The recent earnings announcement from Nvidia was historic. It’s not often that a firm shifts revenue guidance for an upcoming quarter from $7 billion to $11 billion. Nvidia’s total market capitalisation touched $1 trillion, something very few companies ever achieve1.

An overzealous valuation?

Professor Aswath Damodaran of New York University2, well known for his work on valuation, has said he cannot rationalise a $1 trillion valuation.

Damodaran estimates Nvidia has a roughly 80% share of the artificial intelligence (AI) semiconductor market, which is around $25 billion today. Using bullish assumptions, which may not prove accurate, he looks to see growth in the AI semiconductor market to reach $350 billion within a decade. If Nvidia captured 100% future market share (a bold assumption), Damodaran’s valuation still resides about 20% below current prices.

Nvidia is essentially a hardware company. One can see them try to ramp up software, but that is not the main driver. Other companies that achieved the $1 trillion market capitalisation level have software companies with network effects that draw vast numbers of end users into ecosystems. These software businesses have many ways to earn revenue from new products and services.

Professor Damodaran’s valuations do not necessarily lead to share prices that immediately decline—but it may be difficult to keep the return momentum coming with equal fervor.

Nvidia’s products do not operate in a vacuum

WisdomTree spends a lot of time focusing on the AI megatrend. Nvidia’s products do not exist in a standalone fashion, as they are plugged into cabinets containing other hardware functioning in concert. If the AI semiconductor market grows, as many now expect, a lot of companies will benefit.

Nvidia cannot, by itself, manufacture its semiconductors end-to-end. Taiwan Semiconductor Manufacturing Co. (TSMC) is responsible for this part of the puzzle. There is a whole semiconductor value chain, and each element captures a different-sized slice of the economic value pie.

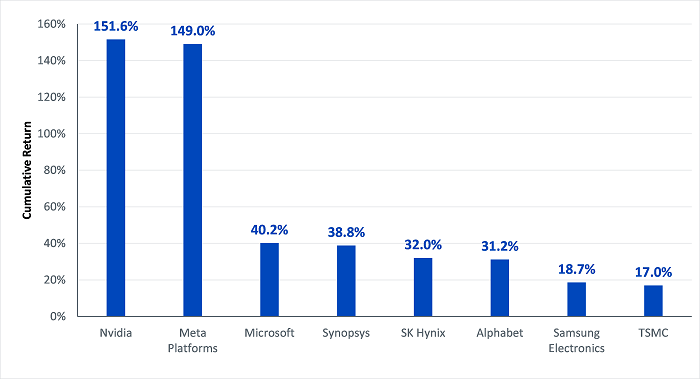

In Figure 1, we show a range of companies associated with ‘generative AI’ over the period from the release of ChatGPT.

- Alphabet, Meta and Microsoft represent companies developing large language models (LLMs) to allow users to directly access generative AI. Meta was beaten down in 2022, due to disappointment with the firm’s metaverse efforts, but AI and cost cutting is helping them in 2023. Alphabet and Microsoft are at the centre of the generative AI battleground. Microsoft, so far, is winning on the cloud computing battle front with its Azure platform, whereas Alphabet’s Google is going to be very difficult to fend off in the internet search space.

- It’s interesting to compare Nvidia to Samsung and SK Hynix. Running AI models, especially large AI models, requires memory, and Samsung and SK Hynix are in the memory chip space. Excitement, at least in recent years, fluctuated in waves across the broad semiconductors market. Right now, during the explosion of generative AI, graphics processing units (GPUs), where Nvidia is the leader, are all the rage.

- Synopsys and TSMC represent notable, necessary value-chain plays on semiconductors. Nvidia chips cannot be created in a vacuum. Synopsys provides necessary electronic design automation capabilities, whereas TSMC is among the only companies with a manufacturing process advanced enough to fabricate Nvidia’s most advanced chips.

Figure 1: Returns across the AI ecosystem have varied since ChatGPT’s release

Source: WisdomTree, Bloomberg, Factset.

Data covers period from 30 November 2022 to 2 June 2023. Nvidia is the primary company in focus, designing many of the world’s most advanced chips. Synopsys, SK Hynix, Samsung Electronics and Taiwan Semiconductor Manufacturing Co. (TSMC) represent other important parts of the semiconductor ecosystem, reminding us that Nvidia doesn’t operate in a vacuum. Meta, Microsoft and Alphabet represent companies that have developed and proliferated large language models.

Historical performance is not an indication of future performance and any investments may go down in value.

Is AI over-hyped?

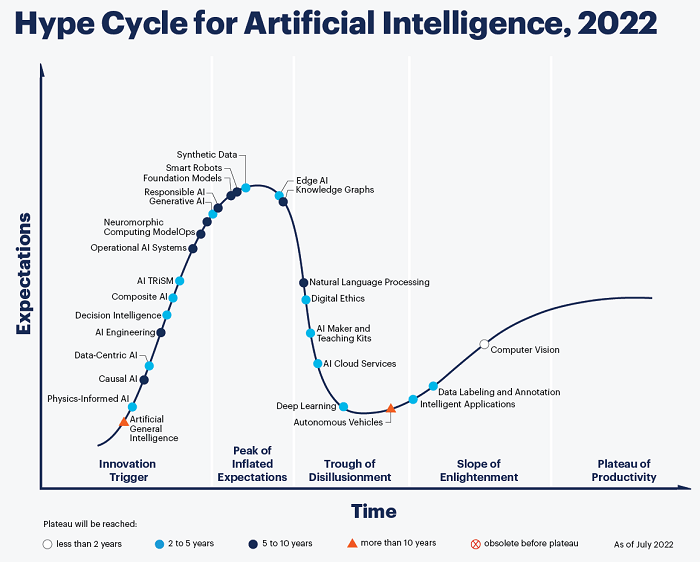

The Gartner Hype cycle characterises one way to view new technologies. In the short term, excitement leads to money flows. Share prices and valuations benefit. At a certain point, a realisation sets in that true success, growth, and adoption takes time, so at this point there is usually a lot of selling and a tougher return environment.

Finally, there is a recognition that pessimism is also not quite appropriate as the technology is still important and still being used, so growth rates and returns then tend to be more reasonable.

We reference a plot of the ‘hype cycle’ for AI in Figure 2.

Figure 2: Hype cycle for artificial intelligence, 2022

Source: https://emtemp.gcom.cloud/ngw/globalassets/en/articles/images/hype-cycle-for-artificial-intelligence-2022.png.

Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties.

AI is not any one single thing. Today we think of it as ChatGPT, LLMs or generative AI, but other disciplines and functionalities are still there, they just aren’t grabbing headlines in same way.

- ‘Generative AI’ and ‘foundation models’ might be nearing a peak of inflated expectations.

- Have you been excited about self-driving vehicles recently? No? Well, that could be part of the reason why ‘autonomous vehicles’ might be near the trough of disillusionment.

- Computer vision, which has been around for quite some time, is making its way up the so-called ‘slope of enlightenment’.

The hype cycle is not an exact science. Any discipline on this graph could generate any sort of return, positive or negative, going forward. It’s simply a tool that helps us place all of these different topics on a broader continuum. The only thing we seem to know for sure is that all of the topics do not generate the same levels of excitement or pessimism all the time.

Conclusion: it’s possible to mitigate single company risk by looking across the AI ecosystem

The hype cycle illustration points out that the various applications of AI are at different points of adoption, excitement, and development. No one knows the future with certainty, but we believe there is growth occurring in all of these disciplines. The world is enthralled with generative AI now, but the world was similarly excited about autonomous vehicles a few years ago. Progress is occurring, even if we are not seeing it reflected in every headline.

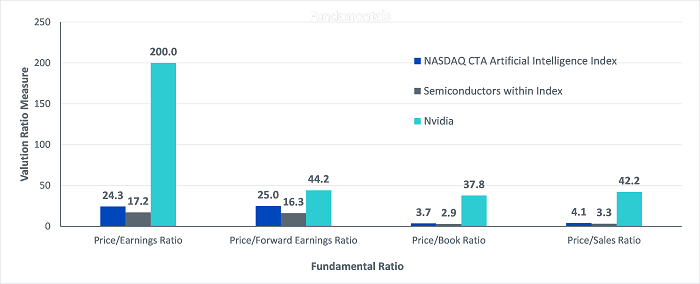

WisdomTree has a broad-based AI index to capture these AI trends. While Nvidia’s valuation is getting stretched, according to Professor Damodaran, WisdomTree’s AI index did not change much following the Nvidia surge. The entire ecosystem of AI defined by WisdomTree is not as beholden to the moves of any single company.

Figure 3: How a broad-based approach to artificial intelligence companies is less influenced by the high current valuation of Nvidia (as of 5 June 2023)

Source: WisdomTree, Bloomberg, Factset.

Trailing P/E Ratio refers to a measure of price level divided by a measure of earnings-per-share over the prior 12-month period, excluding the impact of any stocks that have negative earnings-per-share. Forward P/E Ratio refers to a measure of price level divided by a measure of estimated earnings-per-share over the coming 12-month period, excluding the impact of any stocks with a negative estimated earnings-per-share.

Historical performance is not an indication of future performance and any investments may go down in value.

AI has the potential to impact every industry which is why WisdomTree built a broad-based, ecosystem-oriented approach as opposed to concentrating on any single stock.

Sources

1 Source: Bloomberg.

2 Source: Hough, Jack. “Nvidia Is the New Tesla, the ‘Dean of Valuation’ Says. It’s Time to Cash Out.” Barrons. May 31, 2023.