Data storage has become much cheaper over the past decade and has a lower relative environmental impact

Data centres consume colossal amounts of energy. Powering and cooling their servers and other hardware used between 0.9% and 1.3% of global electricity in 2021.1 The upper estimate is roughly the same as the whole UK economy.

To focus on absolute numbers overlooks a more interesting story, though. Despite exponential growth in global data consumption and accumulated data, total electricity used by the world’s data centres has risen by barely 20% since 2010.2

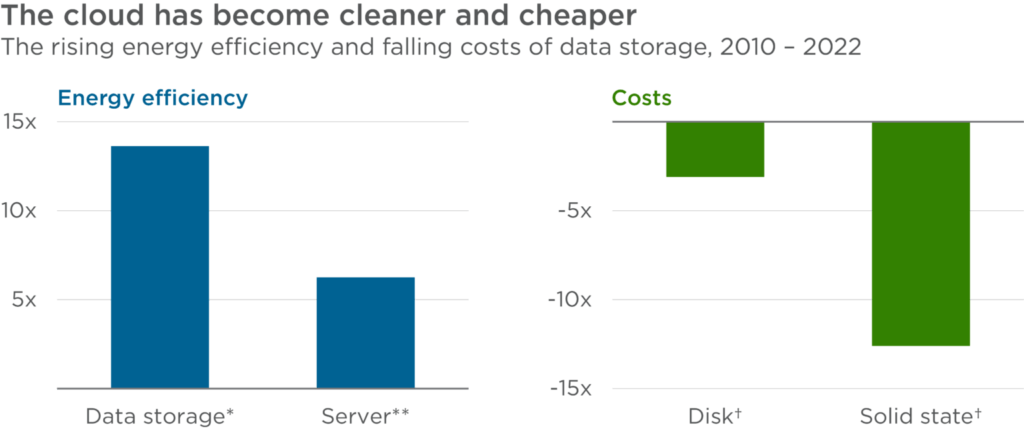

Advances in energy efficiency have kept pace. Electricity use per terabyte of installed storage has fallen by more than 90% since 2010 as a result of storage-drive density and the efficiencies of larger ‘hyperscale’ data centres that now dominate the market.3 Several data centre operators are also major buyers of renewable energy, reducing their emissions further. The three largest cloud providers are among the world’s top four users of renewable energy power purchase agreements.4

Technological advances have meanwhile driven down data storage costs. The cost of high-performance solid-state drives – which, unlike disk drives, store data on electronic circuits – fell more than 12-fold between 2010 and 2022.5

The convenience and scalability of being able to store and access data remotely, as opposed to on premises, have made cloud storage a compelling proposition for more businesses and individuals.

Cloud-based services like data storage form a fast-growing pillar of modern digital infrastructure: spending on public cloud services is forecast to grow by 21% in 2023 to US$592bn.6 Continued adoption of the technology can lead to higher server utilisation rates and so deliver a virtuous cycle of further environmental and cost efficiencies.

1IEA, 2022: Data Centres and Data Transmission Networks. This figure excludes energy used for cryptocurrency mining.

2Masenet et al, 2020: Recalibrating global data center energy-use estimates. Science. In 2010, estimated global data centre energy consumption was 203 to 273 TWh. In 2021, the IEA estimated it to be 220 to 320 TWh.

3Masenet et al, 2020: Recalibrating global data center energy-use estimates. Science. Impax estimates for the period 2019 to 2022, extrapolated from 2010 to 2018 data.

4IEA, 2022: Data Centres and Data Transmission Networks. Amazon, Microsoft and Google were among the top four corporate offtakers of renewable energy power purchase agreements, by GW of electricity, between 2010 and 2021.

5McCallum, J.C., 2022 published in Our World in Data: Historical cost of computer memory and storage.

6Gartner, 2022: Gartner Forecasts Worldwide Public Cloud End-User Spending to Reach Nearly $600 Billion in 2023.

CFA® and Chartered Financial Analyst® are registered trademarks owned by CFA Institute

Nothing presented herein is intended to constitute investment advice and no investment decision should be made solely based on this information. Nothing presented should be construed as a recommendation to purchase or sell a particular type of security or follow any investment technique or strategy. Information presented herein reflects Impax Asset Management’s views at a particular time. Such views are subject to change at any point and Impax Asset Management shall not be obligated to provide any notice. Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary. While Impax Asset Management has used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability or completeness of third-party information presented herein. No guarantee of investment performance is being provided and no inference to the contrary should be made.