Franklin Equity Group’s Jonathan Curtis suggests that the digital transformation seen during the pandemic for a subset of companies and themes will broaden and extend as the world re-opens.

Recent interactions with investors and clients convince us that the market is attempting to gauge the durability of sector growth in this increasingly post-crisis world. Discussions with sector participants and technology buyers give us confidence that our thesis is on track. Specifically, we believe that COVID-19 accelerated the Digital Transformation (DT) opportunity, and that growth will be robust for the businesses we own for many years as businesses and their customers seek to build upon the new digital skills they acquired during the crisis.

Information technology (IT) sector companies have traded at a premium to broad equity indexes over the past 30 years and remained above that average in November 2021. We continue to believe that a premium is warranted given the strong and secular growth in the sector, the acceleration of DT and the improving quality in the sector—e.g., a growing number of companies with data moats, platform business models, growing recurring revenue sources, strong balance sheets and strong overall EBITDA (earnings before interest, taxation, depreciation and amortization) margins. Given this dynamic, we have been more careful about adding to names trading at or above our analysts’ base case scenarios.

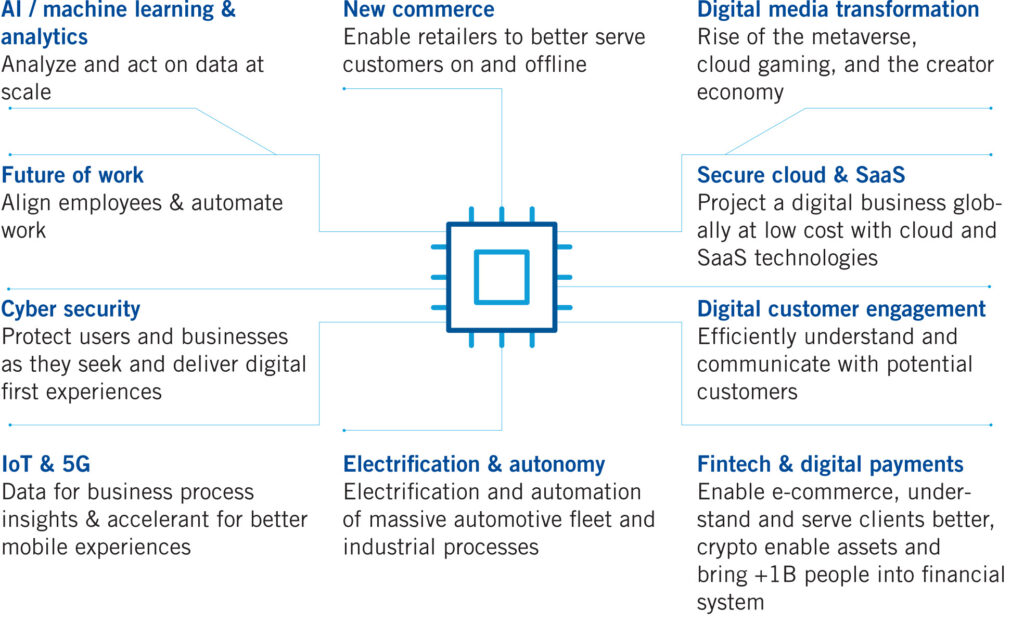

Despite the recent volatility tied to re-opening, rising interest rates, increased inflation expectations and a quickly changing regulatory landscape in China, we believe the sector offers solid exposure to strong secular opportunities relating to DT and its supporting sub-themes, as shown in Exhibit 1.

For illustrative purposes only.

The IT sector has outperformed the broader market in 2021, along with communication services (to a lesser extent). The general resilience of these sectors, we believe, has been driven by investors appreciating that technology was the antidote to many of the operational challenges that the pandemic created. Specifically, the pandemic helped to accelerate investment in “work from home,” cyber security, workflow automation and coordination, remote healthcare, and omni-channel commerce technologies. That said, we do not believe that investors fully appreciate what is coming next as the extended pandemic taught businesses, employees, customers, patients and students that they could be more productive and have more balanced lives using the new digital skills they built during the crisis.

Aside from valuations, risks we are monitoring include the pandemic, regulation, supply chain constraints (semiconductors, electronics manufacturing, and logistics in particular) and the implications of a growing talent crunch across IT and communication services industries. In particular, we are paying close attention to the US and EU investigations into the business practices of key digital leaders including Alphabet, Amazon, Facebook (now called Meta Platforms) and Apple. Finally, tech sales and engineering employment capacity are getting tight; as talent becomes increasingly harder to find, it may lead to more companies embracing low-code and software engineer productivity tools, product-led growth, and digital selling techniques, many of which were heavily embraced during COVID-19.

Given the dynamics mentioned above, we do not anticipate that the world will return to the pre-pandemic norms. Instead, we expect businesses to operationalize and scale what worked during the crisis, abandon what did not, and continue to iterate. We expect consumers to continue to embrace new commerce tools and to increasingly prefer digitally augmented experiences. Simply put, we believe that the crisis was the beginning of our society’s digital transformation—not the beginning, middle and end of it. If this proves true, we believe the fundamental growth we saw during the crisis for a subset of companies and themes will broaden and extend as the world re-opens. Our discussions with many of the companies we follow indicate to us that this is exactly what is happening.

WHAT ARE THE RISKS?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Investments in fast-growing industries like the technology sector (which historically has been volatile) could result in increased price fluctuation, especially over the short term, due to the rapid pace of product change and development and changes in government regulation of companies emphasizing scientific or technological advancement or regulatory approval for new drugs and medical instruments. China may be subject to considerable degrees of economic, political and social instability. Investments in securities of Chinese issuers involve risks that are specific to China, including certain legal, regulatory, political and economic risks.

Any companies and/or case studies referenced herein are used solely for illustrative purposes; any investment may or may not be currently held by any portfolio advised by Franklin Templeton. The information provided is not a recommendation or individual investment advice for any particular security, strategy, or investment product and is not an indication of the trading intent of any Franklin Templeton managed portfolio.