Key takeaways

- Institutional investors are now turning to investment-grade corporate credit as a first step back into fixed income.

- Investing in high-grade corporate credit means investing in businesses that are better placed to weather any possibility of recession.

- We remain very optimistic about our investment-grade markets in both the European Area and the US as rate volatility abates.

After the “great repricing” of 2022 – the worst year on record for bonds – is corporate credit ready for takeoff?

Having shunned bonds for most of last year, institutional investors are now turning to investment-grade corporate credit as a first step back into fixed income after last year’s upheavals and as central banks seem to be nearing the finish line in terms of hikes. This should translate into lower rate volatility and increased credit spread stability.

Flows into investment-grade corporate bond funds totaled USD 19 billion between the start of the year and the third week of February, according to fund flow tracker EPFR.

Investing in high-grade corporate credit means investing in businesses that are better placed to weather any possibility of recession – although it should be noted that economic growth momentum has improved recently with much-reduced gas prices and the reopening of China since Christmas.

Furthermore, since the outbreak of the Covid-19 pandemic in 2020, corporates have been shoring up their balance sheets and are in much better shape as a result.

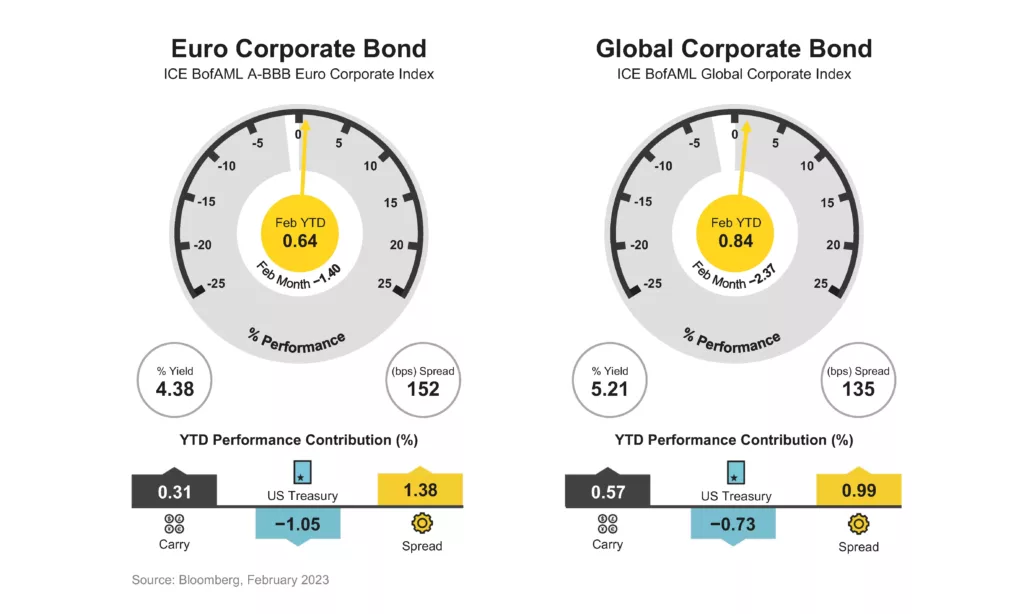

With the recession risk diminishing, credit spreads remain quite attractive, with the potential of narrowing further, about 20 basis points on average from current levels. The Euro Investment Grade index stands at 150 basis points, while the Global Investment Grade index shows a level of 135 basis points (as of the end of February 2023 and based on ICE Bank of America indices).

The figure below uses the analogy of an aircraft cockpit to show the three engines of bond returns for euro and global corporate bonds, based on the reference indices. Rates were not in our favor during February, but on a positive note, the year-to-date carry remains pretty decent. On the right, spread tightening was quite pronounced, helping the total returns remain positive.

Flows into European credit to carry on in 2023

The flows into European Area investment-grade bonds at the start of the year have continued to support the reversal of the negative tendencies that caused the market to unravel in 2022, and we expect these trends to carry on in the coming months.

Looking at the investment-grade market in the European Area in February, the good demand for corporate bonds has continued unabated and has kept driving spreads tighter, despite the rise in benchmark government yields. In our view, these yields are unlikely to march much higher as the higher interest rate policy typically has quite a long lag (i.e., two to three quarters) before it starts to negatively affect consumption patterns.

Consumer credit has slowed down substantially in the fourth quarter of 2022, according to the latest ECB lending survey, and should continue to slow down. This makes us believe the ECB is also not far from its finish line.

We believe the level of cash to be invested is underappreciated, given the regular inflows received and the higher number of opportunities discussed for potential segregated accounts. This is set to stay, given that, in aggregate, real money investor sentiment seems still depressed and investors are still not yet fully invested.

By the time the policy lag becomes more apparent, investors should put more of their cash to good use in European investment-grade corporate bonds, hence we still see a high potential for inflows. In February, our best performing senior issues were in real estate, utilities, cyclicals, and financials – just to highlight the attractiveness of our European Area market.

Demand for global high-grade bonds remains strong

Global investment-grade corporate bonds from developed markets had a phenomenal start to 2023 as investors poured record sums into high-grade corporate bonds.

We have been monitoring the flow momentum carefully and – so far – the trend remains strong. This is despite volatility in the past few weeks as market sentiment has cooled down over the prospects for an imminent US Federal Reserve pivot.

We believe investors are willing to increase risks in their asset allocation. The good news is that yield-seeking investors do not need to go to extremes to lock in decent yields. This might explain the solid demand for high-grade bonds.

The yield increase for corporate bonds in the last few weeks is not bad news. First, the entry level has become even more attractive, which might appeal to those who missed the early January rally. In addition, higher yields translate into a higher “carry” (i.e., running yield), which helps keep the income component high in fixed income investments.

Finding value in triple-B rated global credit

We believe credit investors can find great value and high all-in yield income with global investment-grade bonds.

Our favorite spot in investment-grade portfolios is the BBB segment. Here, investors tend to get an attractive risk premium while knowing that companies are usually keen to keep their rating stable to improving.

A downgrade from investment-grade to high-yield territory typically comes with a significant increase in refinancing costs. Corporates tend to avoid this risk whenever they can, and it is on us to make sure we are not running into a “fallen angel” credit situation. This is one of the risks that investors need to be aware of. However, we do not see huge M&A activities now, which are typically a major driver for rating downgrades.

Besides, higher rates and yields are not a major risk for high-grade companies now, as the so called “interest coverage” ratio – the ability to pay coupons on outstanding debt – is at an all-time high.

Still, there are other risks we need to keep a close eye on. For example, the US economy has improved, and consumer spending remains strong, which may spur the Fed to commit to keeping interest rates higher for longer.

In all, we remain very optimistic about our investment-grade markets in both the European Area and the US as rate volatility abates and the markets have already priced in high terminal interest rates.