Key Takeaways

- Due to higher rates and other pressures, US banks are reducing loans to small and medium-sized businesses, causing concerns over their access to capital.

- Private lenders can potentially fill the lending gap, offering tailored solutions to growing businesses.

- In our view, the US lower-middle market offers a diverse range of opportunities due to its size, activity level and comparatively high debt premium.

- Contrary to assumptions, smaller companies are not necessarily riskier. In assessing their creditworthiness, investors should look at a variety of metrics, including leverage, liquidity and return on assets.

With higher rates and other pressures seeing US banks scaling back loans to small and medium-sized businesses, Michael Smith explains how private players can help fill the gap.

Small and medium-sized businesses are the life blood of the US economy, accounting for over 43% of GDP and more than 46% of private sector employees. On a net basis, they are also responsible for almost two thirds of new jobs.1

However, according to a recent Goldman Sachs survey of c.1500 small business owners in 48 US states, while 75% are optimistic about their financial prospects in 2024, 77% are concerned about their access to capital. Over half say they cannot afford to take out a loan given the current level of interest rates.2

That tallies with the latest Federal Reserve Senior Loan Officer Opinion Survey, which revealed banks are continuing to tighten lending standards for smaller firms as higher rates and stress in the commercial real estate market hit loan activity.3

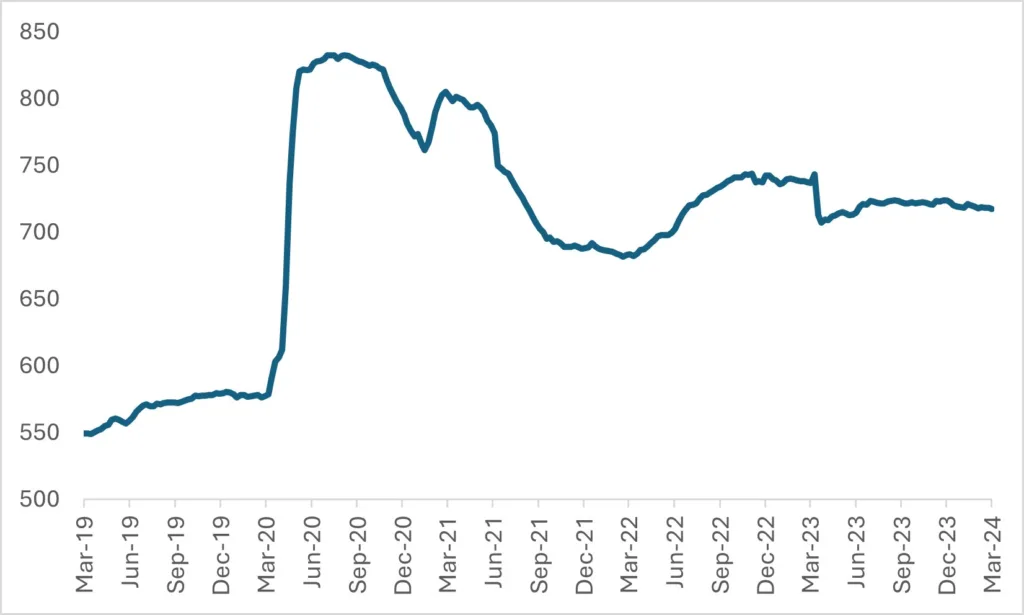

Figure 1: Decline in US small bank commercial loans (US$ billions)

But while some banks are contracting, we see significant opportunities for private lenders to step in and provide growing businesses with tailored financing solutions.

Why we focus on the US lower-middle market

The US private credit market has roots dating back to the 1950s and is an entrenched part of the lending universe. The size and breadth of the US economy and its robust ecosystem for mid-sized companies has helped establish a large and diverse opportunity set.

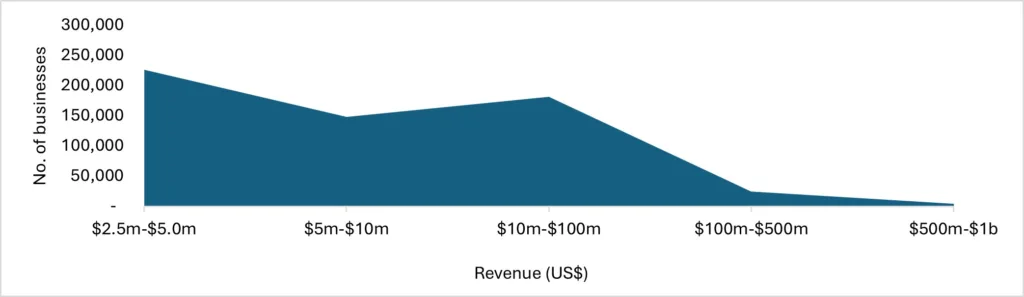

There are around 180,000 companies in the US lower-middle market – businesses with revenues of between US$10 million and US$100 million4 – many of whom have historically sought financing from local or regional banks. With small banks holding around US$720 billion in corporate loan assets,5 the lower-middle market is a meaningful component of the US economy and bank capital.

Figure 2: Number of US businesses by revenue

It is also the most active market segment, accounting for almost 2,800 M&A transactions annually on average and over 70% of total transactions between 2013 and Q3 2023.6 Despite this, purchase price multiples in the lower-middle market are approximately 2 times lower than larger businesses,7 allowing for less leverage, but with comparatively higher debt pricing, with around a 2%+ premium.8

Why bigger is not always better

Smaller does not necessarily mean riskier. According to a Moody’s study in 2021, it noted “the availability of rich data and modern statistical models enable investors to rethink traditional best practices of avoiding lending to smaller companies”.9

While Moody’s said size is a factor in credit risk assessments, especially for larger firms, other factors often play a more decisive role, including EBITDA/interest expense ratios, leverage, liquidity, sales growth, total debt/total assets and return on assets. “Strong financials, even for smaller companies, can lead to investment-grade credit quality. Company size affects credit risk, but the overall impact of financial strength is much more important,” concluded the authors.

These findings match our experience. The lower-middle market covers a wide variety of companies. In our view, private lenders can therefore be highly selective and still potentially generate attractive risk-adjusted returns: you do not need to chase yield with low-quality credits. The key is disciplined origination and rigorous credit analysis.

Keep it in the family

Many companies in the lower-middle market are family and founder-owned businesses where the key stakeholders have a deep-rooted interest in ensuring the company is a success. They are often businesses with solid balance sheets seeking funding for expansion or acquisition opportunities, not because they are distressed. We believe alternative lenders are well placed to provide flexible financing solutions to support these ‘buy and build’ and organic growth strategies.

We look to invest capital at low leverage in strong businesses with durable value propositions – companies that can potentially benefit from long-term secular trends unlikely to be impacted by an economic downturn. This currently includes companies in IT and business services, government contractors, and contract food and beverage manufacturing. We also like companies in certain pockets of the consumer discretionary sector that can withstand fluctuations in economic cycles.

Regional bank failures in the US and the ‘risk-off’ mode of some financial institutions have exacerbated the capital scarcity for lower-middle market companies. This, combined with the continued need for growth capital, could create a ‘capital vacuum’. At the same time, these conditions could set the stage for an unprecedented period in private credit.

References

1.U.S. Small Business Administration, as of March 30, 2023. Most recent data available used.

2.Goldman Sachs, ‘Glass Half Full’, January 31, 2024

3.Federal Reserve, ‘Senior Loan Officer Opinion Survey, January 31, 2024

4.NAICS Association as of March 30, 2023.

5.Federal Reserve Data Assets and Liabilities of Commercial Banks in the United States – H.8 as of March 2024

6.Baird’s perspective on the Global M&A Environment – Global M&A Quarterly as of October 2023. Most recent data available used.

7.Baird’s perspective on the Global M&A Environment – Global M&A Quarterly as of October 2023. Most recent data available used.

8.SPP’s Middle Market Leverage Cash Flow Market at A Glance – February 28, 2024

9.Moody’s Analytics, ‘Middle Market Lending Does Not Always Mean High Risk’, December 2021

Material Risk: This material is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed by Muzinich & Co are as of and may change without notice.