Following a recent research trip to Taiwan and South Korea, Naomi Waistell, Co-Fund Manager of FP Carmignac Emerging Markets, highlights the renewed strength and global relevance of New Asian Tigers.

These economies, once synonymous with post-war industrialisation, have evolved into the critical enablers of the global artificial intelligence (AI) revolution.

ASIA’S HIDDEN STRENGTH IN THE AI SUPPLY CHAIN

AI is often portrayed as a Silicon Valley creation, yet its foundations are firmly built in North Asia’s technological ecosystem.

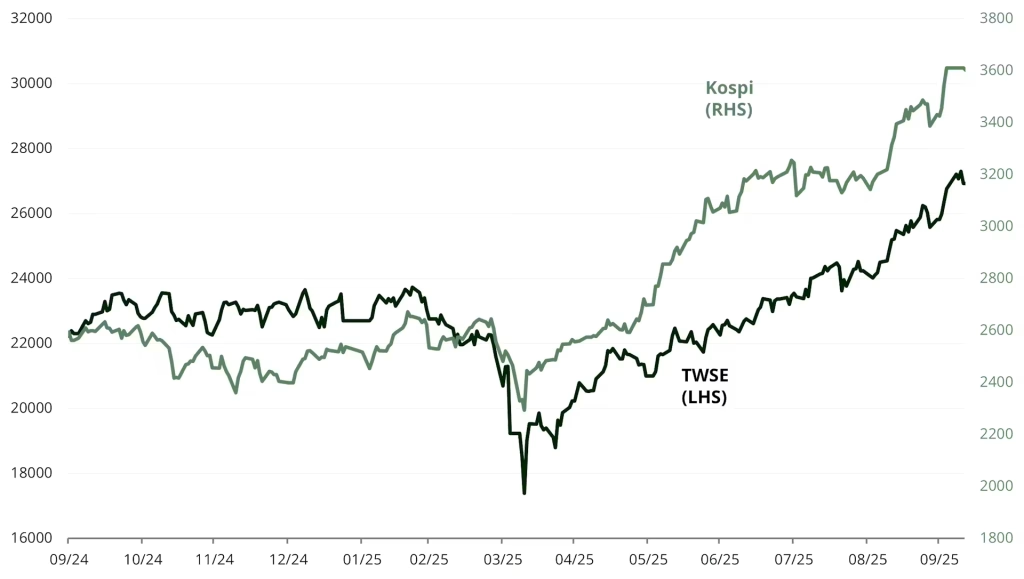

From advanced chip manufacturing in Taiwan to memory chips and component specialists in South Korea, these markets are indispensable to global innovation. Both the Taiex and Kospi indices reached new highs in 2025, but global investors remain under-exposed to the region — a structural inefficiency that creates opportunities for active managers.

During our September research trip, we met over thirty companies spanning the semiconductor value chain — from baseboard controllers and copper-clad laminates to liquid-cooling systems.

These niche players, often mid-cap, are capturing exceptional growth as AI demand accelerates. One firm even achieved its ten-year margin target in under twelve months — a testament to the extraordinary pace of demand.

AI-driven demand remains unrelenting, with utilisation rates near 100%. As supply chains tighten, pricing power strengthens — creating structural opportunities for long-term alpha.

TSMC: THE CORE OF COMPUTE

At the epicentre of this transformation stands TSMC, the world’s leading semiconductor foundry and the backbone of AI computation.

Nearly every AI accelerator chip powering large language models is made in its Taiwanese fabs.

- Revenues have doubled in four years1, driven by explosive AI demand.

- A $40 billion capex programme2 focuses on cutting-edge 2 nm and 3 nm nodes.

- TSMC holds over 90% market share3 in advanced-node manufacturing technologies.

TSMC revolutionised the industry by introducing the fabless-foundry model, enabling design firms to innovate without the burden of manufacturing.

Despite its dominance, management continues to prioritise customer success — maintaining a 30% ROE(return on equity)4 while investing heavily to expand capacity.

As AI applications expand into enterprise software, autonomous vehicles and robotics, TSMC remains the cornerstone of the compute super-cycle.

BEYOND THE GIANTS: THE UNSUNG ENABLERS

Asia’s opportunity extends far beyond TSMC.

- Copper Clad Laminates (CCL): Key materials in printed circuit boards. As the number of GPUs (graphics processing units) multiplies, the component value per compute tray is expected to triple in the next generation5, with tight supply supporting robust margins.

- Liquid Cooling Solutions: As computing power and energy intensity rise, liquid-cooling solutions could see 3-6x higher content value upgrade6, driving both revenue and margin expansion.

These under-the-radar companies are the “picks and shovels” of the AI boom — crucial, profitable, and underappreciated.

SK HYNIX AND SOUTH KOREA’S VALUE TRANSFORMATION

SK Hynix sits at the heart of AI infrastructure thanks to its leadership in high-bandwidth memory (HBM)technology — a critical component for advanced AI chips.

Tight capacity management, disciplined pricing and strong partnerships with major customers like Nvidia position the company for sustained earnings growth through 2026 and beyond.

Meanwhile, South Korea’s “Value-Up” governance reforms add a powerful long-term catalyst.

Recent legislative changes — including stricter board independence, stronger shareholder rights and higher transparency — aim to close the long-standing “Korea discount”.

Share buybacks have surged 80% year-on-year7, signalling a genuine shift toward capital efficiency with Korean companies responding positively to these reforms.

A BROADER GROWTH STORY

Macro conditions are strengthening across the region:

- Taiwan’s GDP grew 8% in Q2 20258, its fastest pace in four years.

- South Korea benefits from a more expansionary fiscal stance and a rebound in exports.

- Both economies enjoy moderate interest rates (2.5%)9, supportive currencies and rising corporate earnings.

Earnings growth in Taiwan and South Korea now outpaces all major Asian peers, yet global portfolios remain structurally underweight — leaving a wealth of undiscovered opportunities.

LOOK BEYOND THE OBVIOUS

For investors, AI exposure does not need to come at Silicon Valley valuations.

The new Asian Tigers — with their depth of expertise, disciplined capital management and strategic role in the global technology ecosystem — offer a compelling alternative.

In a world obsessed with headline names, Taiwan and South Korea remain the quiet engines powering the AI age — and a fertile ground for those seeking the next wave of innovation.

1Source: TSMC data, Bloomberg, September 2025.

2Source: TSMC data, Bloomberg, September 2025.

3Source: TSMC data, Bloomberg, September 2025.

4Source: Bloomberg, TSMC data, Goldman Sachs, BoAML Research, September 2025.

5Source: Bloomberg, BofA Research, September 2025.

6Source: Bloomberg, BofA Research, September 2025.

7Source: Bloomberg Finance L.P., J.P. Morgan Equity Macro Research, NVIDIA, BofA Global Research Estimates, September 2025.

8Source: IMF World Economic Outlook, September 2025.

9Source: IMF World Economic Outlook, September 2025.