In our Investment Outlook 2022, we explain why we expect the global economy to remain on a solid growth path and give reasons for our conviction to expect good single-digit equity returns, though more moderate than in 2021. As the world finds pathways to normalize, we believe that the new year will herald a meaningful transition to a post-covid reality that will also be an opportunity to revisit investing for women.

The last two years have been extraordinary – not only for humanity but also for the global economy. Despite the fact that the COVID-19 pandemic now appears more under control thanks to vaccination programs, parts of the global economy, for example labor markets, have yet to stage a full recovery. Business as usual remains unusual – and will stay so for the foreseeable future. When COVID-19 evolved into a global pandemic in 2020, the ensuing lockdowns sent the global economy into the steepest recession on record. This unprecedented shock led to extraordinary fiscal and monetary support, which helped to trigger a sharp recovery. We believe that a recession like no other will bring a unique recovery.

The recovery continued into 2021, driven by strong stimulus effects and pent-up demand. Inflation rose as well – in part due to so-called base effects, such as ongoing logistics network issues and related disruptions. Toward the end of 2021, some central banks had enough confidence in the economic recovery to start reducing some of the emergency stimulus by slowing down asset purchases (tapering). In 2022, inflation should normalize from the elevated numbers of 2021, though it will likely remain above pre-pandemic levels.

Although, in our view, the coming year will be more “normal” than 2021, plenty of special factors are still at work. At the same time, important trends such as climate change and shifting demographics have reached a level of urgency that could very well result in a permanent change of the current economic order.

Against this backdrop, we foresee good albeit less extraordinary returns from global equities in 2022 than in 2021, with earnings remaining the key driver. Equity segments that lagged the global recovery from the pandemic shock are set to emerge as bright spots alongside industries that benefit from secular growth trends. In contrast, government bond yields will deliver negative returns in 2022. In credit, low spreads – both in investment grade and high yield – will barely compensate for the risks that come with higher yields.

The key for investors navigating this environment is to seek out assets with return profiles that depend on different factors. These diversification effects can be further improved with investment strategies that follow non-traditional patterns.

For women there is perhaps no time like the present to revisit and reengage with investing. Our research has shown that women have been affected relatively more than men during the COVID-19 crisis. More women are employed in sectors that have been most affected by the lockdowns, including retail, restaurants, hotels and personal services. It is vital, both for economic and societal reasons, that women find their way back to the labor market as soon as possible. As women return to the labor market, it is essential that women close retirement gaps widened by the crisis and resume building their wealth, all the more so as interest rates remain unattractively low.

With more than 25 years working as a financial professional, I observe that it continues to be women who are more likely to disengage with their money and hold most of their assets in cash and fixed income. Women tend to be risk averse and often seek to avoid taking risks in their portfolios when they do invest. But in markets, returns are the direct result of taking risk. The outcome is that women too often end up with not enough equities in their investment portfolio and too much cash and fixed income – a clear disadvantage for them in growing their capital over time in a transitioning low interest rate world.

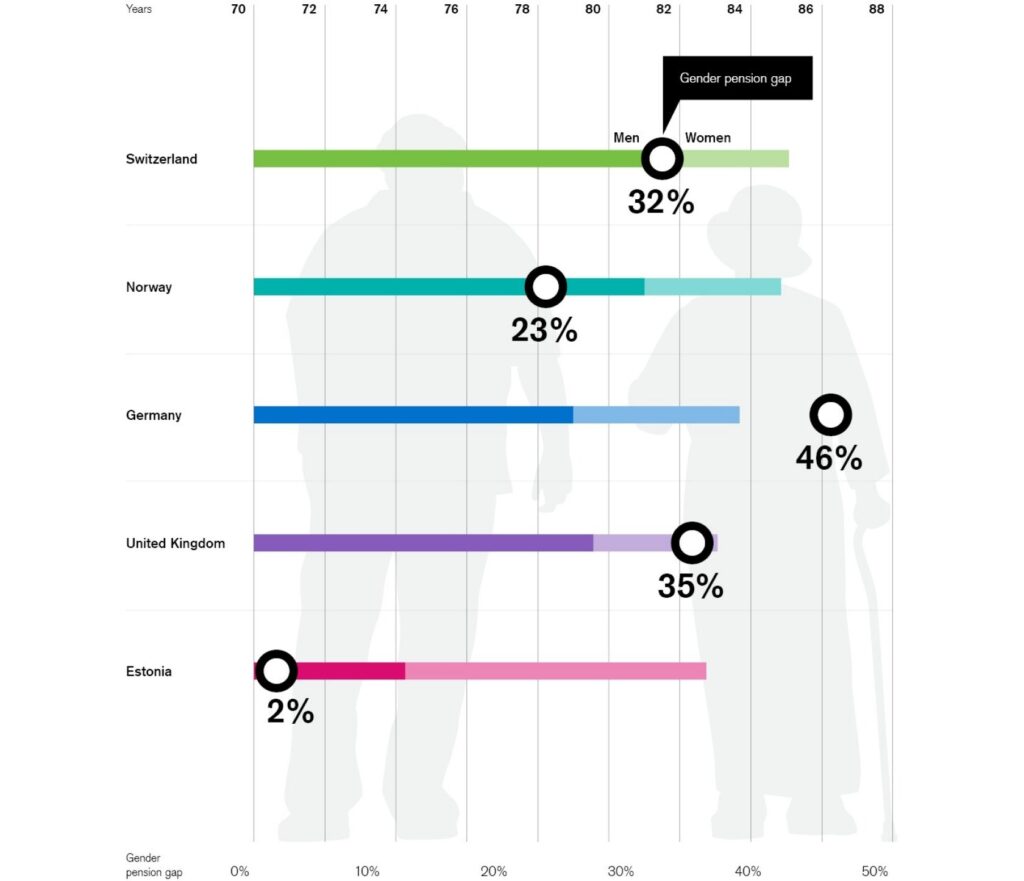

Sources Pensions at a Glance 2019, OECD 2021; Life expectancy at birth (indicator). (Accessed on August 12, 2021), OECD (2021); Credit Suisse.

Note The gender gap in pensions for persons age 65 and over is calculated using the following formula: 1 – women’s average pension / men’s average pension. It includes persons who obtain old-age benefit (public or private), survival pension or disability benefit.

Building wealth: why it matters

Engaging with their money could not be more pivotal for women. Women’s average life expectancy, which exceeds that of men by 4–6 years on average, is above 84 years in some of the member states of the Organisation for Economic Co-operation and Development (OECD). The challenge is that in the zero interest rate world in which we have landed since the global financial crisis, putting cash into a savings account to build wealth no longer suffices.

Investing in “safe” treasury bills or other government bonds is not a very attractive alternative either going forward. Globally, one in five government bonds had negative yields as of November 2021. In Switzerland and Germany, the share of negative yielding government bonds is around 80%. Negative yields mean that if women hold these bonds until they mature (i.e. the payback period), they would end up paying for the opportunity to lend their money to governments instead of having earned a yield. In other words, women would have been sure of only one thing: losing money at maturity if they chose to hold the bonds until expiry. So much for a “safe” investment! Women need to be prepared to take on more risk and expand into multi-asset investing, and equities in particular.

We believe that women cannot afford to ignore their finances and recognize that women face several hurdles when seeking to accumulate wealth. As investors, women do have distinct needs, preferences and characteristics that call for an investment approach that supports them in building their wealth and securing their long-term financial independence. That is why we believe a more nuanced approach that takes into account the financial needs in each of the 4 lifecycles stages of a woman is a great starting point. Every stage is an opportunity for women to learn and fully engage with managing their own money and every stage builds on the last to make their money work harder.

Lifecycle stage 1: Starting out

This lifecycle stage is defined by a relatively low savings rate combined with minimal investment activity, a reflection of the fact that young women tend not to have a steady income as they complete their education or training, and their income tends to be at the lower end of the salary scale when they enter the workforce. This does not mean, however, that it is too early for women to start planning for a secure financial future far down the road. On the contrary, as in other areas of their lives – physical and mental health, education and friendships – young women should take good care of their finances in order to enjoy the benefits throughout their life. Beyond the basic state pension, women should in particular begin building personal retirement savings as soon as possible after they enter the labor market.

Lifecycle stage 2: New responsibilities

As they move beyond the first phase of their career, women tend to have a medium savings rate. Their financial investment activity may really kick off during this period, as they may still have savings even after contributing to occupational and voluntary retirement schemes. Women can still accept a high level of risk (i.e. exposure to equities) during this phase in light of their long investment horizon, especially if they stay on the full-time employment track and thus continue to add to their savings. Their focus will remain on growing their capital at low cost. The most effective way of doing this is via funds managed by professional asset managers, along with ETFs or passively invested funds that track selected reference indices.

For women who decide to take a break in order to take care of children or other dependents, they may need to reduce their earnings and pension contributions, which can lead to wealth setbacks later down the road. Women should ensure that their planning reflects their reduced ability to take risks during this period in order to counteract some of these effects.

Lifecycle stage 3: Shifting priorities

As their careers advance and/or they return to work as their children grow up, women look toward a phase in their lives in which they can generate higher income and therefore savings. Some also carry a mortgage for their primary home or secondary residence. Women at this stage tend to be more sophisticated investors – a reflection of their experience accumulated over two decades of investing, combined with new financial obligations. They may have developed specific investment interests or convictions, be able to devote more time to their finances, or seek to engage more directly in their investment decisions. This is the time when women’s investment portfolios can become more diverse and strategic.

Lifecycle stage 4: Planning beyond

At this stage, women’s risk tolerance declines as they rely more directly on capital income and predictable cash streams to fund their activities and living costs during their pre-retirement or retirement phase. Hence, the focus now shifts to low-risk investments. Many investors want their portfolios to tilt heavily toward direct bond investments (fixed income) or other income investments with reliable annual cash streams and low volatility on the capital invested. Women who inherit money later in life may need to review their existing investment portfolio and adjust it accordingly. Relatedly, women in this lifecycle stage are thinking about how they would like to pass on their wealth eventually.

The challenges presented by this changing low interest rate environment place the ability to make selective investments wisely and manage finances center stage. That is why constructing an investment portfolio that truly reflects individual needs and goals is time well spent. My most important message is that it is never too late to start investing. This is not to say that a woman who has not previously invested should do so at this exact moment. It is important to have a realistic plan that reflects their age and risk profile. Even the smallest steps can effect change. Enabling women to steer and grow their individual wealth actively will not only have an impact on their own lives and their families, but can shift societies as a whole.

Dr. Nannette Hechler-Fayd’herbe

Dr. Nannette Hechler-Fayd’herbe is Chief Investment Officer for International Wealth Management and Global Head Economics & Research of Credit Suisse. As a voting member of the Global Investment Committee, Nannette helps shape the Credit Suisse House View and communicates insights on the global economy and financial markets to wealth management, institutional and corporate clients. She is the architect of Credit Suisse’s thematic equity investment framework Supertrends that harnesses the long-term thinking on societal trends with tangible investor impact. Nannette also serves on the Editorial Board of the Credit Suisse Research Institute, spearheading collaborations with leading academic authorities on the studies of global wealth, investment returns as well as key thought leadership pieces on macroeconomic policy issues.