What’s the point of risk models if they don’t reflect how humans behave? Leading economist John Kay and James Anderson, investment manager and partner at Baillie Gifford, discuss how changing attitudes to known unknowns could make us better investors.

Whether it’s in planning the invasion and occupation of Iraq or failing to anticipate global financial meltdown, policy makers have too often put complex but meaningless risk calculations before an understanding of what’s really going on. In their new book, Radical Uncertainty: Decision-making for an unknowable future, John Kay and former Bank of England governor Mervyn King explore how spurious calculations of probability help create false confidence and how we should avoid similar mistakes about our own financial futures.

In this interview, Professor Kay and James Anderson swap ideas on risk and uncertainty, and how they relate to asymmetric investment returns.

James Anderson: Radical Uncertainty starts out by saying that, just as the tax system 40 years ago needed revising from first principles, so economics does now. What reservations do you have about where economics has led us in the last 30 or 40 years?

John Kay: Major areas of economics have been predicated on the belief that all uncertainty can be characterised probabilistically. That’s been the mainstay of financial economics and macroeconomic theory over the last 30 or 40 years, a lot of it coming from the Chicago school of economics. Mervyn King and I think that belief is just wrong, and that much uncertainty cannot be characterised probabilistically. The subjective probabilities at the base of this kind of analysis simply don’t exist.

The betting shop I pass every day displays the odds on various horse races, and I’ve never even dreamt of thinking: ‘Gosh, these odds differ from my subjective probabilities, I’ll go in and place a bet’.

Most people, sensibly, just do not bet on most things. Once you’ve understood that, it’s an abuse of the concept of rationality to think that it requires that these ‘probabilities’ exist.

JA: Does this apply to investment? It seems the desire for quantification, and to say that you’ve ‘solved’ what risk is, is enforced by our financial system. Most of the industry says it can optimise for returns according to risk metrics, so you can choose your level of return and your level of risk. That thinking is both essential to the workings of investment banks and a critical opportunity for those of us who don’t think in those terms to generate investment returns.

JK: You are absolutely right to say that such thinking is both a mistake and an opportunity. What we mean by risk in Radical Uncertainty is what real people think of as risk. For most people risk is not uncertainty, risk is something bad, whereas uncertainty can be something good or something bad.

People think in stories, rather than numbers. In their business or in their personal finances they construct a reference narrative of how they expect things to play out, and risk is something that might derail that narrative.

If you think about risk that way, you realise it’s personal. What risk means for someone about to retire is very different from what it means for someone in their 20s. What risk means for a bank is very different from what it means for a retailer, and so on. And if risk means different things to different people, the idea that there’s some equilibrium in which there’s a single price for some objective thing called risk is just a mistake. In seeking a profitable strategy, it is important to understand how what you mean by risk differs from what other people mean.

So, it’s very important to think through your finances in an individual way in terms of what your own reference narrative and your own objectives are, and these will be different from those of most other people.

JA: One of the most intriguing facets of stock markets and corporates is that the upside skew is extraordinary. A very small number of companies can generate very high returns which is not captured by the models in financial economics.

JK: Exactly. Imposing statistical normality on distributions is part of the conventional approach to quantifying dispersion of returns.

JA: Are there any characteristics in the companies that subsequently appear to generate very high returns that are identifiable at the time of investment?

JK: It’s difficult. I’m not sure how far the work of people like Professor Hendrik Bessembinder, who has analysed the asymmetrical nature of returns, takes us in identifying common characteristics. We need to ask the question, and I think it’s a question that you have almost always been asking of these early-stage companies: ‘Can this company be a game-changer that generates stellar returns?’.

The classic archetype here is Tesla. None of us could have been sure that Tesla was going to change the world, but there was and is a narrative in which it does.

The economic development of the next two or three decades will not be about information technology as such, but the application of IT in other areas. Healthcare and autonomous vehicles are early examples, and there will be a lot more that we haven’t yet thought about.

Smart electricity grids are also interesting, because if people were to get serious about climate change, rather than just making emotional statements about it, it will be new technologies for transmission and storage of power that are going to make the difference.

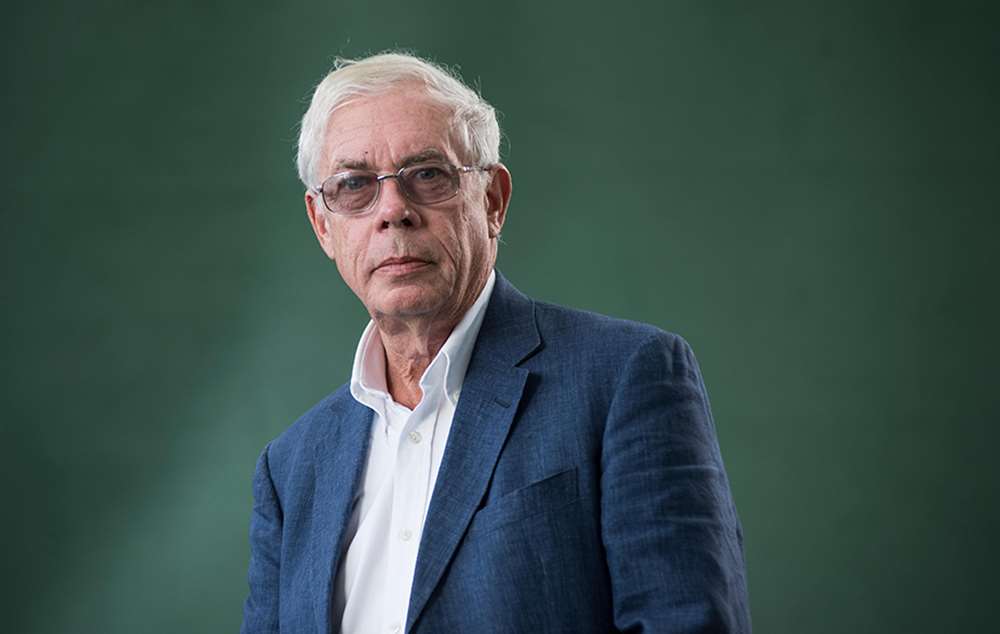

© GL Portrait/Alamy Stock Photo. British economist John Kay, CBE, FRSE, FBA.

JA: There are certain technologies that you can have a degree of confidence in, whether they be in those surrounding the rise of renewable energy or Moore’s law [which states that the number of transistors on circuits doubles every two years]. Something that puzzles me is that those seem like very high-likelihood outcomes, yet the stock market appears to underestimate them in their early years. Is the stock market structurally unable to grasp these possibilities?

JK: Conventional success on the stock market means not really understanding what’s going to happen but understanding what other people think is going to happen three months from now. It’s John Maynard Keynes’s famous metaphor of the beauty contest: you’re not judging who you think is the most beautiful but guessing who others will think is the most beautiful, and who other people think other people will think is the most beautiful.

JA: Is that how our task has become defined?

JK: Yes, it’s why the long-run investor is going to do better by standing away from this noise and accepting that you’re going to have lots of quarters of underperformance. It’s about understanding risk in this different way, by reference narrative rather than volatility.

JA: You’ve alluded to the characteristics a company needs for success in the future, emphasising the competitive advantage in providing broader systemic benefit. How is this changing, and what do we need to be aware of in thinking about investment for the next 20 years?

JK: Gosh, that’s a wide question. People talk endlessly about intangible assets, which seems to me mostly unhelpful. There are intangible assets like software and brands, but Apple’s value is not its software, which is not particularly remarkable, and it’s not its brand either. If I were to buy the Apple brand but not the capabilities, design and innovation that make Apple the company it is, I wouldn’t have much. We need to look at companies by reference to dynamic capabilities.

JA: Thank you John. You’ve left me with many more questions, but that’s what investing is: continually moving on to the next set of questions.