Negative real interest rates on cash deposits will pose challenges for investors for some time to come.

As implausible as it sounds today, there was once a time when only one destination would do for hard-core, anti-bourgeois, anti-capitalist radicals: Zurich. Yes, really. As the First World War disrupted every corner of European life, an extraordinary cast list of avant-garde intellectuals, artists, refugees and draft evaders migrated to the city.

The Cabaret Voltaire, birthplace of subversive artistic movement Dada, became their spiritual home. Artists in residence used absurdity and irrationality to champion their cause that rebuffed the logic, reason and conformity of the modern age. As a protest movement against the folly of the First World War, Dada certainly had its power; but even a brief review today of the esoteric output of that period explains why much of it proved less than enduring1.

An exception was the work of Swiss artist Sophie Taeuber-Arp, who outshone many of her male counterparts with an extraordinary creative talent that spanned painting, dance, design, architecture, embroidery and weaving. Her artistic output has certainly stood the test of time.

Taeuber-Arp’s energy and creative flexibility might provide some inspiration today as we wrestle the apparent absurdities of our own age. Despite the continued global recovery and the post-COVID-19 bounce in prosperity, cash rates for savers in most developed markets have not budged above zero. Nor are they likely to for some time.

At the June Federal Reserve meeting the members did, at least, signal that the first increase in the federal funds target-rate above 0-0.25% would be sooner than they previously indicated; but still only moved ‘lift off’ forward by one year to sometime in 2023 (although, to be fair, market pricing runs ahead of this). Unless those expectations change meaningfully, investors hoping for a better return on their US dollar cash deposits should not hold their breath.

And remember, in the US, inflation is currently running above the central bank target. The recent very high inflation prints might prove short-lived, but real returns on dollars are likely to be dismal for a very long time to come.

A new monetary policy framework

The situation is even more dire elsewhere. The European Central Bank (ECB) recently took a leaf out of the Fed’s playbook and committed to a new monetary policy framework that could enable it to keep cash rates below zero, even as inflation rises back to, or even slightly above, the new 2% target2.

The ECB did not go as far as the Fed and commit to allowing periods of above-target inflation, to make up for previous shortfalls, and work to an average 2% target. Instead, the ECB has opted for a symmetric approach and stresses that undershooting the inflation target is taken as seriously as overshooting. This is a subtle, but important difference, and one that probably says as much about the ‘realpolitik’ of policy setting in the eurozone as it does about the best approach for inflation targeting. But since consensus forecasts for eurozone inflation put the first rate hike out to 2024, or even beyond, the likelihood of cash rates moving into positive territory in the eurozone before then is very remote indeed.

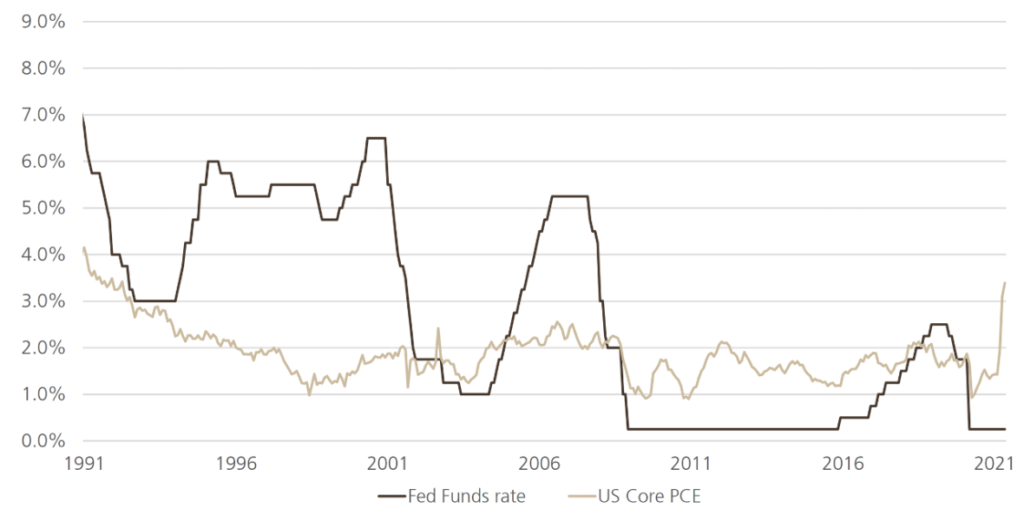

This all feels a far cry from the ‘rational’ world many investors had come to believe in; a world where cash deposits could still earn a return above inflation; the world where US cash rates averaged above 5% in the 1990s and above 3% in the early 2000s (but have been well below that since 2010).

Loss of buying power

For risk averse holders of cash deposits, facing up to the guaranteed loss of buying power of their cash savings, what is to be done? For a while, a plausible approach has been to cling to ‘near-cash’ substitutes. Typically, this led investors to steadily increase holdings of short-maturity government bonds — keep the risk-free element of cash, and earn incrementally higher returns. But many central banks stayed one step ahead and bought government bonds with the explicit aim of crowding out investors into more productive areas of risk-taking for the economy (so-called quantitative easing).

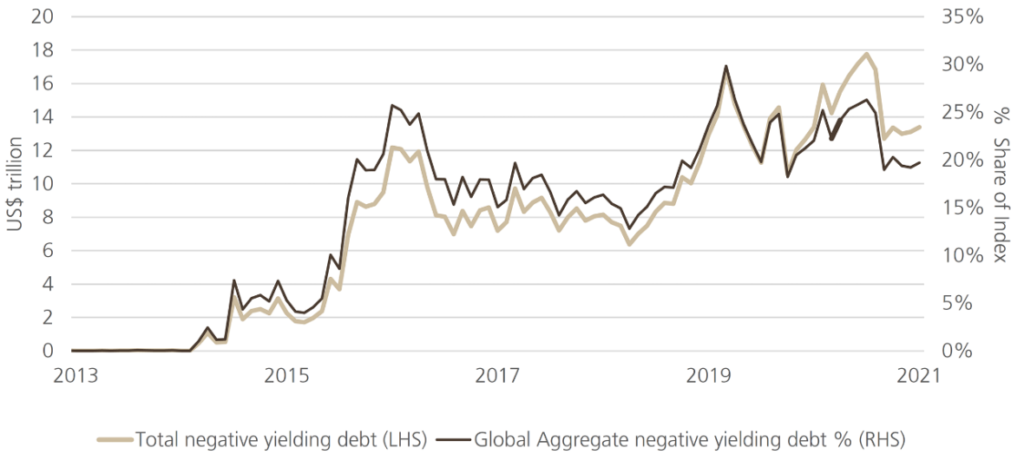

The net result is clear; despite hopes for a sustained recovery into the second half of the year, Chart 1 shows that around USD 14tn of debt globally still has a negative yield. This is equivalent to about 20% of the Bloomberg Barclays Global Aggregate Index (a broad bond universe tracked by many investors). I don’t know if any of the Dadaists were economists, but they surely would have celebrated the subversion of a world where creditors pay for the privilege of lending money. In terms of absurdity-as-art-form it certainly goes further than scribbling a moustache and a goatee on the Mona Lisa3.

Chart 1: The amount of global debt with negative yields remains high

Source: Bloomberg Barclays. Data as at 30 June 2021

Chart one has two lines that show the amount of global debt with negative yields has grown from zero around 2014 to about USD 14 trillion at the end of June and of and they now account for nearly 20% of the Bloomberg Barclays Global Aggregate Index (a broad bond universe tracked by many investors).

For holders of cash, the vast total of bonds trading with negative yields points to a broader, if unpalatable, truth: in a world oversupplied with private-sector savings, which run well ahead of overall investment, it is simply not possible to earn risk-free returns holding cash in the bank. You might rail against the apparent temporal injustice of it. After all, as Chart 2 shows, for much of the past 30 years cash rates have run ahead of some measures of inflation, but the laws of supply and demand at least still hold.

Chart 2: US Fed Funds Rate vs US inflation

Source: Bloomberg data as at 19 July 2021

Chart two shows two lines tracking the US Fed Funds Rate vs the US Core inflation measure since 1991. It indicates that for much of the past 30 years, cash rates have normally run ahead of inflation, but not in recent times.

All is not completely lost though. There are strategies that can offer incremental yield advantages over cash and government bonds without moving into the more esoteric areas of finance. For those looking to preserve capital, but worried about mark-to-market price volatility if inflation moves higher, very long duration strategies are probably best avoided. This would argue against hard-wired passive allocations into standard bond indices such as the Bloomberg Barclays Global Aggregate. With a yield of just 1.0%, but a duration of nearly 8 years, a move of just 0.1% higher in the overall yield would mean mark-to-market price losses could offset all the income over 12 months4.

Potential solutions

Some of these problems can be mitigated by focusing on shorter maturity benchmarks, but note this only really makes sense if the opportunity set is completely flexible many of the negative yielding bonds are found in the front end of yield curves, and guarantee losses for bond holders in almost every conceivable outcome. So a switch to a short maturity benchmark is not a panacea; it must be coupled with a flexible and active investment style. But targeting a bond allocation with a low duration (in other words, a low price sensitivity to a possible move higher in bond yields) can provide some mitigation against capital losses.

Fixed maturity bond funds are another credible approach that aim to capture a positive total return over a predefined, and usually relatively short-term investment horizon of two to three years.

At UBS, flexibility is inherent in a varied investment palette that includes corporate bonds, high yield, emerging markets and floating-rate notes across different countries and currencies. We have a range of short duration and fixed maturity strategies available in different currencies, many of which have durations of less than two years, and offer a positive yield for investors. To be clear, by substituting credit risk for the apparent safety of cash, capital is at risk. But with sound asset allocation and risk management, real returns should exceed cash over time.

1https://www.hilobrow.com/2010/02/22/hilo-hero-hugo-ball

3https://www.artsy.net/artwork/marcel-duchamp-lhooq-mona-lisa

4 A rough approximation based on today’s yield and duration