While 2022 began with optimism that with the worst of the pandemic behind us the global economy could stage a strong recovery from the Covid-induced downturn, it did not take long for reality to bite.

With inflation on the rise around the world, central banks warned at the start of the year they would soon have to start tightening monetary policy. When this was followed by Russia’s invasion of Ukraine in late February – a move that created a shock not just in geopolitical terms but also in global energy and commodities markets – the tone was set for one of the worst years for equities in living memory.

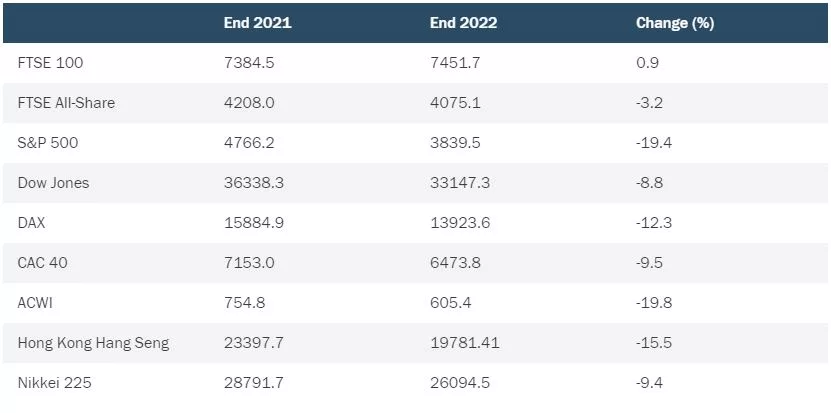

Almost all the major global stock market indices suffered heavy losses, giving up a significant chunk of the gains made during a bumper 2021. Those gains had been driven to a large extent by loose monetary policy and a technology sector that had surged as a result of pandemic-era lockdowns and lofty valuations based on ultra-low interest rates. As interest rates climbed in response to high inflation, it was tech stocks that suffered the most, especially in the first half of 2022. For the likes of energy companies and miners, however, the picture was very different: the sanctions imposed on Russia drove oil and commodities prices to new highs, in Europe in particular.

Investors were also concerned about the impact of China’s ongoing Covid-19 restrictions on the country’s economy as well as on global trade. The Chinese government’s “zero-Covid” approach saw major lockdowns imposed in multiple major cities including Beijing, Shanghai and Chengdu over the course of the year before the policy was effectively abandoned following protests in November.

As the year progressed, concern shifted from rising rates to the potential economic impact of tighter monetary policy. Indicators showed that consumer demand was weakening while manufacturers and other businesses struggled to cope with rising input costs. In general, however, unemployment rates remained low. The final three months of 2022 were more positive for markets with signs that inflation had peaked, raising hopes that central banks would soon slow the pace of monetary policy tightening. However, recessions in many of the world’s major economies appear highly likely while there is ongoing uncertainty over energy prices and global trade in the wake of China’s reopening. With the war in Ukraine also rumbling on, the chances of an imminent end to recent volatility appear remote.

United States

After leading the way in 2021, Wall Street had a far more turbulent year in 2022 with the tech-heavy Nasdaq and S&P 500 indices suffering the greatest losses. After gaining more than 25% in 2021, the S&P subsequently shed almost 20% of its value with rising interest rates causing a slump in major technology names. A global shortage of silicon chips and manufacturing issues in China did not help matters. The Federal Reserve raised rates numerous times as price rises continued to accelerate: US consumer price inflation reached a peak of 9.1% in June and remained above 7% at the year’s end. Many analysts expect the US economy to enter recession in 2023, although the labour market remains strong and company earnings to date have been largely resilient.

United Kingdom

The London stock market was the outlier in 2022 with the FTSE 100 Index posting a small gain for the year. The FTSE was helped by its high representation of energy and mining stocks as well as the global focus of many of its companies. With sterling losing more than 7% of its value against the US dollar over the course of the year, those businesses’ international earnings became more valuable. The FTSE’s relative success should not overshadow what was a very difficult year for the UK economy, with high inflation, rising interest rates and political tumult creating significant headwinds. The disastrous tax-cutting mini-budget announced in September by new prime minister Liz Truss and her chancellor Kwasi Kwarteng led to turmoil on the bond and currency markets and saw Truss being replaced by Rishi Sunak the following month. The Bank of England continued the rate-raising programme it had begun in December 2021 over the course of 2022, with the base rate hitting a post-financial crisis high of 3.5%. Bank governor Andrew Bailey said he expected the British economy to be in recession until 2024.

Europe

Markets across Europe were hit hard by the fallout from Russia’s invasion of Ukraine and the sanctions that ensued. The dependence of Germany’s manufacturers in particular on Russian natural gas created significant problems for the country’s heavy industry, and European leaders spent much of the year looking for alternative sources of fuel. Eurozone companies were also seriously affected by the slowdown in China, in terms of both consumer markets and supply chains. The European Union’s apparent success in weaning itself off Russian oil and gas, and the mildness of the winter so far, have helped to avert a more serious energy crisis. However, the European Central Bank raised interest rates on four occasions in the second half of the year and has warned of further increases in 2023 as it battles to bring inflation under control.

Asia

Few major indices had as volatile a year as the Hang Seng in Hong Kong. Buffeted by China’s zero-Covid policy, a regulatory crackdown on technology firms and the government’s announcement at the Communist Party congress in October that ministers would no longer prioritise growth, the index had slumped by more than a third by early November. In the weeks that followed, the reversal of Covid-19 restrictions, announcements of support for China’s beleaguered property sector and a more benevolent approach to the tech sector helped share prices bounce back.

In Tokyo, the Nikkei 225 was held back by weakness in the US market, while Japanese electronics manufacturers also suffered from problems with global microchip production. The year ended on a downbeat note after the Bank of Japan surprised markets by making a change in December to the way it controls interest rates. Many analysts saw this as a precursor to raising rates in 2023 after official figures showed inflation had hit a 41-year high in November.

Note: all market data contained within the article is sourced from Bloomberg unless stated otherwise, data as at 5 January 2023.

Important information

For marketing purposes.

This document is intended for informational purposes only and should not be considered representative of any particular investment. This should not be considered an offer or solicitation to buy or sell any securities or other financial instruments, or to provide investment advice or services. Investing involves risk including the risk of loss of principal. Your capital is at risk. Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. The value of investments is not guaranteed, and therefore an investor may not get back the amount invested. International investing involves certain risks and volatility due to potential political, economic or currency fluctuations and different financial and accounting standards. The securities included herein are for illustrative purposes only, subject to change and should not be construed as a recommendation to buy or sell. Securities discussed may or may not prove profitable. The views expressed are as of the date given, may change as market or other conditions change and may differ from views expressed by other Columbia Threadneedle Investments (Columbia Threadneedle) associates or affiliates. Actual investments or investment decisions made by Columbia Threadneedle and its affiliates, whether for its own account or on behalf of clients, may not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not take into consideration individual investor circumstances. Investment decisions should always be made based on an investor’s specific financial needs, objectives, goals, time horizon and risk tolerance. Asset classes described may not be suitable for all investors. Past performance does not guarantee future results, and no forecast should be considered a guarantee either. Information and opinions provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This document and its contents have not been reviewed by any regulatory authority.

In the UK: issued by Threadneedle Asset Management Limited, registered in England and Wales, No. 573204. Registered Office: Cannon Place, 78 Cannon Street, London EC4N 6AG. Authorised and regulated in the UK by the Financial Conduct Authority.

In Australia: Issued by Threadneedle Investments Singapore (Pte.) Limited [“TIS”], ARBN 600 027 414. TIS is exempt from the requirement to hold an Australian financial services licence under the Corporations Act 2001 (Cth) and relies on Class Order 03/1102 in respect of the financial services it provides to wholesale clients in Australia. This document should only be distributed in Australia to “wholesale clients” as defined in Section 761G of the Corporations Act. TIS is regulated in Singapore (Registration number: 201101559W) by the Monetary Authority of Singapore under the Securities and Futures Act (Chapter 289), which differ from Australian laws.

In Singapore: Issued by Threadneedle Investments Singapore (Pte.) Limited, 3 Killiney Road, #07-07, Winsland House 1, Singapore 239519, which is regulated in Singapore by the Monetary Authority of Singapore under the Securities and Futures Act (Chapter 289). Registration number: 201101559W. This advertisement has not been reviewed by the Monetary Authority of Singapore.

In Hong Kong: Issued by Threadneedle Portfolio Services Hong Kong Limited 天利投資管理香港有限公司. Unit 3004, Two Exchange Square, 8 Connaught Place, Hong Kong, which is licensed by the Securities and Futures Commission (“SFC”) to conduct Type 1 regulated activities (CE:AQA779). Registered in Hong Kong under the Companies Ordinance (Chapter 622), No. 1173058.

Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies.