The challenging macro backdrop of 1H2022 has weighed heavily not only on beta performance in equities, credit and long duration fixed income, but also on the fundamental relative value strategies that underpin our multi-strategy approach.

Heading into August, we find ourselves tempted to turn the page on the challenging macro backdrop that has weighed heavily not only on beta performance in equities, credit and long duration fixed income, but also on the fundamental relative value strategies that underpin our multi-strategy approach.

This is not to say that the market has resolution on the host of macro concerns (inflation, monetary policy tightening, supply chain and commodity market disruptions, growth headwinds) that confront investors, but rather these risks –are fully known and largely discounted by market participants. In fact, from an alternatives perspective, we expect a pretty significant bifurcation to materialize between the first and second halves of 2022. Whereas 1H2022 was an excessively macro environment where macro, quant and systematic strategies drove returns, we expect 2H2022 to be characterized by more balanced risks, fewer trends, and less volatility in the macro space, where fundamental investors and corporates will begin again to proactively manage their portfolios, businesses, and capital structures, creating significant alpha opportunities for relative value strategies.

As we always highlight to investors, fundamental relative value strategies are durable in most market backdrops but can be susceptible to periods of risk aversion when the economic and policy environment is rapidly transitioning. The good news is that substantial alpha opportunities often emerge from these periods of risk aversion, and there is a growing sense of optimism across O’Connor that the second half of 2022 will present just that for our investors.

Interest rate volatility

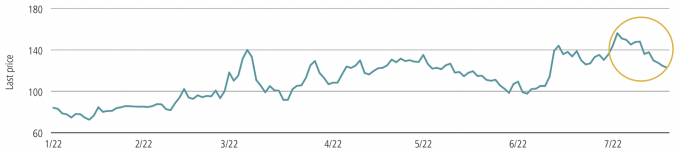

By now, investors are very familiar with the core O’Connor belief that interest rate volatility is the key indicator to monitor for risk aversion associated with rapid changes in the macro investment landscape. Reviewing this indicator in the first half of 2022, it is easy to see the building and persistent risk aversion that brought about challenging performance across most asset markets and relative value strategies.

However, a closer look at the same graph shows the early signs of normalization happening toward the end of June and into July. For those investors looking for a more tangible sign of this normalization, consider the CPI reports for June and July and the resulting move in 10-year yields. The June 10th CPI report of an 8.6% YOY increase led to an astonishing 50 bps move higher in yields over several days, while an even larger July 13th CPI report of a 9.1% YOY increase produced less than a 10 bps move in yields over several days.

The major takeaway for investors is simply that this normaliza¬tion of interest rate volatility is an indicator that the range of potential economic and policy outcomes is beginning to be discounted by the market. And while we would like to see rate volatility compress another 30% to 40% before we declare this regime shift completed, we do not believe a return to the prior low interest rate volatility range is necessary for a significantly better backdrop to exist for relative value strategies.

Investor positioning and psychology

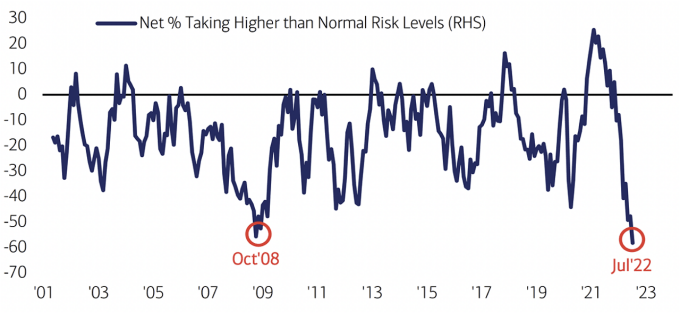

We strongly believe that the BofA Global Fund Manager Survey is required reading for investors looking to get the broadest possible assessment of institutional investor positioning and psychology, and the July survey was especially enlightening. No matter where we look in the survey, every¬thing ranging from growth optimism, to profit expectations, and even cash positioning in portfolios indicate extreme pessimism has become the baseline mindset for institutional investors.

In fact, the overall survey was so extreme that it was challenging for us to narrow it down to just one example to demonstrate investor positioning. Eventually though, we found ourselves returning to the graph that shows the percentage of investors taking higher than normal levels of risk as a record low of -58%. Said differently, 58% of investors are taking below average levels of risk: this is the highest percentage of investors carrying low levels of risk ever recorded in the survey, surpassing the levels seen during the depths of the GFC and the Lehman bankruptcy.

Strategies for the second half of 2022

While we are broadly optimistic about our strategies for the second half of 2022, two strategies that we are particularly excited about are convertibles/capital structure and merger arbitrage – both of which are central to the O’Connor investment DNA. We have seen many market cycles and de-risking events where these two strategies offered compel¬ling value and rarely are we more comfortable fading broader de-risking moves than in these two disciplines.

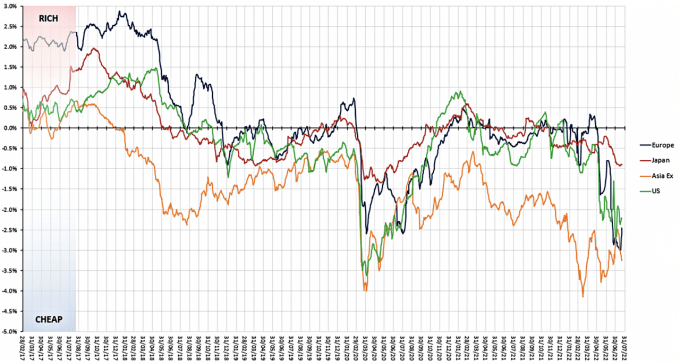

Convertibles valuations have fallen

Convertibles are one of the most complex products for investors to understand due to the embedded equity, credit, interest rate and derivative factors that drive fair values. To help us monitor fair values over time, we often refer to the Jefferies Fair Value Tracker for convertibles globally which provides a long-term and consistent framework to assess valuation. While the challenging broader risk environment explains some cheapening of convertibles, it is surprising and illogical to us that convertibles are in the same range of cheapness as they were in during the COVID pandemic in the spring of 2020.

Importantly, we think the convertible market is substantially cheaper than indicated by this Fair Value Tracker when we begin to factor in the benefit of low dollar prices that charac¬terize many bonds in the convertible market. These low dollar priced bonds are a function of the combined impact that lower stock prices, wider credit spreads and higher interest rates have had on the convertible market. And while many hedge funds shy away from the higher credit content of these bonds, we like this risk profile a great deal and view low dollar prices as providing substantial and asymmetric optionality on the underlying credits. Low dollar prices enable a lower jump to default risk, while providing the same credit duration exposure and a superior corporate action payoff profile relative to par bonds. As we think back on our collective experience trading credit products broadly and convertibles specifically, in our view we are uniform in recognizing this as one of the most compelling risk profiles ever available in financial markets.

“While we are broadly optimistic about our strategies for the second half of 2022, two strategies that we are particularly excited about are convertibles/capital structure and merger arbitrage.”

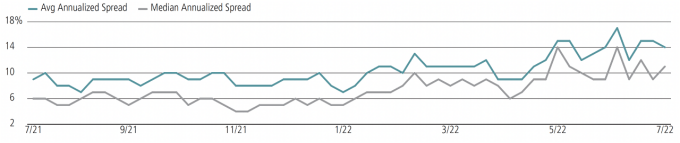

Merger arbitrage spreads are widening

With merger arbitrage being a foundational strategy for O’Connor, we recognize that the recent widening in spreads is following a familiar pattern. The deteriorating economic backdrop is pressuring equity market valuations and leading to some buyer’s remorse, coupled with more anxiety about credit extension due to higher yields and wider credit spreads. These factors push spreads even wider and then risk management procedures create technical selling which in turn further pressures spreads, completing the vicious cycle that we have weathered many times in the past.

Importantly, we do not believe that the current situation is anything other than a normal, albeit lengthy, de-risking cycle, and as such, we have been adding to risk on weakness throughout the second quarter. The fact of the matter is merger agreements contemplate all types of risks and are generally structured to ensure the deals close unless there is a specific, and material adverse change in the target company’s business.

We are confident that recent weakness presents a great opportunity to increase exposure and that a well-managed and diversified portfolio like ours will deliver a compelling risk/return profile over the balance of 2022. It is worth a reminder that we invest in merger arbitrage knowing that deals can break and that spreads can widen, and our portfolio construction and risk bucketing are specifically designed to weather this type of market.

The excessively macro environment thus far in 2022 has created challenges for our relative value strategies, and the tone of de-risking that has permeated equity, credit and debt markets has been an ongoing headwind. A reactionary move to the first half of 2022 would entail O’Connor trying to bring on several of the more macro and systematic strategies that seem to have delivered the bulk of returns in the alternative space thus far. However, O’Connor has quite consciously chosen our core long/short equity, credit relative value, and global event driven strategies, and we believe that, over time and over market cycles, the synergies, returns, and correlation profile that this strategy mix presents is a compelling solution for investor portfolios.

We have conviction in our strategies and our approach. Moreover, we think the market landscape has shifted substan¬tially in our favor and expect these fundamentally driven relative value strategies to outperform other disciplines and beta indices on a risk/return basis in the second half of 2022.

Before I sign off, I would like to share with you how proud I am of my time working with the O’Connor team over the past seven years. As we announced last week, I have decided to step down from my role as Head of O’Connor and CIO of the multi-strategy fund and will leave the firm towards the end of the year.

I pass the mantle to Blake Hiltabrand, who succeeds me as Head of UBS O’Connor, and Bernie Ahkong and Casey Talbot, who become co-CIOs of our flagship Global Multi-Strategy portfolio, effective October 1 2022. I will work closely with them and the O’Connor leadership team to ensure a seamless transition and continuity for our investors.

I am confident that I leave behind a strong global platform and tenured leadership team well-positioned and excited to execute on our proven strategy and drive the business forward. Thank you for your support and trust in us.