Key Takeaways

- As interest rates remain higher for longer, banks continue to benefit from tangible improvements in margin and return on equity, leading to lower probabilities of default in CoCos.

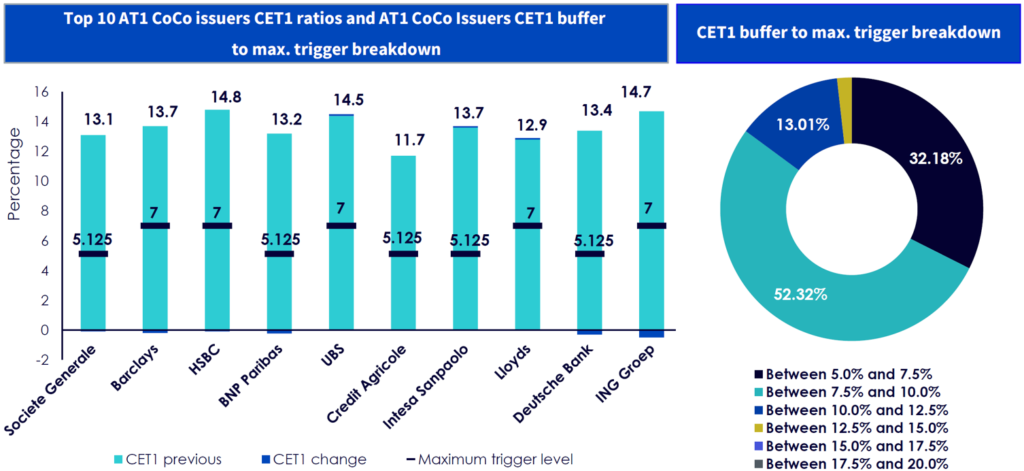

- The CET1 ratios have regained healthy levels, supported by higher margins and increased stability.

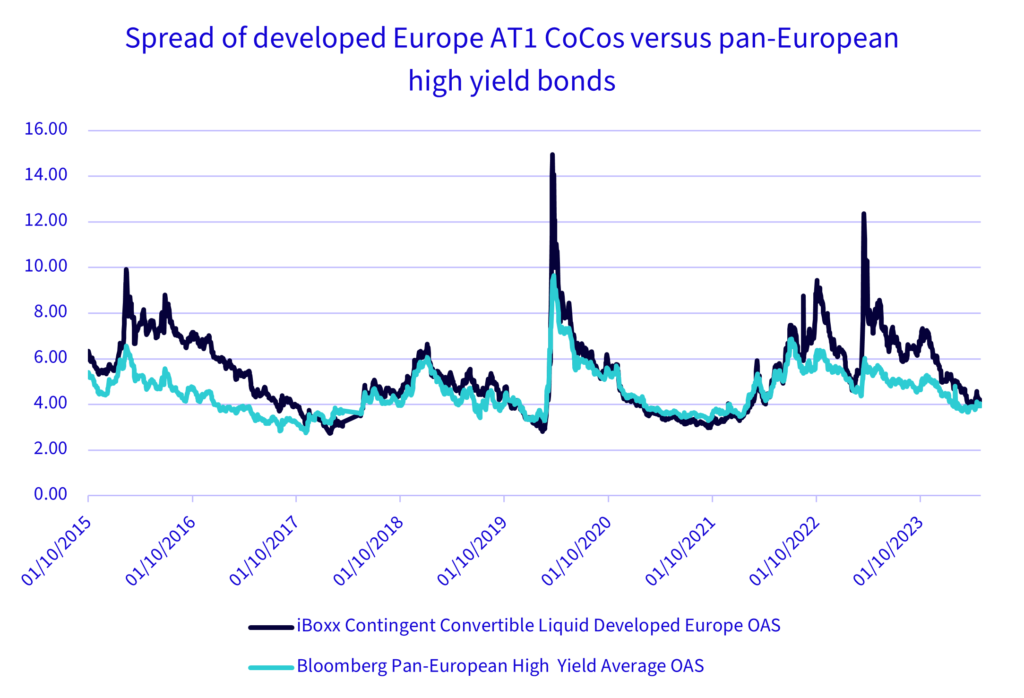

- CoCos have come back strong after the banking crisis that involved the default of Credit Suisse bonds. We expect further strengthening in the asset class given the favorable macro environment.

- Related ProductsWisdomTree AT1 CoCo Bond UCITS ETF – USD AccFind out more

The global financial landscape has undergone significant transformations in recent years, reshaped by various macroeconomic factors, including shifts in monetary policies, geopolitical tensions, and evolving market dynamics. Among the most impactful changes has been the steady climb of interest rates, a trend that has both challenged and benefited different sectors of the economy. Understanding the nuances of these shifts, particularly within the banking sector, is crucial.

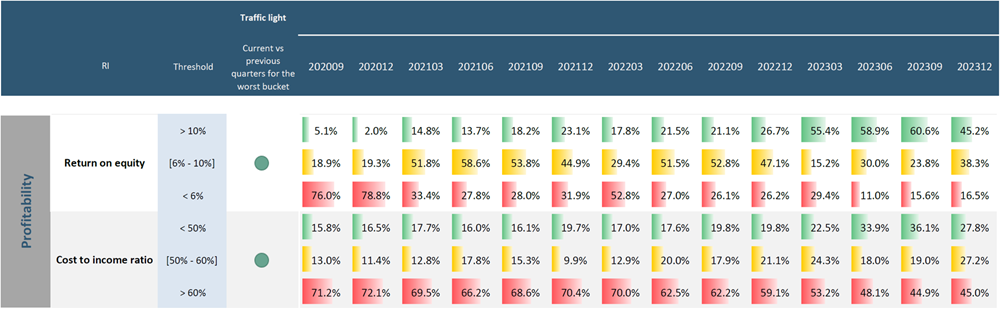

The primary mechanism through which banks earn a profit is through the spread between the interest they pay on deposits and the interest they earn on loans and investments. As interest rates rise, banks are generally able to charge disproportionally more for loans compared to the interest they pay to account holders, which can significantly enhance their interest income. This environment has been particularly beneficial in recent years, as central banks across major economies have hiked rates to combat inflation and stabilise financial markets. For banks, higher interest rates have directly supported Return on Equity (ROE) by widening the interest margin.

Source: European Banking Authority

A higher ROE signals strong profitability and reassures investors about the bank’s overall financial health. With central banks increasing rates almost globally, many financial institutions have reported substantial gains in net interest income, bolstering their financial statements and appeasing stakeholders.

While the rising interest rates regime has sparked concerns regarding the fundamentals of high-yield companies – owing to the increased cost of borrowing and its subsequent impact on their financial health – the banking sector tells a different story. Over the past few years, banks have not only managed to navigate through these higher rates but have also strengthened their fundamental operations. The CET1 ratios have also maintained healthy levels, making CoCos more secure investments. Despite these improvements, the valuation the hybrid capital instruments like CoCos remains relatively low. The undervaluation Continent Capital’s CoCo bonds presents is intriguing.

Despite the bank’s robust fundamentals and the broader sector’s resilience, these bonds have historically traded at relatively high yields, whereas bank fundamentals have improved in recent years. The gap has closed over the last few months, but in the current environment, given the robustness of CoCos, we expect further improvements in option adjusted spreads (OAS), thus leading to further upside for CoCos.

Conclusion

While the landscape of rising interest rates tests the resilience of various sectors, the banking industry, supported by strong fundamentals and strategic regulatory compliance, appears well-positioned to thrive. In that context, CoCos could be a compelling investment that benefits from the current high interest regime.