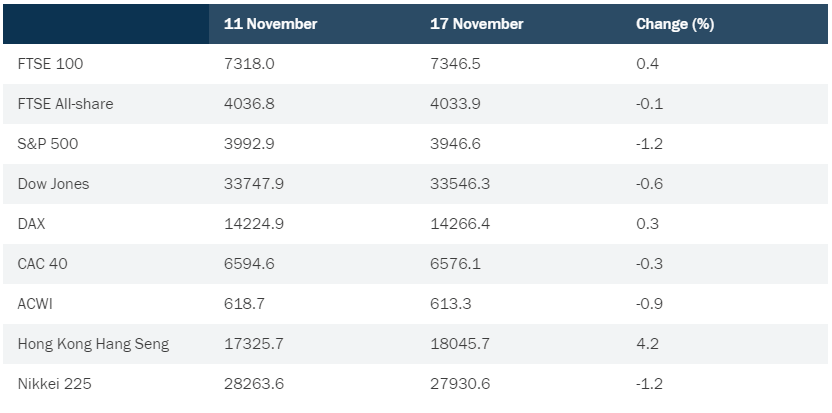

Global stock markets have given up some of their recent gains this week as concerns about slowing growth returned. The optimism that accompanied last week’s decline in the rate of inflation in the US has evaporated to some extent, but major indices remain well above their mid-October lows.

Downbeat economic data and some pessimistic company earnings reports have combined to give investors something of a reality check in the past few days. Even if the pace of interest rate rises does start to slow in the weeks ahead, the potential impact of a global recession may make it difficult for share prices to recover this year’s losses as we head into 2023.

US markets

On Wall Street, the Dow Jones Industrial Average ended trading on Thursday 0.6% down for the week so far, with the S&P 500 losing 1.2% after major retailers warned that the upcoming holiday season could be severely affected by weakening consumer demand. There were encouraging signs that rises in the input prices faced by US factories are starting to slow, although growth in US manufacturing output in October was more sluggish than expected.

Europe

In the UK, the FTSE 100 closed on Thursday 0.4% up for the week. The gloomy economic picture painted by chancellor of the exchequer, Jeremy Hunt, in his Autumn Statement on Thursday prompted sterling to fall slightly against the dollar. However, Hunt’s overall budgetary package was received far more calmly by the currency and bond markets than the fiscal plans proposed by his predecessor Kwasi Kwarteng in late September.

Figures published on Wednesday showed that annual inflation in the UK had risen to 11.1% in October, its highest level in more than 40 years. British food and drink producers called on the government to cut restrictions on trade with the European Union in order to reduce upward pressure on prices, while confidence among UK businesses as a whole has reportedly fallen to its lowest level since the financial crisis.

In Frankfurt, the DAX index ended Thursday’s session up 0.3% for the week, while France’s CAC 40 lost 0.3%. The German market was boosted by strong company earnings figures from one of its biggest industrials businesses, although the European Central Bank repeated its warning that rising energy costs and slowing growth posed a serious threat to financial stability in the eurozone.

Asia

In Asia, the Hang Seng index in Hong Kong rose 4.2% after authorities in Beijing unveiled a raft of measures designed to stabilise China’s struggling property sector. Japan’s Nikkei 225 index of leading shares, meanwhile, fell 1.2% after the unexpected news that the country’s economy had contracted in the third quarter of the year. Reports of problems in global semiconductor supply chains also weighed on the Tokyo market.

Note: all market data contained within the article is sourced from Bloomberg unless stated otherwise, data as at 17 November 2022.