Fiorino tracks the AI journey from sci-fi to hi-fi(nance) and where the faux-human tech may take the real financial industry next…

Artificial intelligence (AI) is so hot right now.

Once derided as science-fiction fantasy fodder, AI has now entered the popular narrative as a real technology capable of feats ranging from auto-ordering milk to ending human civilisation.

And while AI is probably (hopefully) some way from reaching the feared ‘singularity’ when machine-consciousness decides humanity is surplus to the universe, it is already proving multiple use cases in the financial industry.

How banks, insurers and other finance firms implement AI (along with the related field of machine-learning, or ML) in their businesses has important implications for investors as we assess their profitability and long-term sustainability.

Before we get there, however, it’s worth reviewing how we got here.

Communication breakdown: from hot talk to cool tech

Scientists have been seriously investigating AI and ML for decades (see breakout box) but the real practical breakthroughs came only when computer-processing power and data storage reached critical mass this century. (Although, the victory of the ‘Deep Blue’ computer over world chess champion, Gary Kasparov, in 1997 marked a key public milestone for AI).

But the fundamental roots of AI, and IT in general, can be traced back to the work of engineer-cum-mathematician, Claude Shannon. Working at the famous Bell Labs in 1948, Shannon produced the seminal paper, ‘A Mathematical Theory of Communication’, that extended the concept of thermodynamics to everyday human activities1.

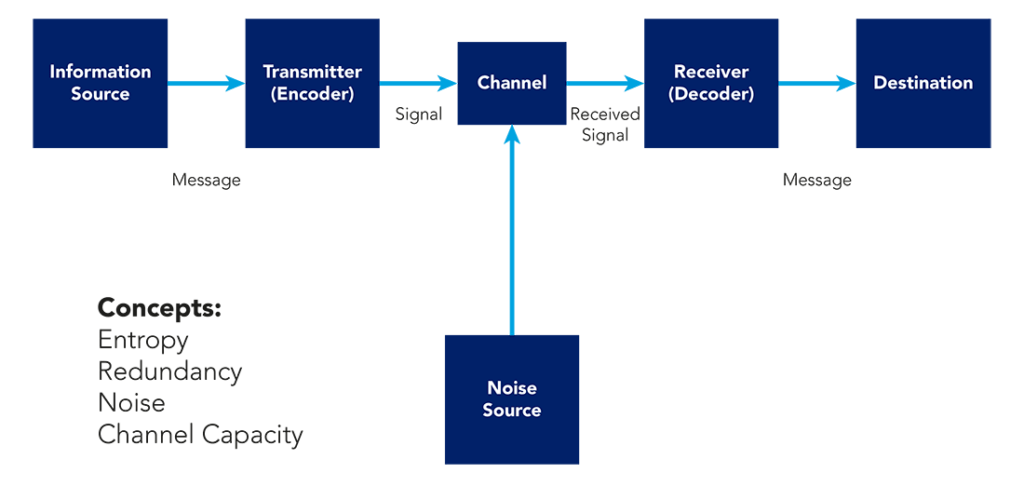

Shannon’s genius was in breaking down the flow of generalised ‘information’ into an objective, clearly defined process that enabled, in theory anyway at the time, us to convert almost any communication – even a painting, a poem, a symphony – into a programmable format.

His system boiled down to a simple flow diagram (as below) showing the transmission of information from source to target, separating the signal from the noise.

Figure 1: General Communication System

Effectively, Shannon considered any information system (say, written English) in the same way that Ludwig Boltzmann idealised the behaviour of gas. As discussed in a previous Fiorino, Boltzmann’s thermodynamic gas musings led to his broader definition of entropy.

(Math enthusiasts will note the neat equivalence between the Boltzmann equation for entropy – S=-kb i ln pi – and the Shannon equation for calculating the size of any given information system, H=-i pi logb pi.)

From Shannon’s model of a world composed of information and interpretation, scientists and engineers have built the hardware and software of functional AI systems that are now in turn feeding on the millions of data points across many types of human activity emerging from the internet.

Artificial Intelligence (AI) focuses on computer systems able to perform tasks that would otherwise required human intelligence. Whether narrow or general, AI has been a subject of scientific research since the 1950s.

Machine Learning (ML) is a field of studies aiming to allow computers to learn and improve at a task from data, without being programmed for it. Venture capital has flown into ML companies at a rate of $5bn to $10bn per year2.

Front-to-back connections open more efficient industry channels

According to some estimates, the world already holds some 20 billion smart computing devices, outnumbering the 7.5 billion human population by almost three to one3. At the same time, the cloud storage and data processing technology that underpins the smart device functionality is now a $100bn market4.

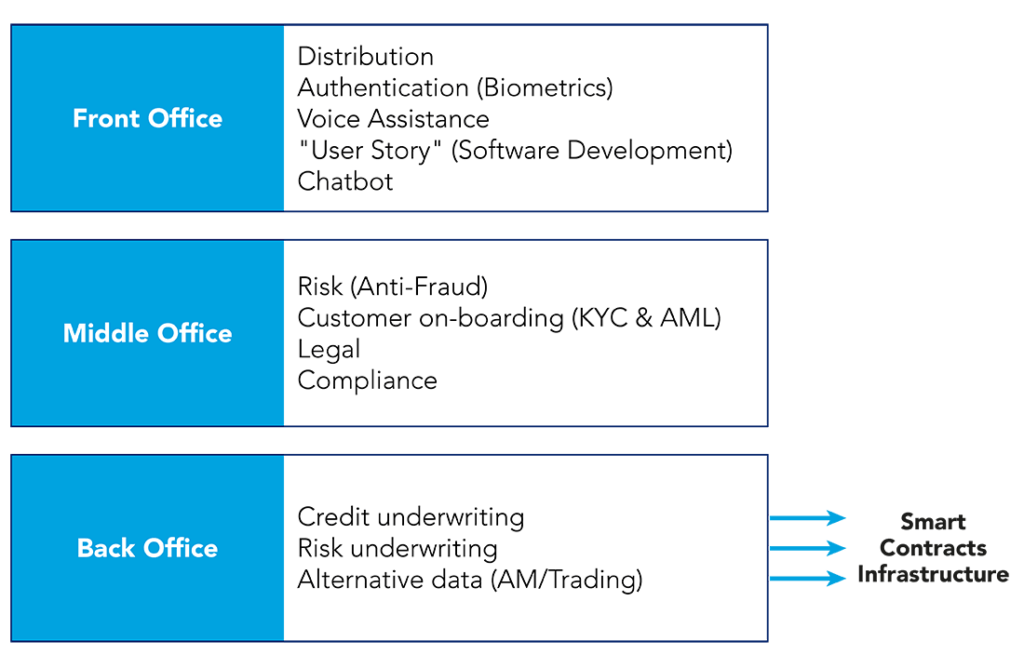

For the financial industry the AI-ML applications tend to fall in three main buckets covering the traditional front-, middle- and back-office services, as below.

Figure 2: AI Applications

Most financial services consumers have almost certainly already interacted with AI via the ubiquitous ‘chatbots’ answering phones and online questions. The customer-facing front-office AI tools have proven effective in integrating financial data and account actions with ersatz human software agents capable of holding simple conversations with clients and support staff.

Rather than a Terminator-style digital overlord nightmare, humans and machines appear to be collaborating without too much friction to solve mundane administrative issues. Banks and other institutions, too, have tapped into AI resources to fast-track payments (or even more complex financial transactions such as mortgages) authenticated by thumbprint or facial recognition captured on a smart phone – leading to huge potential efficiency gains in a paperless, industrialised process.

AI also offers hope in clearing middle-office regulatory quagmires by introducing real-time intelligent oversight, risk-management and know-your-client systems. Again, financial institutions stand to reap enormous efficiencies by introducing appropriate smart technology across all these complex behind-the-scenes processes.

Meanwhile in the back-office, product manufacturers are turning to AI to assess factors including:

- credit risk – adding new types of data such as social media, free-text fields (scanned documents, for example) to gain a more complete picture of consumer credit-worthiness;

- insurance underwriting – to access medical records or telemetric driving data, for example;

- claims management – where technology like machine vision utilises CCTV footage to assess damage (such as a broken windshield, for instance) for insurance claims; and,

- investment selection – alternative data sets are now commonly combined with human expertise to enhance the investing process.

Mixed messages as machines speak to money

AI, of course, is both an opportunity and a threat to incumbent financial institutions. As described above, the technology can introduce material cost-savings for existing providers but also open the door for more nimble, AI-savvy start-ups to grab market share.

The rapidly escalating AI revolution might have more fundamental longer-term impacts on the financial sector, too.

For example, insurers can gain useful insights into policyholder behaviours through the growing network of web-connected devices – also known as the internet-of-things (IoT). Real-life consumer data may enable insurers to more precisely price policies with possible spin-off benefits for broader society including fewer accidents or a healthier, longer-lived population.

On the flip-side, AI-driven behavourial changes could reduce demand for traditional risk cover, eroding the profits of insurers over time.

Investors will need to closely track how AI plays out in the financial sector to understand the emerging dynamics (perhaps, AI itself may help here). Nonetheless, we should not let the bright light of new technology blind us to the fundamental truths of finance.

As the progress from Boltzmann to Shannon to the AI reality shows, scientific knowledge is culmulative; in finance, however, knowledge tends to be cyclical – people come and go, forgetting the lessons of the past.

Thermodynamics and communication theory might have something to teach finance yet: eventually, every hot thing cools down to the average prevaling temperature; but in the meantime it pays to separate the signal from the noise.

Intellect with interest

“Physicists like to think that all you have to do is say, these are the conditions, now what happens next?” |

Richard Feynman (1918-1988), Nobel laureate. |

Risk profile

- The views and opinions contained herein are those of the author and may not necessarily represent views expressed or reflected in other communications. This does not constitute a solicitation or offer to any person to buy or sell any related securities or financial instruments.

- 1https://people.math.harvard.edu/~ctm/home/text/others/shannon/entropy/entropy.pdf

- 2PitchBook 2021 Annual Artificial Intelligence & Machine Learning Report

- 3State of IoT 2021: Number of connected IoT devices growing 9% to 12.3 B (iot-analytics.com)

- 4Gartner Forecasts Worldwide Public Cloud End-User Spending to Grow 23% in 2021