Source: United States Department of Agriculture (USDA), Bloomberg as of 22 August 2022.

Historical performance is not an indication of future performance and any investments may go down in value.

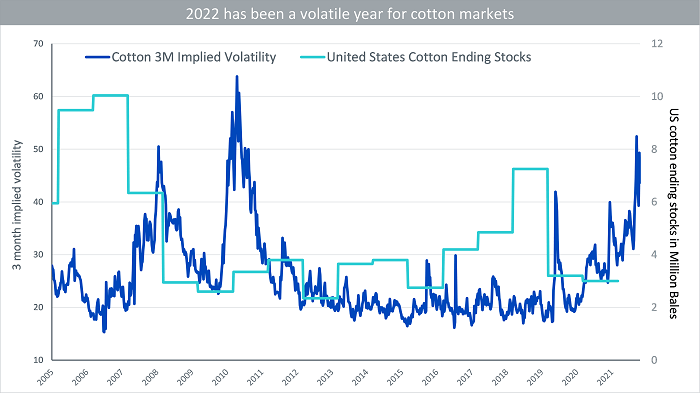

Back in 2011, Texas (the biggest growing cotton state in the US) witnessed the driest year on record. The reason for the drought was the weather anomaly La Nina. The La Nina results in an abnormal cooling of waters in the equatorial Pacific Ocean that is linked to severe droughts in the southwestern parts of the US. In the wake of the drought, the US Department of Agriculture (USDA) cut its estimate of 2011/12 cotton production by 1mn bales to 17mn bales. Cotton prices reached a record 215.151 USD/lbs in response.

Drought plaguing US’s biggest cotton growing state

We are seeing history repeat itself with a persistent drought in Texas this year. The National Oceanic and Atmospheric Administration sees a 72% chance of La Nina between November and January raising the odds for a rare third-straight La Nina to form across the Pacific. USDA has slashed its supply projections for global cotton ending stocks by 1.5mn bales in 2022/23. Production is lowered nearly 3.1mn bales whilst consumption is reduced by 800,000 bales. US producers increased their cotton acreage by 11% this season to 5.05m hectares. But, with the drought becoming more severe over the last couple of months, the USDA expects that the harvested area won’t exceed 2.89m ha. The abandonment of 43%, if confirmed, will be by far the highest since USDA records began in 1960. Owing to historically high abandonment in the US Southwest region, US production estimates are forecast to reach their lowest level since 2009/10.

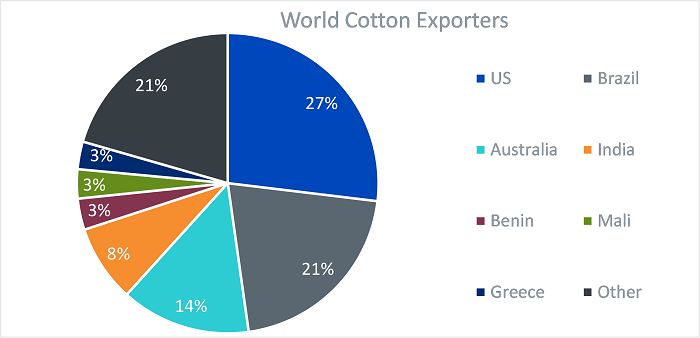

The US is the world’s largest exporter of cotton, having more than 27% share of the world export market. That implies that the fall in US production will dampen the world trade surplus, putting pressure on declining inventories.

Source: United States Department of Agriculture (USDA), Bloomberg as of 22 August 2022

Harsh climate conditions amongst key cotton producers threaten supply

Unpredictable weather patterns have been challenging the cotton crop outlook in other key producer countries as well. Drought is hitting China’s cotton crop in the Xinjiang province, which grows majority of the country’s crop. In China, ending stocks are estimated at 36.2 million bales in 2022/23, the lowest in 4 years2. Australia, Brazil, and Pakistan experienced untimely rains that have reduced a large share of their grades. The World’s stocks to use ratio at 68.25% is at its lowest in five years highlighting the constraints on supply with respect to demand.

Cotton’s demand outlook set to weaken amidst slowing global economy

Cotton consumption is likely to weaken amidst a challenging macroeconomic backdrop. Europe is on the brink of a recession and the European consumer will be exposed to soaring energy costs. Meanwhile the US consumer’s spending pattern is shifting away from goods to services. In China, the economic headwinds are multifaceted – from a weaking property market, intermittent covid lockdowns alongside supply shortages to strategically imported goods. The outlook for apparel and textile consumption looks tricky. Consumption in 2022/23 is projected lower than a month ago in the US, Pakistan, Vietnam, Turkey, and Bangladesh3.

Conclusion

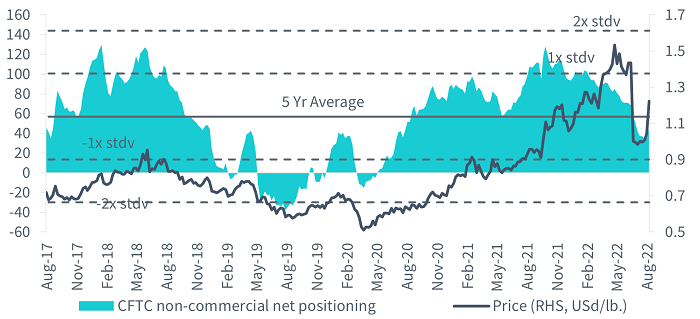

Supporting prices higher has been the 25.8%4 rise in speculative positioning over the past month. A 12% unwind in short positioning alongside a 10% build up in long positioning underscores the improvement in sentiment towards the cotton markets. The front end of the cotton futures curve remains in backwardation with a positive roll yield of 3.2% versus 8.5% a month back. Evidently the supply situation remains tight however amidst a tougher macroeconomic environment cotton prices are likely to walk a tight rope. In order for cotton prices to stage a sustained move higher we will need to see an improvement in demand.

Source: Commodity Futures Trading Commission, from 19 July 2022 to 16 August 2022. Please note: Stdv – Standard deviation is a measure of the amount of variation or dispersion of a set of values.

Historical performance is not an indication of future performance and any investments may go down in value.

Sources

1 Source: Bloomberg as of 4 March 2011

2 Cotton Outlook August 2022, Economic Research Service

3 United States Department of Agriculture

4 Source: CFTC, from 19 July 2022 to 16 August 2022