Our Non-U.S. Growth portfolio team weighs in on how the Russia-Ukraine conflict may affect energy security, inflation and earnings.

Key Takeaways

As the Russia-Ukraine conflict unfolds, we’re keeping an eye on three key areas of concern.

- Energy security (notably natural gas)

- The inflation outlook

- Pressure on earnings growth

Russia’s invasion of Ukraine remains an extremely fluid situation. We’ve seen surprising changes in just six days.

Ukraine’s ability to defend the capital and the swiftness with which governments have reacted with sanctions have seemed to solidify global support for Ukraine against Russian aggression. The move to disallow Russian access to SWIFT1, expected by some as a follow-up to initial sanctions, was quickly implemented. The agreement by both governments to talk along the Belarus border adds to the uncertainty. It is unclear if talks will lead to a ceasefire, a Russian military pullback, or some other form of compromise.

We are focused on three key variables where markets and fundamentals are concerned: energy security, the inflation outlook, and pressure on earnings growth.

Energy Security Is a Key Concern

The potential disruption of the flow of gas from Russia to Europe has important implications.

- Russia provides approximately 40% of Europe’s natural gas and supplies about 10% of the world’s oil. (Source: FactSet.)

- Some commodity analysts have suggested that, despite sanctions, oil always finds a home in a global, interconnected and liquid market. Therefore, we are seeing a more muted reaction to higher oil prices.

- We see no signs that Russia has curtailed the flow of natural gas to Europe. In the near term, we consider the threat to natural gas to be low risk.

- The sanctions put into place so far exclude oil- and gas-related transactions. Europe remains unlikely to boycott Russian energy given its dependence on Russian gas exports.

- The ECB estimates that every 10% reduction in gas shipments would lead to a -0.70% hit to European GDP.

Conflict Clouds the Outlook for Inflation

How the conflict will be resolved remains unclear, clouding the outlook for inflation, growth, and central bank policy.

Rising Energy Costs Could Stoke Inflation

- Natural gas prices rose dramatically in Europe—almost tripling from late-summer levels—as the threat of the invasion began. They spiked again last week as Russian tanks moved into Ukraine territory.

- Since Europe depends on natural gas for heat and electricity generation, the price increase presents significant pressure on business and personal operating costs.

- While the rise in oil prices has been limited so far, we believe there is still a possibility of further increases if hostilities escalate.

- We expect higher energy prices to work their way through to higher power prices overall. The spot market for German electricity shows prices have already risen by approximately 50%.

…and Higher Inflation Could Dampen Growth

- Continued high inflation risks increase downside risk to growth, in our view. This could lead to a stagflationary environment.

- Should we see even greater inflationary pressure, we would expect European consumer disposable income to decrease, which could slow consumption.

- A weakening outlook could also dent business confidence and curtail growth investment and capital spending.

According to consensus estimates, every 10% increase in natural gas prices or $10 increase in oil prices reduces European GDP by approximately 0.10%.

(Source: Goldman Sachs)

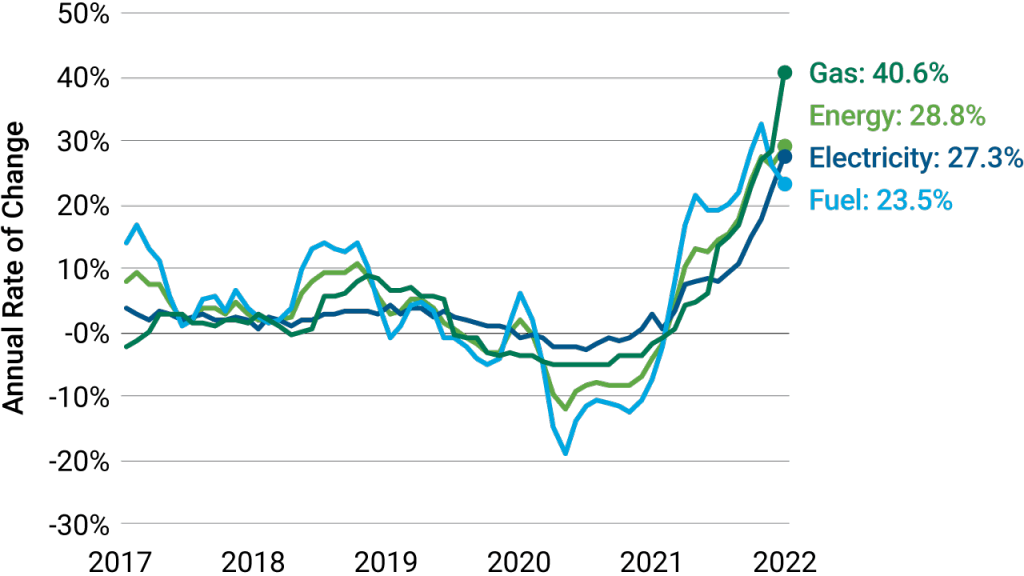

Evolution of Energy Prices in the Last 5 Years, Euro Zone

How Will Central Banks Respond?

- Central banks, such as the Federal Reserve and the European Central Bank, had already shifted to an aggressive, hawkish stance driven by high inflation trends evidenced in recent months’ data.

- Greater inflationary pressure would also put central bankers into a pickle. On the one hand, they need to follow directives to cool inflation through rate increases. On the other hand, they need to preserve liquidity and account for the growth challenges related to the conflict.

Higher Inflation Could Pressure European EPS Growth

A material drag on growth from higher inflation and/or weakening of business and consumer confidence could have negative implications for earnings-per-share (EPS) growth.

- Consensus estimates that every 0.10% cut in GDP forecasts results in a 1% reduction in expected EPS growth.

- Consensus estimates expect 5.5% growth in 2022 European EPS growth. Higher inflation and lower GDP forecasts could lead to downside risk to earnings.

The key area to watch is the spike in energy prices. With global supply already tight, further sanctions could have significant consequences for global growth and inflation.