Asset-backed securities exposed to secular growth and pandemic recovery trends and those featuring floating interest rates provide compelling opportunities in rising rate/high inflation environments.

Key Takeaways

- Select securities backed by commercial and consumer collateral offer fixed-income exposure to broad growth and pandemic recovery themes.

- With relatively high yields and short durations, structured credits are more immune to rising rates versus other bonds and may enhance multisector income strategies.

- The securities feature customized structures, enabling active managers to select the yield and risk profiles most appropriate for their goals.

- Unlike other bonds, asset-backed securities related to data infrastructure and aircraft are not directly exposed to the Fed’s planned balance sheet reduction.

Investing in bonds when rates are rising, the Fed is tightening and inflation is surging can be tricky. This complex backdrop typically triggers price volatility that may overwhelm coupon income, particularly among government and investment-grade corporate bonds.

We believe this climate highlights the advantages of investing in a mix of fixed-income securities. Pursuing a multisector income approach means investors have exposure to complementary sectors and securities that respond differently to the prevailing economic backdrop.

In this climate, securities exposed to secular growth and pandemic recovery trends and those featuring floating interest rates may offer performance advantages. Certain structured credit securities provide direct and efficient exposure to these themes and represent important components of a multisector income strategy.

Additionally, these bonds offer the potential to outperform passive corporate strategies and broad fixed-income indices that remain highly exposed to cyclical industries and Fed policy.

A Diverse Bond Market Sector

The structured credit sector is a large and varied segment of the U.S. bond market, delivering to investors potential diversification and performance benefits. Structured credit securities finance a broad range of income-producing commercial and consumer collateral types, including:

- Data centers.

- Cell towers.

- Aircraft.

- Maritime containers.

- Floating-rate corporate loans.

- Commercial mortgages.

- Residential and consumer credit.

Potential Yield and Structural Advantages

Structured credit securities typically offer higher yields and shorter duration than comparably rated corporate bonds. These features may be particularly desirable during periods of rising interest rates.

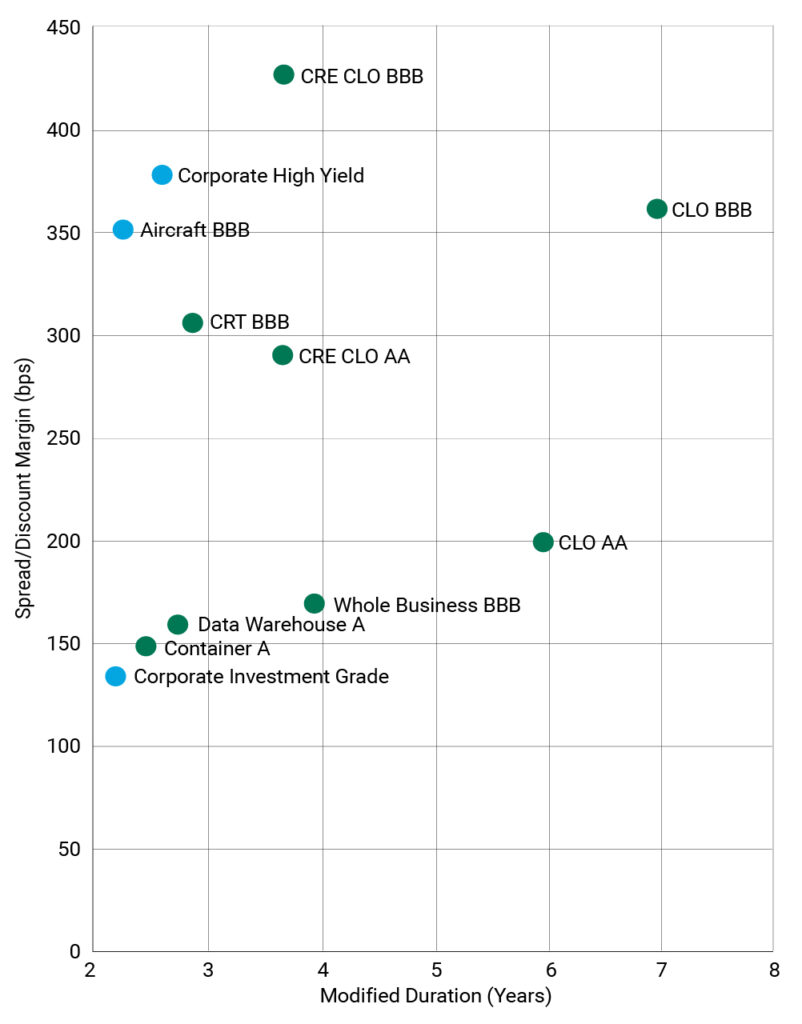

Figure 1 shows the modified duration and spread or discount margin for structured credit securities with AA, A and BBB credit ratings. It includes similar information for investment-grade and high-yield corporate bonds. Recent results point to the yield advantage (measured by spread or discount margin) of most structured credit securities versus investment-grade corporates of similar modified duration.

The chart also shows that several investment-grade structured credit securities offered similar spreads or discount margins as high-yield corporates.

Figure 1 | Structured Credit Offered Yield Advantages Compared with Corporate Bonds

Spreads vs. Modified Duration

Additionally, structured credit securities regularly feature investor-friendly structures. These include amortization, which reduces refinance risk, and performance-based tests that protect certain investors against deteriorating collateral.

But there are trade-offs, and investors need to be mindful of the risks. For example, some market segments are small and less liquid than their government and corporate peers. Additionally, credit risk varies depending on the underlying loans.

Quality Considerations

Structured credit offers a wide range of customized investment profiles to meet an investor’s specific yield objectives and risk tolerance. Structured credit transactions provide a loan for the acquisition of a portfolio of assets. The issuer divides that loan into multiple pieces, or tranches, with varying degrees of seniority.

Investors can select the tranche that meets their specific investment objectives. For example, the senior-most tranche is the safest (relative to other tranches) but also the lowest-yielding. Junior tranches are higher-yielding but contain greater risk of loss.

Other characteristics include:

- Senior tranches enjoy payback priority compared with junior tranches.

- First-lien debtholders are paid back before all others, including other senior debt holders.

- Senior tranches enjoy low loan-to-value metrics, creating significant cushion against loss.

- Junior tranches provide credit support to senior tranches by first absorbing any potential defaults and losses.

Investors with greater risk tolerance may also seek to enhance income by purchasing subordinated securities. Subordinated securities benefit from the same collateral credit but bear higher risk of loss due to their junior payment priority and higher loan-to-value.

Exclusive Opportunities for Active Investors

Opportunities available in structured credit are generally reserved for active investors. Most structured credit sectors are not represented in the Bloomberg U.S. Aggregate Bond Index, which primarily consists of U.S. government and investment-grade corporate securities.

By tracking the broad market index, passive investors may miss out on the $3.2 trillion structured credit sector. For active investors, the sector offers access to:

- Historically strong credit performance.

- Higher yields than comparably rated corporate securities.

- Available floating-rate alternatives to battle a rising interest rate environment.

By selecting senior, investment-grade structured credit supported by strong collateral types, investors may increase their portfolio yield without adding additional credit or interest rate risk.

Structured Credit Offers Potential Benefits in Today’s Rate Environment

Many investors may prefer floating-rate securities in rising-rate periods. Unlike traditional corporate credit, structured credit typically offers investors a variety of scalable floating-rate options at attractive yields.

Collateralized loan obligations (CLOs), commercial real estate securities and residential mortgage-related securities offer floating-rate alternatives. Investors can select suitable profiles for different risk tolerances and yield requirements.

For example, risk-averse investors may prefer AAA-rated profiles with modest yields. Risk-tolerant investors may choose high-yield profiles offering greater return potential.

Leveraging Today’s Growth and Recovery Trends for Fixed-Income Investors

In today’s post-lockdown economy, we favor securities leveraged to key growth and pandemic recovery themes. For example, we believe upbeat trends in the data storage and transmission and global air travel industries aren’t reserved for stock investors. Asset-backed securities (ABS) enable fixed-income investors to participate in these trends, too.

Data Demand Continues to Explode

In our view, data infrastructure represents a significant long-term growth opportunity—for stock and bond investors. Demand for data aggregation, storage and transmission has increased significantly in recent years, particularly in the pandemic’s wake.

And demand is likely to increase further with the growth of 5G networks, automated vehicles, Web 3.0 and other initiatives. Consider these industry projections:

- Analysts expect enterprise data storage to grow at a 52% compound annual growth rate.1 The prioritization of data capture for performance analytics, sales and marketing and business process improvement functions is fueling this growth.

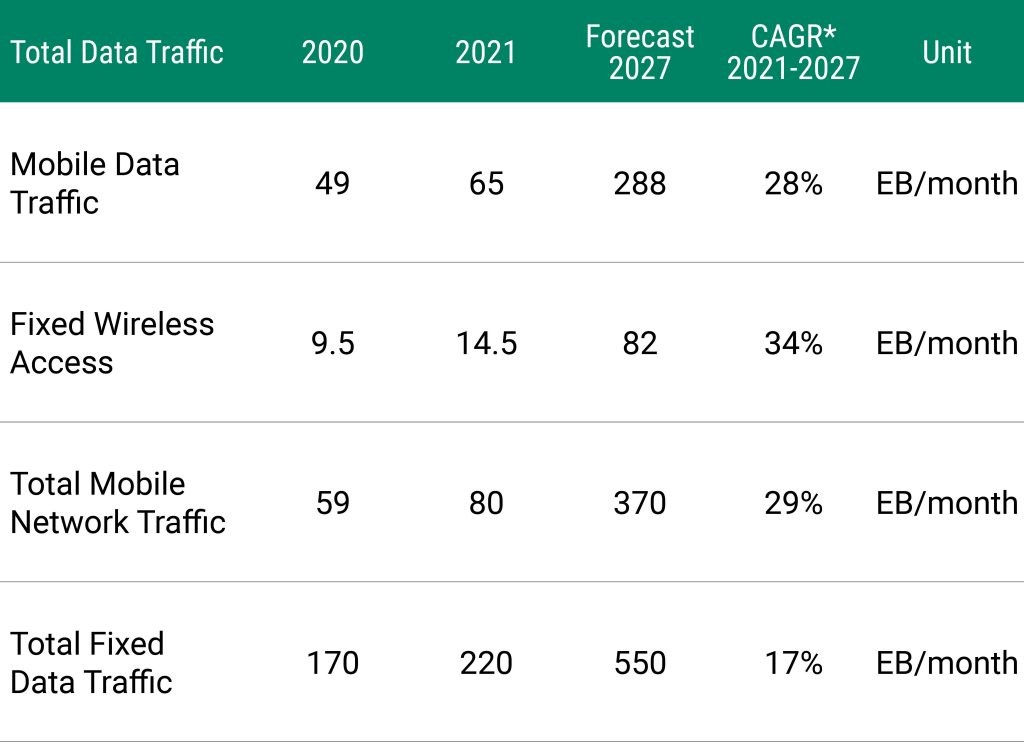

- Mobile data networks carry almost 300 times more mobile data traffic than they carried in 2011.2 Additionally, analysts project a 28% compound annual growth rate for mobile data traffic from 2021 through 2027. See Figure 2.

Industry experts project hyperscale cloud services3 to reach approximately $567 billion in value by 2026, with a five-year compound annual growth rate of 36%.4

Figure 2 | Total Data Traffic Set to Soar

Total Data Traffic in Exabytes per Month

Opportunities Among Data Infrastructure ABS

Data infrastructure ABS, including cell tower and data center ABS, give bond investors a stake in the industry’s positive demand trends. These securities finance diverse portfolios of fully constructed and operational cell towers and data center facilities with low leverage. This feature may make the securities lower risk even in distressed scenarios.

We believe several characteristics of data infrastructure ABS underscore their potential benefits for investors:

- In-place, contractual cash flows are sufficient to cover the related ABS debt at an investment-grade level of certainty.

- Data center revenue growth and occupancy rates have steadily risen over the last decade. Additionally, tenant retention is typically very high.

- In most cases, experienced operation and management teams with proven track records manage the facilities.

- In the event of significant collateral deterioration, performance-based tests can limit losses. This feature redirects cash flow from the issuer’s equity to rapidly pay down the senior ABS securities.

U.S. Travel Is on the Upswing

As pandemic-related restrictions and concerns fade, we expect travel and travel-related industries to experience a broad, sustainable recovery. Wide-ranging data suggest this rebound is well underway:

- The worst of the pandemic appears to be over. After peaking in mid-January 2022, the number of daily U.S. COVID-19 cases plummeted, prompting the easing of lingering pandemic-related restrictions nationwide. Additionally, as of early March 2022, 66% of the U.S. population was fully vaccinated against the virus.5

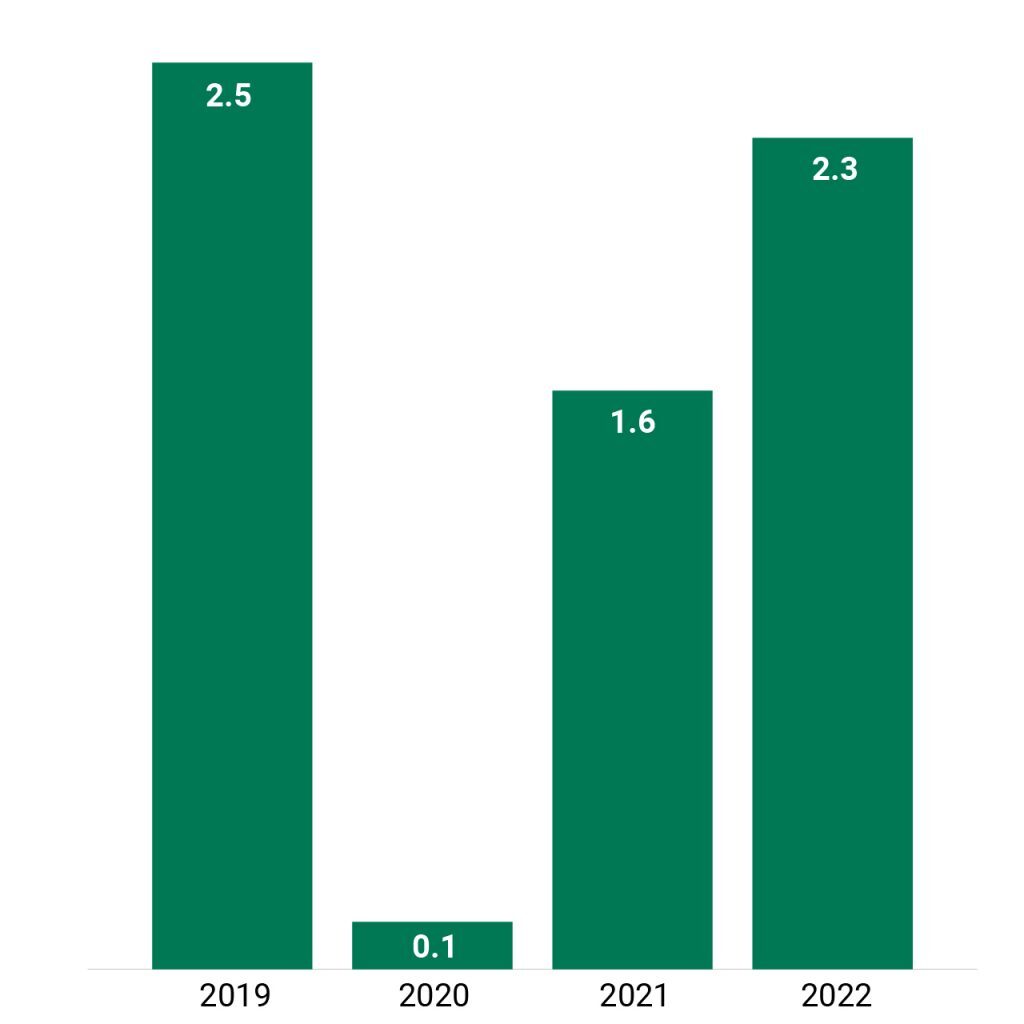

- U.S. air travel has substantially improved since the onset of the pandemic. At its low, daily TSA passenger traffic fell from approximately 2.5 million in early 2020 (pre-pandemic) to 87,534 on April 13, 2020. Recently, passenger volumes have rebounded to more than 2 million.6 See Figure 3.

- Aircraft storage rates remain elevated but have substantially improved since 2020. Approximately 18% of non-regional western passenger aircraft were stored at year-end 2021. This compares with 27% at the end of 2020 and 60% at the height of the pandemic.7

- U.S. hotel performance metrics have rebounded strongly since the depths of the pandemic. But revenue per available room remains nearly15% lower than pre-pandemic levels, suggesting room for improvement.8

Figure 3 | Travel on the Upswing

Millions of Passengers on April 1 of Each Year

Opportunities Among Aircraft ABS

Aircraft ABS offer investors clear and direct exposure to economic re-openings and post-pandemic travel growth. These securities finance portfolios of new and mid-life aircraft on lease to airlines around the world.

Investors may benefit from the exclusive characteristics of aircraft ABS:

- The most senior aircraft ABS are investment grade, amortize and have low loan-to-value ratios. These features may help reduce risk even in distressed scenarios.

- In general, aircraft ABS issued post-COVID feature stronger collateral packages (better, newer planes) and high-credit-quality lessees.

- Certain pre-COVID aircraft ABS offer significant upside potential from ongoing improvement in aircraft storage rates and aircraft values.

- By financing the aircraft rather than the airlines, investors are not subject to rising fuel costs.

Potential Advantages Versus Agency Mortgages

Focusing on ABS rather than their mortgage-backed securities cousins may help investors avoid an emerging risk tied to the Fed. In its effort to subdue inflation, the Fed plans to reduce its nearly $9 trillion balance sheet, including $2.7 trillion in agency mortgage-backed securities (MBS).

The Fed’s asset-purchase program, launched in early 2020 in response to pandemic-induced market instability, provided crucial support to the MBS market. Now, without the Fed’s regular purchases (which were as much as $40 billion per month), that support is gone. The agency mortgage market must adjust to the absence of a significant and consistent buyer.

CLO Sector’s Appeal Rises Along with Interest Rates

We also believe floating-rate securities—particularly corporate CLOs—present compelling opportunities for investors contending with today’s rising-rate environment.

Floating-rate securities may offer investors bond price protection against rising interest rates. By adjusting the bond’s coupon monthly or quarterly, floating-rate bonds avoid some of the extreme price volatility of fixed-rate, longer-maturity bonds.

CLOs Feature Floating Rates

Among floating-rate securities, we believe CLOs and commercial real estate CLOs are appealing in today’s rising-rate environment. In our view, CLOs are creditworthy instruments. They offer investors floating-rate, investment-grade bond profiles.

- Traditional CLOs comprise an $875 billion market. These securities are backed by senior-secured corporate loans that have a first lien on all the assets of high-yield corporate borrowers.

- The commercial real estate CLO market is substantially smaller at $85 billion. These securities are backed by low-leverage commercial mortgage loans related to primarily multifamily apartment buildings.

A Strong Credit History

CLOs have exhibited strong credit performance over time and through various market cycles. The investment-grade CLO sector has withstood the financial crisis, the oil market correction of 2016 and COVID.

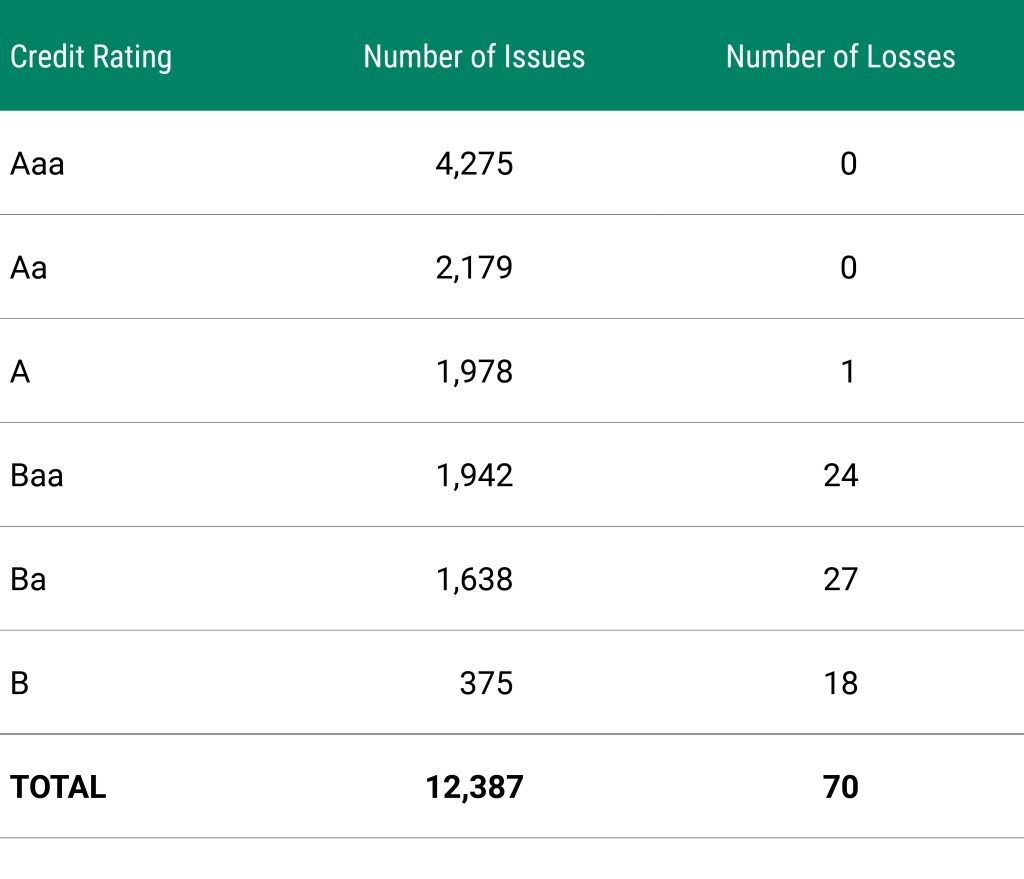

Since the sector’s inception in 1993, only 70 out of more than 12,000 U.S. CLOs have taken principal losses. And most of those losses were in higher-risk issuers. See Figure 4.

Figure 4 | Historical U.S. CLO Data Show Few Principal Losses

Number of Principal Losses and Issues by Rating, 1993-2020

Among commercial real estate CLOs, we tend to favor those collateralized by multifamily apartment buildings, which we believe offer compelling opportunities for investors. In our view, the rental housing market remains attractive due to:

- Low housing inventory.

- Historically high nationwide home price appreciation.

- Slowing middle-class wage growth.

Risks of CLOs

We believe CLOs offer many potential benefits. But it’s important for investors to understand the primary risks of these complex securities:

- Historically, CLOs have encountered few losses. However, significant defaults and losses related to the underlying loans may impair CLO tranches from returning investors’ full principal.

- While floating-rate yields may insulate investors from rising rates, changes in risk sentiment may affect the market price for CLOs (as with other securities).

An Important Component of Multisector Income Portfolios

We believe today’s rate and inflation backdrop underscores the importance of maintaining broadly diversified, actively managed fixed-income exposure. While rising interest rates and higher inflation present challenges for certain bonds, they may unleash opportunities for others.

As history has shown, rising rates and elevated inflation tend to negatively affect longer-maturity Treasuries and other high-quality bonds. However, other sectors, including structured credit, may offer better performance potential in a more challenging bond market environment.

With their shorter durations and higher yields than most government bonds, these securities may be better equipped to withstand challenging rate and inflation influences.

In such a backdrop, structured credit may merit a more prominent position in well diversified portfolios. But we do not recommend abandoning other fixed-income securities.

We believe a mix of bonds working together in a diversified portfolio may offer investors an attractive combination of income and total return potential.

1Digital Realty Trust’s Data Gravity Index, 2020.

2Ericsson Mobility Report, November 2021.

3Scalable cloud computing systems in which several servers are networked together.

4Market Share Report: Hyperscale Cloud Q3 2021 Update.

5Johns Hopkins Coronavirus Resource Center.

6TSA Checkpoint Travel Numbers, www.tsa.gov.

7Cirium, Deutsche Bank.

8Bank of America research.

Past performance is no guarantee of future results. Investment returns will fluctuate and it is possible to lose money.

Material presented has been derived from industry sources considered to be reliable, but their accuracy and completeness cannot be guaranteed. Past performance is no guarantee of future results. This information is not intended to serve as investment advice.

The opinions expressed are those of American Century Investments (or the portfolio manager) and are no guarantee of the future performance of any American Century Investments’ portfolio. This material has been prepared for educational purposes only. It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice.

No offer of any security is made hereby. This material is provided for informational purposes only and does not constitute a recommendation of any investment strategy or product described herein. This material is directed to professional/institutional clients only and should not be relied upon by retail investors or the public. The content of this document has not been reviewed by any regulatory authority.