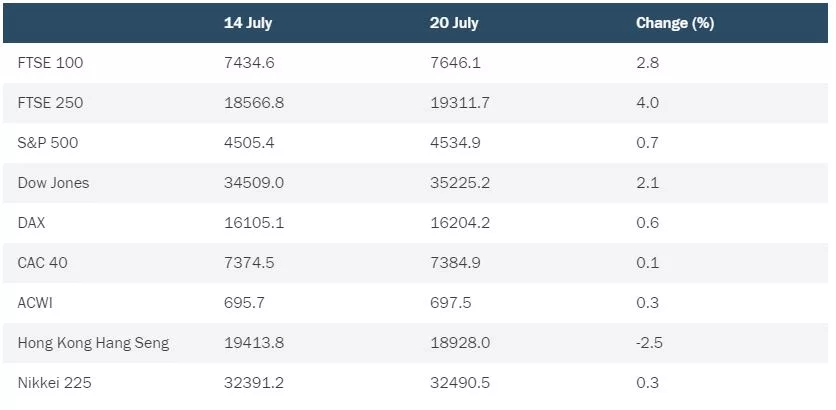

Global stock markets have made solid gains this week following recent signs that inflation is starting to slow

Solid company earnings reports for the second quarter of 2023 have also lifted investors’ mood and raised the prospect of a “soft landing” for the world’s major economies following the steep interest rate rises imposed over the past 18 months. The big economic news this week was the UK Consumer Prices Index reading for June, which came in below expectations at 7.9%. Given the fact that inflation in Britain has proved stickier than in Europe or North America in recent months, the figure boosted sentiment considerably.

United States

On Wall Street, the Dow Jones Industrial Average ended trading on Thursday 2.1% up for the week so far, with the S&P 500 gaining 0.7%. There were fresh signs of a slowing US economy, with retail sales for June coming in below expectations and indications that the housing market was cooling. However, combined with last week’s fall in inflation, the pressure on the Federal Reserve to raise interest rates appears to be receding. Investors welcomed comments from Treasury Secretary Janet Yellen that the US was unlikely to enter recession this year, although mixed earnings reports from major technology companies held back gains on the tech-heavy S&P 500 and Nasdaq indexes.

UK

In the UK, the FTSE 100 closed on Thursday 2.8% up for the week so far, with the index recovering most of the losses incurred since the start of the month. Housebuilders were the main beneficiaries from the fall in inflation, with interest rates in Britain now expected to peak below 6% later this year. The outlook for the UK economy remains mixed, nevertheless: latest figures showed insolvencies were up by nearly a third in June compared to the same month in 2022, while recent falls in property prices are reportedly starting to dampen consumer confidence.

Europe

In Frankfurt, the DAX index ended Thursday’s session up 0.6% for the week, while France’s CAC 40 gained 0.1%. Gains in Europe were limited by lacklustre data from China, with second quarter growth coming in below expectations. Meanwhile, a downbeat trading forecast from a major Asian semiconductor manufacturer hurt sentiment in the technology sector. However, there was some positive news with comments from a European Central Bank official indicating that next week’s expected interest rate hike could be the last in the current cycle.

Asia

In Asia, the Hang Seng index in Hong Kong dipped 2.5% as Chinese GDP growth undershot forecasts while government tax revenues also showed an unexpected decline. Officials reiterated their commitment to providing extra stimulus for China’s economy, but investors remained unconvinced that such measures will prove to be effective. Japan’s Nikkei 225 index of leading shares advanced 0.3%, hitting a two-week high on Wednesday following the Bank of Japan’s renewed commitment to maintaining its relaxed stance on monetary policy. However, technology firms declined on Thursday on wider concerns about the outlook for the semiconductor sector.

Note: all market data contained within the article is sourced from Bloomberg unless stated otherwise, data as at 20 July 2023.