In our global investor survey on Asian fixed income, respondents highlighted corporate governance and liquidity as their key concerns for investing in Asian bond markets. While studies indicate that Asia’s corporate governance standards and bond market liquidity have improved over the years, we believe idiosyncrasies in each market still provide room for active managers to add alpha.

Eastspring Investments (Singapore)

2021 has been a challenging year for Asian bonds as the delta variant delayed the economic reopening in many Asian countries, resulting in patchy recoveries. Rising bond defaults in China also caused significant volatility in the Asian bond market.

This did not seem to temper the appetite of investors for Asian bonds. More than half of all respondents in a global survey that we conducted from July to September 2021 indicated that they were looking to increase their exposure in Asian bonds over the next 12 to 24 months.

In a world where the amount of negative-yielding bonds has risen since its low in March 2020, Asia’s higher bond yields remain compelling. 73% of all survey respondents agreed that Asian bonds offer higher risk-adjusted returns than their developed market peers.

Better governed

This is not to say that there are no challenges when investing in Asian bonds. 42% of all respondents in the survey highlighted corporate governance issues as their top concern when investing in Asian bond markets.

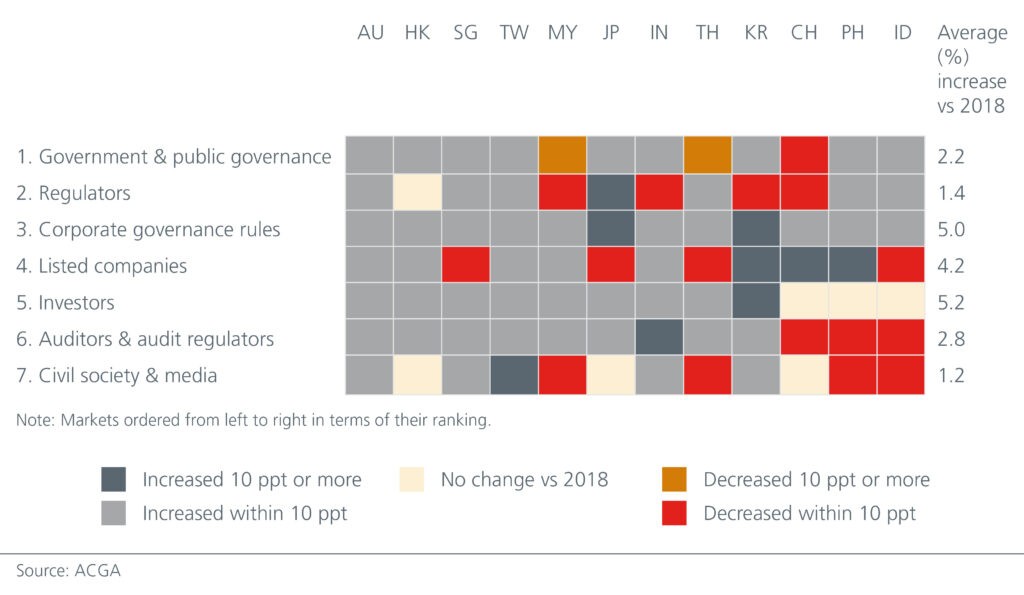

Despite the impression of limited progress, Asia’s corporate governance standards, according to CG Watch1 have largely strengthened since 2018. While government and public governance measures may have deteriorated in Thailand and Malaysia given the political challenges there, the following improvements have been observed in the rest of Asia:

- Better standards for sustainability reporting

- Updated corporate governance codes

- New or revised stewardship codes

- Tighter definitions for independent directors

- Stronger enforcement tools

- More sophisticated and transparent audit regulations

Fig. 1. Heat map of corporate governance metrics (2020 vs 2018)

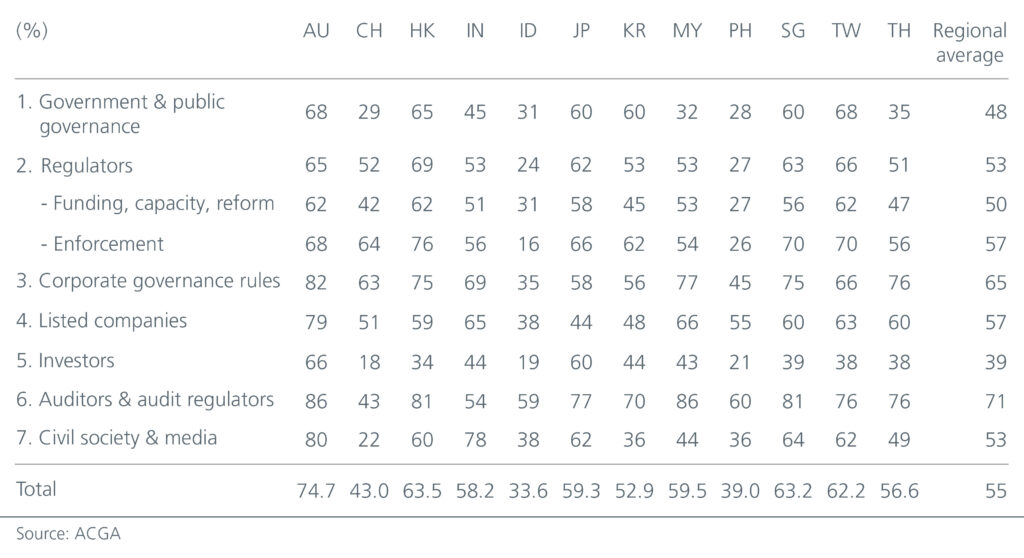

However, the wide range of scores for the different corporate governance metrics suggests that significant divergence exists between the top (Australia) and bottom ranked (Indonesia) markets, as well as within the region. See Fig. 2. Given the idiosyncrasies in each market, it is imperative for Asian bond investors to know their markets and credits well and to be dynamic in their analysis.

Fig. 2. Assessment of corporate governance metrics (2020)

Rising liquidity

In our global survey, liquidity came in second in the list of key concerns for Asian bond investors.

The Asian bond market has grown significantly over the years. The current market capitalisation of the Asian bond market (USD and local currency) stands at USD22 trillion, around 18% of the global bond market. Since 2006, Asia’s local currency and foreign currency bond markets have grown at a compound annual growth rate (CAGR) of 15% p.a. and 13% p.a. respectively2. That said, some markets within the region are less liquid than others.

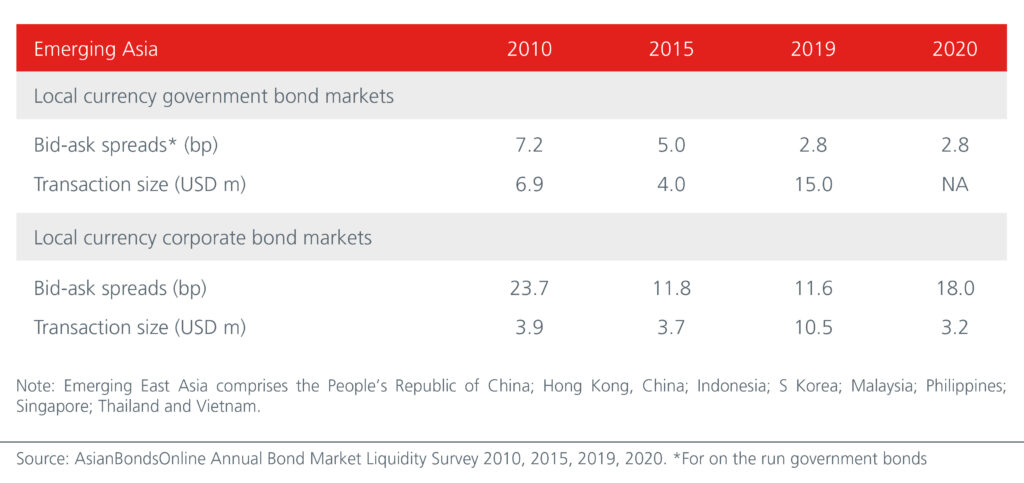

Bid-ask spread is one of the measures we can use to assess bond market liquidity. The average bid-ask spread for on-the-run local currency government bonds in Emerging Asia has fallen substantially from 7.2 bp in 2010 to 2.8 bp in 2019. See Figure 3. Even if we were to compare these figures against 2020’s average bid-ask spread (which would have been impacted by the COVID-19 pandemic), the region still shows significant improvement.

There is however a wide divergence amongst the individual markets. The more developed government bond markets, such as Korea and China, have bid-ask spreads of 0.4 bp and 1.1 bp respectively, while spreads for the Vietnam government bond market are wider at 5.5 bp3. The liquidity of China’s government bond market has improved following its inclusion in the Bloomberg Barclays Global Aggregate Index in April 2019.

Liquidity in the region’s local currency corporate bond market has also improved over the years, although bid-ask spreads are wider than in the government bond market. This is largely because pension funds, insurers and financial institutions tend to be the largest investors in the local currency corporate bond market and have long holding periods.

Fig. 3. shows that the average bid-ask spread in local currency corporate bond markets in the region fell from 23.7 bp in 2010 to 11.6 bp in 2019. Investment grade and government-related issues typically enjoy higher liquidity. Liquidity conditions differed significantly too across countries with Korea having the narrowest bid-ask spread at 1.2 bp and Vietnam having the largest (70 bp).

Fig. 3. Quantitative liquidity measures

Transaction size is another measure that investors use to gauge liquidity. Bigger transaction sizes reflect the presence of large investors, although the amount of issuance and monetary policies are also contributing factors. On average, the transaction size of local currency government and corporate bond markets in the region have increased over the years. In the local currency corporate bond market, China and Korea enjoy larger average transaction sizes of USD8.6 m and USD8.4 m respectively, while transaction sizes are smaller in Indonesia (USD0.8 m) and Philippines (USD0.3 m).

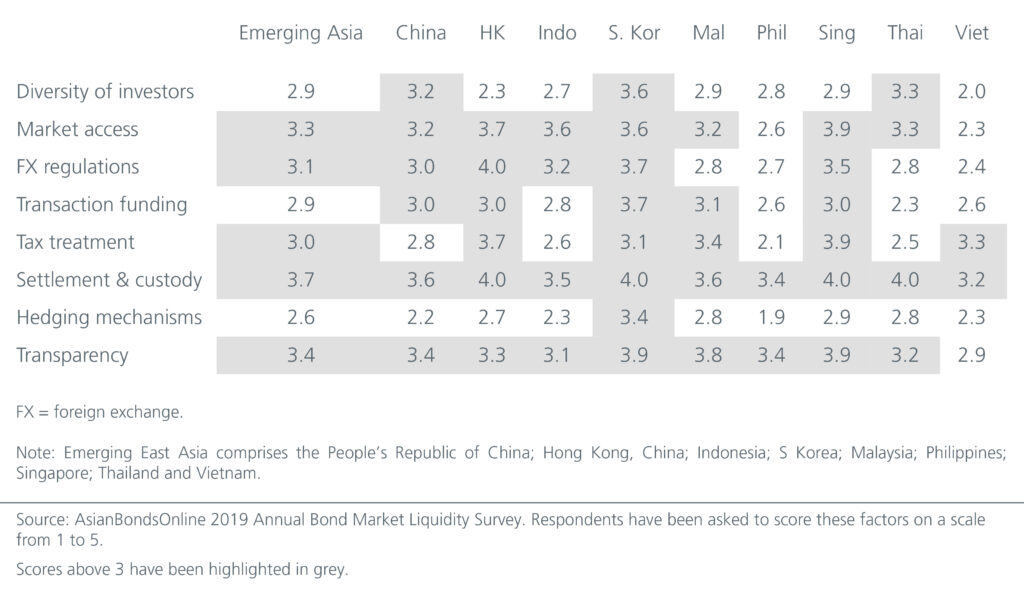

Qualitative factors can affect a bond market’s liquidity. According to the Annual Bond Market Liquidity Survey conducted by AsianBondsOnline, Emerging Asian local currency government bond markets score well in terms of settlement and custodial processes, but need to work at making more hedging options available for investors. Again, we see that each market has its own dynamics – Thailand for example scores better than Singapore in investor diversity but underperforms Vietnam when it comes to tax treatment. See Fig. 4.

Fig. 4. Assessment of structural factors in local currency government bond markets

Opportunities to add alpha

Asia’s corporate governance standards have improved over the years, and we expect the increased emphasis on Environment, Social and Governance (ESG) to effect more meaningful changes in corporate governance frameworks across the region. We also expect initiatives such as the Asian Bond Fund (ABF) project and Asian Bond Markets Initiative (ABMI) to help enhance Asian bond market liquidity going forward.

The diversity of Asian bond markets presents significant room for active managers to add alpha. Active and dynamic credit analysis is key in investing in such markets. When corporate governance failures occur, the loss in bond capital values often materialise long before the actual credit rating downgrade or default.

While Asia’s bond markets see different levels of liquidity, an active manager with scale can potentially improve trading efficiencies and enjoy stronger issuer engagement, which can add to returns. At times, size can also facilitate better primary deal allocation. In Asian markets and cultures, where human relationships are highly important, having local investment teams on the ground can go a long way.