In our latest roundup of developments in financial markets and economies, we look at how various asset classes fared in the first half of the year and consider what the next six months might bring.

The market was in wait-and-see mode last week, a combination of critical US inflation data being released on Friday afternoon (which came in line with expectations), the first round of the French elections at the weekend and the end of the first half to the year.

During the week, we saw signs things are perhaps not as stable as asset prices suggest. Inflation in Canada1 and Australia2 accelerated in May. In the latter, inflation has increased from 3.4% at the start of the year to 4% in May: unless there is a sudden loss of momentum in prices, the Reserve Bank of Australia may be forced to hike policy rates at its next monetary policy meeting in August.

On the economic activity front, Germany’s closely watched business confidence index, the ifo, unexpectedly fell from 89.3 points in May to 88.6 points in June, with both current and outlook components weakening.3 This could be a sign the gradual recovery in Europe’s largest economy faces headwinds. Similarly, in the US, a string of soft housing data and a downside surprise to durable goods orders4 offer further evidence the Federal Reserve’s continued restrictive interest rate policy is biting parts of the economy.

Debts and depreciation

It was the turn of the International Monetary Fund this week to warn the US of the dangers of unconstrained government spending, stating its “fiscal deficit is too large, creating a sustained upward trajectory for the public debt-GDP ratio”.5 Earlier in the month, the Congressional Budget Office increased its estimate for the current fiscal year’s budget deficit by 27% to $1.9 trillion, 6.7% of GDP, from its February forecast of 5.3%.6

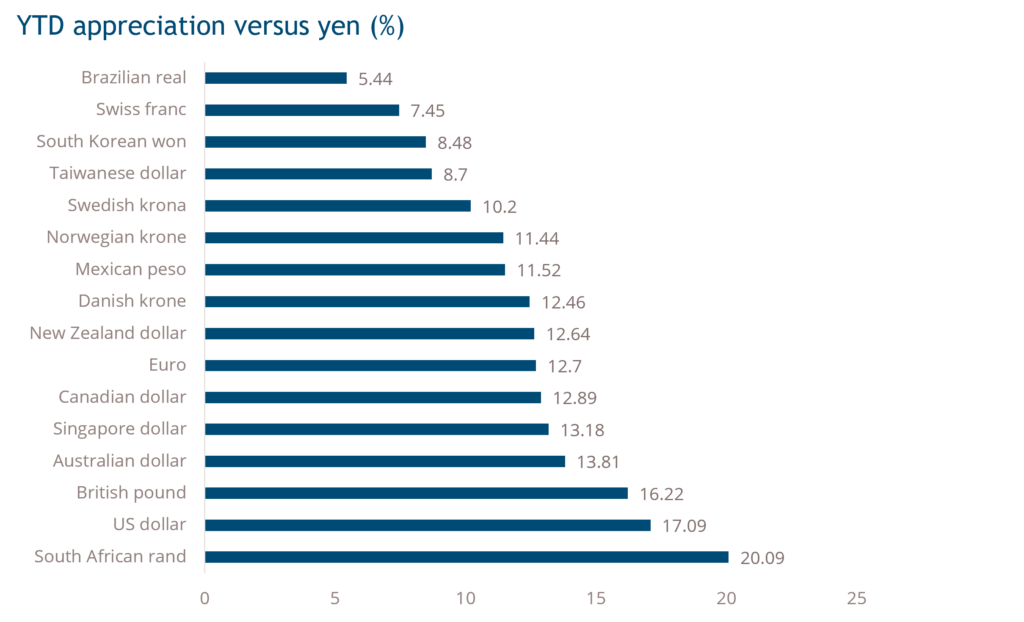

Meanwhile, in Japan, pressure on the yen returned, closing the week above the psychological 160 level against the US dollar, with finance minister Shunichi Suzuki again airing his displeasure at the ongoing weakness.7 If a currency is the clearest reflection of the health of an economy, what we are seeing with the yen could suggest problems for Japan. The yen is the weakest of all major currencies year-to-date (See Chart of the week).

Reflections on H1

As the first half of the year ends, what stands out from an investment perspective?

Most 10-year government bond yields moved higher, the notable exceptions being China and Switzerland, with both cutting policy rates during the period. Most government bond curves moved higher in lockstep, apart from the UK and Japan, whose curves bear steepened. French debt was the underperformer among G10 countries, perhaps a warning to other nations of the need to maintain fiscal discipline and political stability.

In credit, high yield outperformed investment grade, as the higher-for-longer interest rates and soft-landing narratives took hold.

The unloved emerging-markets sub asset class — at least in terms of investor flows — outperformed in both investment-grade and high-yield buckets. EM high yield finished the first half 3% ahead of its US counterpart, with returns broadly distributed by geography and sector. While Latin America was the largest contributor to the index for total returns, Asia took top spot for efficiency-per-unit invested.

Such a broad-based pattern is commonly observed once a peak in the default cycle has taken hold. The EM corporate universe is relatively clean, in our view, with weak companies defaulting and falling out of the index, leaving behind a stronger cohort. Bond prices for distressed credits remaining in the index could recover as investors realise the likelihood of default has been overpriced. This can occur as domestic conditions improve, through policy loosening, and a pick-up in growth and earnings, which we are seeing across emerging markets.

It was a different story for equities, with developed markets outperforming emerging markets, thanks mainly to the Magnificent Seven US technology stocks, which gained 38% in the first half. In Latin America, both Brazilian and Mexican equity markets fell more than 15% in US dollar terms. This may be a warning to incoming governments in both countries against pursuing socialist leaning agendas.

The US dollar appreciated versus most major currencies due to the Fed’s higher-for-longer stance, while commodities benefited from the soft-landing narrative, alongside supply constraints that boosted energy prices and saw metals such as copper, zinc and gold increase by over 10%.

With decent returns across everything from credit and equities to commodities, it may be surprising that assets held in money market funds (MMFs) remain elevated following record inflows in 2023. In fact, at the end of the first half, assets in US MMFs stood at US$6.1 trillion, marginally higher than where they were at the start the year.8

This leads us to the cliffhanger question: Could the unwinding of MMFs be the big story in the second half?

Chart of the Week: Japan imbalances reflected through its currency

Past performance is not a reliable indicator of current or future results.

References

[1] Bank of Canada, as of June 25, 2024

[2] Reserve Bank of Australia, as of June 26, 2024

[3] Ifo Institute, as of June 24, 2024

[4] United States Census Bureau, as of June 27, 2024,

[5] International Monetary Fund, as of June 27, 2024

[6] Congressional Budget Office, as of June 18, 2024

[7] Reuters, ‘Japan issues fresh warnings against sharp yen falls,’ as of June 27, 2024.

[8] Investment Company Institute, as of June 27, 2024

This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed by Muzinich & Co. are as of July 1, 2024, and may change without notice. All data figures are from Bloomberg, as of June 28, 2024, unless otherwise stated.