Key Takeaways

- Even though the volatility and drawdown of bitcoin or crypto in general is elevated on a single asset basis when added in a small quantity to a multi-asset portfolio, the relative risk (volatility or drawdown) created is quite minor and has been historically very richly rewarded.

- Even conservative investors with small risk tolerance could benefit from a small (1%) allocation to bitcoin as the added volatility and relative drawdown remain very small.

- Looking forward, even assuming conservative behaviour for cryptocurrencies1, the most optimal multi-asset portfolios would include bitcoin. The optimal allocation for a balanced portfolio would hover around 5%.

- Despite its high volatility, and thanks to its low correlation, a 1.5% allocation to bitcoin would only represent 3% of the risk in a balanced portfolio that includes equities, fixed income, and a small proportion of commodities.

- Related ProductsWisdomTree Physical Bitcoin, WisdomTree Physical Ethereum, WisdomTree Physical Crypto Mega Cap Equal WeightFind out more

With 2024 turning into year one of “the institutionalisation of bitcoin”, investors focus is quickly moving from “does it make sense to allocate to crypto in a multi-asset portfolio?” to “what is the optimal allocation to crypto in my portfolio?”.

Adding crypto to a multi-asset portfolio is an idea more mainstream than cutting-edge

Our research paper, Bitcoin in multi-asset portfolios, which was first published a few years back but updated earlier this year, aimed to highlight the advantage of adding cryptocurrencies to a multi-asset portfolio. Our work provided four important results for institutional investors:

- Digital assets represent between 1% and 2% of the market portfolio (depending on when one looks). Multi-asset allocations that don’t invest in cryptocurrencies are effectively underweighting the asset class and betting against it, which, in our opinion, should be a position reserved to investors with deep knowledge and a strong “negative” thesis on the space.

- Bitcoin exhibits high growth potential compared to other asset classes, having been the best asset in nine of the last 12 years and remains uncorrelated. It is, therefore, a very strong candidate for a multi-asset allocation.

- Even a modest allocation in a portfolio can significantly boost returns with a minimal increase in overall risk, thereby enhancing the portfolio’s risk/return profile. The information ratio of such an addition hovers at around 1, making it a highly appealing proposition.

- The increase in volatility and drawdowns caused by the inclusion of bitcoin in a portfolio is effectively managed through diversification and regular rebalancing. Adding 1% to a 60/40 portfolio historically would have only added 0.07% of volatility, demonstrating the stability of the portfolio2.

A framework to assess the optimal allocation to bitcoin for investors

While the answer will vary depending on investors’ specific situations, In a second paper, The role of bitcoin in a portfolio, which we published recently, we have leveraged three different quantitative techniques to help answer investors’ new questions about the optimal allocation.

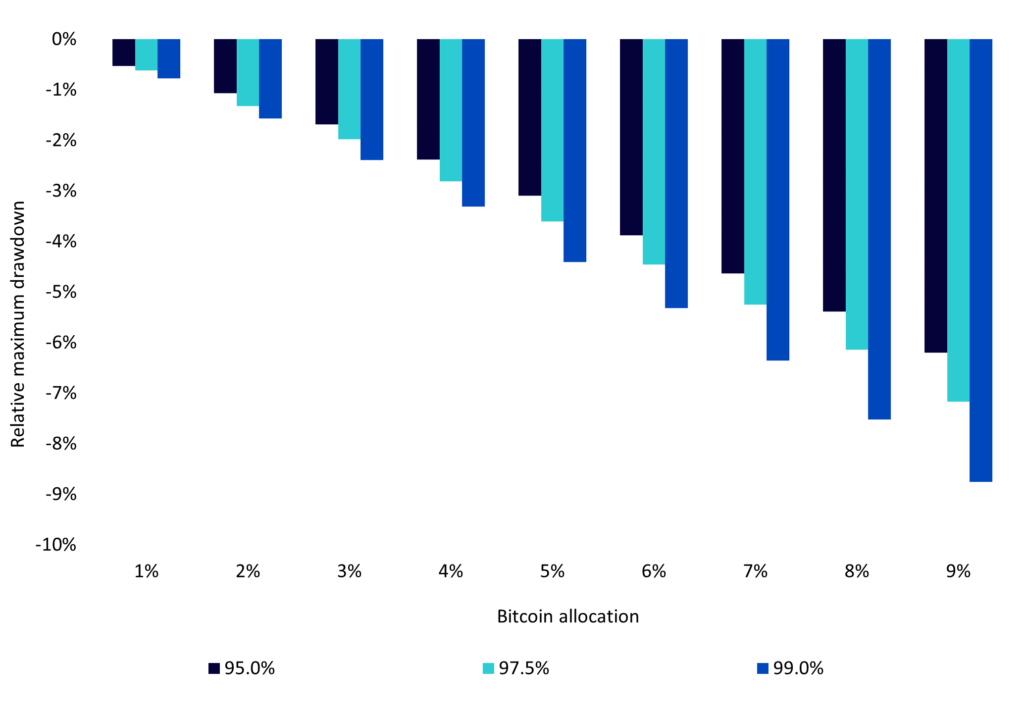

The first technique used is a bootstrapping technique that consists of using historical data for fixed income, equities and cryptocurrencies over the last 10 years and then generating Monte Carlo simulations of 36 months periods through random sampling. In other words, bootstrapping creates new series of returns by reordering existing historical series. This makes the bootstrap samples inherit the same distribution as the original data, allowing estimation of the sampling distribution of various statistics. Using those simulated series, we can construct a time series for a 60/40 portfolio (equity/fixed income) and portfolios that add bitcoin to the 60/40 portfolio. We then study the resulting distribution and in particular the distribution of relative risk and relative drawdowns.

In Figure 1, we can see that in the case of 5% bitcoin investment, in 99% of the cases the investor would have experienced a relative maximum drawdown (versus the 60/40) of less than -4.4%, and in 1% of the cases they would have experienced a relative maximum drawdown worse than -4.4% (the blue bar).

Figure 1: Using relative drawdown to calibrate the allocation to bitcoin

Source: WisdomTree, Bloomberg. S&P. From January 2014 to May 2024. Calculations are based on monthly returns in USD. Historical performance is not an indication of future performance and any investments may go down in value.

Using this technique, an investor can determine their preferred crypto allocation from the risk they are willing to take. For instance, consider a conservative investor who is comfortable with a maximum 1% relative drawdown (compared to a traditional 60/40 portfolio) with a 99% confidence level. From the chart, they can conclude that allocating between 1% and 2% to bitcoin would be most suitable.

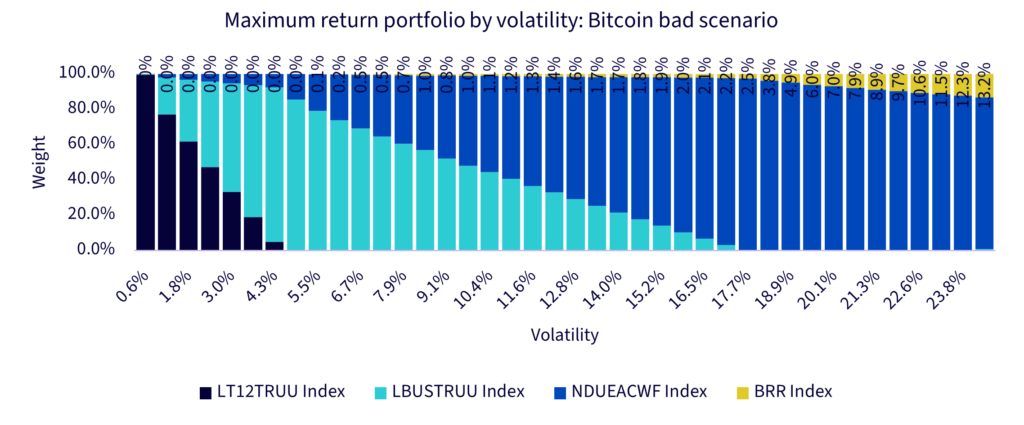

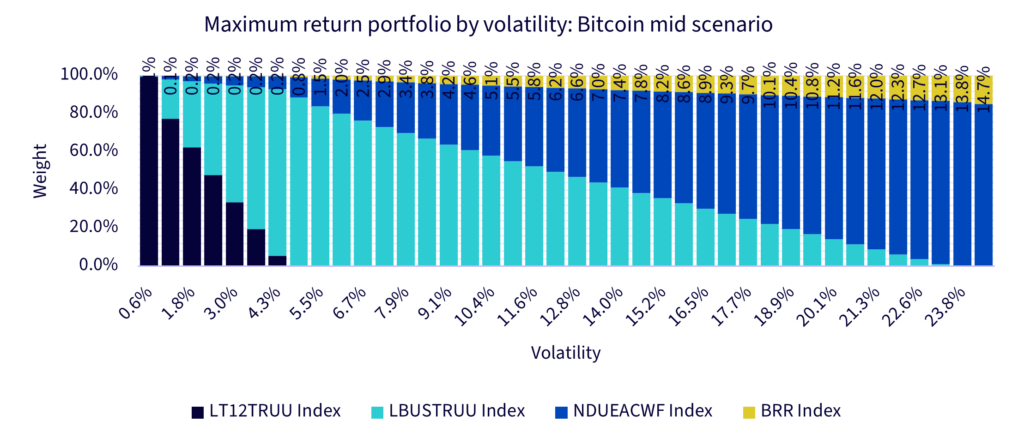

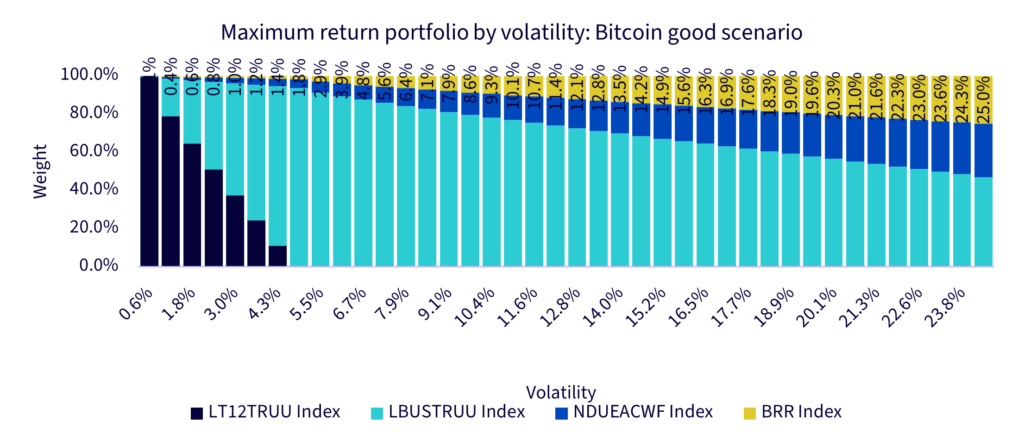

The second technique consists of using a mean-variance optimisation framework, as proposed by H. Markowitz, based on JP Morgan Long Term Capital Market Assumptions for equity and Fixed Income and based on three scenarios for Bitcoin:

- Good scenario: Bitcoin’s return is assumed to be equal to the US large cap equity estimated return + 20% per annum — this remains significantly below historical returns and below the 2023 performance by a wide margin. The volatility is assumed to be 20% lower than bitcoin’s historical volatility

- Mid scenario: Bitcoin’s return is assumed to be equal to the US large cap equity estimated return + 12.5%. The volatility is 10% lower than bitcoin’s historical volatility and the correlation with the other assets is increased by 10%

- Bad scenario: Bitcoin’s return is assumed to be equal to the US large cap equity estimated return +7.5%. The volatility is equal to bitcoin’s historical volatility and the correlation with the other assets is increased by 20%

We can note that:

- In both the good and mid scenario, bitcoin receives a non-negligible weight even in low volatility portfolios. For example, in the mid scenario, the optimal portfolio with a 5.5% volatility would allocate 1.5% to bitcoin

- Bitcoin allocation is present in all portfolios with more than 5% volatility, even in the bad scenario, where crypto returns only 7.5% more than equities per annum

- For an aggressive multi-asset portfolio (~10% volatility) allocations range from ~ 1% to ~9% depending on the scenario

Figure 2: Asset allocation of efficient portfolios by portfolio volatility in three forward-looking scenarios

Source: WisdomTree, JP Morgan. Calculations are based on monthly returns in USD. Historical performance is not an indication of future performance and any investments may go down in value.

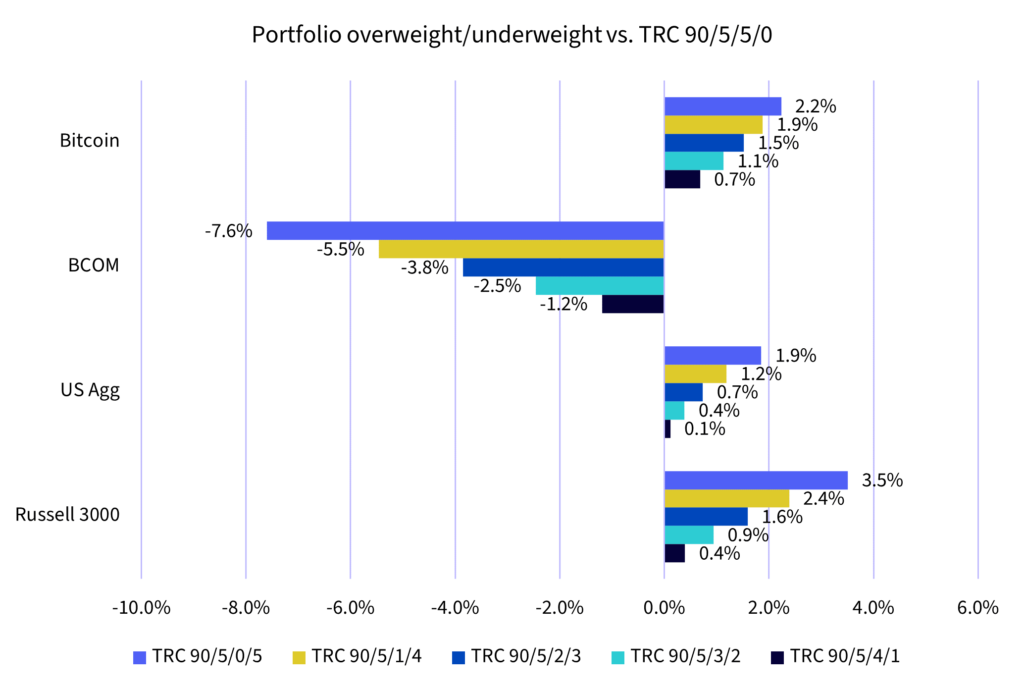

The third technique is to construct portfolios not based on allocating weights to assets but on defining target risk contribution for each asset and deriving weight from those targets. An investor that wants to dedicate one per cent of its portfolio risk to bitcoin would then have to allocate 0.7% to bitcoin, as indicated in Figure 3. A more aggressive investor who wants to dedicate 5% of the risk would allocate 2.2%.

Figure 3: Average overweight/underweight vs. benchmark portfolio

Source: WisdomTree, Bloomberg. From January 2014 through December 2023. ‘TRC’ denotes ‘Target Risk Contribution’, and ‘90/5/5/0’ representing the benchmark portfolio of 90% risk allocated to equities, 5% to bonds, 5% to commodities, and 0% to bitcoin. Historical performance is not an indication of future performance and any investments may go down in value.

Conclusion

As cryptocurrencies slowly gain their place in multi-asset portfolios, it becomes necessary to create a framework to assess the relevant allocation to those assets, taking into account their growth potential, diversification potential, and the change wrought by their wider adoption. Our findings can be found in the table below summarised across three types of portfolios: Conservative, Balanced and Aggressive.

| Conservative portfolio | Balanced portfolio | Aggressive portfolio | |

| Bootstrapping method |

~1% Allocation resulting in 1% relative max drawdown with 99% confidence |

~3% Allocation resulting in 2.5% relative max drawdown with 99% confidence |

~5% Allocation resulting in 5% relative max drawdown with 99% confidence |

| Markowitz Mean-Variance method |

~1% Optimal weight in mid scenario for 5% Target Vol portfolio |

~5% Optimal weight in mid scenario for 10% Target Vol portfolio |

~8% Optimal weight in mid scenario for 15% Target Vol portfolio |

| Risk contribution method |

~0.7% 1% risk contribution allocation to crypto |

~1.5% 3% risk contribution allocation to crypto |

~2.2% 5% risk contribution allocation to crypto |

Overall, it looks like a conservative portfolio would aim for a slight underweight to crypto compared to the market portfolio, with an allocation of around 1%. This is perfectly logical as a conservative portfolio is also underweight other risk assets, such as equities. A balanced portfolio could aim for a slight overweight with around 3% of the allocation. Finally, an aggressive portfolio, with its classic overweight to risky assets compared to the market portfolio could easily target a 5% allocation to crypto.

If there is one thing to take away from this research, it’s that the time for ignoring this asset class has passed. Not allocating to the asset class is no longer the default decision. Investors or multi-asset managers need to have a view and a plan for this maturing asset class. To find out more about the role of bitcoin in a portfolio, read the full portfolio insight here.

1 Conservative behaviour for cryptocurrencies: positive return but well below what we experienced historically, similar volatility and correlation.

2 Bloomberg, WisdomTree. From 31 December 2013 to 31 December 2023. In USD. Based on daily returns.